New Delhi: Even as factors playing out in the US have driven the price of the popular cryptocurrency Bitcoin past the $100,000 mark—up 45 percent in just one month—there is a small but quickly growing segment of investors in India who are cashing in.

The price of Bitcoin crossed the $100,000 mark early Thursday morning (India time), trading a little higher than $102,000 per Bitcoin. The price of the cryptocurrency stood at about $69,000 a month ago. The reason for the rapid rise in its price since then, according to market participants, is Donald Trump—his win of the US presidential elections and subsequent pro-crypto statements and moves.

Simultaneously, India in 2024 once again topped global crypto adoption indices, indicating that the value of cryptocurrencies Indians were trading ranked the highest as a proportion of the country’s per capita gross domestic product (GDP). India had topped the ranks in 2023 as well.

Crypto analysts have also highlighted how Indian investors have been particularly undeterred by the Indian government’s high taxes on cryptocurrencies, and instead moving their transactions to foreign exchanges.

“Bitcoin is now effectively one of the top 10 most valued assets in the world, ranking above all commodities except gold and higher than most companies,” Rahul Pagidipati, CEO of ZebPay, an Indian crypto exchange, said in a statement. “The crypto market’s total capitalisation has also crossed the $3.5 trillion mark, demonstrating the scale of interest and widespread adoption in the space.”

Also Read: Unemotional, faster & more secure — AI has many benefits for crypto, but don’t trust it blindly

Trump effect drives the crypto rally

Bitcoin has reached the “historic $100,000 milestone”, just a month after Donald Trump’s election as the 47th US President, Edul Patel, co-founder and CEO of Mudrex, a popular crypto exchange operating in India, said in a statement.

“Key developments, including Elon Musk heading the newly established Department of Government Efficiency, plans for a dedicated White House crypto policy role, and Trump’s appointment of Paul Atkins as SEC Chair, have fuelled this remarkable rally towards this mark,” he added.

Musk has been a vocal advocate for cryptocurrencies, especially for Dogecoin, a cryptocurrency he has reportedly invested in. His political ascendancy during Trump’s second term has been widely seen as a substantial positive for the crypto industry.

Trump himself has been vocal about his support to the crypto industry. During the run up to the US elections, he commented that, if he became President, it would be the official policy of the US government to hold on to all of the Bitcoins it “currently holds or acquires into the future”.

“For too long our government has violated the cardinal rule that every bitcoiner knows by heart: Never sell your bitcoin,” Trump said at a Bitcoin conference in July.

The US Senate in July saw a new Bill introduced, called the ‘Boosting Innovation, Technology, and Competitiveness through Optimized Investment Nationwide Act of 2024’, otherwise called the Bitcoin Act 2024. If passed, this Act would see the US Treasury establish a Strategic Bitcoin Reserve “for the secure storage of U.S. Bitcoins”.

Chances of the Bill being passed increased substantially with the US Senate and the House passing into Republican control following the US elections.

Finally, Trump’s appointment of vocal crypto advocate Paul Atkins as the head of the US Securities and Exchange Commission (SEC) has also been viewed favourably by the crypto industry and investors.

All of this has led to a “pivotal moment” for Bitcoin, according to Vishal Sacheendran, head of regional markets at Binance.

“Today’s milestone marks a pivotal moment in Bitcoin’s journey from a niche asset to a mainstream financial instrument, attracting institutional and retail investors while solidifying its position in the global financial landscape,” Sacheendran said.

India an eager crypto market

While Indian regulators have adopted a stern stance on cryptocurrencies—with the Reserve Bank of India (RBI) still advocating for a ban and the government imposing a 30 percent capital gains tax and 1 percent tax deducted at source on crypto transactions—Indian crypto investors have remained enthusiastic.

They have, however, taken this enthusiasm away from Indian exchanges. Crypto industry participants have told ThePrint that Indian crypto investors’ transactions on foreign exchanges stands at about 3-5 times the amount on Indian exchanges.

