New Delhi: As part of its effort to reduce government presence in businesses, the Narendra Modi government plans to completely privatise state-owned firms in non-strategic sectors, and retain a maximum of four firms in the strategic sectors. But getting the right valuations for these firms may be a challenge as public sector undertakings have seen a significant erosion in their market value since the Modi-led BJP first came to power in May 2014.

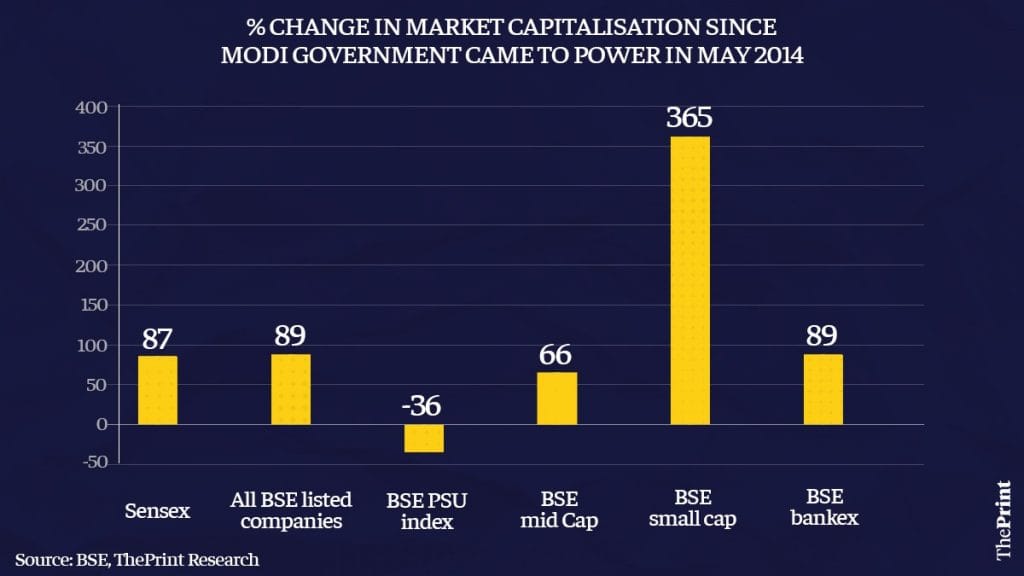

The stock markets have zoomed in these six years, with the market capitalisation of all BSE-listed companies put together, as well as indices like the Sensex, almost doubling. But the market cap of public sector firms and banks has declined by 36 per cent in the same period.

The current market cap of PSUs is Rs 12.2 lakh crore, down Rs 6.9 lakh crore from the May 2014 figure of Rs 19.1 lakh crore, according to the BSE PSU index, reflecting the value erosion faced by these firms. The index comprises all listed state-owned firms as well as banks.

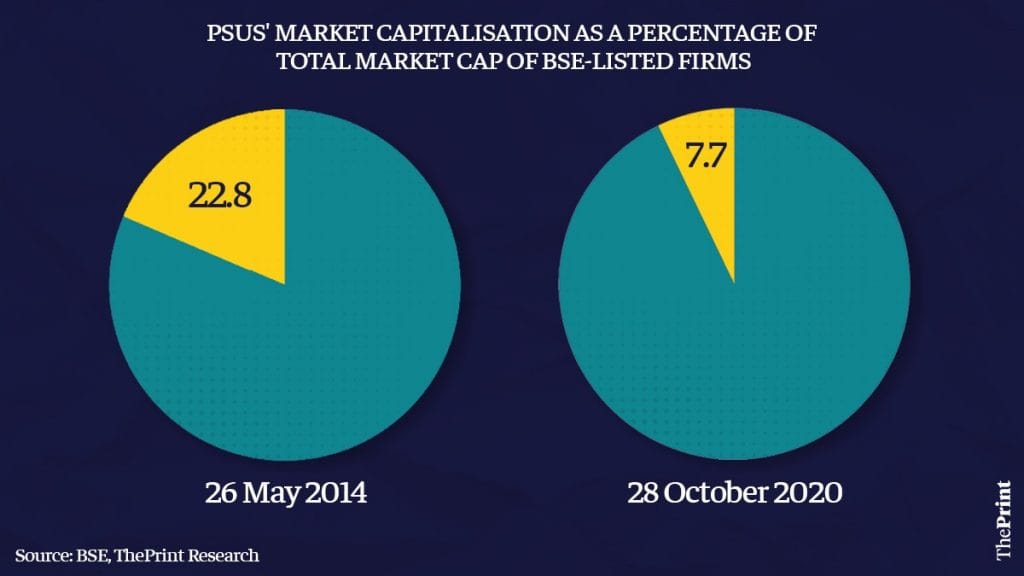

The share of public sector firms and banks in the total market capitalisation of all listed companies has also fallen sharply by 15 percentage points in the last six years — from nearly 23 per cent in May 2014 to around 8 per cent now.

