New Delhi: Top private hospitals, including Fortis, Max, BLK and Medanta, warned the Narendra Modi government Thursday of suspending the cashless treatment under the Central Government Health Scheme (CGHS) and Ex-servicemen Contributory Health Scheme (ECHS) if their dues are not paid within the next 15 days.

The government is yet to settle the dues of Rs 650 crore and the hospitals have claimed to be hard-pressed for resources. Over the last month, the government has released more than Rs 1,000 crore out of the total pending dues of Rs 1,700 crore.

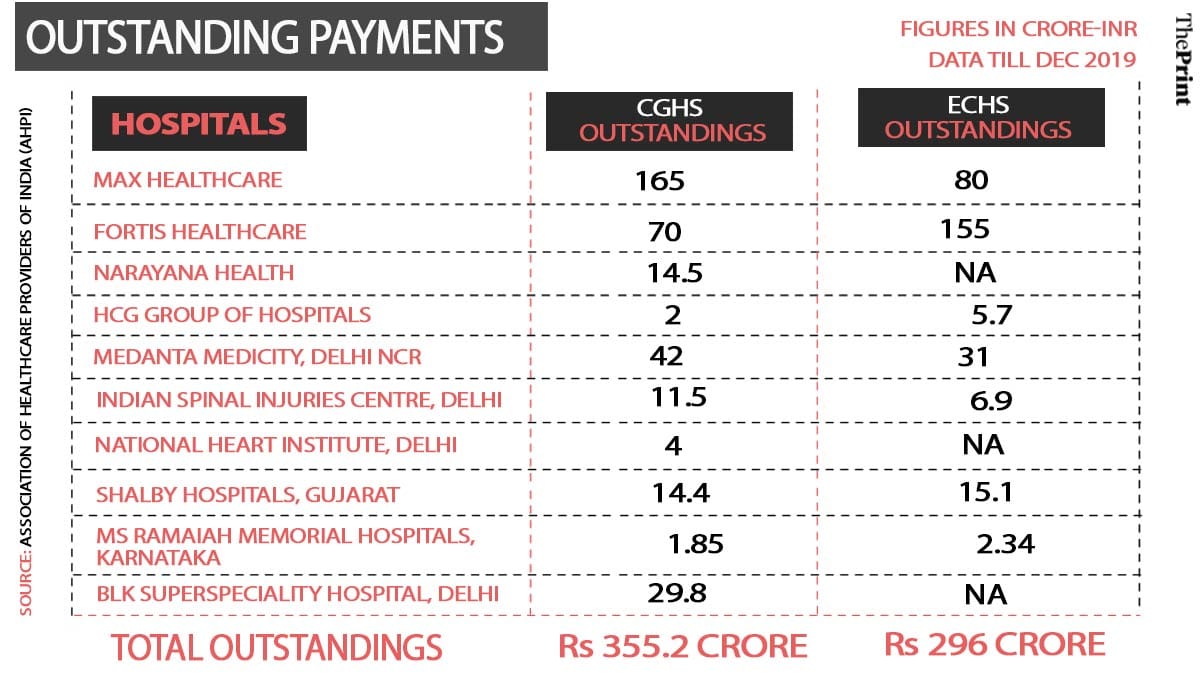

Popular hospital chains Max and Fortis are the biggest creditors with total dues of Rs 245 crore and Rs 225 crore, respectively. Other creditors are Bengaluru-based Narayana Health, cardiologist Naresh Trehan’s Medanta and Delhi-based BLK Hospital.

“We have met Mr Anurag Thakur, Minister of State, Finance, and may soon meet Nirmala Sitharaman, Union Finance Minister. The government has started releasing the amount and we have been given assurance that the full amount will be released soon,” Dr Girdhar J. Gyani, director general, Association of Healthcare Providers-India (AHPI), told ThePrint.

The AHPI represents 2,500 specialty and 8,000 smaller hospitals across India.

“Considering the assurances, we will wait for the next 15 days before announcing the withdrawal of the scheme,” Gyani added.

ThePrint sent an email to the finance ministry but is yet to get a reply. This report will be updated as and when the ministry responds.

The AHPI also issued a joint statement with the IMA Thursday, saying: “The healthcare industry is passing through a crisis. The hospitals have been pushed to the brink of unsustainability due to which we will be constrained to suspend cashless services for the beneficiaries of CGHS and ECHS.”

“Max Healthcare has been constantly following up with government officials regarding its dues from CGHS. The assurances regarding payments have not been met so far and the dues continue to mount. However, keeping the interests of CGHS beneficiaries in mind, we are continuing to treat them on a cashless basis,” a Max spokesperson told ThePrint without clarifying further on the statements given by the AHPI and IMA.

ThePrint had reported on 6 December that the above-mentioned private hospitals are contemplating to withdraw the CGHS and ECHS services due to non-payment of the dues totalling Rs 1,700 crore.

Over 37 lakh Indians are entitled to cashless treatment under the two schemes, which are meant to ease public access to quality healthcare. If the cashless facility is withdrawn, beneficiaries will be charged the discounted rates outlined under CGHS and ECHS and then be reimbursed by the government, directly. At present, the government reimburses hospitals.

Also read: Fortis, Max, Medanta — Why private Indian hospitals are selling out to foreign players

‘Hospitals are unable to pay salaries to employees’

Non-payment of dues by the government is taking a toll on the day-to-day functioning of the hospitals and may start affecting the patients soon, according to the statement.

“Hospitals are unable to pay salaries to the employees. Many hospitals have begun to cut down the operations by closing certain wards or beds. Hospitals are constrained to lay off the employees. If the situation is allowed to persist, it is feared that lakhs of hospital employees may lose jobs,” said the statement.

The IMA and AHPI further said the “financial resource crunch coupled with a reduced number of staff is going to adversely affect patient safety, by which it will have an impact on increased morbidity and mortality…”

Private hospitals — an important part of healthcare

India currently has less than half the number of required beds, according to the World Health Organization (WHO) norms.

The government, in March 2017, had mandated a minimum of two beds per 1,000 population, whereas India has 0.9 beds per 1,000 — far below the global average of 2.9 beds.

Out of the total patient burden, 70 per cent patients of Out-Patient Department (OPD) and 60 per cent of In-Patient Department (IPD) are being taken care of by private healthcare providers, according to IMA statistics.

“The likely disruption of health services due to financial crunch is going to impact the national healthcare scenario more so in tertiary care where the private sector provides more than 85 per cent of such services,” the statement added.

Also read: Fortis takeover by Malaysian firm IHH halted by Supreme Court’s contempt ruling

Something similar may happen, one fears, to the universal health coverage scheme. It assumes a theoretical liability of upto half a million a year per family. If the required funds are not budgeted for and provided to private institutions on time, there will be widespread difficulties.