New Delhi: A recent Supreme Court order allowing fugitive businessmen Sandesara brothers to wipe their criminal slate clean by repaying part of the money they allegedly owe banks has sparked a debate—can high-profile economic offenders similarly “buy” their way out of trouble?

Even though the court clarified that its Sandesara brothers ruling cannot be treated as a precedent, the handling of this USD 1.6-billion bank fraud case is being closely analysed in legal and financial circles, especially when dozens of fugitives are similarly wanted over major loan defaults and criminal cheating cases.

The Supreme Court on 19 November agreed to drop all civil and criminal proceedings against the Sandesara brothers, the promoters of Sterling Biotech Ltd, and their chartered accountant if they pay Rs 5,100 crore—roughly a third of total alleged fraud amount with fines and interests—”as a full and final payment” by or on 17 December to the SC registry.

Founded in 1985, Sterling Biotech Ltd is a Gujarat-based Sandesara group company owned by brothers Nitin and Chetan Jayantilal Sandesara.

The brothers own another company called Sterling Oil Exploration and Energy Production Ltd. which was established in 2003, and is headquartered in Nigeria.

Also Read: ED files 5th chargesheet in Sandesara fraud but no mention of CBI No. 2 Asthana so far

The case & the numbers

The Sandesaras left India in 2017 on Albanian passports as they faced multiple loan fraud allegations from agencies including the Central Bureau of Investigation (CBI), Enforcement Directorate (ED), Serious Fraud Investigation Office (SFIO) and the Income Tax Department.

In 2020, they were designated ‘Fugitive Economic Offenders’ under a 2018 law that also freezes their ability to participate in civil litigation and mandates attachment of properties. Their CA Hemant Hathi is also allegedly involved in this case.

Even though they were declared ‘Fugitive Economic Offenders’ in India, the brothers expanded their oil and gas operations in Nigeria through their Sterling Oil Exploration and Energy Production Limited, which, according to its official website, contributes 2.5 percent of Nigeria’s federal revenue.

Coming back to the case against them, it involves loans worth over Rs 5,383 crore. According to the CBI, this money was diverted through shell companies to fund the Sandesaras’ business operations overseas and personal luxury assets, including private jets and upscale real estate.

The CBI put the alleged fraud amount to Rs 5,383 crore in 2017. Over time, with penalties and interest compounding, the total amount owed to the banks grew significantly, with ED putting the total fraud amount now at over Rs 16,000 crore or about USD 1.6 bn.

The SC order noted that the CBI FIR alleged a “defalcation” (fraudulent appropriation of funds or property) of Rs 5,383 crore. In 2020, the brothers moved a petition in the Supreme Court, expressing willingness to pay all the dues as a one time settlement (OTS) to drop all litigations against them.

The OTS for their Indian companies was Rs 3,826 crore and their foreign companies Rs 2,935 crore, totalling Rs 6,761 crore. The petitioners, the court was told, have voluntarily deposited with banks around Rs 3,507.63 crore, leaving dues of Rs 3,253.37 crore.

Proceedings under the Insolvency & Bankruptcy Code (IBC) before the National Company Law Tribunal (NCLT) led to recoveries worth Rs 1,192 crore. Thus, against the higher One Time Settlement (OTS) amount (compared to the FIR sum), the remaining unpaid amount is Rs 2,061.37 crore.

As noted in the SC order, Solicitor General Tushar Mehta on 18 November submitted in a sealed cover a demand of Rs 5,100 crore—after consultations with lender banks and investigating agencies—against the dues and recoveries against the brothers.

As the petitioners intended to end all litigation against them, they agreed to deposit this amount as “full and final payment” to the lender banks and seek quashing of all proceedings.

No useful purpose in prosecution: SC

A bench of justices J.K. Maheshwari and Vijay Bishnoi said in the order that the general spirit of the proceedings indicate an intent to “protect the public money” and get back the defalcated amount.

And because the public money was being returned to the lenders, continuing the criminal proceedings against the brothers would serve “no useful purpose”, they said.