“Consistent selling by government via exchange-traded funds, weak earnings performance and relatively weaker perception are the primary reasons PSUs have underperformed compared to the rest of the market,” said Gautam Duggad, head of research for institutional equities at Motilal Oswal Financial Services Ltd.

“Broadly, it is the trend across sectors that PSUs underperform compared to their private sector counterparts. If privatisation and disinvestment is pursued consistently, it can help improve the sentiment for these stocks. Merely reducing the government stake by a few percentage points won’t be of much help,” Duggad said.

Also read: India to raise Rs 20,000 cr by selling stakes in Coal India & a PSU bank to fund stimulus

PSU index worst performer at BSE

The BSE’s PSU index is the worst performer among other indices like the mid cap, small cap, large cap, bankex and the benchmark Sensex. In the six years since the Modi government came to power, the market capitalisation of all BSE-listed firms has gone up 89 per cent, while that of the 30 firms that make up the Sensex has risen 87 per cent.

The BSE small cap index was up a mammoth 365 per cent, while the mid cap index rose 66 per cent and the Bankex 89 per cent. To be sure, there are some stocks that overlap between the PSU index and other indices.

“As a group, they (PSUs) have been the worst performers, and even across the respective sectors, they would be in the bottom quartile,” said Ambareesh Baliga, an independent market analyst.

Baliga said the general perception of PSUs is that they do not utilise their resources in an optimal manner, and are answerable to the ‘big boss’ in the ministry despite being run by professional management. This leads to their stocks being quoted at a discount.

“If a specific PSU was in a near-monopoly segment, or had a specific advantage, due to which it was able to churn out excellent cash flows, the government was quick to consider it as a cash cow that would fulfil any shortfall in the treasury,” he said.

“Through large dividend payouts, the PSUs have had to curtail their own expansion plans. They (the government) have also forced mergers to ensure payouts,” Baliga added.

Looking within the other indices, state-owned firms’ market capitalisation is much lower than their private sector competitors. For instance, the market cap of the largest Indian lender, state-owned State Bank of India, lags that of Kotak Mahindra Bank, a relatively smaller private sector lender. While SBI’s market capitalisation is Rs 1.7 lakh crore, Kotak Mahindra Bank’s is over Rs 3 lakh crore. The market capitalisation of the rest of the state-run banks, including the bigger banks like Punjab National Bank, Canara Bank and Bank of Baroda, is less than Rs 30,000 crore apiece.

Also read: Under Modi’s ‘swadeshi’ govt, PSU maharatna BHEL saw market cap sink 55% to Rs 26,864 crore

7 major CPSEs’ market value less than book value

Even the Union finance ministry had cited the decline in market capitalisation of public sector firms in its internal discussions on reducing government presence in many areas.

Under the Atmanirbhar Bharat package announced in May, the Modi government had declared its intent to completely exit non-strategic sectors while retaining a maximum of four firms in strategic industries. Even in these firms, the government proposes to retain only sufficient stake so as to retain control.

The government has proposed to classify 18 sectors as strategic in its draft cabinet note circulated to different ministries. Sources said the cabinet note had pointed out that the market perception of listed CPSEs (central public sector enterprises) has not been enthusiastic, with the market share of these firms in the total market capitalisation of all listed companies coming down in the last five years from 13 per cent of the combined total market cap of BSE and NSE-listed companies to just around 8 per cent at present.

The note had also flagged how the seven major CPSEs’ market value was below their respective book values as of June-end, though it must be stated that the market was recovering from a sharp fall in March then, and was much below its current trading levels of 39,000-40,000.

These seven CPSEs — Bharat Heavy Electricals Limited (BHEL), Indian Oil Corporation Limited (IOCL), NHPC Ltd, NTPC Ltd, Oil and Natural Gas Corporation Ltd (ONGC), Power Finance Corporation (PFC) and Steel Authority of India Ltd (SAIL) — account for 44 per cent of the net worth of all CPSEs.

The book value of a firm is what is reflected by the financial position of the company, and is roughly calculated by deducting the total liabilities and intangible assets from the total assets.

Baliga pointed out that investors abhor uncertainty as well as dilution of equity. “The divestment tap seems forever open, resulting in frequent ‘offer for sale’ as well as ‘follow on public offers’ at discount. This drives away any serious interest investors, as the ‘sword of Damocles’ always hangs above the PSU stocks,” he said.

“Instead of piecemeal placement, the government should sell its stake to strategic investors without stiff conditions. The government doesn’t have any business to be in business, but has never been able to give up that control,” Baliga added.

Also read: Modi govt must learn from Vajpayee on how to generate wealth from disinvestment in PSUs