New Delhi: Defence players including Hindustan Aeronautics Ltd (HAL) and Garden Reach Shipbuilders & Engineers (GRSE) have built on last week’s momentum to continue their impressive rally in stock markets.

An analysis of the stock prices of defence manufacturers from 23 April—the day following the Pahalgam terror attack—to closing session Thursday shows investors have shown key interest in the defence stocks amid tension between India and Pakistan.

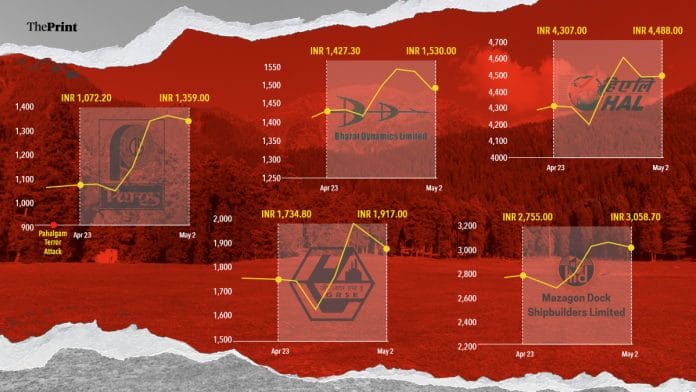

For instance, HAL, which rose from Rs 4,307 on 23 April to a peak of Rs 4,609 on National Stock Exchange (NSE) on Monday, before settling at Rs 4,488 Thursday, marked a 4.2 percent gain. GRSE also posted a strong momentum, rising from Rs 1,735 to Rs 1,917 Thursday, a gain of 10.5 percent.

Another two DPSUs—Bharat Dynamics Limited (BDL) and Mazagon Dock Shipbuilders Ltd (MDL)—showed a similar trajectory. While shares of BDL climbed from Rs 1,427 apiece to Rs 1,530 (7.2 percent increase), those of MDL jumped from Rs 2,755 to Rs 3,058 (11 percent rise).

Paras Defence & Space Technologies, a prominent private sector company, has posted the steepest rise of 26.8 percent with its shares rising from Rs 1,072 to Rs 1,359.

Also Read: Amid escalating India-Pakistan tensions over Pahalgam, IAF launches ‘Aakraman’ exercise

The trigger

The main trigger for the rally in stocks can be primarily attributed to the rising tensions between the two neighbouring countries following the Pahalgam massacre on 22 April.

Apart from putting its military on high alert, Pakistan has issued multiple naval warnings, a no-fly zone and a Notice to Airmen/Mariners (NOTAM) for parts of the Arabian Sea on 24 and 25 April. There has been no let up in cross-border firing along the Line of Control (LoC) as it continued Wednesday for the seventh straight night.

India’s firm response post the Pahalgam attack, which includes suspending the Indus Waters Treaty and closing the Attari border, has reinforced market sentiment that defence-related expenditures may spike.

The market, according to market watchers, is reacting not just to the immediate threat, but also to the expected ramp-up in procurement.

A key factor driving this sentiment is the growing perception and narrative that the government will lean more heavily on domestic defence manufacturing under its ‘Atamnirbhar Bharat’ initiative, especially if the country enters a period of heightened military preparedness, they said.

India this week also finalised a major intergovernmental agreement, valued at Rs 63,000 crore, with France for the procurement of 26 Rafale Marine fighters. This agreement is reported to be among the most costly defence contracts inked in recent times and is seen as another attributor in aiding the windfall for defence players.

The ‘FOMO’ factor & market mechanics

Alongside fundamental triggers, behavioural market dynamics are also shaping the rally. As previously reported by ThePrint, the “FOMO” (Fear of Missing Out) effect was one of the factors that led to the previous rally in defence stocks.

Typically, once a strong narrative forms, particularly around defence spending and national security, investors rush in, fearing they’ll miss out on quick gains. This herd behaviour often accelerates stock movements in a short window before tapering off.

Furthermore, in the case of DPSUs, a majority of shares are held by the government. This limited availability in the open market makes prices highly sensitive to concentrated buying activity. When large volumes are absorbed with minimal selling pressure, prices spike rapidly, only to face sharp corrections when the rally fades or heavy holders begin to offload positions, as observed mid-week.

(Edited by Tony Rai)

Also Read: Indian Navy flexes muscle in Arabian Sea with long-range precision anti-ship missile firings