New Delhi: The right to digital access is an instinctive component of the right to life and liberty under Article 21 of the Constitution. With this significant ruling, the Supreme Court Wednesday issued a set of directives to the Centre to ease the Know-Your-Customer (KYC) process and make it accessible for acid attack survivors or those may have suffered eye injuries or visual impairment or have low vision.

The judgement was delivered by a bench of justices J.B. Pardiwala and R. Mahadevan while hearing two petitions that sought directions or guidelines to make KYC platforms accessible for visually impaired persons by conducting a video KYC.

The current KYC process is cumbersome for those with visual impairment. It requires a person to click his/her selfie, sign on a paper and take its picture and upload it using a mouse, and then in some cases print and rescan or click photos of filled up form. A One Time Password sent on the mobile number of the customer to validate the entire exercise remains active for a very short duration.

Taking note of it, the SC said in its judgement that since this process excludes visually impaired persons, it violates their right to live with dignity, denying them equal opportunity to participate and seek benefit of government schemes.

The judgement said visually impaired persons are unable to complete the eKYC process, which requires them to perform tasks such as blinking, moving and positioning their head within the specified frames. This either causes delay in completing the formalities or prevents them from establishing their identities to open bank accounts or access essential government benefits, it added.

The bench held that persons who suffer from facial and eye disfigurement due to acid attacks, or visual impairment are treated as disabled under the Persons with Disabilities Act of 2016, and are, therefore, entitled to all benefits underlined in the law for the disabled.

This special legislation makes it mandatory for the government as well as private firms to provide equal opportunity to the disabled. Rules framed under it expressly prohibit measures to prevent discrimination of the disabled when it comes to hiring, working conditions and promotion, the court observed.

“The constitutional and legal provisions confer upon the aggrieved petitioners the statutory right to demand accessibility and appropriate reasonable accommodation in the digital KYC process. Therefore, it is imperative that the digital KYC process guidelines are revised with the accessibility code,” the judgement held, directing the Centre to ensure that KYC’s digital process is universally accessible.

The bench said the right to life under Article 21 of the Constitution must be re-interpreted in light of new technological realities, and highlighted how in the contemporary era access to essential services, governance, education, healthcare and economic opportunities are increasingly mediated through digital platforms.

The landmark SC ruling is a culmination of a long-drawn battle started by an acid attack survivor and a visually impaired lawyer. They moved the court when they faced personal challenges while completing KYC formalities online.

Advocate Amar Jain claimed that none of the existing KYC methods was designed keeping accessibility in mind and as such, persons with blindness or low vision are unable to complete the process without assistance.

Acid attack survivor Pragya Prasun, who suffered severe eye-disfigurement and facial-damage, approached the top court after she could not open an account with the ICICI bank. She could not complete the KYC process as the bank staff insisted she must blink her eyes to fulfill the requirement of a “live photograph”.

Following a social media outrage, a bank executive reached out to her and told her that they could make an exception for her. For Prasun, however, this was not a solution. She again faced problems purchasing a SIM card which prompted her to approach the top court for a remedy.

Also read: Why disability rights non-profit has moved Delhi HC against Swiggy & Zepto

Directions

The top court has now ordered all ministries and authorities to direct government as well as privately regulated entities (RE) to mandatorily follow accessibility standards and appoint a nodal officer to ensure compliance.

The judgement has also made accessibility audit compulsory for all regulated entities and they will undergo periodic assessment by certified accessibility professionals. They would also have to involve persons with blindness in the user acceptance testing phase while designing mobile app or websites. This drill should be followed even if any new feature is being launched on the app or the website, the court added.

The Reserve Bank of India has been asked to issue guidelines to all regulated entities to adopt and incorporate alternative modes beyond the traditional “blinking of eyes” method for verifying the “liveness” or capturing a “live photograph” of the customers. This will ensure inclusivity and user-convenience, the court said.

The court said the regulated entities should be told to accept the image of thumb impression during the digital KYC process.

