New Delhi: Amid the Maldives’ free trade agreement (FTA) with China coming into force and a potential trade deal with Türkiye, India on Friday said it would “take that into account” while framing foreign aid policies.

“We remain in close touch with Maldivian authorities on the situation facing them. Recent agreements that are likely to result in revenue loss for the Maldives Government are, obviously, a matter of concern and do not bode well for the long term fiscal stability of the country. We would, obviously, need to take that into account while framing our own policies,” Ministry of External Affairs (MEA) spokesperson Randhir Jaiswal said, without naming China or Türkiye.

On 1 January, 2025, the China-Maldives Free Trade Agreement (CMFTA), which was signed in 2014, came into force. The Maldivian Parliament had approved the trade agreement in 2017, but the Ibrahim Solih-led government suspended it in 2018.

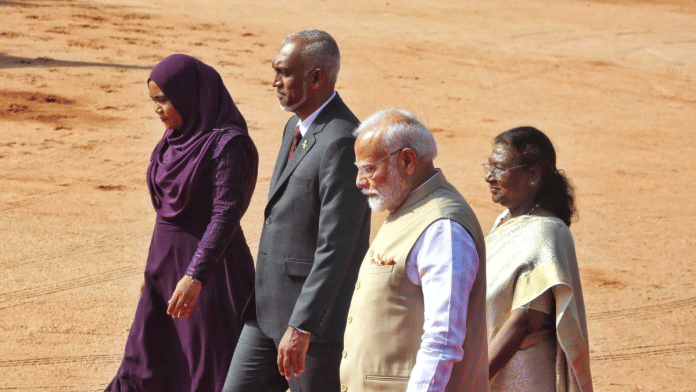

His successor Mohamed Muizzu, who won the 2023 polls on the back of an ‘India Out’ campaign, allowed the CMFTA to come into force this year. Muizzu, however, has spent about half the year in 2024 building close ties with India.

The CMFTA is likely to benefit China and further reduce the revenue Malé earns from customs duties, given that the trade agreement reduces duties on imports from Beijing. This could have a negative impact for the island archipelago nation due to its liquidity challenges.

Last June, American ratings agency Fitch had downgraded the Maldivian economy to ‘junk’ status. The country has been facing a worsening external financing and liquidity crisis. In May, the State Bank of India agreed to roll over a $50 million loan for another year, after a request from Muizzu’s government was made.

In September 2024, India rolled over another $50 million loan, as a part of a budgetary support measure. The rollovers along with a thaw in ties between New Delhi and Malé saw Muizzu make a state visit in October 2024. During the visit, New Delhi sought to strengthen its position as a financial backer for the Maldives, announcing a $400 million currency swap agreement, as well as a separate rupee denominated swap agreement for Rs. 3,000 crore.

The two currency swap agreements combined total roughly $750 million in support for the beleaguered Maldivian economy, and easing the immediate short-term liquidity challenges for Malé.

However, in November, Malé signed a preferential trade agreement with Ankara, which would see tariffs on 39-key products reduced to zero, according to media reports. Some of the 39 products faced up to 60 percent tariffs. Further, concessions were made for additional 103 products, according to media reports.

The agreement with Türkiye is set to come into force on a mutually agreed date sometime in the first quarter of 2025. Both these agreements are likely to dent Maldives’ revenue collection, which may lead to a rethink by the Indian government in extending further monetary support to the island archipelago.

(Edited by Tony Rai)

Also Read: MEA slams WaPo reporting on ‘anti-Muizzu plot’, Pakistan killings. ‘Nurse compulsive hostility’