Chinese and US trade negotiators have lined up an array of diplomatic wins for Donald Trump and Xi Jinping to unveil at a summit this week. Those easy hits are pleasing investors, but leave deeper core conflicts unresolved.

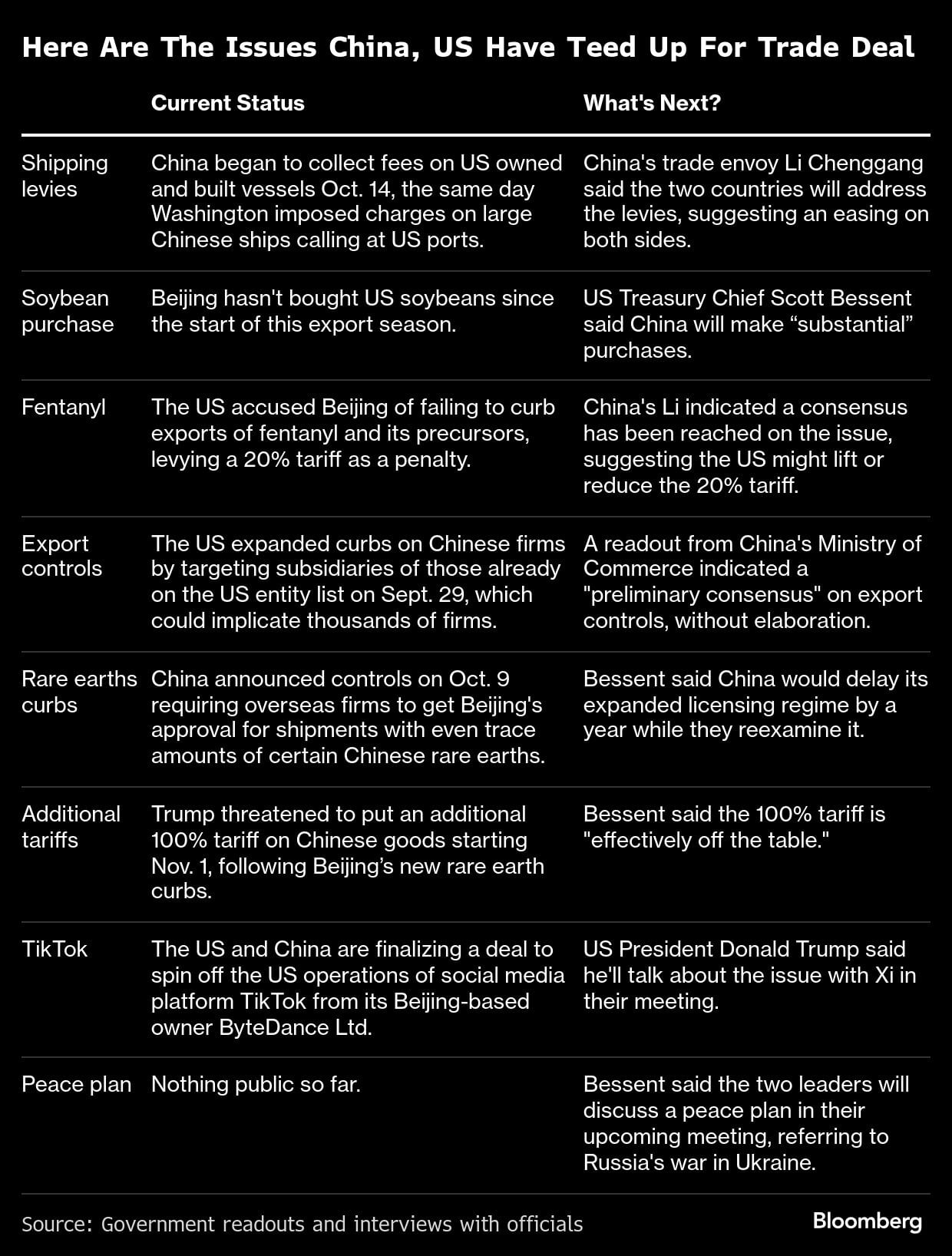

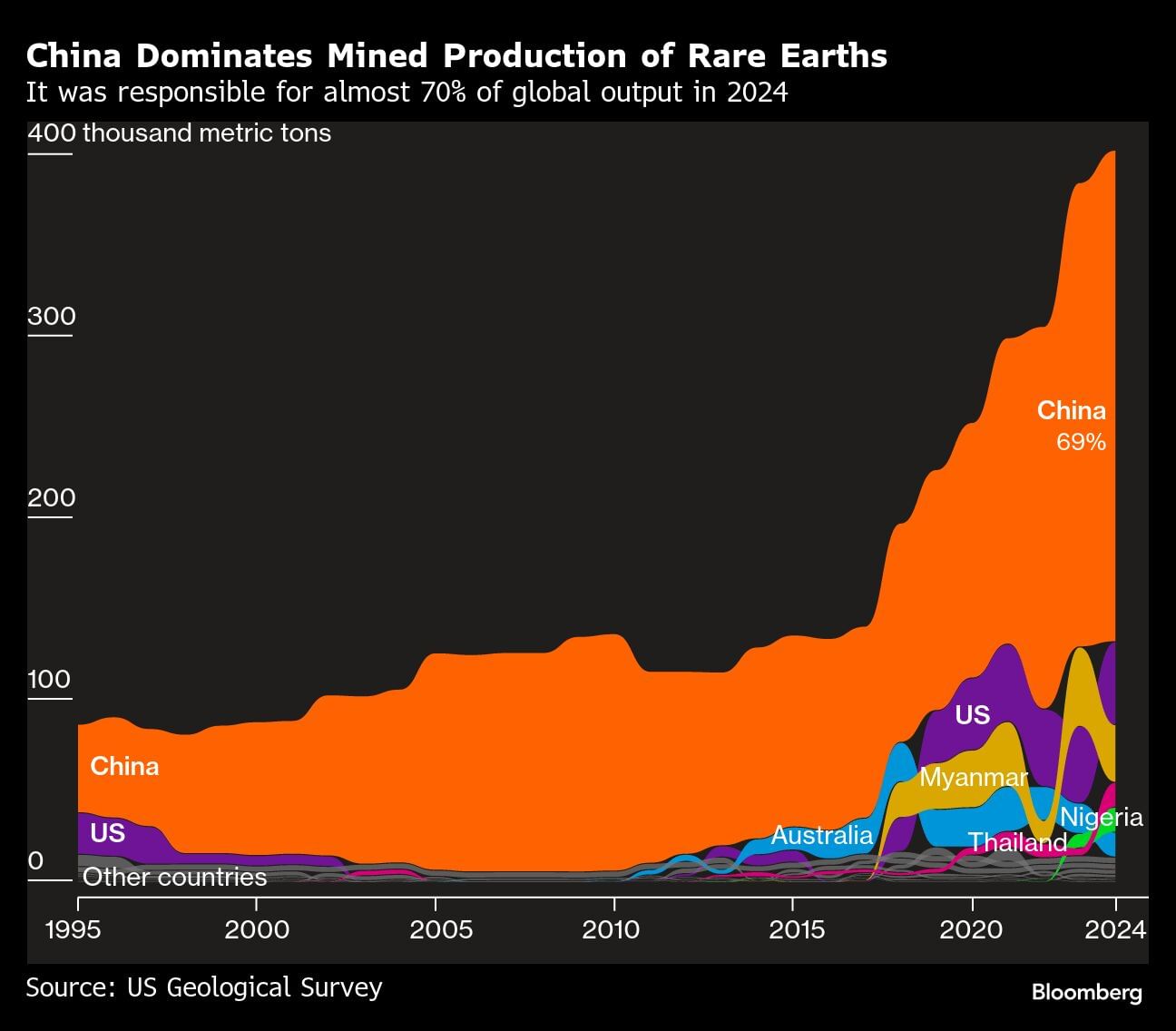

President Donald Trump told reporters on Monday that “I really feel good” about a deal with China, after officials this weekend in Malaysia unveiled a slew of agreements to ease trade tensions. That’ll likely see China resume soy purchases in key Republican voting states, while America walks back its latest 100% tariff threat in exchange for securing Beijing’s critical rare-earth magnets.

Markets soared on the news with the MSCI’s index for global stocks testing all-time highs, but analysts cautioned the deal teed up for Trump and Xi to sign in South Korea ignored thorny issues. Fundamental fights over national security appeared untouched, they said, along with Trump’s stated core mission of rebalancing trade. Making that harder, Chinese investment into America remains heavily restricted.

“Picking the low-hanging fruit makes the path ahead inherently tougher because it leaves the hard, high-stakes conflicts for last,” said Sun Chenghao, a fellow at Tsinghua University in Beijing. “The ‘grand deal’ requires tackling profound disagreements on state subsidies, tech competition and national security — areas where both sides’ fundamental models clash.”

That means a series of smaller, sectoral agreements achieved through sustained dialogue are more likely over the coming years, he added.