The RBI should also ask the REs to introduce Customer Due Diligence (CDD). On-boarding of new customers, the court said, can be done using the video-based KYC process or the V-CIP (Video-Based Customer Identification Process) in accordance with the 2016 provisions of the Master Directions (MD) on KYC, wherein blinking of the eyes is not a mandatory requirement.

However, it suggested the central bank amend its Master Directions on KYC to enhance the implementation of the ‘OTP-based e-KYC authentication’ (face-to-face).

The court further directed the authorities to design their KYC templates or customer acquisition forms to also capture users with disabilities.

The court felt the paper-based KYC process should continue and directed the Department of Telecommunications to modify its December 2023 notification to enable customers such as the petitioners to avail of accessible alternative mode to complete the KYC procedure.

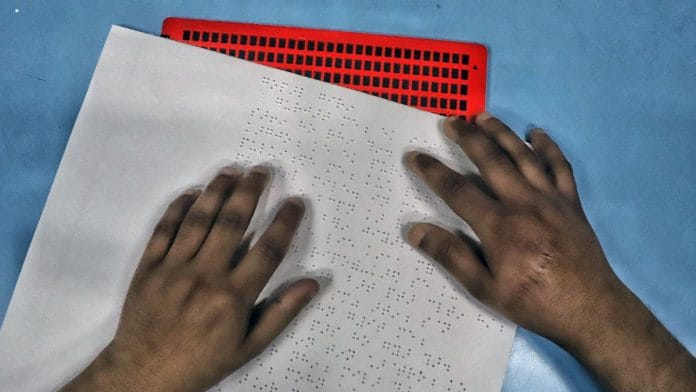

Asking the authorities to provide options for sign language interpretation, closed captions, and audio descriptions for visually and hearing-impaired users, the court said the government “shall develop formats including Braille, easy-to-read formats, voice-enabled services, to disseminate government notifications and deliver public services, ensuring accessibility for all”.

The government was also directed to ensure that all websites, mobile applications and digital platforms comply with Web Content Accessibility Guidelines, apart from adhering to the Disability Act of 2016 that requires both electronic and print media to be accessible to persons with disabilities.

Also read: SC order on accessibility for disabled persons presents an opportunity for universities

Digital Equality

All online services, the court said, must be accessible to disabled persons and for that all authorities “shall issue appropriate guidelines to develop and implement a mechanism where customers who have already completed their KYC process with one RE may authorize the sharing of their KYC information with other entities through the Central KYC Registry (CKYCR).”

The court mooted the establishment of a dedicated grievance redressal mechanism for the disabled to report accessibility issues and asked the government to set up a system for a human review of rejected KYC applications where verification was denied due to accessibility-related challenges.

A dedicated helpline should be there to offer step-by-step assistance to complete the KYC process through voice or video support, it said.

According to the judgement, the RBI should undertake routine public campaigns through press releases and other mediums to disseminate information about alternative methods of conducting digital KYC and mandate all REs to display notices containing such information.

The central bank shall also be responsible to ensure strict adherence by all REs to its guidelines and notifications, including the directions set out in the judgement.

Unequal access to digital infrastructure causes a digital divide and this “perpetuates systematic exclusion not only of persons with disabilities but also of large sections of rural populations, senior citizens, economically weaker communities and linguistic minorities,” said the bench, emphasising the urgent need to remedy the existing structural gaps in the digital ecosystem.

Digital transformation should be inclusive and equitable to align with the principle of substantive equality, the bench said, while pointing out how digital revolution has caused a rift in the society between those who can access technology and those who cannot due to physical limitation or digital illiteracy.

“Bridging the digital divide is no longer a matter of policy discretion but has become a constitutional imperative to secure a life of dignity, autonomy and equal participation in public life,” said the bench.

“The right to digital access therefore emerges as an instinctive component of the right to life and liberty, necessitating that the state proactively design and implement an inclusive digital ecosystem that serves not only the privileged but also the marginalised and those who are being historically excluded,” it added.

(Edited by Ajeet Tiwari)

Also read: What’s missing in govt’s plan to secure ‘accessibility’ for persons with disabilities