New Delhi: With more women entering the workforce and becoming financially independent, the number of women borrowers in India in 2022 grew to 63 million, accounting for 28 per cent of the total borrowers in the country, according to a report by credit information firm TransUnion CIBIL.

The report, released Monday, noted that the number of women borrowers in India has increased at a compound annual growth rate (CAGR) of 15 per cent over the last 5 years. However, of the estimated population of 1.4 billion in India, of which approximately 454 million are women, only about 63 million are active borrowers as of calendar year (CY) 2022, it said.

“Credit access for women (percentage of borrowers to total adult population) has grown from 7 per cent in CY (calendar year) 2017 to 14 per cent in CY 2022. With about 63 million credit active women borrowers as of December 2022, the growth rate of women borrowers (16 per cent) has been more rapid than men (13 per cent),” it added.

The report also noted, among other things, that women borrowers have a better risk profile compared to men, that the number of women seeking business loans has more than tripled in the last five years, and that there has been an increase in the footprint of women borrowers in semi-urban and rural locations.

“The marked evolution of women borrowers as active participants in India’s credit market bodes well for the government’s financial inclusion mandates that intend to improve access to financial opportunities for traditionally underserved segments such as women,” said Harshala Chandorkar, Chief Operating Officer of TransUnion CIBIL, in the report.

“Customised products for women borrowers across socio-economic categories, age-groups and geographic locations will further empower them to fulfil their aspirations and economic goals while catalysing steady portfolio growth for credit institutions.”

Among the top 12 states (by total credit active borrowers), West Bengal (22 per cent), Rajasthan (21 per cent) and Bihar (21 per cent) have seen the highest growth in women borrowers between CY 2017 and CY 2022.

Also Read: Burdened by domestic work, nearly 50% of India’s urban women don’t step out even once a day

Women have higher share in gold loans

According to another credit information firm, CRIF High Mark, the portfolio outstanding of retail loans availed by women stood at Rs 26 lakh crore as of December 2022, and the share of women borrowers in overall retail loans (by value) increased to 26 per cent in December 2022, from 25.3 per cent in December 2021.

Portfolio outstanding refers to the current outstanding balance of the loan account.

According to CRIF, among major retail loan products, women have the highest share in gold loans, accounting for 42 per cent of such loans, with Rs 7 lakh crore of overall portfolio outstanding (OPO). They account for 35 per cent of education loans with Rs 1.3 lakh crore of OPO, 32 per cent of home loans with Rs 30 lakh crore of OPO, and 29 per cent of property loans with Rs 7.9 lakh crore of OPO, it added.

Gold loans saw the biggest year-on-year (Y-o-Y) growth in portfolio outstanding for women borrowers, at 64 per cent, in December 2022, followed by two-wheelers at 42 per cent, and personal loan at 35 per cent.

Women constitute 99% of microfinance clients

Additionally, according to Bharat Microfinance Report 2022 by Sa-Dhan (Association of Impact Finance Institutions), for the microfinance sector, the gross loan portfolio is over Rs 1.35 lakh crore, of which 99 per cent is accounted for by women.

“Microfinance (MF) is a woman-focused activity. World over, the focus of microfinance has always been on serving women. In India also, women clients constitute 99 per cent of the total clients of MFIs,” the report noted.

The TransUnion CIBIL report says women borrowers have a better risk profile. In CY 2022, 57 per cent of women borrowers had a score of prime (731-770) and above compared to 51 per cent of male borrowers.

