Thank you dear subscribers, we are overwhelmed with your response.

Your Turn is a unique section from ThePrint featuring points of view from its subscribers. If you are a subscriber, have a point of view, please send it to us. If not, do subscribe here: https://theprint.in/subscribe/

In the run-up to the December 2022 Assembly elections in Gujarat, the BJP did not offer revdis but also vehemently ran their campaign against it. In the November 2023, Madhya Pradesh elections, the BJP extolled its Ladli Behen yogna whilst arguing vehemently against Revdis. By August 2024, the BJP had forgotten about Revdi politics and was largely using these welfare schemes to win elections. Today we wonder, why are welfare handouts suddenly working and whether these are ominous signs for our political economy.

Why are welfare handouts working?

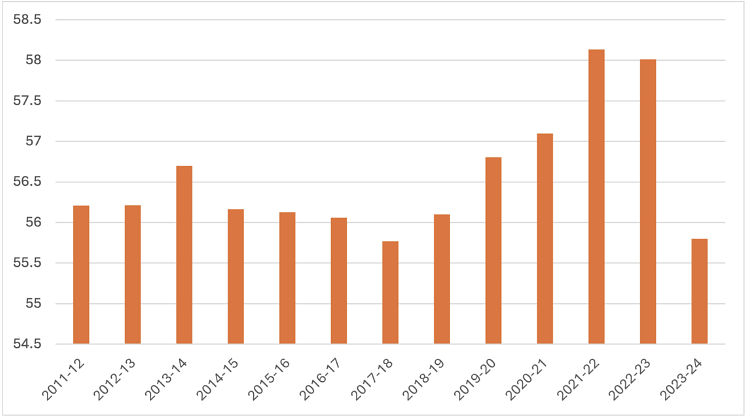

During the last decade, India’s GDP has been growing at an average rate of 6% which is slightly down from 6.86% growth in the preceding decade. While the GDP growth decline is concerning, the real story lies in private consumption expenditure. Private consumption expenditure (PCE) pertains to household spending on personal use. PCE in India usually accounts for 50 to 60 percent of GDP, with a higher consumption-to-GDP ratio often indicating a robust economy. If we look at the consumption-to-GDP ratio over the last 10 years (Figure 1), we see that this ratio has gone below 56% only twice. Once in fiscal year 2017/18 – just after demonetisation and again in the most recent year, 2023-24. This begs the question, why is consumption (as % of GDP) back to demonetization levels when households virtually had no liquidity?

Figure 1: Private Consumption as % of GDP

On the back of a very low quarterly growth rate of 3.3% in Q3 of 2019-2020, the government of India in 2019 announced massive corporate tax cuts. These tax cuts were perhaps enacted to motivate companies to invest more money, thereby creating jobs and possibly growth. Since these tax cuts did not do much to boost the incomes of fellow Indians, companies did not foresee any increase in demand. With the additional burden of the pandemic, many companies instead, ended up returning money to the shareholders. According to market data between 2019 and 2021, the profits of listed companies in the stock market increased from 2.8% to 3.5% as a percentage of the GDP. This is when the GDP had just rebounded back from the pandemic to its original 2019 levels. With the subsiding of lockdowns and massive government spending, both economy and the private consumption roared back because of revenge spending. But that revenge spending came at the cost of household savings and did not do much for household incomes.

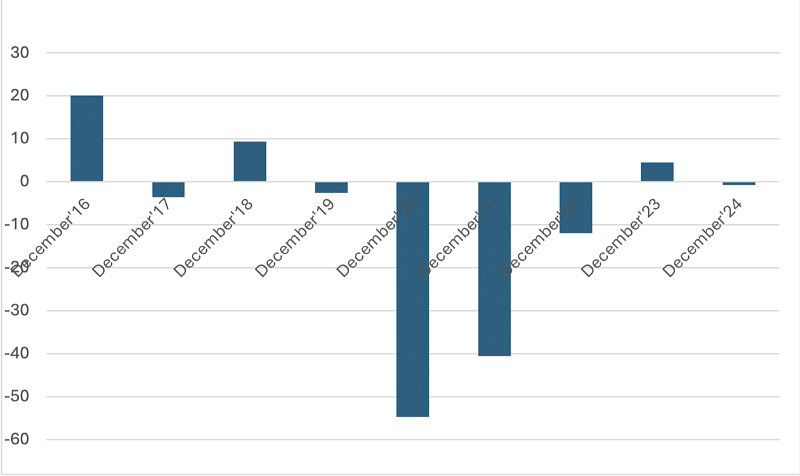

Since companies neither invested nor increased salaries, wages have hardly increased in the last few years. According to the consumer confidence survey, (Figure 2) majority of consumers have reported declining incomes in the last four out of five years. This fact has also been reflected the consumer confidence which is down from 104 in 2016 (before demonetisation) to 94 in 2024 – a decline of 10%. Some of these indicators also align with the warning signs being reported by the financial press including declining car sales, increased gold NPAs, and low investment growth.

Figure 2: Consumer Confidence Survey on Income

What can the government do about it?

As we write this, Budget 2025 is upon us. In this political climate expecting the government to wean off politically successful welfare schemes is foolish. At the same time, realizing that welfare schemes are un-sustainable as well as inflationary is equally important. Add the fiscal deficit considerations which limits how much the government can spend. Since a spending blowout is not possible, the government can still help the economy by repositioning its priorities. The current NDA government needs to move from being corporate-friendly to being market-friendly. For too long, successive governments have taken a protectionist stance concerning domestic industries, with much less to show for it in terms of investment growth and manufacturing. This has additionally made them complacent and non-competitive. Name one global Indian brand popular worldwide. Opening the markets will undoubtedly lead some companies to fail but will also spur investments, create new jobs, and increase wages. To that end, the government needs to stop being a market regulator and become a market enabler.

That means no export bans before elections, no price fixing of petrol, no windfall tax, and specifically no luxury tax. Third, it needs to encourage spending at all costs. Consumer spending creates demand for new products and ushers in a positive cycle of investment, job creation, and wage growth. More importantly, the government needs to start embracing its rich – no matter the political costs. It must realize that India’s rich are the ones who are driving its economic growth. They don’t have to like their rich, but they need to keep them here. Free market reforms are what led to our economic growth and our geopolitical heft, and it’s time to embrace them once and for all.

These pieces are being published as they have been received – they have not been edited/fact-checked by ThePrint.