New Delhi: The ED, often accused of “witch-hunting” Opposition leaders and conducting raids just before scheduled elections, seems to be working towards changing its image. Now, its focus is on creating a “people-centric” image by emphasising its role in restituting properties and funds attached in money laundering investigations to legitimate claimants or victims.

To expedite this restitution process, the agency has established a special committee — headed by a special director-rank officer. It is also developing a dedicated software to streamline the disbursal of funds. ThePrint has also learnt that the committee has been conducting regular meetings with representatives from various banks, which have also been victims of fraud, to file joint applications.

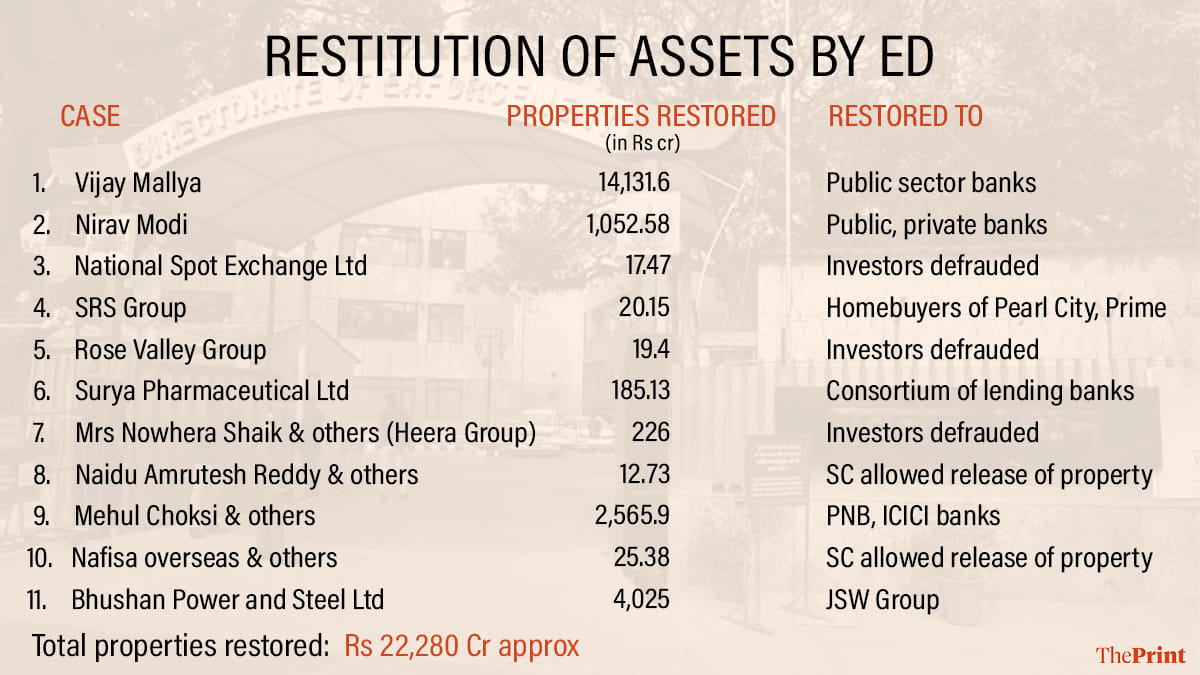

According to data provided by the agency, the ED has, so far, restored properties valued at roughly Rs 22,280 crore to victims or legitimate claimants in as many as eleven cases in the last year. Sources said the process is ongoing in more cases. The cases include bank fraud, Ponzi schemes, and real estate and Chinese loan application fraud.

“The purpose is to ensure that all attached assets are effectively utilised. These include productive and depreciable assets worth crores. These should not go to waste,” an ED officer said. “We realised the major pitfall was attaching assets without ensuring their productive use. If these assets remain alienated, it defeats the purpose. It is more prudent to restore them to the banks in relevant cases so they can be monetised. Moreover, in many instances, even after attaching these properties, the accused continued to use the premises — which did not serve the intended purpose,” the officer added.

A second officer stated that a list of cases eligible for restitution has been prepared and prioritised based on the “nature of the cases”. “Bank loan cases are the priority, followed by real estate cases and Ponzi schemes, such as the Shine City Lucknow case, where the real estate firm defrauded numerous investors. One cannot wait endlessly for the trial to conclude,” the officer explained.

The officer emphasised that the Prevention of Money Laundering Act (PMLA), 2002, grants powers to investigate, prosecute, and restore to the victims what was lost. “The ultimate purpose of attaching properties is to restore them to the rightful claimants,” the officer said.

However, the officer said that the ED had always worked towards restitution, but the effort received renewed momentum after Prime Minister Narendra Modi announced in May this year that the government is exploring options to facilitate the return of money seized by the ED, with discussions involving legal experts already underway.

