New Delhi: With economic growth losing momentum and urban consumption showing persistent signs of a slowdown, Union Budget 2025-26 faced a complex challenge. In the first full-year budget of Modi 3.0, Finance Minister Nirmala Sitharaman announced individuals earning up to Rs 12 lakh annually would be exempt from income tax under the new tax regime. Bihar received special attention, with key announcements including the establishment of a Makhana Board and increased support for expanding the capacity of IIT Patna.

Union Budget 2025: UPDATES

6.00 pm: The power sector was one of the six main focuses of the Budget and most of the policies in the sector were in the nuclear energy segment. Additionally, the document also spoke about electricity sector reforms, particularly in states, to improve distribution and transmission. Read Akanksha Misra’s article about the Union government’s Nuclear Energy Mission.

5.45 pm: A major step taken for the farming community was enhancing the limit for the interest subvention scheme for Kisan Credit Cards from Rs 3 lakh to Rs 5 lakh. “Kisan Credit Cards facilitate short-term loans for 7.7 crore farmers, fishermen, and dairy farmers,” Sitharaman said in her speech. Read Shubhangi Misra’s article on what the Budget has for the agricultural sector.

5.30 pm: Union Minister Ashwini Vaishnaw said the Budget was a big boost for the electronics and IT sector.

“If you look at the budget for Electronics and IT, one major announcement which has happened is the announcement regarding components. The finished products are already manufactured in India. Now, with the component manufacturing coming in, the entire electronics manufacturing will get a very big boost.”

“Customs-related simplifications have been announced and simultaneously provisions related to permanent establishment, and provisions related to the storage of electronic components, all have been announced in the budget,” he added.

5.15 pm: The government has laid out a plan to make tourism a key sector for employment-led growth in India. In her Budget speech, Finance Minister Nirmala Sitharaman announced a plan to develop 50 tourist destinations in India to generate employment, attract investment, improve infrastructure, and expand India’s tourism capability. Read Vandana Menon’s article on the tourism sector budget.

5.00 pm: The Union Finance Minister said, “One crore more people will pay no tax. On the capex, I think there are two things playing out. One, of course, this particular year has had the elections happening and because of that both central government and state governments were catching up with investments, public spending on investments only from the second and the third quarter. So, it showed. It is equally true that when fundamental requirements are taken care of, when you are bringing in additional over it, there is a pace at which those additions happen…”.

4.45 pm: The government’s declaration to add additional seats on top of these numbers have come amid growing unease about the lack of faculty and the subsequent degradation in the training of future doctors in many medical colleges in India, mainly the ones opened over the last few years. Read Sumi Sukanya Dutta’s article on health budget.

4.30 pm: “There is no reduction in the public spending on capital expenditure,” said Sitharaman.

“We continue to place emphasis on the multiplier effect that capital expenditure done by government has shown has sustained us. We continue on that, and with all this, our fiscal prudence has been maintained…”.

