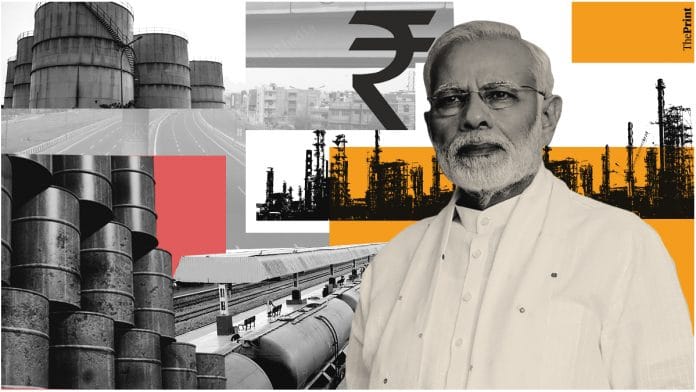

The global oil slump will benefit India because it imports 80 per cent of its crude oil requirements. The windfall has given Modi government the cushion to increase fuel taxes to meet the revenue shortfall arising out of slowing economic activity. But retail petrol and diesel prices still hover around pre-coronavirus levels.

ThePrint asks: Should Modi govt let oil crash cushion finances or will lower retail prices revive economy?

Modi govt should use oil windfall to give India an effective stimulus package

Radhika Pandey

Radhika Pandey

Fellow, National Institute of Public Finance and Policy (NIPFP)

The crude oil price crash has come at a time when the world is battling a global health emergency in the form of Covid-19 pandemic. For India, the situation is particularly worrying as its fiscal position is weak.

The government had budgeted to bring down its fiscal deficit to 3.5 per cent of the GDP in the current fiscal. But with growing expenditure commitments and falling revenues, it is increasingly becoming clear that the fiscal deficit target would be missed by a wide margin. Government has not revised its deficit target (borrowing target) for the current fiscal but is trying to shore up finances through other measures such as the Ways and Means Advances from the RBI.

In this backdrop, it would be prudent for the government to use the windfall arising from the crash in oil prices to cushion its fiscal position and use the finances to come up with an effective stimulus package.

Fall in retail prices would not be effective at this juncture, as the economy has come to a virtual halt due to the nationwide lockdown. The major oil consuming sectors are grounded. Subdued demand for fuel would result in limited tax collection from its sales.

The oil price crash should be used as an avenue to support the health infrastructure and the worst hit sectors of the economy.

Views are personal

Consumers should get the benefit, lowering fuel prices will increase their disposable income

Anupam Manur

Anupam Manur

Assistant Professor, Takshashila Institution

At a time when even deficit hawks are clamouring for an expansive fiscal policy to fight the severe economic consequences of Covid-19, it will be tempting for the government to exploit every opportunity to fund the welfare programmes. When oil prices first dropped to less than $30 per barrel, the Modi government had promptly increased the central excise duty. However, this will not result in increased revenue due to the enforced lockdowns and halting of economic activity.

If the objective is to help the economy rebound and bolster government finances, there are better ways than raising petrol taxes. In fact, lowering it will increase the disposable income of consumers, who will go out and spend more on other goods and services. Apart from increasing incomes, it will also help the government collect higher indirect taxes. Many businesses, which are reliant on petrol, such as transport and logistics, will get a much-needed fillip by reduced petrol prices.

Since the price of oil has a cascading effect on the general price level in the economy, maintaining petrol and diesel prices at the same level or increasing it can lead to higher inflation and can further dampen their demand. Moreover, additional revenue gained by the government is offset by increased subsidy payments and revenue foregone from sectors dependent on oil. Further, since petrol is outside the purview of GST, states will want their fair share as well and will competitively increase VAT on petrol.

The additional amount that can be raised by petrol taxes is about Rs 30,000 crore, which will not make a dent to the Rs 8-10 lakh crore required for the post-pandemic economic revival package. It’s time to pass on the benefit to the consumers.

Govt should look beyond fuel to cushion finances. Lower fuel prices will provide relief to farmers

Himanshu

Himanshu

Associate professor at Jawaharlal Nehru University

The taxes on diesel and petroleum are far too high, despite more than a 60 per cent collapse in oil prices since January. Therefore, there is already sufficient cushioning to the finances of Narendra Modi government. I don’t think that the fuel prices are the only source of revenue that the government should be looking at. Monetisation of deficit, rationalising expenditures and issuing government bonds are just one of the many ways to generate revenue. I’m sure even the recent salary cuts and freeze in dearness allowance of government employees, implemented during the Covid-19 crisis, must have provided additional cushioning.

