China’s oil refiners are discreetly purchasing cheap Russian crude as the nation’s supply continues to seep into the market.

Unlike India’s state-run oil refiners, which have issued a number of tenders seeking to buy Russia’s flagship Urals crude among other grades, traders say China’s state processors are negotiating privately under the radar with sellers. The nation’s independent refiners are also quietly buying, according to traders who asked not to be identified as the information is confidential.

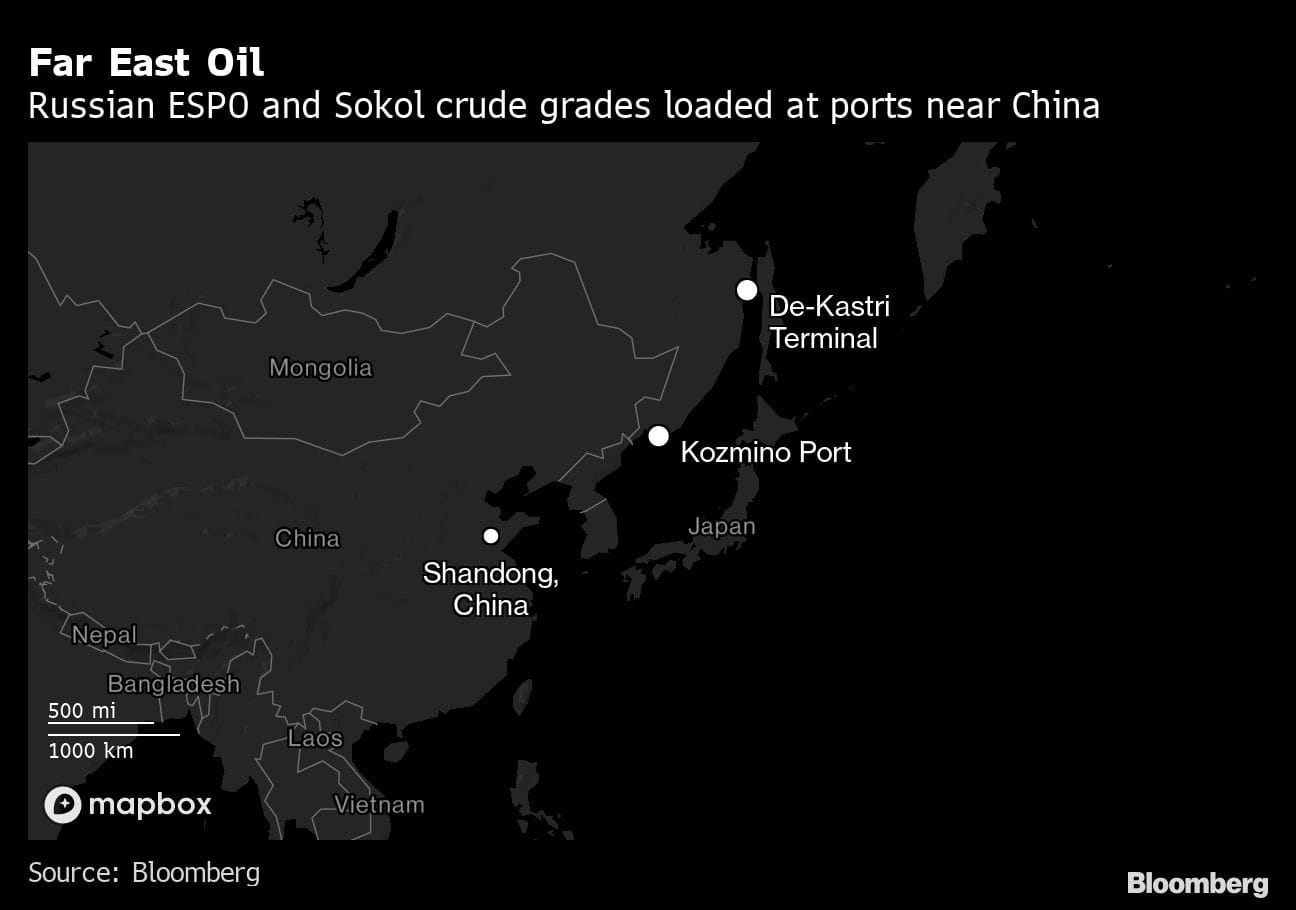

Most buyers are shunning Russian crude after its invasion of Ukraine, fearing damage to their reputation or falling foul of sanctions. China’s independent refiners, which account for a quarter of the nation’s processing capacity and are mainly based in Shandong province, bought some ESPO oil that’s loaded at Russia’s eastern port of Kozmino, according to traders.

The recent ESPO purchases by independent refiners, known as teapots, are for May-loading cargoes, and the Chinese processors are continuously making inquiries about Russian oil, traders said. ESPO is a favored grade because it can be shipped to their smaller ports — that are unable to unload larger vessels — from a shorter distance, cutting down costs.

Some teapots are working with traders on financing options and checking on the availability of vessels to ship the crude at a reasonable price, and are also considering buying Urals, said traders. The cargoes of Urals purchased by state-run processors are for June delivery, they added.

Trading of Russian oil has mostly shifted away from the public eye after its invasion of Ukraine. Willing buyers and sellers are being forced to engage in private negotiations after some tenders attracted zero bids. Shell Plc got heavy criticism after its purchase of Urals not long after the war started.

Another of Russia’s Far East crude grades — Sokol — is also flowing to India. State-run Indian Oil Corp. and Hindustan Petroleum Corp. bought some Sokol loading in May from ONGC Videsh Ltd., an equity partner in the Sakhalin-I project, according to traders. Cargoes are loaded from the De-Kastri terminal.

Indian Oil, Hindustan Petroleum and ONGC declined to comment.

Japan’s Sakhalin Oil and Gas Development Co. known as SODECO, which also has an equity interest in Sakhalin-I, declined to comment on its future exports of Sokol crude. Traders said some buyers in North Asia are likely to take their already-committed cargoes of the grade in May.

India has so far bought at least 13 million barrels of Urals since late February, according to data compiled by Bloomberg, with Indian Oil purchasing a further 3 million barrels in its latest tender. Volumes to the nation averaged about 128,000 tons a month in 2021, Bloomberg calculations based on ship-tracking data show. Urals is shipped from ports in the Baltic and Black Seas. –Bloomberg

Also read: Tech billionaires back nuclear power as alternative to carbon emissions, Russian gas