New Delhi: Though a late entrant, Amazon has entered India’s rapidly expanding health diagnostics sector with the launch of Amazon Diagnostics. And with this, it has just arrived in a $15-billion sector that has remained poorly regulated, highly fragmented and where players thrive on consumer confidence.

Amazon is leveraging its e-commerce app to offer an “integrated” user experience, but the Fortune 500 company is currently dependent entirely on Orange Health Labs, an accredited player in the diagnostics sector, for sample collection, testing, and report generation.

Its competitors see it this way—access to reliable testing has a rural India-sized hole and Amazon’s entry could help bridge the urban-rural divide faster.

But at this stage, they do not foresee any significant change in market dynamics, since by its own admission, Amazon’s plan of action is to study usage patterns and demand signals to shape its expansion roadmap.

Dr Arjun Dang, CEO of New Delhi-headquartered Dr Dangs Lab which has been in the diagnostics business since 1983, said Amazon’s arrival “signals a clear push towards deeper decentralisation, bridging the stubborn urban-rural divide in access to reliable testing”.

Prashant Tandon, CEO of Tata digital owned e-pharmacy Tata 1mg which includes diagnostics, had a somewhat differing view. “From what I understand , the (Amazon) model is essentially lead generation for third party labs presently,” he told ThePrint.

Apps such as Tata 1mg offer at-home health diagnostics by collecting samples and delivering reports online. They often partner with National Accreditation Board for Testing and Calibration Laboratories (NABL)-accredited labs to provide these pathology solutions.

On 22 June, Amazon India announced the launch of Amazon Diagnostics, an at-home diagnostics service enabling customers to book lab tests, schedule and track appointments, and access digital reports instantly from the Amazon app. “With Amazon Diagnostics, customers in 6 cities across 450+ PIN codes can easily book from over 800 diagnostic tests, get doorstep sample collection in under 60 minutes and digital reports in as less as 6 hours, for routine tests,” the company said in a press statement.

The six cities are Bengaluru, Delhi, Gurgaon, Noida, Mumbai and Hyderabad.

What sets the new vertical apart, Amazon said in response to queries by ThePrint, is not just the faster testing, but a “truly integrated experience”.

“… Diagnostics sits alongside Amazon Pharmacy and Amazon Clinic, enabling customers to complete an entire outpatient journey without switching platforms,” it said.

Driven by attractive margins and significant growth potential, the Indian diagnostics sector has emerged as a preferred bet within the country’s expanding healthcare landscape.

