Mumbai: The possibility of an erosion of Prime Minister Narendra Modi’s grip on power may exacerbate troubles for Indian stocks. But there’s one fund manager who says he would ride out any volatility and even look to buy into declines.

“Any weak coalition will be bad for the markets, as it will have to manage the demands of smaller parties,” Harshad Patil, Tata AIA’s chief investment officer, said in an interview in his office in Mumbai last week. “In an extreme scenario, as a knee-jerk reaction, stocks may correct by as much as 10 percent,” he said.

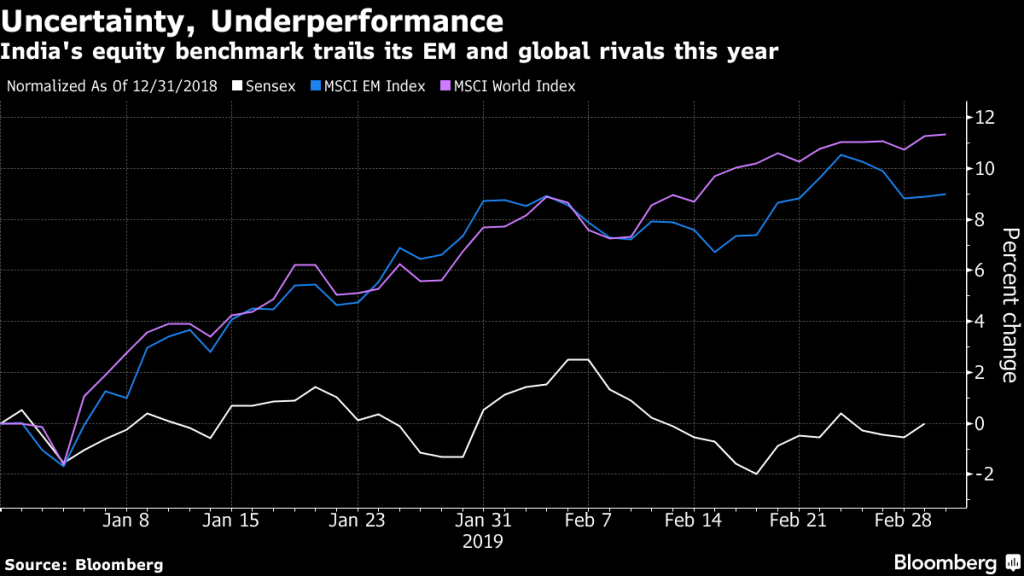

While investors are likely to stay on the sidelines until after the election, Patil sees every decline in Indian stock prices as an opportunity. The benchmark Sensex index is little changed since the start of 2019, lagging the rally in global markets. In addition to the political uncertainty, markets have been jolted recently by India’s military skirmishes with neighboring Pakistan. Tata AIA expects the tension to add to market volatility amid the elections as well as ongoing China-U.S. trade talks and rising oil prices.

Some surveys have shown that Modi, who in 2014 won the largest national mandate in three decades, won’t get a majority this time. While investors see the vote — expected to be held in April-May — as a one-off event with a short-term impact on markets, concern over how much power may be ceded to smaller political parties has weighed on sentiment.

Patil is bullish on private banks, which have more exposure to retail loans than corporate transactions. The CIO is also betting on consumer stocks, as the government’s latest budget aims to boost individual income through measures including tax breaks.

About 25 percent of Tata AIA’s 268 billion rupees ($3.8 billion) of assets is invested in equities. Its 33 billion rupee Whole Life Midcap Equity Fund has returned an average of 21 percent annually over the past five years compared with the NSE Nifty MidCap 100 Index’s 18 percent, according to data compiled by Bloomberg.

Patil believes India’s long-term economic growth story remains intact though it may take some time for the market to overcome the recent adversity. “Investors — both foreign and domestic — are a little cautious, and will wait for the formation of a new government and its policies before they start investing with high conviction,” he said.

Also read:India was the largest borrower from World Bank for 3 of last 4 years