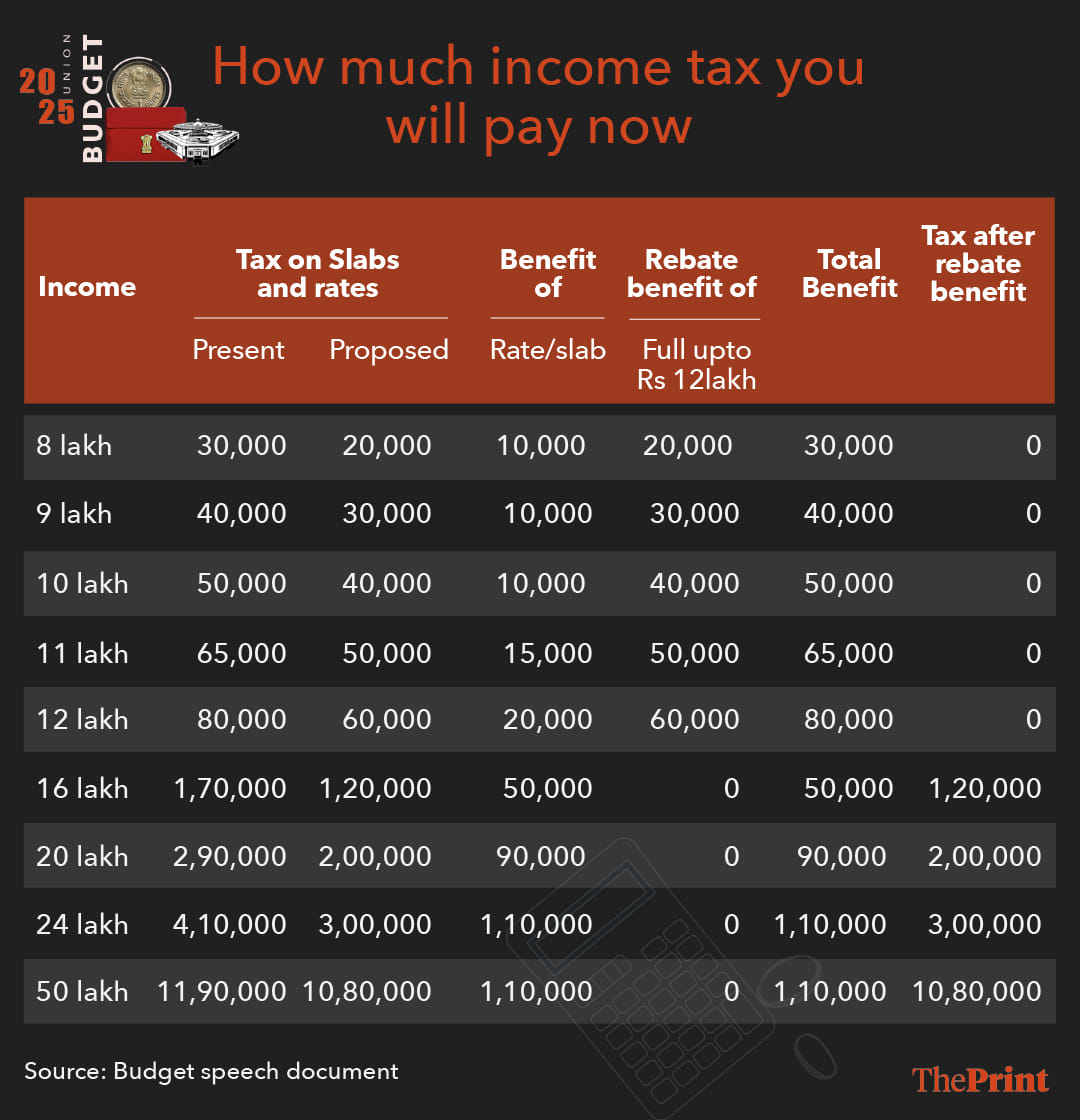

4.25 pm: On the announcement that no income tax will be payable on earnings up to Rs 12 lakh, Finance Minister Nirmala Sitharaman stated that the tax cuts would benefit every taxpayer and ultimately boost the economy through increased spending.

“For someone earning Rs 8 lakh, this means an additional Rs 1 lakh to spend; for those earning Rs 12 lakh, nearly Rs 2 lakh more; and for those with an income of Rs 24 lakh, about Rs 2.4 lakh extra,” she explained.

4.15 pm: On the new income tax bill, Sitharaman said it will go to the standing committee.

4.10 pm: Speaking to the media following her Budget presentation, FM Nirmala Sitharaman said, “I would like to highlight that the budget is responding to the voice of the people. It is a very responsive government. The tax simplification I mentioned in July is now set to be introduced in Parliament next week.”

“Additionally, there is a strong focus on rationalising customs duties, with tariffs being systematically reduced,” she added.

4.00 pm: Former NITI Aayog CEO Amitabh Kant says the budget has provided huge relief to the middle class, and that it will help boost consumption, production, investment, and growth. “It has been done in a fiscally responsible way and by considering macroeconomic stability… The focus on nuclear energy and the opening of insurance will greatly benefit the country in the future…”.