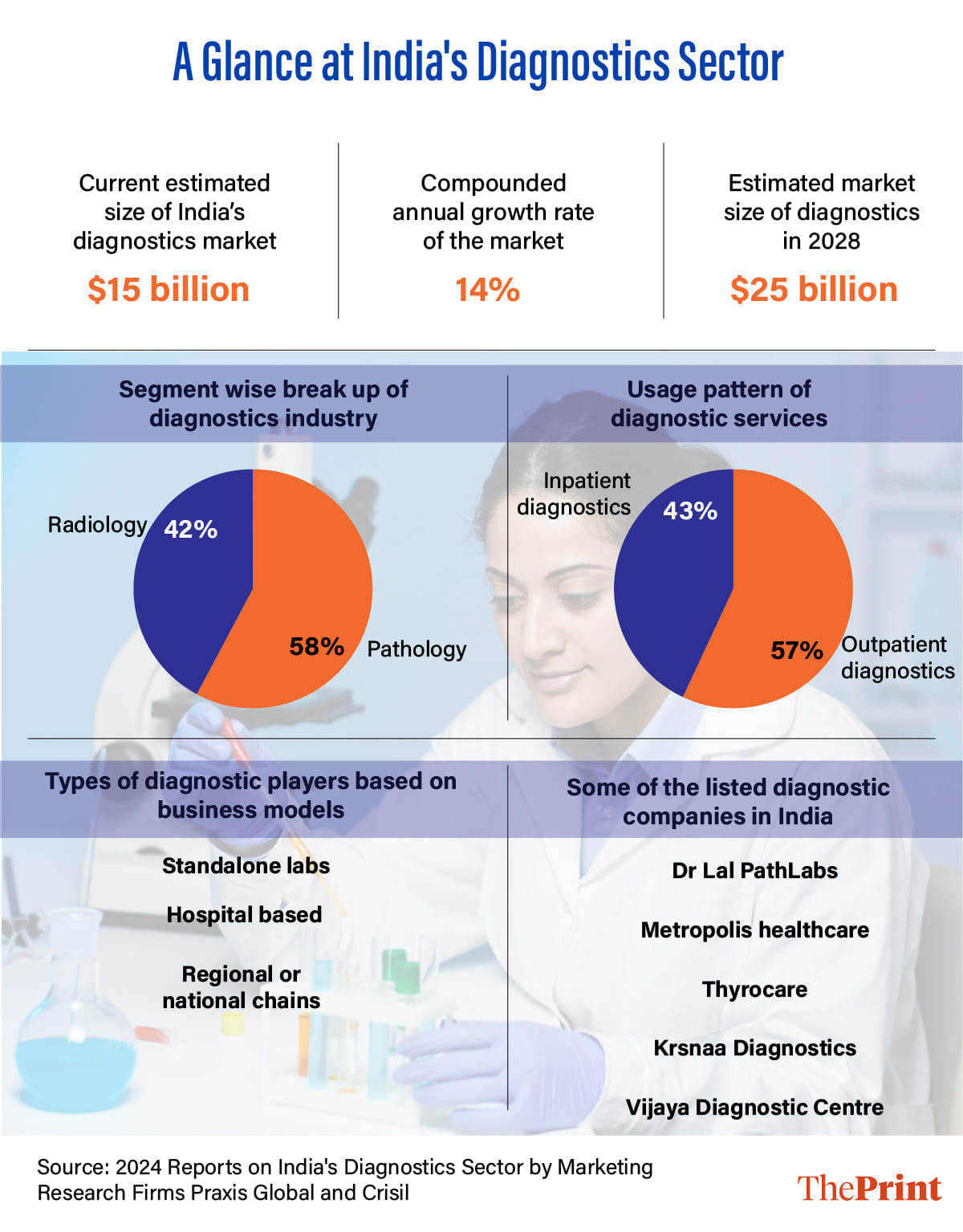

According to the World Health Organisation (WHO), diagnostic test results form the basis of approximately 70 percent of healthcare decisions, but account for only about 3-5 percent of healthcare budgets. A 2024 report by market research firm Praxis Global Alliance estimated that the Indian diagnostics sector is projected to grow at a compound annual growth rate of nearly 14 percent between 2023 and 2028. This growth trajectory, it said, would be fuelled by rising factors such as the increasing prevalence of chronic diseases, growth in the geriatric population, rising demand for preventive tests, and government initiatives.

Within the sector, pathology—which involves diagnosis of disease through examination of cells, tissues and body fluids—contributes 58 percent of total revenue with radiology accounting for the remaining 42 percent, covering tests such as CT (computer tomography) scans, MRI (magnetic resonance imaging), nuclear imaging, and ultrasound scans.

Also Read: From cancer to diabetic retinopathy, how AIIMS is betting big on AI to aid in diagnostics

Low-entry barriers, lack of regulation

India, it is estimated, has nearly 3 lakh diagnostic labs but less than 1 percent of them are accredited, which is voluntary though considered a hallmark of reliable testing. In 2024, only 2,150 medical labs across states were accredited by the top lab accreditation body.

The mushrooming of diagnostic labs has been attributed to low-entry barriers and lack of regulation by the central or state governments. Trust and quality control remain central challenges in the sector.

Established players too underlined that the scope for preventive healthcare has expanded in India over the years, accelerated by the COVID-19 pandemic and the rise of aggregator platforms that drove prices down and raised consumer awareness, but reliable testing remains a sticking point.

Models like offering preventive test packages at Rs 399 or some such rates worked 10-15 years ago, they said, adding that integrated diagnostics are the future.

This would encompass pathology, imaging, genomics (assessment of a person’s genetic makeup), proteomics (analysis of disease-related protein patterns) nuclear medicine (use of radioactive tracers to assess organ and tissue function) and metabolomics (study of products of cell metabolism to provide insights into disease status and treatment effectiveness).

The Indian diagnostics industry is also marked by a high degree of fragmentation, with standalone centres accounting for 46 percent of total revenue, private hospital-based labs 28 percent and national chains (Dr Lal PathLabs, Metropolis Healthcare and Thyrocare among them) at 6 percent. The remaining 20 percent is generated by state-run labs.

At present, a handful of large regional and national chains are steadily consolidating their hold, the vast majority of testing still happens in small, standalone labs with varying levels of quality and standardisation, explained Dr Dang.

While imaging tests (CT, MRI, X-ray) deliver tangible outputs, pathology and blood tests rely on consumers’ trust in the lab processes, Dr Harsh Mahajan, eminent radiologist and founder and managing director of New Delhi-based Mahajan Imaging, told ThePrint.

In terms of earnings, reports released by the analytics firm Crisil and consulting firm Praxis Global Alliance last year estimate, national and regional chains account for about 24 percent of the market size, led by Dr Lal PathLabs at about 12 percent, while the rest goes to diagnostic centres within hospitals or standalone facilities.

