Bangalore: Masayoshi Son isn’t losing his appetite for backing money-losing startups.

Son’s SoftBank Vision Fund is leading an investment round of more than $200 million in Grofers, the online grocery startup said in a statement. Tiger Global and Sequoia Capital and new investor KTB joined SoftBank in the deal, which pushes the company’s valuation to almost $1 billion even as it competes against powerful rivals: Walmart Inc.-controlled Flipkart, Amazon.com Inc. and BigBasket, backed by Chinese e-commerce giant Alibaba Group Holding Ltd.

The investment comes just after SoftBank-backed Uber Technologies Inc. flopped in its initial public offering, a sign that some investors are souring on tech startups with big dreams and bigger loses. Uber had a $3 billion operating loss last year on revenue of $11.3 billion.

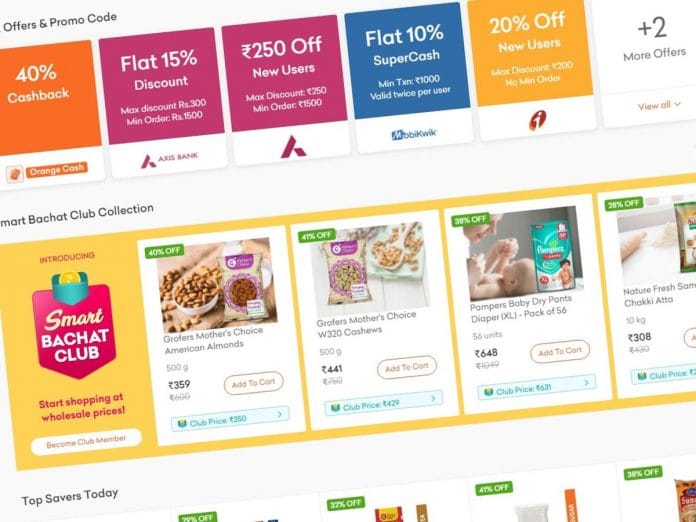

While Grofers operates in a $600 billion market with many competitors, the company said it’s prioritizing profit given the sliver of market share served by online merchants. Walmart and Amazon have been investing heavily in India because they see the country as the last unclaimed major market in the world. Last year, Alibaba led a $300 million investment in BigBasket, pushing its valuation to $950 million.

SoftBank Group Corp. and Alibaba are such close allies that Son sits on the Chinese company’s board, while Alibaba co-founder Jack Ma is a director at SoftBank. Yet in India, they are backing startups that go toe-to-toe. Grofers is in 13 cities, is already profitable in Delhi and getting there in Kolkata, according to Dhindsa.

“Grofers had a top line of $400 million and grew 8X in the last two years,” said Albinder Dhindsa, co-founder and chief executive officer. Grofers would become India’s largest online grocer this quarter, he said.

India’s grocery market is projected to grow at 55% per year through 2021, according to TechSci Research, making it the leading growth segment in online retail. SoftBank is an existing investor in Grofers along with Sequoia and Tiger Global. – Bloomberg.

Also read: How lessons from the dotcom bust fueled India’s largest e-grocer, BigBasket