Thank you dear subscribers, we are overwhelmed with your response.

Your Turn is a unique section from ThePrint featuring points of view from its subscribers. If you are a subscriber, have a point of view, please send it to us. If not, do subscribe here: https://theprint.in/subscribe/

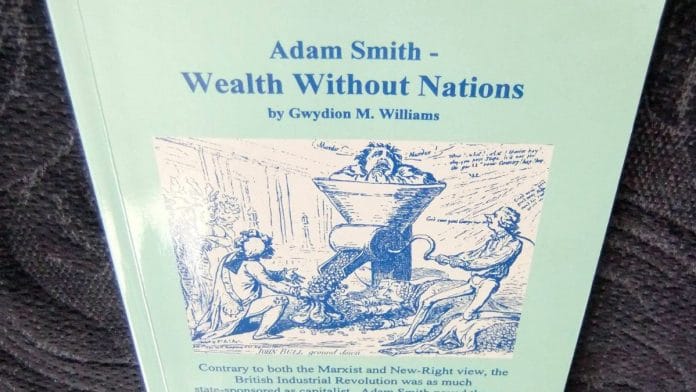

Free Market and Capitalism have often been used in tandem. First published in 1776, Adam Smith’s thoughts in the famous book ‘Wealth of Nations’ have been widely used as a reference point for the marketplace as we see it today or the edifice of a capitalist society.

The oft-quoted remark, “It is not from the benevolence of the butcher, the brewer, or the baker, that we expect our dinner, but from their regard to their own interest”, goes to the heart of Smith’s analysis of trade and commerce. ‘Capitalism’ came into currency later and was not a Smithian expression.

From the ‘Baker’ referred to by Adam Smith to the character Gordon Gekko in the movie Wall Street (“greed, for lack of a better word, is good”) the common element is self-interest.

The latter of course embodies total self-interest and extreme ‘self-love’ with a ‘who gives a damn’ for others. It will be very wrong to see Gekko as an extension of Smith’s thoughts. Smith also said in his other publication i.e. The Theory Moral Sentiments, “How selfish soever man may be supposed, there are evidently some principles in his nature, which interest him in the fortune of others, and render their happiness necessary to him, though he derives nothing from it except the pleasure of seeing it”

Jesse Noman, a respected parliamentarian in the UK and an author of repute, in his book on Adam Smith writes that Smith put markets squarely at the centre of his economic thought and deplored the tendencies to monopoly, exploitation and distortion of domestic policies created by ‘mercantile lobbies’ (probably, synonymous with cronyism in the contemporary lexicon).

Amartya Sen, in his introduction to Penguin’s 2009 publication of The Theory of Moral Sentiments, sums up thus. “The need for recognising the plurality of motivation, the connections between ethics and economics and the co-dependent, rather than free standing, role of institutions in general and free markets in particular in the functioning of the economy”.

So, to see Smith as an apologist of pure ‘capitalism’, devoid of ethics, virtues, and consequences, misses the mark. His views and thoughts were relevant to that era and as Dr Sen comments “a vision that has a remarkably current ring”.

More recently, after the global disruption caused by Covid, most countries have felt the urgent need to trim dependency on imports. The clarion calls for ‘atma nirbhar’ (self-reliance in English) has picked up decibels not just in India but in most economies. Re-configuring of supply chain is beginning to have its immediate effect i.e., increase in costs- a common phenomenon across the globe. Capital allocation is taking centre-stage after a hiatus. India too is seeing a tidal wave of entrepreneurial activity- be it capacity expansion or new products. India is now reported to have the third largest number of Unicorns ie more than US $1bn in valuation. This is wonderful news. However, let’s not forget that every entrepreneurial venture will not succeed and unless there is proper governance, we may not improve the start-up survival statistic, which is below 30%. Hence, there is a lot at stake.

Without going too far back, its generally accepted that the internet and telecom boom started a rush of start-ups in the 1990s and thereafter, birthing of new enterprises slowed down. And the older start-ups grew and grew. FANG (Facebook now Meta, Amazon, Netflix, Google now Alphabet) became the bellwether of the stock market. The slowing-down trend continued in the USA, while new ecosystems have emerged from Asia and Europe.

If Adam Smith were to be alive today, he would be thrilled with the surge in number of start-ups and the prospect of wealth creation. And, if we ran a ‘what-if’ algorithm on data base consisting of The Wealth of nations, Theory of Moral sentiments, and Lectures on Jurisprudence, I would imagine the probable Smithian advice (output) to be:

Entrepreneur: Market is the ultimate leveller and will reward good ideas and execution. Don’t try to manipulate the market. Good governance, credibility will facilitate wealth creation

Business: ‘Half a product’ is no product (Courtesy Macquarie Telecom). If the product does not perform as the offer warrants, expect the ‘invisible hand’ of the market to humble you.

Regulator: Enforce what you regulate and regulate what can be enforced. Retail Investor: Any promise of higher return has increased risks. Educate yourself to recognise the risks. Separate what Smith described as the “prodigals and projectors” from your risk buffet.

Environment: Nature provides us with ‘free’ goods that carry a value. Smith’s belief in the duties for sovereign nations justify action from both the state and the market against climate change (Adam Smith’s ‘Wealth of Nations’ Updated for Climate Challenge, in COP26 lecture series, Glasgow – Nov 2021).

These pieces are being published as they have been received – they have not been edited/fact-checked by ThePrint.

COMMENTS