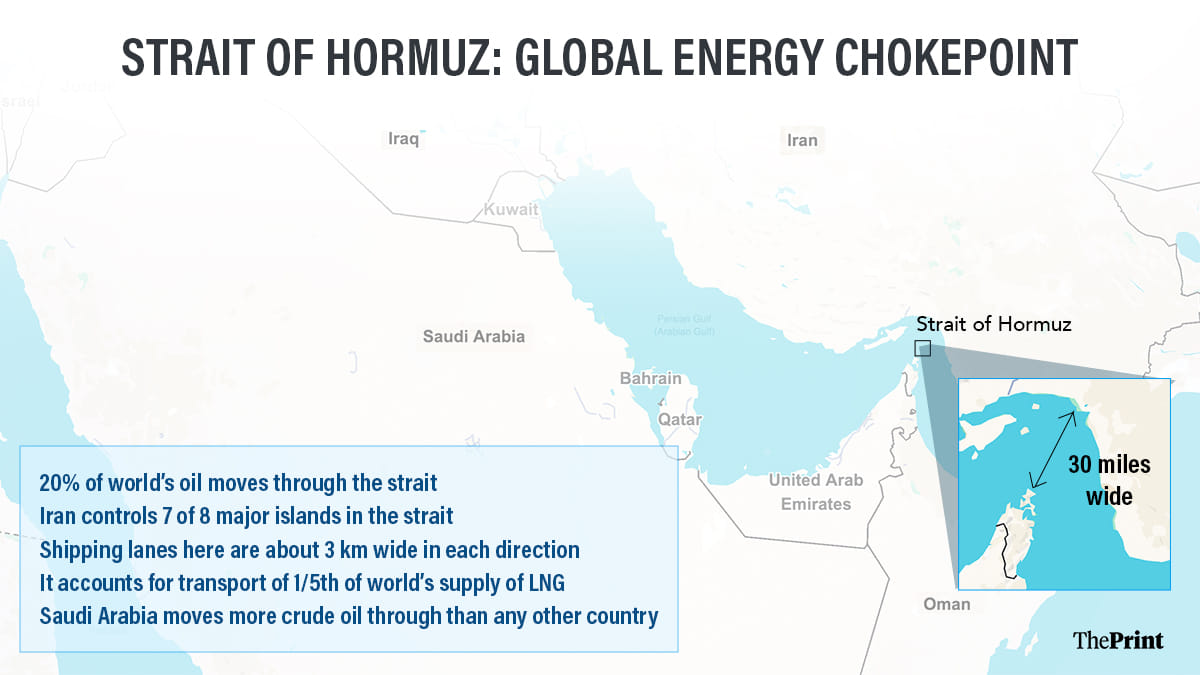

New Delhi: With American strikes on nuclear facilities in Iran marking an unprecedented escalation in the Middle East and Tehran threatening to close the Strait of Hormuz as retaliation, India is watching the situation closely. Closure of the Strait of Hormuz, a narrow channel between Iran and Oman that links the Persian Gulf to the Arabian Sea and subsequently to the Indian Ocean, could cause supply chain disruptions for India’s energy sector and result in a major spike in crude oil prices, multiple analysts told ThePrint.

On Sunday, Iranian media quoted a senior lawmaker as saying that the majlis (Iranian parliament) had approved a potential closure of the arterial strait, but a final decision will be made by the Supreme National Security Council.

The country’s top security body, the council is chaired by the president of Iran.

About 40 percent of India’s crude oil imports from the Middle East currently transits through the Strait of Hormuz. Besides, over 50 percent of India’s LNG import, a bulk of which comes from Qatar, also traverses through the narrow channel.

India won’t be the only country affected if Tehran decides to choke the Strait of Hormuz.

According to an analysis by the US Energy Information Administration, in 2024, oil flow through the Strait of Hormuz averaged 20 million barrels per day (b/d), or the equivalent of about 20 percent of global petroleum liquids consumption.

“China, India, Japan, and South Korea were the top destinations for crude oil moving through the Strait of Hormuz to Asia, accounting for a combined 69 percent of all Hormuz crude oil and condensate flows in 2024. These markets would likely be most affected by supply disruptions at Hormuz,” the US Energy Information Administration concluded.

