India’s retail food inflation has been high since early 2022, averaging 7 per cent annually in both 2022 and 2023. It has risen further for the first eight months of 2024, averaging 8 per cent. In response, the government introduced several interventions to shield consumers, many of which have been rolled back last month. These include freeing up white rice exports, halving of export duty on parboiled rice and onions and increasing import duties on edible oils. To support soybean farmers, the government also announced procurement of over 5 million metric tonnes (MMTs) of the upcoming kharif crop at in Karnataka, Maharashtra, Madhya Pradesh, and Telangana. That is about 40 per cent of the estimated crop.

While more policy announcements, especially on ethanol prices from crops like rice and sugarcane, are expected, this article focuses on the edible oil sector. On 13 September 2024, the government raised import duties on edible oils, arguing this would increase domestic demand for oilseeds like soybean, groundnut, and mustard. However, the relationship between import duties and oilseed prices has become less clear-cut due to factors such as the meal and biofuel markets.

Duty changes on edible oils

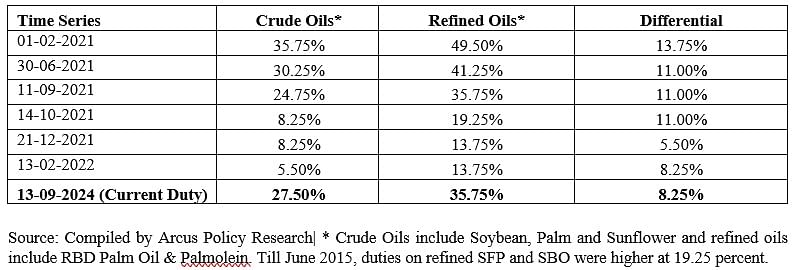

The new import duties on crude and refined oils increased to 27.5 per cent and 35.75 per cent, respectively, from earlier levels of 5.5 per cent and 13.75 per cent (Table 1). These adjustments should in turn boost demand for locally produced oilseeds. India imports 55 per cent of its edible oil needs, including 32 per cent of the world’s soybean oil, 22 per cent of sunflower oil, and 20 per cent of palm oil (TE2023-24).

Table 1: Import Duty on Crude and Refined Oils Over Years

Typically, three factors ideally guide edible oil import duty decisions in India:

Global prices: When global oil prices rise, India lowers import duties to make oil more affordable for refiners. Conversely, when global prices fall, duties are increased to protect domestic interests, ensuring that refiners continue to find value in locally sourced oils. FAO’s vegetable oil index reached its highest levels since 1990 in years 2021 and 2022, and India reacted by strategically reducing the import duties in the two years (Table 1).

Landed Prices: Imported oils compete with locally produced oils. Import duties are adjusted to ensure that locally sourced oils, especially when oilseeds are purchased at MSP, remain profitable for domestic refiners.

Crude vs. refined oils: The government keeps import duties on crude oil lower than those on refined oil, allowing domestic refiners to remain competitive. This differential helps local refiners process crude oil domestically rather than the market relying on imported refined oils. Most recently this difference has been maintained at 8.25 percent (Table 1).

Impact on Consumers

Since the duty increase on 13 September 2024, retail prices (south zone) for palm, soybean, sunflower, and mustard oil surged by about 17 per cent, 2 per cent, 11 per cent and 3 per cent respectively by 27 September 2024.

In the Consumer Price Index (CPI) basket, oils and fats hold a weight of 4.21 in rural areas and 2.81 in urban areas. With higher import duties, edible oil prices are expected to rise further once the stocks from pre-duty increase times get exhausted. According to our econometric modelling, CPI annual inflation rate for oils and fats was projected to exceed 5 per cent by December 2024, even before the duty hike. Now, inflation is expected to rise faster. Preliminary estimates suggest that the duty hike could add 0.5 to 0.7 percentage points to overall food inflation over the next two to three months.

Impact on farmers

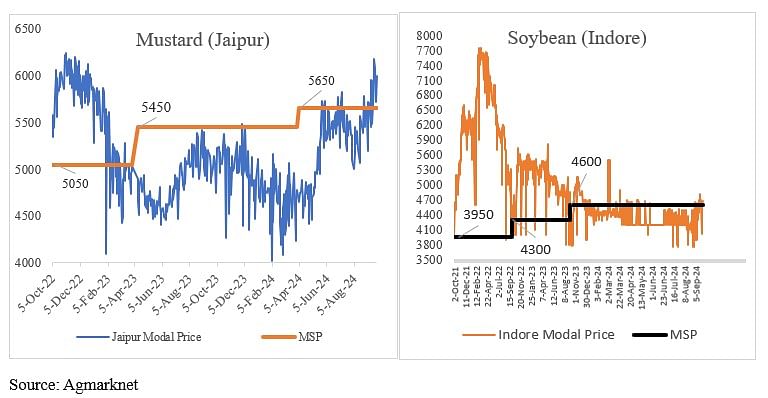

Since the September 2024 duty hike, mandi prices for key oilseeds like soybean and mustard have risen, although the trends differ (Figure 1). As of 27 September 2024, mustard prices in Jaipur mandi increased by 10.6 per cent, reaching Rs. 6,248 per quintal, against the MSP Rs. 5,650 per quintal. Soybean prices, however, rose only 2.2 per cent, reaching Rs. 4,700 per quintal against the MSP of Rs. 4,600. The MSP for the new soybean crop, starting 1 October is Rs. 4,892. While mustard prices have seen a notable rise, soybean prices remain subdued, also as a new crop is due to arrive soon. The purchase of about 2 MMTs of mustard seed by the National Agricultural Cooperative Marketing Federation of India (NAFED) and Haryana State Cooperative Supply and Marketing Federation Limited (Hafed) together has also helped in supporting mustard seed prices. Soybean purchases under PSS (price support scheme) are to commence on 25 October 2024.