3.30 pm: Sensex recovered by 5 points during market close to settle at 77,505, while Nifty continued to be under the red line at 23,482 points after Union Budget 2025.

3.15 pm: Poll-bound Bihar got a major boost in the Union Budget, with the FM announcing a slew of schemes and projects for the state. Moreover, her sartorial choice for the day—a Madhubani saree—was a hat tip to the cultural heritage of Bihar. Read Neelam Pandey’s article on the Budget giving Bihar a boost.

3.00 pm: The middle class is always in PM Modi’s heart,” said Union Home Minister Amit Shah in a post on X. Congratulating the PM and FM after big tax relief, he said, it will go “a long way in enhancing the financial well-being of the middle class”.

2.50 pm: Speaking about reforms which are going to bring a big change in the coming times, PM Modi said, “By giving it infrastructure status, the construction of big ships in India will be encouraged, the Atmanirbhar Bharat Abhiyan will get momentum. We all know ship building is a sector that gives maximum employment. Similarly, there is a lot of potential for tourism in the country. Hotels will be built at 50 important tourist stations, for the first time. By bringing hotels under the ambit of infrastructure, tourism will get a big boost. This will give energy to the hospitality sector, which is a very big sector of employment…”

2.40 pm: Congratulating Nirmala Sitharaman on presenting a “people’s budget,” Prime Minister Narendra Modi said the budget prioritises putting money in people’s pockets and boosting their consumption, rather than increasing government revenue.

In terms of reforms, many important steps have been taken in this budget, the PM said. “Encouraging the private sector in Nuclear Energy is historic. It will ensure a big contribution of Civil Nuclear Energy in the development of the country.”

2.20 pm: What will be cheaper and what will now cost you more.

Finance minister Nirmala Sitharaman presented her 8th consecutive Union Budget for the year 2025-2026 on Saturday.

Here are the items that have become cheaper and costlier for consumers.#Budget2025 pic.twitter.com/kMCqpVB7aw

— ThePrintIndia (@ThePrintIndia) February 1, 2025

2.00 pm: A comparison of new and old tax slabs.

1.50 pm: TMC MP Abhishek Banerjee says, “There is nothing for the common man in the budget. As you know, there are elections in Bihar this year, so keeping that in mind, the budget has been presented for Bihar. Everything has been given to Bihar. When the budget was presented in July 2024, everything was done for Andhra Pradesh and Bihar. For the past 10 years, BJP has been in power and Bengal has not got anything, it is sad and unfortunate…”

1.45 pm: Speaking to the media following the budget presentation, Congress MP Shashi Tharoor says the FM failed to address the issue of “unemployment”.

“…If you have a salary you may be paying less tax. But the important question is what happens if we don’t have a salary? Where is the income going to come from? For you to benefit from income tax relief, you actually need jobs. Unemployment was not mentioned by the finance minister… Ironic that the party that wants one nation, one election is actually using each election in each state each year to give them more freebies. They may as well have multiple elections so they can get more applause from their allies.”

1.35 pm: ThePrint editors reflect on the central government’s Budget for FY2025-26 unveiled by Union Finance Minister Nirmala Sitharaman in her speech Saturday.

Watch LIVE the discussion featuring Radhika Pandey, Associate Professor at National Institute of Public Finance and Policy (NIPFP), and Rumki Majumdar, Economist at Deloitte India.

1.30 pm: Congress MP Kumari Selja says, “Farmers didn’t get MSP. They talked about nuclear power but our nuclear power plant in Haryana’s Gorakhpur (Gorakhpur Haryana Anu Vidyut Pariyojana) has been there for a long time and both are happening there. Many such issues are there—like MGNREGA—but nothing was announced in this regard. All that was announced was mainly because of elections in Bihar and Delhi.”

“This can be called a dream budget,” says Maharashtra CM Devendra Fadnavis, “especially for the middle class”.