Subscribe to the Bloomberg Daybreak Podcast on Apple, Spotify and other Podcast Platforms.

US Treasury Secretary Scott Bessent has been pushing China to rebalance its economy and get the domestic consumer spending more during recent trade talks. Beijing appeared to ignore those calls last week, unveiling a policy document that emphasized manufacturing and tech self-sufficiency as the driving forces of the Chinese economy until at least 2030.

The contours of the China deal emerged as Trump began his weeklong trip to Asia by clinching trade pacts with Thailand and Malaysia touching on rare earths, and pledges to combat anti-dumping with Cambodia — all areas of contention with China. The Republican’s rallying of American allies in Beijing’s backyard appeared designed to build leverage ahead of his first sit down with Xi since returning to power.

Secretary of State Marco Rubio said during a call with Chinese Foreign Minister Wang Yi on Monday that the leaders’ meeting would take place in the southern South Korean city of Busan, according to a State Department spokesperson.

Underscoring the importance of leader-to-leader dialogue, Trump reiterated his pledge to visit China and suggested Xi could come to Washington or Mar-a-Lago, his private club in Florida. China is hosting the Asia-Pacific Economic Cooperation forum in 2026, while the US will hold the Group of Twenty leaders’ summit, giving both a reason to visit each other’s nations.

Ever since Trump made China the top target of America’s steepest tariff regime since the 1930s, bilateral ties have lurched between tit-for-tat escalation and economic talks to bring down the temperature.

The Chinese Communist Party’s official mouthpiece on Monday urged the world’s biggest economies to avoid lapsing back into that cycle, appealing for efforts to “jointly safeguard the hard-won achievements” from their latest talks.

That People’s Daily commentary called on the US to stick to the consultation mechanism led by Bessent and Chinese Vice Premier He Lifeng. Export curbs announced by US officials outside that framework have destabilized ties several times, prompting Beijing to jam its supply of rare earths critical to American manufacturing.

“Both sides now seem to be focused primarily on stability,” Daniel Kritenbrink, partner at The Asia Group and former US assistant secretary of state for East Asian and Pacific affairs, told Bloomberg Television. “But none of the fundamentals in this relationship have changed.”

While Bessent said he believed China would delay its latest rare-earth restrictions “for a year while they reexamine it” after the latest talks, friction over export controls remains. Chinese officials have used their chokehold over magnets needed to make everything from mobile phones to missiles to push back against US curbs on cutting-edge chips. Washington says those measures are necessary to restrain China’s military ambitions.

It had been unclear, however, how Beijing would logistically enforce curbs asserting control over any global shipment containing even a trace of certain rare metals from China, a move that sparked outcry in Europe, too.

China unveiled its latest measures in retaliation to the US expanding its own sanctions list to include thousands more Chinese companies. With Bessent saying that rolling back US export controls was off the table, a key question is what Xi gets in return for the pause other than reducing the threat of higher tariffs — and how long the delay will remain in place.

“China’s never going to give up its leverage on rare earths,” said Dexter Roberts, a nonresident senior fellow at the Atlantic Council’s Global China Hub. “That would be sheer stupidity on their part.”

One area where US officials signaled progress was fentanyl, raising the prospect a 20% tariff Trump imposed to pressure Beijing into halting the flow of chemicals used to make the deadly drug could be lowered. Relief on that levy — which stacks on top of Liberation Day tariffs — could be a boon for the Asian nation at a time when domestic demand is weak.

The removal of fentanyl tariffs on China could limit its US export losses to less than 10%, according to Bloomberg Economics’ Maeva Cousin.

Other major issues such as an investigation into China’s implementation of the “Phase One” agreement from the first trade war appear unresolved, although Trump on Monday suggested he could drop that probe, if things work out well.

Ultimately, the deal signaled amounted to a mix of small issues, said Scott Kennedy, senior adviser at the Center for Strategic and International Studies in Washington, noting Beijing’s industrial policy seemingly wasn’t up for discussion.

“They’ve kicked the can to the side and are focusing on very concrete, narrow issues, putting aside broader questions about China’s economic system and economic security,” he added. “It’s highly unlikely they’ll ever address those broader issues head on.”

(Reporting by Colum Murphy, Jing Li, Philip J. Heijmans, Allen Wan, David Ingles and Yvonne Man.)

Disclaimer: This report is auto generated from the Bloomberg news service. ThePrint holds no responsibility for its content.

Also Read: In China, Ashley Tellis’ arrest is proof that US-India trust was always fragile