New Delhi: Amid tightening Western restrictions, two public sector oil companies and one private refiner—Indian Oil Corporation Limited (IOCL), Bharat Petroleum Corporation Limited (BPCL) and Russia-backed Nayara Energy—are the lone buyers of crude from Moscow in January.

Indian refiners have slowly weaned away from Moscow as seen in Reliance Industries Limited (RIL), the biggest Indian buyer of Russian oil, pausing intake in 2026.

Similarly, Mangalore Refinery and Petrochemicals Ltd (MRPL) remained offline since November, and Hindustan Petroleum’s joint venture HMEL (HPCL-Mittal Energy Limited) took only a single shipment in December. Hindustan Petroleum Corporation Limited (HPCL) also recorded zero Russian crude purchases in December and January.

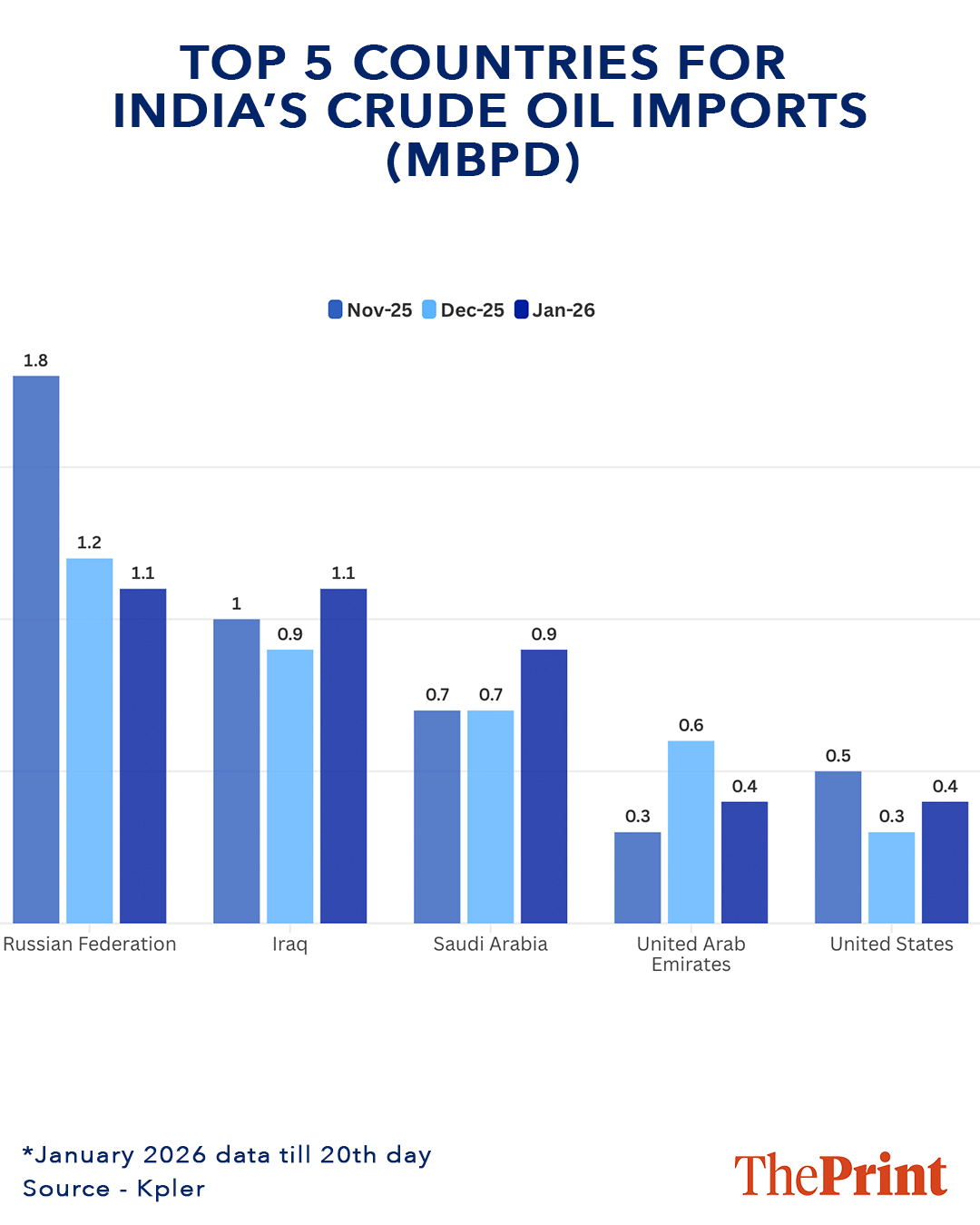

Overall, India’s crude imports from Russia are tightening, with volumes expected to average around 1.2 million barrels per day (mbpd) in January 2026—a 35 percent drop from November 2025 and broadly in line with December 2025 levels.