“In the agriculture sector, several schemes have been announced…Several schemes were announced today. I believe this is a pathbreaking Budget. This is a budget that shows a new path in the 21st century…,” he added.

1.15 pm:

Items that got cheaper:

Mobile phones

Lifesaving drugs & medicines

EV batteries

Frozen fish paste (surimi)

Wet blue leather

Carrier-grade ethernet switches

12 critical minerals

Open cells for LCD/LED TVs

Raw materials for ship manufacturing

Marine products

Cobalt products

LED products

Scrap of lithium-ion batteries, lead, zinc, and other critical minerals

Items that became costlier:

Flat panel displays

Knitted fabrics

1.10 pm: Congress MP Jairam Ramesh has criticised Finance Minister Nirmala Sitharaman for turning down proposals like inclusion of breakfast in schools, upward revision in honorarium given to Anganwadi workers under Saksham aanganawadi and Poshan 2.0 in the Union Budget.

“The Finance Minister has announced the revision of cost norms in Saksham anganwadi and Poshan 2.0—after many years of turning down this demand. The FM has however not extended this announcement to, i. Inclusion of breakfast in schools ii. Provision of a glass of milk, as is done in Karnataka through the Ksheera Bhagya Scheme. iii. Upward revision in honorarium given to Anganwadi workers,” Ramesh said in a post on X.

1.00 pm: Uttarakhand CM Pushkar Singh Dhami calls the Union Budget a ‘big gift’ to the middle class. “This decision will not only encourage economic development but will also bring positive changes in the lifestyle of the people,” he writes in a post on X.

12.45 pm: “Finance Minister’s speech is a small synopsis of the Budget. Unless one reads the Budget in detail, one can’t make a clear assessment,” says Congress MP Karti Chidambaram to the media.

12.30 pm: Sitharaman announced that the tax deduction limit for senior citizens will be doubled to Rs 1 lakh.

12.20 pm: Stocks remain in red as the FM announces new tax regime and new tax slabs.