There’s no need for the government to lean on fuel prices, especially when it comes at the cost of the needs of the economy. People are anyways going to suffer from inflation, job losses and declining incomes.

Modi government needs to look at the agriculture sector — a steady consumer of diesel for cultivation purposes — as an important input cost too. With the next sowing season coming up in June-July and the agricultural commodity prices expected to decline, farmers’ hardships will only balloon. A reduction in fuel prices will provide them much-needed relief. It will also help boost demand by increasing disposable income in the hands of people, a necessity at a time when the economy is already suffering from demand deflation.

No significant benefits from low oil prices due to lack of demand during the Covid-19 lockdown

Amit Sadhukhan

Amit Sadhukhan

Assistant professor, Tata Institute of Social Sciences, Hyderabad

International oil glut reached historic levels when the West Texas Intermediate — WTI— the benchmark price for US oil, touched a negative price of $40 a barrel. The international benchmark, Brent crude, hit $20 levels.

Being an importer of the crude oil, India could gain on multiple fronts: improve its balance of payment and strengthen its already deteriorated exchange rate, which has reached a highest level of Rs 76 per dollar. It can also gain from a higher tax collection from its petrochemical companies. If some of the benefits are passed on to the producers — mainly to the freight transport and manufactures — there would be an indirect benefit to the common people through reduction in prices of food and other necessary goods with an immediate effect.

However, all these windfall possibilities are difficult to achieve because of the collapse of demand due to the lockdown. The lack of demand, therefore, would make no significant benefit for the public finance even if retail prices are lowered.

Also read: E-commerce curbs and China FDI rules: Is Covid-19 making India more protectionist?

By Pia Krishnankutty, journalist at ThePrint

All discussions around revival of economy are centered on the single fact of “reviving demand. ” It is straight forward that increasing taxes lowers demand. On the contrary reducing taxes lowers cost and increase demand. By decreasing prices of fuel the government will be putting money DIRECTLY in the hands of consumers with liberty to save or spend on useful items. Lower cost of fuel will ” FUEL” demand for other items as well as petrol, diesel, and increase in taxes. In view of current price of crude oil government should drastically reduce prices of petrol and diesel to Rs. 30 per liter. Offcourse there will be accountants in bureaucracy who raise this or that reason by nit picking , but this is historic calamity both healthwise and economy wise. This situation can become a disaster or opportunity on how government acts. It is obvious from last 5 years of experience that economy cannot be revived only by government. The economy is ultimately based on SENTIMENTS. A reduction of fuel prices will be the biggest boost government can give to uplift the sagging sentiments of ordinary consumers. As was done by ALL earlier governments , this government MUST reduce fuel prices by widest possible cuts.

All discussions around revival of economy are centered on the single fact of “reviving demand. ” It is straight forward that increasing taxes lowers demand. On the contrary reducing taxes lowers cost and increase demand. By decreasing prices of fuel the government will be putting money DIRECTLY in the hands of consumers with liberty to save or spend on useful items. Lower cost of fuel will ” FUEL” demand for other items as well as petrol, diesel, and increase in taxes. In view of current price of crude oil government should drastically reduce prices of petrol and diesel to Rs. 30 per liter. Offcourse there will be accountants in bureaucracy who raise this or that reason by nit picking , but this is historic calamity both healthwise and economy wise. This situation can become a disaster or opportunity on how government acts. It is obvious from last 5 years of experience that economy cannot be revived only by government. The economy is ultimately based on SENTIMENTS. A reduction of fuel prices will be the biggest boost government can give to uplift the sagging sentiments of ordinary consumers. As was done by ALL earlier governments , this government MUST reduce fuel prices by widest possible cuts.

The government is in no position to let go of one drop of ATF. Every cent from lower oil prices will have to be shared between Centre and states. The only meat on their plate at the moment. The views senior functionaries had expressed while in opposition may be good for a few memes.

I think it is simple logic – no expertise required: No reduction is price of GAS

Even after lock down is lifted by the people of India (Government enforced lock down for the people – don’t make it out that the Governments world over are RESPONSIBLE for the lock down – Lock down is because of the lethality of the virus, usage of Gasoline will be a fraction of what it was before the Lock Down – usage will only gradually increase. In the interim Government can’t afford to lose incomes from which ever source possible without too much stress on the economy.