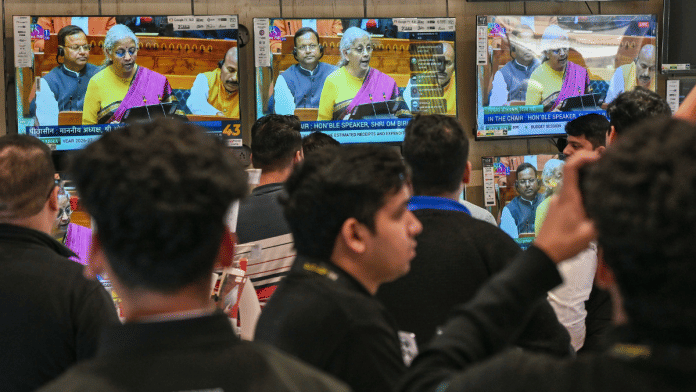

New Delhi: Finance Minister Nirmala Sitharaman, while presenting Union Budget 2026 Sunday, delivered a major blow to India’s derivatives market, proposing to raise the Securities Transaction Tax (STT) on Futures and Options (F&O) trading by up to 150 percent in a move aimed at curbing excessive speculation.

The announcement triggered sharp market losses, with the BSE Sensex plunging over 2,200 points and the Nifty 50 falling 668 points after the announcement. Both indices recovered partially but continued trading in the red, marking the most negative Budget-day reaction in at least three years. Last year’s Budget had seen a muted market response.

Derivatives are contracts that derive their value from underlying assets like stocks or indices. Futures are agreements to buy or sell an asset at a predetermined price on a future date, while options give the holder the right—but not the obligation—to buy or sell at a specified price.

The Securities Transaction Tax is a direct tax levied by the government on purchase and sale of securities—such as stocks, mutual funds and derivatives—on recognised stock exchanges. It is automatically deducted during transactions, regardless of whether investors make a profit or loss.

In her Union Budget 2026 speech, Sitharaman announced an increase in STT on options premium from 0.1 percent to 0.15 percent, and on futures from 0.02 percent to 0.05 percent.

“To provide reasonable course correction in F&O segment in the capital market and generate additional revenues for the government, it is proposed to raise the STT on Futures to 0.05 percent from present 0.02 percent. STT on options premium and exercise of options is proposed to be raised to 0.15 percent from the present rate of 0.1 percent and 0.125 percent, respectively,” Sitharaman said.

The steep hike comes barely a year after Budget 2024 raised STT by 60 percent, increasing the levy on options premium from 0.0625 percent to 0.1 percent, and on futures from 0.0125 percent to 0.02 percent.

Shripal Shah, MD & CEO of Kotak Securities, said the cumulative impact of successive increases would raise costs for market participants. “The steep increase in STT on futures and options, coming on top of last year’s hike, is likely to raise impact costs for traders, hedgers, and arbitrageurs. This could cool derivative activity and lead to a reduction in volumes. The intent appears to be volume moderation rather than revenue maximisation, as any potential revenue gain could be offset by lower derivative volumes,” he said.

Zerodha Founder Nithin Kamath, who had expressed concerns about STT ahead of the Budget announcement, said he had hoped the levy would be reduced but it had instead continued to rise. Referring to the 2024 hike, he said the increase initially had little effect on trading volumes as the bull market persisted, but the true impact became apparent over the past year as market conditions changed. He said such decisions increase the overall tax burden on investors.

Introduced on 1 October 2004, STT was intended to replace the long-term capital gains (LTCG) tax, reduce evasion in equities and derivatives trades, and streamline tax collection. However, the Union Budget 2018 reinstated LTCG on listed securities while retaining STT.

The Budget came days after gold and silver prices crashed on Friday, wiping $5 trillion in global market capitalisation.

Budget 2026 also suggested taxing all share buybacks as capital gains. Sitharaman imposed an extra buyback tax on promoters to deter them from utilising them to lower their tax liabilities. According to the new rationalisation of share buyback, corporate promoters will have an effective tax of 22 percent and non-business promoters will have a tax burden of 30 percent. This builds on the October 2024 guidelines, which transferred the tax liability from corporations to shareholders.

According to the Finance Minister, the updated structure will eliminate gaps that led publicly traded corporations to favour buybacks over dividends. The additional levy for promoters is intended to address what the government perceives as an unfair tax benefit brought about by the previous regulations.

Sitharaman also proposed setting up a high-level committee on banking “for Viksit Bharat” to review the sector. This sparked speculations about greater regulation and possible mergers in the sector, leaving an impact on investor sentiment.

“The Indian banking sector today is characterised by strong balance sheets, historic highs in profitability, improved asset quality and coverage exceeding 98 percent of villages in the country. At this juncture, we are well-placed to futuristically evaluate the measures needed to continue on the path of reform-led growth of this sector,” she said.

(Edited by Prerna Madan)

Also Read: Union Budget 2026-27: What it really says about India’s economy