Hong Kong: On the ninth floor of a building near Hong Kong’s old Kai Tak airport, Kung Fu master Lam Shu-shing teaches the Wing Chun technique to students, something he’s been doing since 1978. A banner on the wall nods to a legacy that traces back to his teacher’s master, who also trained Bruce Lee.

Passing on this cultural touchstone to the next generation is proving to be Lam’s biggest challenge yet as the number of students has dwindled to a handful. “This is the toughest moment in the past 40 years that I am teaching Kung Fu,” said Lam, who at almost 70 had to give up his gym when he couldn’t afford the rent. “I don’t see any improvement in Hong Kong any time soon.”

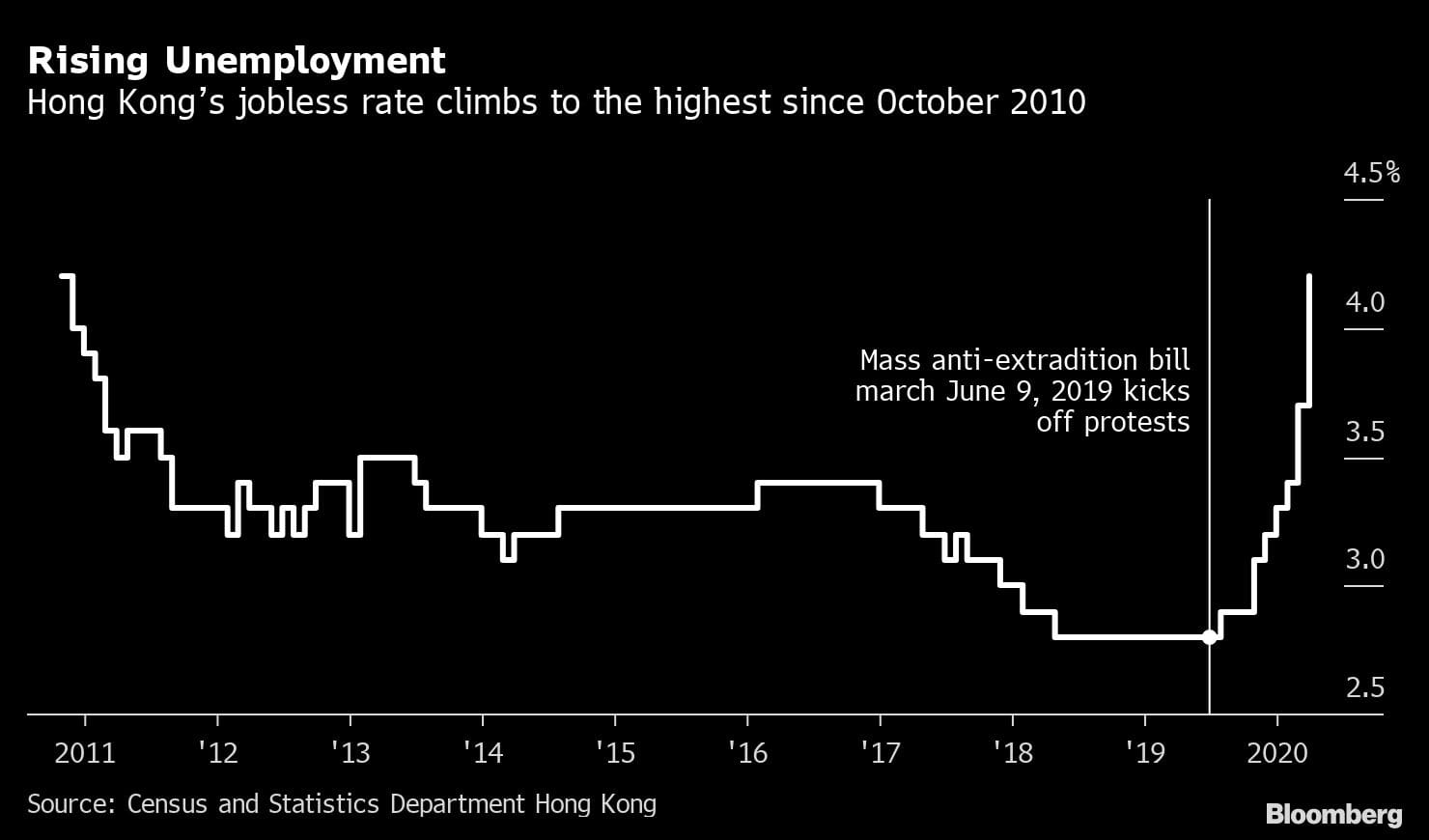

First came months of protest in 2019 and then the coronavirus outbreak, sending Hong Kong spiraling. Now, just as other economies around the world look to a recovery as their virus restrictions ease, Hong Kong’s reprieve appears fleeting: clashes between police and protesters are resuming and worries about another virus wave remain. It’s a dual threat that has businesses and shoppers on edge and raises fundamental questions about how — or if — one of the world’s most storied finance hubs will regain its past prominence.

Financial Secretary Paul Chan has described Hong Kong’s economic challenges as unprecedented. In the first quarter, the city had its worst slump on record.

Even pillars of the economy that had been holding up, like finance and real estate, are showing signs of softening.