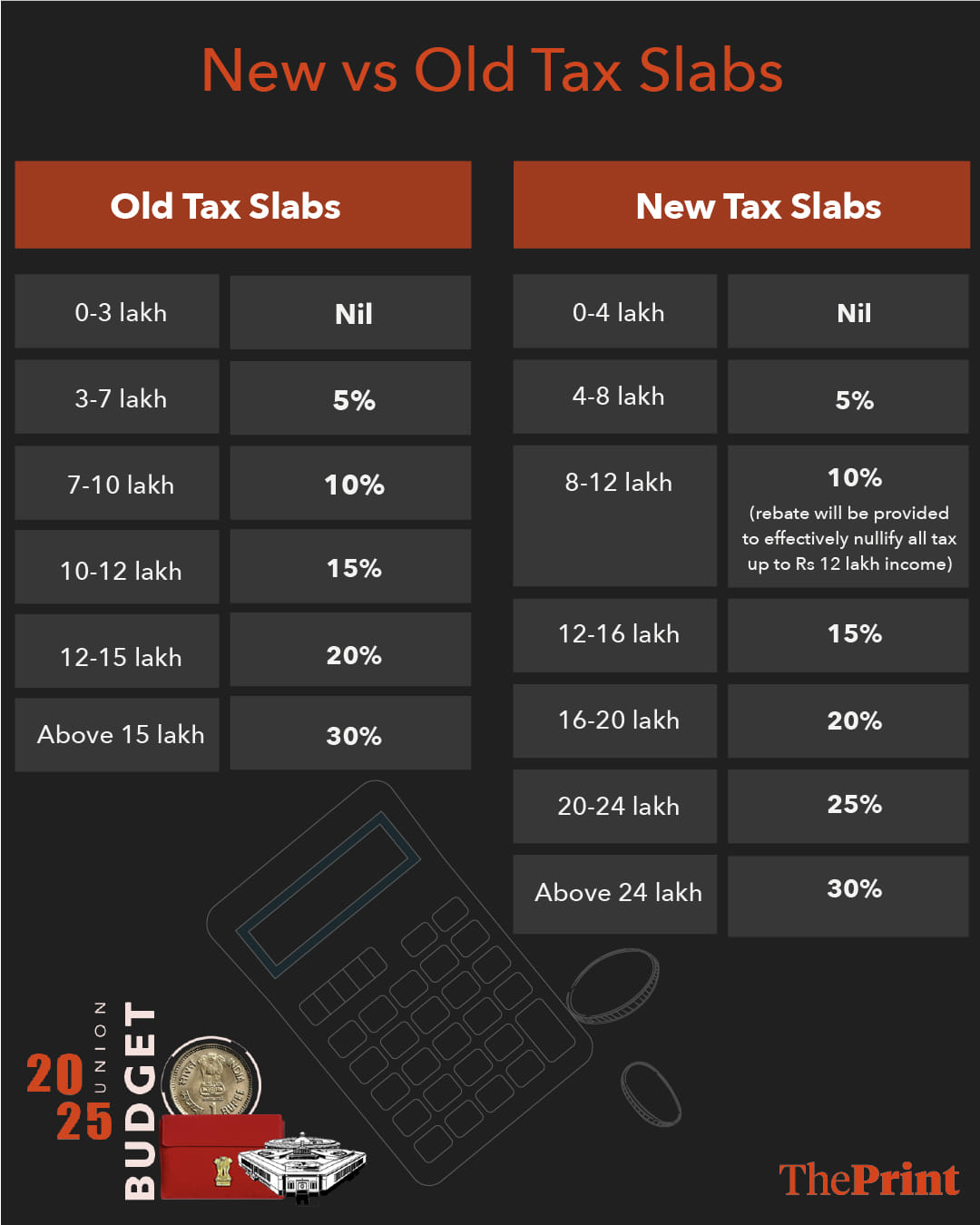

12.15 pm: Sitharaman announces new income tax slabs:

Rs 0-4 lakh: Nil

Rs 4-8 lakh: 5%

Rs 8-12 lakh: 12% (rebate will be provided to effectively nullify all tax up to Rs 12 lakh income)

Rs 12-15 lakh: 15%

Rs 16-20 lakh: 20%

Rs 20-24 lakh: 25%

Rs Above 24 lakh: 30%

Sitharaman announced an increase in Foreign Direct Investment (FDI) cap for the insurance sector from 74 percent to 100 percent. This elevated limit will apply to companies that allocate their entire premium within India.

12.12 pm: In a major change in direct tax slabs, Sitharaman announces that no income tax will be payable on income of up to Rs 12 lakh.

“Middle class provides strength for India’s growth,” says FM, adding that the “Modi government has always believed in the admirability of the middle class in nation building. We have periodically reduced their tax burden.”

12.10 pm: On direct taxes, Sitharaman says the new income tax bill will carry forward the spirit of ‘nyay’ (justice), and will be clear and direct in text. This, she says, will be aimed at shoring up tax certainty and reducing litigation.

At least 33,000 taxpayers have availed of the Vivad Se Vishwas scheme which came into effect last October, says Sitharaman. The scheme is intended to ensure timely resolution of pending income tax disputes.

The financial assistance policy for shipbuilding will undergo a revision to tackle cost disadvantages. Additionally, large vessels exceeding a certain size will be incorporated into the harmonised master list for infrastructure. A maritime development fund, with a total allocation of 25,000 crore rupees, will be established, as announced by the Union Finance Minister.

12.05 pm: Finance Minister says, “As a part of a comprehensive review of customs rates structure announced in the July 2024 budget, I propose to remove 7 tariff rates. This is over and above the tariffs removed in the 2023-24 budget.”

“I propose to exempt social welfare surcharge on 82 tariff lines that are as subject to cess…,” she adds.

12.00 pm: Additional borrowing of 0.5 percent of state GDP to be allowed to strengthen electricity distribution & transmission companies, says FM.