“India’s Russian crude intake remains material (but not high as we used to see in 2023, 2024, 2025) in early 2026, but the near-term trajectory is softer, more selective, and increasingly compliance-led, reflecting higher execution risk versus the peak buying pattern seen in 2023–2025,” Sumit Ritolia, lead analyst for refining and modelling at global trade intelligence firm Kpler, told ThePrint.

It is to be noted that the January data sourced from the Kpler is till the 20th day of the month.

The decline follows sanctions imposed by the US Treasury’s Office of Foreign Assets Control (OFAC), which targeted Russian oil majors—Lukoil and Rosneft. Announced on 22 October 2025, the sanctions came into effect from 21 November.

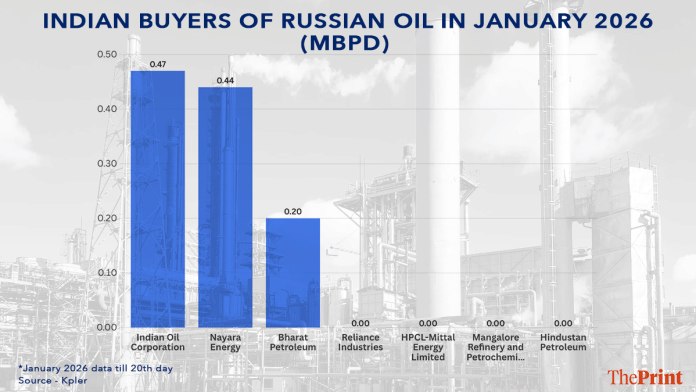

Data from Kpler shows that India imported around 1.1 mbpd of Russian crude till 20 January 2026 from non-sanctioned entities. IOCL emerged as the largest buyer with an average of 0.47 mbpd, followed by Nayara Energy at around 0.44 mbpd, and BPCL at about 0.20 mbpd.

While Russia continues to be a key supplier, recent cargo patterns point to a deliberate pullback by large refiners.

“The refiners are stepping back ahead of EU [European Union] sanctions coming into effect from 21 January, while expectations around broader India–US trade engagement are also encouraging a more cautious stance at the margin,” Ritolia explained.

New European Union sanctions, effective 21 January, will prohibit the import from third countries of petroleum products made from crude originating in Russia, adding to compliance and execution risks for buyers.

Also Read: IMF revises India’s growth forecast upward, sees economy expanding 7.3% this fiscal year