Industry body Chainalysis found that India once again topped the global ranks in its crypto adoption index for 2024, a repeat of 2023. Among the factors measured was the total value of crypto transactions as a ratio of the country’s per capita income.

“Last year, we noted that India remained a top global cryptocurrency market, amid evolving regulatory and tax environments,” the index report, released in September, said. It noted that the high tax environment likely pushed Indian crypto investors to explore international exchanges “without such stringent regulatory requirements”.

“Regardless, these developments didn’t seem to hinder crypto’s overall growth in the country, and it is the same this year,” the report said.

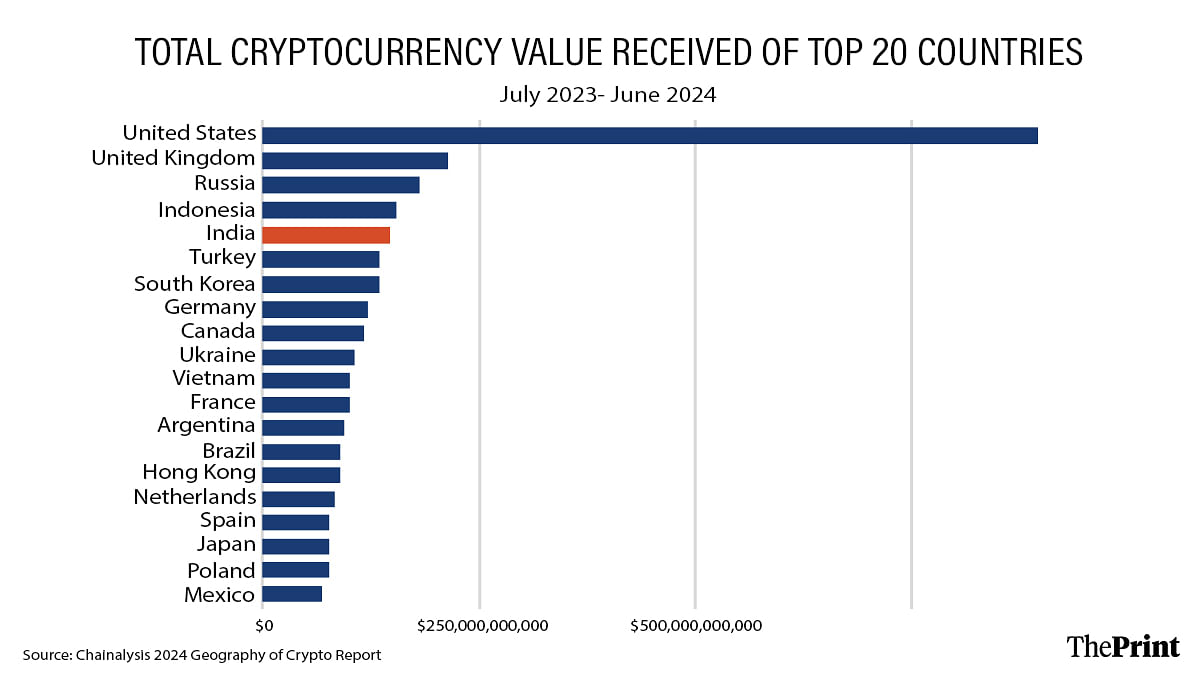

According to the report, $250 billion worth of crypto transactions originated from India in the July 2022 to June 2023 period, the second highest in the world following the US.

In the next year (July 2023 to June 2024), Indian investors accounted for nearly $150 billion of crypto transactions in the world. While this was lower than the previous year, it reflected a global slowdown in crypto trading activity, and still placed India among the top 5 countries in the world in terms of crypto volumes.

“India’s remarkable growth in crypto adoption, even amid high taxation, shows the country’s resilient and forward-thinking investor base,” Patel of Mudrex said. “This continued engagement highlights not just a strong belief in the transformative power of digital assets, but also a readiness to adapt and innovate despite challenges.”

(Edited by Radifah Kabir)

Also Read: Indians have two attitudes towards cryptocurrency – deep suspicion or blind hero-worship