11.55 am: Sitharaman announces the government’s plan to launch an investment-friendliness index of states in 2025. She also says that the Centre will set up a high level committee for regulatory reforms which will submit its recommendations within a year in an effort to further enhance ease of doing business.

Keeping focus on public education, Sitharaman said that 50,000 new Atal Tinkering Labs will be introduced in government schools to encourage scientific and innovative thinking in young minds. Additionally, she announced that broadband connectivity would be provided in all government secondary schools and primary health centres under the BharatNet Project.

Bharatiya Bhasha Pustak Scheme to be implemented to provide digitised Indian language books for primary and higher education, says FM.

11.50 am: FM Nirmala Sitharaman sets 4.4 percent fiscal deficit target for FY26

11.48 am: The Centre, says Sitharaman, intends to launch the Dhan Dhanya Krishi Yojana under which the government—in partnership with states—will help 1.7 crore farmers in 100 districts with low productivity to “build rural prosperity”. A urea plant with an annual capacity of 12.7 lakh metric tonnes will be set up in Assam, which, along with the reopening of three urea plants in the Eastern region, will augment urea supply, says the finance minister.

Government to arrange identity cards and registration on e-shram portal to assist 1 crore gig workers, says FM.

11.45 am: FM Nirmala Sitharama says a new Tax Bill will be introduced in Parliament next week.

Also announces launch of the National Geospatial Mission to develop foundational geospatial infrastructure and data. With the help of PM Gati Shakti mission it will facilitate the modernisation of urban planning, land reforms and infrastructure projects.

11.40 am: Under the modified UDAN scheme, 120 new destinations to be launched in the next 10 years, helipads and airports to be developed to facilitate the travel of 4 crore new passengers.

The Finance Minister announced a new scheme for 5 lakh first-time women entrepreneurs from Scheduled Castes and Scheduled Tribes. They will be provided with Rs 2 crore term loans during the next 5 years.

Development of 100 GW of nuclear energy by 2047 is essential to India’s energy transition efforts, says Sitharaman, referring to the government’s nuclear energy mission for which the government will make amendments to the Atomic Energy Act and the Civil Liability for Nuclear Damage Act. She adds that, under this mission, five small nuclear reactors will be operationalised by 2033.

The govt will also set up an Urban Challenge Fund of Rs 1 lakh crore to implement the proposals to make cities as growth hubs, she says

11.35 am: Announcing the extension of Jal Jeevan Mission till 2028, Union finance minister says the government’s focus will be to enhance rural piped water in the next phase of this mission.

11.30 am: Sitharaman announces the government’s plan to provide loans for women, SC and ST communities, a new fund to support start-ups.

11.25 am: “The investment and turnover limits for classification of all MSMEs will be enhanced to 2.5 and 2 times respectively. This will give them the confidence to grow and generate employment for our youth,” says the FM.

11.20 am: FM announces setting up of a National Institute of Food Technology in Bihar to boost food manufacturing and encourage farmers of the state.

She also says a national mission of high yielding seeds will be launched, as well as a 5-year mission to promote cotton production.

11.15 am: The budget announces an increase in the loan limit for the Kisan Credit Card (KCC) scheme with loan limit increased from Rs 3 lakh to Rs 5 lakh.

11.05 am: Focus of this budget is to accelerate growth, on inclusive development and boosting middle class income, says Sitharaman.

Focus on six domains: Taxation, power sector, urban development, mining, financial sector, regulatory reforms

11.00 am: Union Finance Minister begins the budget speech amid protest by Samajwadi Party MPs including party chief Akhilesh Yadav.

10.50 am: The budget and the RBI monetary policy committee need to work in tandem to rescue India’s flagging growth story, Economist Radhika Pandey and Deputy Editor TCA Sharad Raghavan discuss in ThePrint #MacroSutra. Watch

10.40 am: Speaking to the media before the budget presentation, Congress MP Jairam Ramesh says, “Budget has an intent, content…We don’t have much expectations from the budget that some big announcements will be made and that will encourage private investment… Let’s see if there will be some tax relaxation for the middle class or not. Also, we need to see if the investors get some relaxation from the ‘tax terrorism’. We have demanded some reforms in GST.”