This renewed push also came amid the ED’s relatively low conviction rate. According to the data shared by the Finance Ministry in the Rajya Sabha, the agency, in the past five years, secured convictions in only 42 cases — just 4.6 percent of the total 911 cases where prosecution complaints were filed.

The officer attributed the low conviction rate to the prolonged legal process. “Courts take significant time first to determine whether the case amounts to a predicate offence. Only after that gets established does the evidence get examined,” the officer said.

The agency is also developing a software solution with the help of experts to ensure the process is seamless. “We are creating a software application through which claimants can file claims. Claims will be invited on a case-by-case basis, making it an ongoing process. At any time, a claimant can file a claim through the application for a specific case, after which the claim will be reviewed,” the officer explained.

Cases of restitution include the Vijay Mallya case, where properties worth Rs 14,131 crore were restored to public-sector banks; the Nirav Modi case, where properties of Rs 1,052.58 crore were restored to public and private banks; and the Supreme Court order to the Bhushan Power and Steel Ltd (BPSL) to restitute assets worth Rs 4,025 crore to JSW Group.

The last is a bank fraud case where the creditor banks initiated the Corporate Insolvency Resolution Process (CIRP) under the Insolvency and Bankruptcy Code (IBC), 2016, and JSW was the successful resolution applicant. The ED filed an affidavit before the Supreme Court, asking for the restitution of the attached properties of Rs 4,025 crore (covered under the CIRP) to JSW under the second proviso in Section 8(8) of PMLA (restitution pending trial), read with Rule 3A of PMLA Restoration of Property Rules — which the court then approved.

The law

But how are assets restored before a trial ends? Under PMLA, the law stipulates assets may be returned to bona fide claimants once a trial commences — specifically after the special PMLA court has framed the charges against the accused. According to the officer, effectively using sections 8(7) and 8(8) of the PMLA allows properties to be restored to the rightful claimants when it has been determined that those properties, initially acquired through illicit means, ultimately belonged to innocent parties.

Section 8(8) of PMLA states that if the central government has confiscated property under Section 8(5) of the PMLA, the special court has the authority to direct it to restore the seized property to a claimant who has a legitimate interest in the property and has suffered a quantifiable loss as a result of an offence of money laundering.

While the old PMLA rules only allowed for the restoration of property after the conclusion of the trial in the case of money laundering, Section 8(8) of the PMLA was amended in 2018 in light of how long the trials took to end. A second proviso was inserted in Section 8(8) — which said that a special court could consider the restoration of the property to the claimant while the trial was ongoing and established a separate procedure for it.

Section 8(7) says that where the trial cannot be on the grounds of the death of an accused or the accused being declared a proclaimed offender, the special court shall, on an application moved by the director or a person claiming to be entitled to the possession of a property, pass appropriate orders regarding confiscation or release of the property.

“These provisions empower the ED to act swiftly to ensure that legitimate claimants regain control of their assets before the conclusion of the legal process,” the officer said.

When asked what happens if an acquittal occurs in a case, the officer explained that an undertaking is obtained from the entity to which the property is being restored.

“In cases of a bank or an individual defrauded in a Ponzi scheme, they provide an undertaking stating that they will return the assets if the person is acquitted,” the officer said.

The officer added: “In the case of banks, it is undisputed that the bank paid the loan. Therefore, the liability of the individual in question, whether convicted or acquitted, remains.”

On board with banks

A second officer said that in the cases of bank fraud, the agency is now ensuring that mortgaged assets are restored to the banks so they can monetise them, particularly in loan fraud cases.

In such scenarios, banks provide guarantees to the courts, allowing them to put the recovered money to productive use.

This marks a significant shift in the policy of the ED, which had previously been at loggerheads with banks. The ED engaged in disputes with various banks, asserting its powers under the PMLA, which, it claimed, allowed it to attach properties mortgaged by offenders and confiscate them until the trial concluded.

In 2018, the PMLA Appellate Tribunal ruled in favour of the banks, affirming they had the first right over pledged assets. However, the Delhi High Court overturned this ruling in April 2019, allowing investigating agencies to attach secured properties.

“There is no point in fighting with the banks. Trials often take years, and banks should be allowed to recover their money during this period. This issue was in discussions with various stakeholders, and now we regularly meet with banks. We are filing joint applications to facilitate the restitution of assets to banks in such cases,” the officer said.

“Efforts are on to identify the victims or legitimate claimants of money laundering offences, with a focused priority on the restitution of the proceeds of crime to them,” the officer added.

“ED is actively working to ensure that these rightful claimants receive due restitution, addressing the harms caused by illicit financial activities and facilitating the return of assets to their rightful owners as swiftly as possible,” the officer further said.

(Edited by Madhurita Goswami)

Also Read: Illegal immigration racket: ED lens on 2 firms, 35,000 student visas & role of Canadian colleges