Purchases from Middle East rises

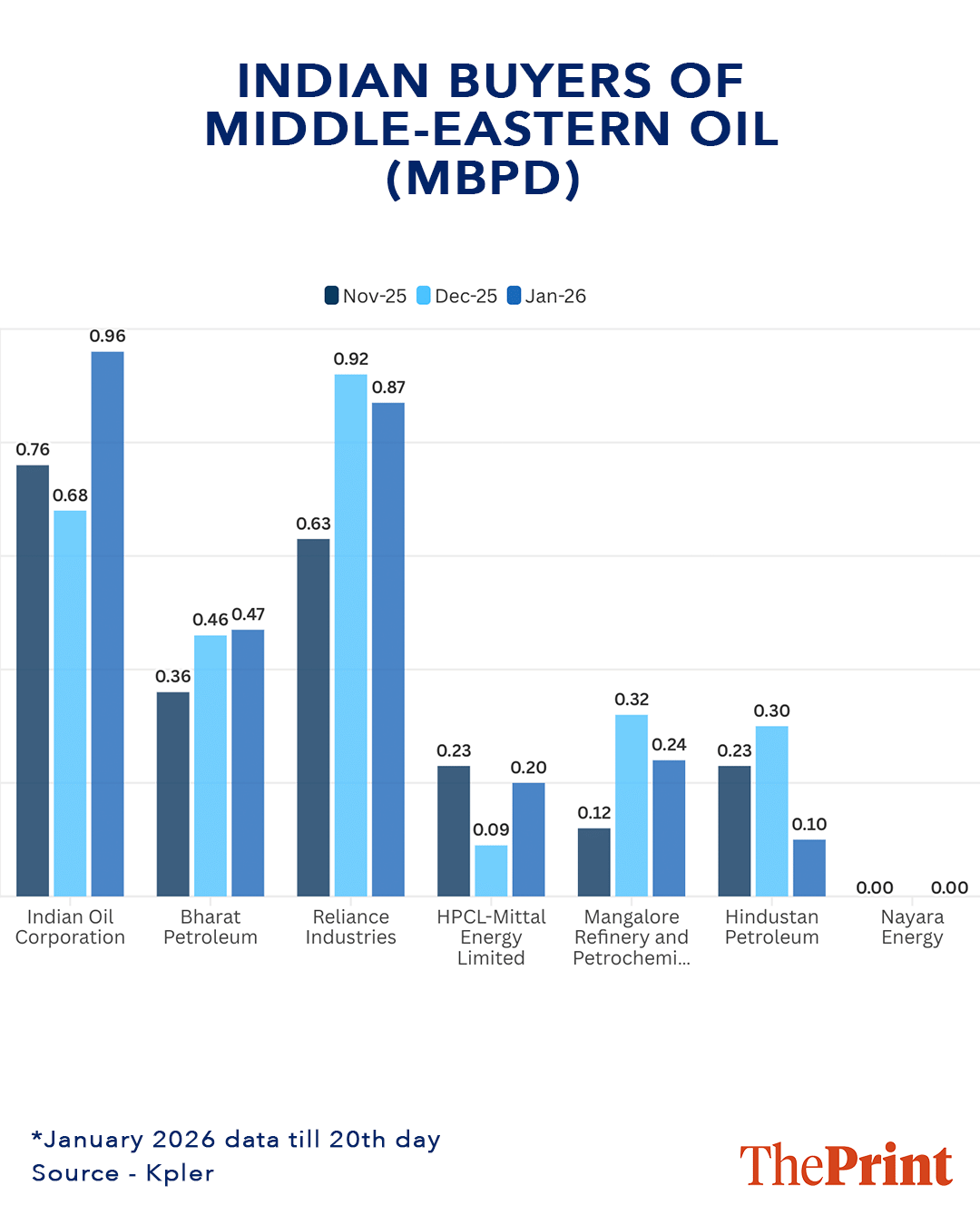

As Russian volumes soften, India’s crude imports from the Middle East have risen over the past two months. Indian refiners are increasingly leaning on Middle Eastern grades to fill the gap, drawn by supply reliability and simpler logistics in a sanctions-sensitive environment.

RIL has pivoted towards Middle Eastern crude in the aftermath of Russia-related sanctions, with data showing imports of around 0.9 mbpd in December 2025 and January 2026, up from an average range of 0.3–0.7 mbpd between January and November 2025.

India imported around 1.06 mbpd of crude oil from Iraq till 20 January—the highest level in the past eight months and 18 percent higher than December 2025. Saudi Arabia emerged as the third-largest supplier after Russia and Iraq in January, shipping close to 0.9 mbpd, a 25 percent jump over previous month and the highest in over a year.

“The result is a clear rebalancing of India’s crude slate, with Middle East flows moving higher and Russian inflows trending lower as refiners prioritise reliability of supply and sourcing flexibility,” Ritolia said.

Iran & Venezuela—limited impact

Fresh sanctions on Iran are unlikely to directly affect India’s crude imports, as New Delhi has not officially purchased Iranian oil since mid-2019, when US sanctions waivers expired, Ritolia noted.

However, he pointed to possible indirect effects, warning that higher compliance requirements, along with shipping and insurance risks linked to “grey-zone” trade, could add pressure. Any curbs on Iranian exports could also tighten global crude supply overall.

Before the American sanctions, Iran was a key supplier, with imports of around 0.45–0.50 mbpd, including about 520 thousand barrels per day (kbpd) in 2018.

As for Venezuela, there is little change on the Indian front. Venezuelan crude imports have not shown any uptick in January, with the last shipment dating back to May 2025, largely bought by RIL. Current flows remain absent, with no immediate signs of a return, Ritolia noted.

Globally, China and the US were the largest buyers of Venezuelan crude in January, importing about 319 kbpd and 179 kbpd, respectively.

(Edited by Tony Rai)

Also Read: Geoeconomic confrontation top trigger for global crisis, cyber insecurity biggest risk for India—WEF