10.30 am: The Union Cabinet approves Budget for 2025-26.

10.20 am: Union Minister Gajendra Singh Shekhawat says, “The Budget will be in continuity and will be for the welfare of the country, of the poor and will be a novel and strong step towards the resolve of making Viksit Bharat.”

10.10 am: Finance Minister Nirmala Sitharaman in the Parliament premises, holding the bahi khata that contains the tablet.

VIDEO | Union Finance Minister Nirmala Sitharaman (@nsitharaman) poses with the tablet containing Budget documents in the Parliament premises.

She is scheduled to table the Union Budget at 11 am. #BudgetSessionWithPTI #Budget2025WithPTI pic.twitter.com/18k2jQz2Lg

— Press Trust of India (@PTI_News) February 1, 2025

“The Budget will be for the people… dedicated to the people,” says Union Giriraj Singh as he arrives at the Parliament.

10 am: FM Sitharaman leaves for Parliament from the Rashtrapati Bhawan.

Budget 2025 must move away from the politically attractive notion of focusing only on the poor, writes TCA Sharad Raghavan. Instead, the government should prioritise two key areas: redefining the middle class and tailoring tax incentives to support this group. Read here.

9.40 am: FM Nirmala Sitharaman and MoS Finance Pankaj Chaudhary meet President Droupadi Murmu at Rashtrapati Bhavan ahead of the budget presentation.

Union Finance Minister Nirmala Sitharaman and MoS Finance Pankaj Chaudhary meet President Droupadi Murmu at Rashtrapati Bhavan. The #UnionBudget2025 will be presented at the Parliament today. pic.twitter.com/yhU0UCM1v3

— ANI (@ANI) February 1, 2025

9.30 am: Speaking to the media Saturday morning, Karnataka Minister Priyank Kharge says, “Personally, I have zero expectations from this budget. We have seen over 10 years of Modiji’s masterstroke, ‘Modinomics’. And what has that led to? Highest unemployment, closure of SMEs and MSMEs, farmers protesting right at the doorstep of the parliament.”

“Start-ups have failed to take up; Make in India, Skill India and Digital India, all have remained on paper and just mere slogans,” says the Congress leader.

9.15 am: A strong economic revival will be unlikely next year, Economist Ajit Ranade tells Deputy Editor TCA Sharad Raghavan in #ThePrintUninterrupted. This will be down to a combination of sluggish private investment, slowing consumer demand, high interest rates and the unpredictable ‘Trump factor’. Watch the conversation here.

9.10 am: Indian markets open green Saturday, signalling a positive sentiment towards the Union Budget. BSE Sensex opened at 77,734, 200 points higher from its previous close, while Nifty rose by 87 points from its previous close to open at 23,596.

9.00 am: What are the expectations from Modi govt’s Budget 2025? Watch Editor (Politics) DK Singh, Deputy Editor TCA Sharad Raghavan, and Deputy editor Moushumi Das Gupta analyse the key pain points in the economy and the political expectations.

8.45 am: Union Finance Minister Nirmala Sitharaman arrives at the Ministry of Finance.

#WATCH | Delhi: Union Finance Minister Nirmala Sitharaman arrives at the Ministry of Finance. She will present #UnionBudget2025 at the Parliament today. pic.twitter.com/T59lxfo5YT

— ANI (@ANI) February 1, 2025

8.30 am: Ahead of the Union Budget 2025, Finance Minister Nirmala Sitharaman tabled the Economic Survey on 31 January, which predicted India’s economy would likely grow at the rate of 6.3-6.8 percent this financial year. However, it also acknowledged that India needed to grow at more than 8 percent a year—“for at least a decade”—to achieve its economic aspirations. Read more on what the survey said here.

Also Read: For India’s youth to drive growth, Budget 2025-26 must deliver on jobs and skills