In the property market – the world’s priciest — the political deadlock is eroding demand from buyers based in mainland China, according to Simon Smith, head of research and consultancy at Savills Plc.

“Obviously, the outbreak really reduced mainland visitors to almost nothing and the return of the unrest will continue to keep them away,” he said. Wealthy individuals from China had dominated the high-end home market, with about 60% of international buyers hailing from the mainland over the past 10 years, according to Savills.

In a sign of weakness, a plot of land near the former Kai Tak airport failed to sell at auction.

Banks are feeling the strain, too. Loan risks loom for lenders including HSBC Holdings Plc as the city’s recession grinds on, according to Francis Chan, a senior analyst at Bloomberg Intelligence. Insurance agents and private bankers have been hurt by the virus outbreak as travel curbs blocked potential customers from the mainland.

At the same time, deteriorating relations between the U.S. and China will squeeze the city’s port if trade tensions resume. U.S. lawmakers routinely threaten to punish China for its actions against Hong Kong’s democracy protesters.

Sales Slump

The biggest strain so far has been on retailers, hotels, bars and restaurants. Tourism to Hong Kong has dried up amid virus-related travel restrictions, and for months before that mainland visitors stayed away because of the political unrest. Retail sales by value slumped by more than 40% for an unprecedented second straight month in March as inbound visitors sank by 99%.

To ease the pain, Hong Kong’s government has announced about HK$287.5 billion ($37 billion) of direct virus-related aid this year, or about 10% of GDP, including a wage subsidy program and a cash handout of HK$10,000 to all permanent residents age 18 or older.

Also read: Wristband monitors, fines and jail time – how Asia is battling a second coronavirus wave

Open Again

Elaine Cheung, who runs Elaine Beauty House not far from the central finance district, recently reopened her beauty salon after a 28-day compulsory shutdown to contain the virus. She is racing to make the most of pent-up demand, while it lasts.

“My WhatsApp just kept popping up messages from clients. I’m rushing to serve as many customers as possible when the situation is relatively safe,” she said. “Who knows what will happen next?”

Government officials warn the city may see its worst full-year economic performance on record, with a contraction of as much as 7%, after the economy shrank 1.2% last year. It contracted 8.9% in the first quarter from year-ago levels. Unemployment has risen for six straight months while industry barometers including small business sentiment and Markit PMI hover near record lows.

It’s an outlook overshadowing Hong Kong’s success in containing the virus, with cases in the city slowing to a trickle. Hong Kong has confirmed just 1,051 cases and four deaths, and hasn’t recorded a virus-related death since March. Yet the risk of another wave became real in recent days as health officials confirmed two new local cases, bringing to an end a 23-day streak without a locally transmitted case.

As authorities take a more aggressive approach to rein in protesters with little sign of compromise to meet their demands, the unrest is expected to heat up again in coming months.

Last Drinks?

On Friday, May 8, in the city’s popular bar district, the mask wearing staff at the Honi Honi Tiki Cocktail Lounge were hustling to prepare for reopening after the enforced shutdown. Just 30 minutes after the doors opened, customers began trickling in, adjusting to the temperature checks and rules on spacing as they ordered tropical cocktails in Polynesian tiki mugs.

Bar owner Max Traverse has had to reduce staff. A rental discount has helped tide him over. Conditions had been improving earlier this year before the virus hit yet now, like others, he’s worried what will happen if either the protests or another virus outbreak returns.

“If the city has to close again, it would be a ghost city,” he said.

That concern is widespread across the bar and restaurant sector. Alan Lo, co-founder of the Classified Group of eateries as well as the Michelin-starred restaurant Duddell’s, said the political logjam could be a blow that shrinks the city’s food and beverage industry, with owners “down to their last drop of capital.”

Expat Exit

Hong Kong’s bustling lifestyle, low tax rates and gateway-to-China status have long attracted expatriates. There are anecdotal signs that the appeal is waning after months of home schooling and travel restrictions, though much will depend on what happens in coming months.

“I think many companies are still taking a wait-and-see approach to matters,” said Lee Quane, regional director for Asia with expat consultancy ECA International. “If you see two years of continued disruption and no real solution in sight, a lot of companies will think twice about it.”

What Bloomberg’s Economists Say…

“We expect the economy to recover in the last quarter of this year, as stimulus kicks in to lift growth in major economies. Uncertainties remain high, though — on the pandemic, tensions between the U.S. and China and tensions between the city and central government. However, in the longer term, there are upsides. The city’s economy has proved to be highly resilient in the past.” –Qian Wan Bloomberg Economics

To navigate a way out, the government will need to shake up the economy by playing to its strengths in health care and financial services, along with a renewed focus on high-end manufacturing that would offer new opportunities, according to Christopher To, chairman of the Hong Kong Institute of Directors.

Yet such solutions seem a long way off for those struggling to keep their businesses alive now.

Back at the gym, while demonstrating the flowing movements and quick arm-and-leg attacks of Wing Chun, Lam worries that things may never return to the way they were, for him and for Hong Kong.

“I won’t be able to go back to the past where I have my own center,” Lam said. “I will continue to roam around with my students.” – Bloomberg

Also read: Hong Kong is testing saliva of travellers to thwart the spread of coronavirus