In the world of critical minerals, it’s either feast, or famine. For much of 2025, manufacturers dependent on the suite of rarely used, vital elements whose production is dominated by China were in a state of mild panic. Export restrictions imposed by Beijing in the wake of President Donald Trump’s Liberation Day tariffs caused collateral damage way beyond their intended target, the US.

Indian scooter manufacturers and European automakers were caught in the crossfire, promising chaos throughout much of the world’s industrial sector. The latest threats, directed against Japan after Prime Minister Sanae Takaichi angered Beijing with comments about defense policy, shows China is still more than willing to reach for the weapon.

It might be hard to discern it at this point, but we may be rapidly heading into an age of wild abundance for these same materials.

Trump’s announcement Monday of a $12 billion stockpile nicknamed Project Vault is the bazooka the market has been waiting for. The size of the fund — comprising $10 billion from the US Export-Import Bank plus $1.67 billion from the private sector — goes well beyond the wildest expectations, or indeed needs, of the critical minerals sector. A bipartisan bill introduced to Congress last month proposed a far smaller $2.5 billion fund — a number that the authors of the legislation might have expected to get whittled away before passage.

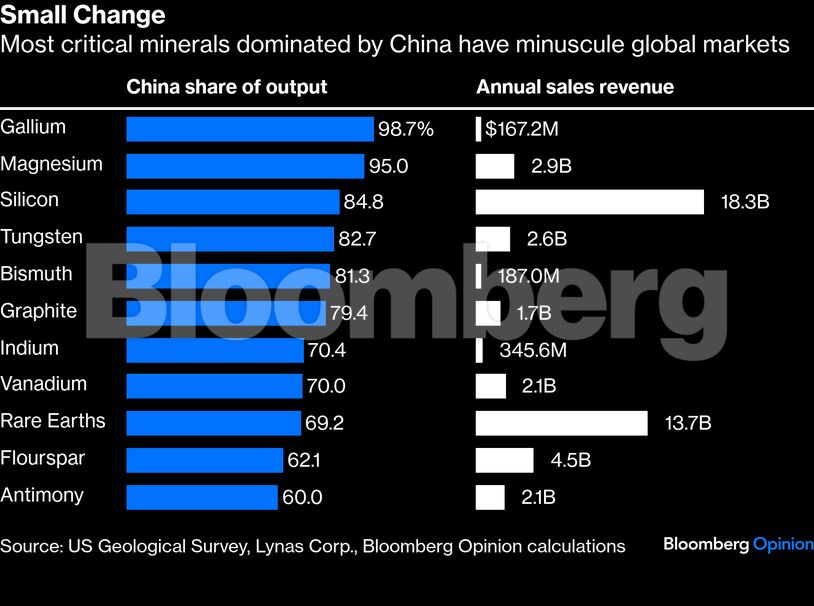

What does $12 billion buy you? Unless you use an extremely loose definition that includes widely traded commodities with diverse supply chains such as copper, aluminum, nickel, chromium and manganese, it should easily be sufficient to buy every gram of critical minerals consumed outside of China in a year.

Or compare it to the US strategic petroleum reserve. At current crude prices, the 413 million barrels held in that stockpile are worth about $25 billion. Project Vault is committing almost half this amount to safeguard a sector that’s about one-hundredth the size of the $2.5 trillion global oil market.

Take some recent estimates from the International Energy Agency. You could secure the entire supply chain of the rare-earth magnets used in electric vehicles and wind turbines for all developed economies for about $1 billion.

Most of that up-front expenditure will be recouped as inventory is sold back to manufacturers. The ongoing expense is essentially the cost of finance and running a warehouse, a far smaller sum. Consider gallium, a semi-liquid, silvery metal almost entirely refined in China and used in semiconductors and LEDs. Operating costs for a pile sufficient to keep all its member countries well-supplied would come to about $800,000 a year, the IEA said, roughly equivalent to the salaries of four senior White House officials.

Given the geopolitical stakes and Trump’s penchant for grandiosity, it makes some sense to go big or go home. With the Ex-Im bank loan expected to run for 15 years, it’s sensible to set up a much bigger facility than you need right now. By the early 2040s, with the transition to clean energy advancing inexorably, the volumes of critical minerals the world needs will be vastly larger than at present.

Even so, this long-overdue action is likely to result in some substantial surpluses down the line. The dozens of ministers from the likes of the EU, Australia, Japan, South Korea and Brazil who are due to meet in Washington this week to discuss ways to protect rare elements against Chinese dominance will initially welcome such a substantial facility. Over time, however, they may grow more wary.

The stockpile as currently envisaged would be sufficient to suck up every ounce produced outside China, as well as all the production from a constellation of early-stage mining and processing projects that will now find it vastly easier to get financial sign-off. It will still, however, be a US facility, operated by the US government, with the interests of US manufacturers in mind.

When the IEA was established after the 1973 oil crisis, it didn’t require a single global stockpile of crude in the country. Instead, member states were required to hold 90 days’ worth of net imports. If that diversity of national inventories was considered an imperative during the heyday of Cold War solidarity between democracies, it will be even more important now.

European and Japanese manufacturers that have seen their supplies of vital materials threatened by China and Russia might once have counted on a White House less inclined to throw its weight around on the world stage. Those times are long gone. None will want to exchange dominance at the hands of China for dominance at the hands of the US. Expect a domino effect of reserve proliferation, as every government looks to lock down its own supply chain. The era of critical-minerals shortages is behind us. The era of gluts is about to dawn.