While this fragmentation presents challenges in terms of capabilities and scalability, it also offers opportunities for consolidation and the emergence of new business models.

On its part, Amazon said its goal is to simplify access to high-quality healthcare through a familiar, reliable platform. “From booking a test to getting your report to consulting a doctor and ordering medicines, everything is available at your fingertips, backed by Amazon’s technology, service standards, and focus on trust,” it said.

Amazon’s strength & weakness

What can Amazon bring to the table in this highly fragmented space? Dr Arjun Dang hoped its established distribution network and proven last-mile delivery capability could extend testing access to tier 2 and tier 3 cities, where reliable lab services are still scarce.

But transporting biological specimens from remote areas to labs is a complex task that even experienced operators struggle with, pointed out A. Velumani, founder of Thyrocare, India’s third largest diagnostic company after Dr Lal PathLabs and Metropolis.

API Holdings, parent company of the e-pharmacy PharmEasy, acquired majority stakes in Thyrocare in 2021 for Rs 4,546 crore.

According to Velumani, Amazon’s strength lies in product delivery but its logistics model doesn’t align with specialized requirements of the diagnostic sector, which involves services like sample collection that its existing delivery network may not be equipped to handle.

Beyond tier 2 cities, diagnostic facilities are by and large provided by independent operators. They provide a range of diagnostic services, often specializing in certain areas, and may sometimes collaborate with local healthcare providers, clinics or hospitals for sample collection and delivery of reports.

Regional or national chains, on the other hand, operate on a hub-and-spoke model, where samples collected from the customer’s doorstep are routed to various centres (spokes) and then sent to a central lab (hub) for processing. These labs are highly automated, which means that they use tools or instruments for sample handling, reagent addition, incubation, and result interpretation, which were traditionally done manually.

Automation leads to increased efficiency, reduced turnaround time, improved quality control, and reduced chances of contamination of samples.

Velumani said that for over two decades, he ran Thyrocare primarily with its power of logistics. “From any pin code in the country, I could get the specimen to the centralised laboratory in Mumbai where the specimens were analysed.” In the case of Amazon, he said, its strength is supplying products and not picking up samples.

Orange Health Labs, Amazon’s partner for the diagnostics business, has its own logistics network and it too works through a hub-and-spoke model, where samples are first dropped off at a local collection centre before being transferred to the main lab for processing.

But the start-up operates, as of now, in selected metros with limited reach.

As such, most industry insiders do not see Amazon reaching the untapped markets in smaller cities just yet. The e-commerce and cloud computing giant told ThePrint that Orange brings deep clinical expertise, trained phlebotomists, and rapid logistics to the table, which allows it to deliver a high-quality experience to customers from day one.

According to Velumani, while smaller players make profits with low turnovers, larger players face difficulties scaling due to the nature of the business, which requires reaching significant turnover thresholds to become profitable.

Major corporations, including Adani Group and Reliance Industries, apart from a number of pharma giants such as Lupin and Torrent, among others, have entered the diagnostics space, but their investments are not significant, and diagnostics is not their core business.

“For them, it’s a side project rather than a primary focus and they just seem to be studying the market as of now,” said Velumani.

Dr Mahajan said he saw Amazon’s entry into the diagnostics space as the first part of a broader omnichannel business strategy—one that encompasses telemedicine, diagnostics, and potentially pharmacy services. Diagnostics serve as powerful tools for customer acquisition in omnichannel health apps, aligning well with Amazon’s ambitions in healthcare which is being seen in countries like the US, he remarked.

Amazon’s response to queries by ThePrint confirmed Mahajan’s assessment.

“We’re actively studying usage patterns, demand signals, and operational readiness to shape our expansion roadmap,” it said, adding that while it does not own diagnostic infrastructure, it is focused on making this partnership (with Orange Health Labs) a benchmark for customer-centric diagnostics.

Nilaya Verma, group CEO and co-founder of management consultancy firm Primus Partners, said that given the rapid growth of the Indian diagnostics sector, Amazon’s investment has the potential to position it as a leader in the digital health and diagnostics markets.

Leading domestic diagnostic firms are likely to encounter stiff competition due to the e-commerce giant’s logistical strength and network footprint, especially in semi-urban areas, Varma maintained.

Tandon said with Amazon joining the bandwagon he looks forward to seeing how things play out, while Velumani felt that players with business under Rs 5 crore or over Rs 500 crore are making good profit but the rest are struggling.

Many companies, he stressed, do not seem to have the strength to take off.

As he put it: “The two components required in the business are molecules and money. Some have the molecule and some others money but they are not coming together to establish a real disruptor in the industry.”

(Edited by Amrtansh Arora)

Also Read: ICMR proposes testing of TB at village level in revised national essential diagnostics list