Bengaluru: Indian investors expecting quick returns on investment is a concern for deep tech start-up founders. Kamakoti Veezhinathan, director of Indian Institute of Technology-Madras (IIT-M), in an exclusive interview, told ThePrint that, “If you take deep-tech, it’ll take 10 years for the money to come (as returns) and it needs continuous funding at regular intervals to keep themselves alive.”

The investors should be able to understand the value of science as well, he added. “If I am an investor, I should appreciate technology, meaning my team should appreciate it. I may be a businessman with a commerce background. I have a lot of money, but I will have a team which will evaluate and find out whether we can use it,” he said.

The other part is to be aware of the return on investment. Sectors such as deep-tech need regular funding at continuous intervals to survive. Investors as well as incubators have a significant role to foster such start-ups. “The role of an incubator is not just to incubate and give some initial funding,” Kamakoti said.

The role of the incubator, as he said, should also be to provide the human support to build the product and get it to the market, he added.

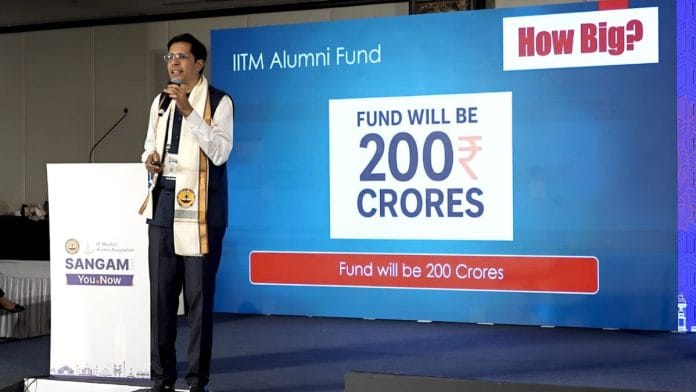

In a latest announcement last week at the IIT-Madras alumni event in Bangalore, Kamakoti unveiled a call for a Rs 200 crore venture capital (VC) fund to support start-ups incubated at the institute. With the number of start-ups being incubated at IIT Madras having increased exponentially in recent years, the Institute anticipates a need for careful investments to help start-ups scale, according to the press release.

Last year the Union Cabinet approved the establishment of a Rs 1,000 crore VC fund dedicated to supporting India’s space sector.

However, 7 months into 2025, the space sector still worries start-up owners who find it difficult to fund their innovation.

Previously ThePrint reported on the need for an attitude reset from VCs who fund space-tech start-ups as the Return on Investment (ROI) takes longer than the usual mature fund maturity period of 7 years.

In these cases, a safer way is to look for risk funds arranged through government support to back the start-ups at an early stage, according to Prabhu Rajagopal Head, School of Innovation & Entrepreneurship, IIT-M.

“We will try to get it through some governmental support, alumni support, charitable sources. The goal is to fund our deep tech start-ups in the initial stages,” Rajagopal added.

That said, Rajagopal notes that Indian medtech entrepreneurs also struggle with funding, which makes focusing on India-specific issues a challenge.

Balancing global markets and home challenges

India’s healthcare industry has been growing at a compound annual growth rate of around 22 percent since 2016, according to NITI Aayog’s 2021 report. The country’s relative cost competitiveness and availability of skilled labour are also making it an increasingly favoured destination for medical value travel.

But the number of medtech start-ups that focus on India’s necessity is not in great numbers, said Rajagopal.

Start-ups need sustainable revenue, a reality one can’t turn a blind eye to. Hence, to solve Western-centric health problems could be more financially feasible as there might be a better market. But this leaves critical local health challenges underfunded, he said.

NITI-Aayog, too, identifies that the adoption of healthcare solutions in the country is at a nascent stage.

Rajagopal also sees an attitude problem in the Indian market. While a technology developed in India costs a significant amount, people expect it at a price lower than what it took to build the product. “If I go to the market (with) a medtech device at 5,000 rupees (end customers ask) can you give it to me for 500 rupees? But at the same time if a German or a Japanese company comes, they are even (ready) to buy it for 10 times that value,” Rajagopal said.

Although Rajagopal supports fair pricing from start-ups, he advocates for a better understanding of the costs involved in developing products in India.

“We (are) not developing solutions for our problems because our people are not willing to buy our solutions,” Rajagopal adds.

(Edited by Zinnia Ray Chaudhuri)

Also read: EtherealX to Agnikul, Indian startups enter space defence domain. Op Sindoor was the pivot