Figure 1: Mandi Prices of Mustard & Soybean (Rs/Qtl)

But there’s more to the soybean market than just oil—meal prices are a crucial factor.

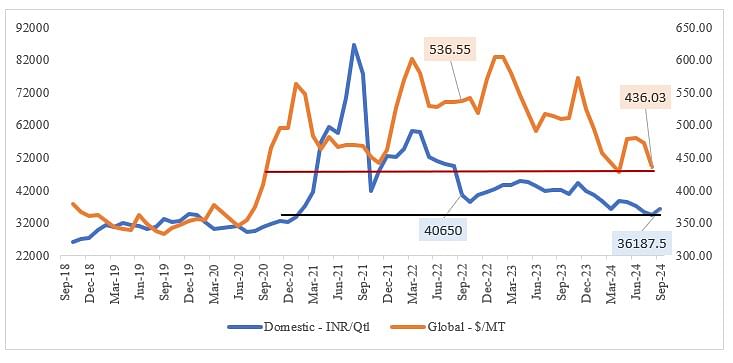

India produces about 13.7 MMT of soybean annually, yielding about 2.1 MMT of oil (at the conversion rate of 18 per cent) and 9.4 MMT of meal (TE 23-24). While India imports around 3.6 MMT of soybean oil, it exports approximately 1.7 MMT of soybean meal. Recently, domestic and global prices for soybean meal have fallen (Figure 2). Domestically, meal prices dropped by 11 per cent, from about Rs. 40,000/tn in September 2022 to Rs. 36,000 in September 2024. Globally, they fell by 18 per cent (from US$537 to US$ 436/tn).

Figure 2: Soybean Meal Price Trend (INR/Qtl)

Source: UPAg (Averaged price till Sep 23, 2024) | WB Pink Sheet (Till Aug 2024)

This decline in soybean meal prices is partly due to a global bumper crop, leading to surplus supply. Lower meal prices make soybean oil extraction less attractive for processors, as 80 per cent of the soybean output is meal. As a result, soybean farmers face reduced demand for their crops from the crushing industry.

Additionally, India’s push for E20 ethanol blending is creating new competition for soybean meal. Ethanol production from rice and maize generates a byproduct called Dried Distillers Grains with Solubles (DDGS), which can substitute for soybean meal. As E20 mandates expand, DDGS availability will increase, potentially shrinking demand for soybean meal even further.

Mustard, on the other hand, is primarily domestically produced and consumed, with India producing around 12.6 MMT annually. Annual production of mustard oil is about 4 MMT and of meal is about 7 MMT (TE 24-25). Around 80 per cent of the mustard meal production is consumed domestically, indicating a relatively stable market.

In April 2024, as the new mustard crop arrived in Jaipur mandis, prices hovered around Rs.47/kg, against an MSP of Rs.56.5. As per our calculations, mustard oil millers purchasing mustard at Rs. 47/kg could produce refined mustard oil at approximately Rs. 93/litre. Upon comparing with the cost of imported palm oil (when palm CNF was at US$ 996/tn) in April 2024, the total cost of refined palm oil in Jaipur mandi is assessed to be about Rs. 95.4/litre. This means that domestically produced refined mustard oil was at least Rs. 2 per litre cheaper than imported palm oil. Despite this price advantage, India continued to import palm oil in bumper quantities and mustard mandi prices suffered from lack of sufficient demand. The mandi prices were even lower than Rs.47 in March 2024. This trend highlights a growing domestic market for palm oil, which is increasingly competing with local oils like mustard oil, despite the latter’s price advantage. As a result, mustard farmers are facing reduced demand for their product, further complicating the dynamics of the edible oil market.

Need for integrated approach

The challenges faced by India’s edible oil sector highlight the need for a more integrated approach.

Improving oilseed crop yields is critical. India ranks fourth globally in soybean acreage but is only fifth in productivity. This gap exists not just in soybeans but across various crops. Enhancing productivity would enable farmers to generate higher incomes from the same land, supporting India’s move toward self-sufficiency in edible oil production. Over emphasis of policy on mustard and soybean may actually be balanced with other oilseeds like sunflower, and ground nuts. Domestic demand for sunflower oil has been growing steadily, and is largely met via imports.

The edible oil and bioethanol markets are becoming increasingly intertwined. The push for bioethanol production, particularly through the B5 mandate, has the potential to affect the demand for palm and oilseeds, particularly soybeans. Globally, 20 per cent of vegetable oils produced are being utilised for biofuel, rising at the rate of 5 to 6 per cent annually. Climate change is another significant factor influencing both domestic and global commodity markets.

In this interconnected world, commodity relationships are becoming increasingly complex and non-linear. The edible oil market is evolving rapidly, requiring agility and foresight from policymakers, refiners, and other stakeholders alike. As India continues to influence and be influenced by global edible oil and energy markets, a more comprehensive strategy is important that addresses all: food, feed and energy security.

Views are personal. Shweta Saini is an agriculture economist and CEO and Shruti Priya is a Research Analyst at Arcus Policy Research, New Delhi. Views are personal.

(Edited by Ratan Priya)