The SC specifically noted that the ruling is confined to the “peculiar facts” of this case, and wrote that it does not create a precedent.

ED’s apprehensions

Notably, the Enforcement Directorate, which attached immovable and movable properties worth Rs 14,550 crore belonging to firms linked to the Sandesaras, was not a party to the proceedings before the apex court.

However, the CBI, which booked the Sandesaras and their firm Sterling Biotech in 2017, was made a party in the case by the fugitives based in Nigeria.

The Enforcement Directorate feels the order allowing Sandesaras to “buy” themselves out of the trouble could be referenced by the other fugitive economic offenders.

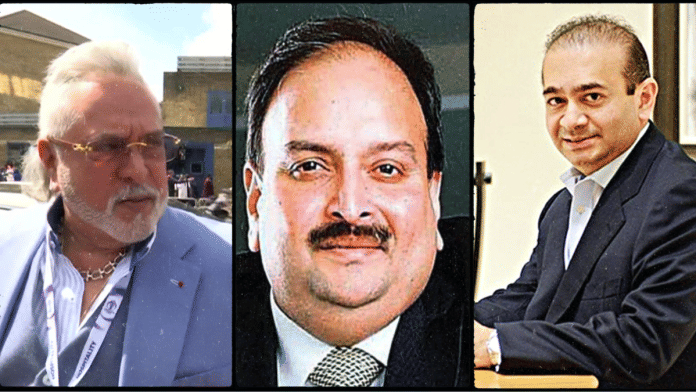

Sources in the agency said that fugitives such as Vijay Mallya and Nirav Modi have long argued against the attachment of their properties. They challenge the legality and methodology of seizing their properties in their absence.

“This judgment (in Sandesara case) could only come in handy for their defence. The judgment makes it clear that it would not be made a precedent, which is a good thing, (but) it sets a foundation that economic fugitives could pay up the amount owed to the banks and walk free,” an ED official said.

Another official said the development could incentivise fraudsters first to flee the country and then negotiate with financial institutions and investigative agencies.

For example, another ED official said, Mallya has been claiming and vocal about the government having already taken more money from his assets than he owed to the banks.

“So should he be absolved of all the charges? These businessmen became fugitives only because they could afford to do so, and settling cases based on payment of dues does injustice to hard work and investigation of probing agencies,” the official said.

The United Kingdom has withheld his extradition to India, citing “confidential legal issues” despite rejection of his appeal against the extradition process by courts there.

‘Buy back deals’

Meanwhile, the Ministry of Finance informed Parliament earlier this week that two economic fugitives (it did not name them) opted for a one-time settlement with banks. The government also said it was not considering enacting any law that would put potential economic offenders on a watchlist to stop them from fleeing the country.

Legal observers caution that such orders by the SC could embolden other similar absconders to propose “buy-back deals” in exchange for immunity.

Vinod Kothari, a corporate law consultant with more than 30 years of experience, said they cannot do so legally as the court has clarified the Sandesara order cannot be used as a precedent. However, the decision is “possibly hinting at a new regime”, or “a continuation of an approach relating to economic offences”, he said.

“In the past 3-4 years, we have decriminalised thousands of legal provisions, replacing the good old ‘fine or imprisonment’ with a monetary penalty,” Kothari told ThePrint.

Going into the judicial pragmatism, he said, “Think of the so-called fugitives against whom the major issue is the defalcation of bankers’ money. Fraud is a criminality, but how much do we recover by prosecuting a fraudster? How has been our track record of recovery with several years of pursuing against the so-called fugitives?”

“So, if the offender is doing a sort of a one-time-settlement to buy peace, it is a question to consider whether we are better off recovering the money or punishing the offender. In true legal sense, one cannot buy one’s way out of a crime, but in case of economic offences, this ruling indicates a new realisation,” Kothari added.

Advocate S. Vasudevan, who heads the economic offences and white collar crime practice at Lakshmikumaran and Sridharan Attorneys (LSA), explained that any litigation involves not only time and efforts but cost of the government.