Also Read: What is Strait of Hormuz & why its closure by Iran could disrupt global energy trade

Analysts see short-term impact

Though Iran is one of India’s top suppliers of crude oil, the real impact will be short term, said Navin Thakur, director, Drewry Maritime Research, a leading consultant to the maritime and shipping industry. “In the long term Strait of Hormuz can’t be shut. Because Iran is not the only stakeholder. There is Saudi Arabia, there is Qatar, there is the UAE—all of which are big influencers in the Middle-East,” Thakur told ThePrint.

“What is the biggest source of revenue for Iran? It is their oil. So, in the time of war, why would somebody want to cut off their own supply of money. It’s more economics and less geopolitics that will make sure that the Strait of Hormuz remains open in the long run.”

However, in the short term, closure of the Strait of Hormuz could result in oil prices going through the roof, said an energy sector analyst who did not wish to be named. “That will be the immediate impact. Not that India will have an issue sourcing its crude oil. Russia is India’s ally. So probably India will buy more from Russia. Other options include Venezuela, to an extent Nigeria. Obviously, it will have to pay a higher price. That is the most natural course of action for India.”

New Delhi, the analyst added, will have to evaluate its stocks and its strategic reserve.

“I think India will inch towards maintaining a 90 days’ worth of petroleum reserves, as recommended by the International Energy Agency, from about 75 days currently. If they don’t have storage, probably they can hire some old tankers, which are not very energy efficient, not sailing anymore or they can hedge their prices in the futures market, where they can lock their prices,” the analyst told ThePrint.

Besides crude oil, India also exports textiles, garments and food grains including basmati rice to Iran and the Middle East through the Strait of Hormuz.

Soaring freight rates, insurance premium

Any disruption in the Strait of Hormuz could also lead to an increase in freight rate of shipments and insurance premium of ships passing through it. Freight rates have already gone up since the Iran-Israel flare-up, so have insurance premiums.

“Every time there is a war-like situation or risks, freight rates usually spike. What we are seeing now is shipping companies are charging a war risk premium to ensure your cargo is safe because this is a high risk zone. The insurance premium has gone up by around 40 to 50 percent,” said Thakur.

Even freight rates have seen an uptick of 10-15 percent since the conflict started, a second shipping sector analyst said, adding that shipping companies will ultimately pass the increase on to their customers. Thakur said the current freight rate impact can be attributed to fears that Tehran may restrict access to the Strait of Hormuz, which is why buyers are picking up as much cargo as they can, and fast.

“I think it has created a slight panic for demand from Iran. Whenever something like this happens, countries who import from these countries start building up their strategic reserves, not just from here but also from other suppliers. India and China will already be buying from other suppliers. That has already affected the oil prices that are increasing every day,” Thakur said.

Union Minister for Petroleum and Natural Gas Hardeeep Singh Puri in a post on X Sunday wrote that India has been monitoring the evolving geopolitical situation in the Middle East closely. “…we have diversified our supplies in the past few years and a large volume of our supplies do not come through the Strait of Hormuz now.”

“Our Oil Marketing Companies have supplies of several weeks and continue to receive energy supplies from several routes. We will take all necessary steps to ensure stability of supplies of fuel to our citizens,” he added.

A senior shipping ministry official, however, told ThePrint that there will be additional costs because of re-routing if the Strait of Hormuz is closed. “The freight rate will increase. We are constantly watching and assessing. Based on developments, a call will be taken on alternative routes. At the moment there is no specific demand from the industry for any intervention,” said the official who did not wish to be named.

At the same time, crisis in the Middle East has once again underscored the need for India to ramp up its shipping fleet. “India does not have its own container ships at present. We are dependent on foreign shipping lines for our imports. We need to build ships at a large scale. Building one or two ships will not help,” said the second shipping sector analyst.

(Edited by Amrtansh Arora)

Also Read: Why Fordow, Natanz & Isfahan facilities struck by US are critical to Iran’s nuclear ambitions