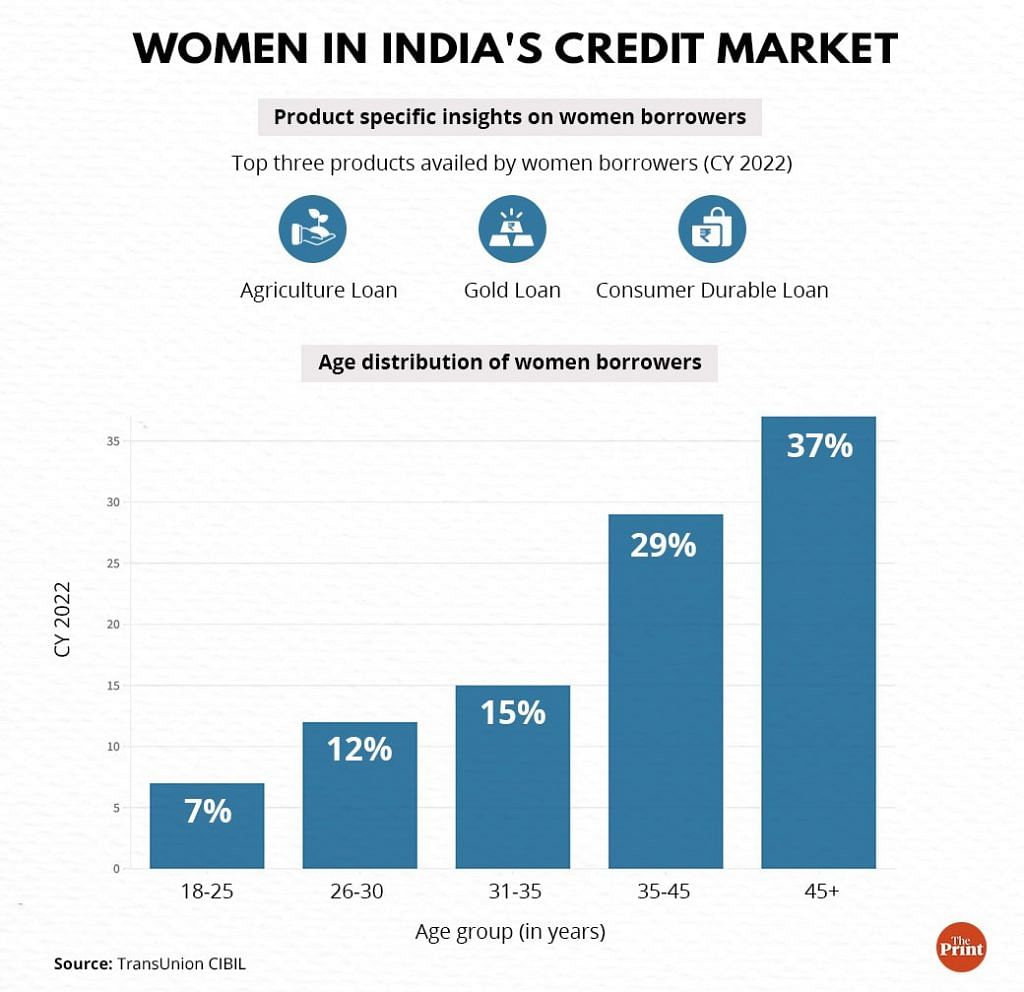

“Insights on the type of credit products availed by women reveal that consumption-led credit products like personal loans and consumer durable loans are gaining popularity among them. As more women borrowers enter the workforce and become financially independent, they are seeking credit opportunities to fulfil their life goals and aspirations,” it said.

It also added that the number of women seeking business loans has more than tripled in the last 5 years (CY 2017 to CY 2022), which is a reflection of growth of women-led startups. During this period, the share of women in the overall business loan portfolio increased by 12 percentage points (32 per cent in CY 2022 versus 20 per cent in CY 2017).

According to CRIF, women borrowers accounted for 23 per cent of the business loans in December 2022, with a portfolio outstanding of Rs 13.7 lakh crore.

TransUnion CIBIL also found that there has been an increase in the footprint of women borrowers in semi-urban and rural locations.

“The share of women borrowers in semi-urban and rural locations grew at a CAGR of 18 per cent between CY 2017 and CY 2022, compared to 14 per cent growth in metro and urban areas. The overall share of women borrowers in semi-rural and rural locations has risen to 62 per cent, marking an increase of 6 percentage points during the same period,” it added.

(Edited by Geethalakshmi Ramanathan)

Also Read: All about autonomy: single women farmers form collective, become entrepreneurs