“In cases involving settlement with banks, the court may look at the larger public interest being served by way of settlement and closing the proceedings” and the court, according to him, has viewed the larger public interest as the accused persons agreed to pay the amount demanded by the solicitor general on behalf of the lender banks and the investigating agencies.

Vasudevan emphasised on the court noting that the entire amount could not be received through IBC route and therefore, “the court seems to have exercised its powers under Article 32 of the Constitution.”

Vasudevan couldn’t deny the possibility of the same route being adopted by other fugitive offenders.

In fact, he noted how the Supreme Court has quashed criminal proceedings in other cases as well in the past on account of settlement with the banks. “The Court has been of the view that once the settlement is done and the banks agree to closing the matter, no public interest will be served by continuing the criminal proceedings”, he added.

Other fugitives & their cases

In a response to a question in Lok Sabha, the Ministry of Finance said that during the ongoing Winter Session that as on 31 October this year, 15 persons have been declared Fugitive Economic Offenders (FEOs), out of which, nine are linked to large-scale financial frauds committed against public sector banks.

Among others, the list includes the names of Kingfisher Airlines founder Vijay Mallya, and diamond traders Nirav Modi, Mehul Choksi and Jatin Mehta.

Like the Sandesaras, they left the country just before loan fraud charges were registered against them. They all were declared fugitive offenders after leaving India before trial, and not cooperating with investigators. They all deny the charges against them.

According to the government response, the total value of financial loss associated with Vijay Mallya and his companies, including Kingfisher Airlines Ltd. and other entities across various banks is approximately Rs 27,073.41 crore.

The total amount recovered from Mallya and associated entities till 31 October, according to the government, totals approximately Rs 15,094.93 crore. The recovery through the State Bank of India alone stands at Rs 10,814.54 crore.

The financial losses attributed to Nirav Modi and his companies, including Firestar Group, Firestar International Ltd, Firestar Diamond International Limited, across various banks total approximately Rs 9,664.50 crore, according to the government response.

The total amount recovered from Nirav Modi and associated entities till 31 October stands at approximately Rs 671.63 crore. Notably, the recovery from the non-borrowal fraud entry at Punjab National Bank was ₹93.21 crore. Non-borrowal fraud entries refer to a fraudulent transaction or activity related to a bank’s internal operations rather than the lending process.

Nirav Modi is currently under arrest in the UK, contesting his extradition. In July 2025, Nirav Modi’s brother, Nehal, was arrested in the U.S. and is facing extradition proceedings for allegedly assisting his brother in the fraud.

In the case of Sudarshan Venkataraman, Ramanujam Sesharathinam and their Chennai-based technology firm Zylog Systems Ltd., the total alleged financial loss across several bank entries is approximately Rs 2,145.93 crore. And the total recoveries for these combined entries is ₹4.45 crore, according to the government figures.

Pushpesh Kumar Baid—the “mastermind” behind an alleged large-scale bank loan fraud who has been declared a fugitive economic offender by a special court in Kolkata—is responsible for a total loss of approximately Rs 181.71 crore to a consortium of banks. The total recovery from his Rs 2.06 crore, according to the government response.

Fugitive diamond trader Mehul Choksi is wanted with a total default amount of Rs 8,515 crore. He has taken the citizenship of Antigua & Barbuda, with extradition attempts ongoing.

Jatin Mehta, who was associated with Winsome Diamonds, has defaults of approximately ₹6,800 crore against him, which has increased to approximately ₹7,000 crore with accumulated interests and penalties. Recoveries made in this case aren’t publicly available. Mehta currently is a citizen of Saint Kitts and Nevis. Investigations against him continue.

Their cases illustrate the magnitude of public money tied up in fraud-linked defaults, and the challenges lenders face in recovering full dues despite asset attachments.

All eyes are now on December 17, when the Sandesara brothers must complete the deposit of the “full and final” settlement amount. Their status as fugitive offenders will also be cleared if the settlement goes through, enabling them to return to India without fearing arrest and prosecution.

(Edited by Ajeet Tiwari)

Also Read: What’s stalling India’s efforts to bring back fugitive white-collar criminals? The state of prisons