New Delhi: India’s economy maintained its momentum in April as a wider reopening from the pandemic kept rising prices from depressing demand for the time being.

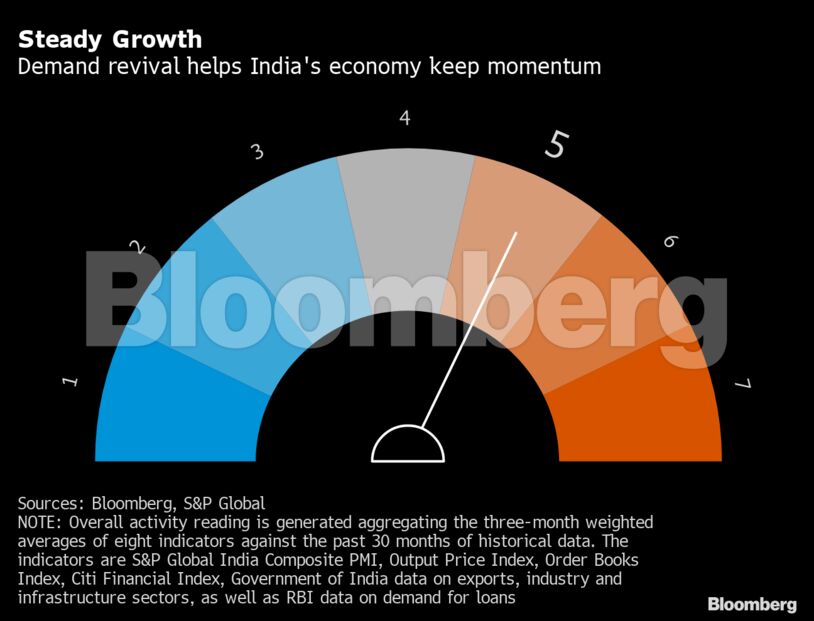

Activity in the services sector as well as factories gained last month, while the three-month weighted averages of monthly changes in indicators from exports to credit demand suggested enduring strength. That helped keep the needle on a dial measuring so-called ‘Animal Spirits’ steady at 5 for the 10th straight month.

While April marked India’s early steps toward living with the virus, including the first full-month of commercial international flights after two years, risks loom for the economy as the war in Ukraine fans inflation and lockdowns in China strain supply chains. India’s government and its central bank acted in tandem this month to counter price pressures, with steps such as tax cuts and a surprise increase in borrowing costs.

Reserve Bank of India Governor Shaktikanta Das, who is due to lead a meeting of the policy panel next month, has signaled more tightening to keep inflation from denting household spending power.

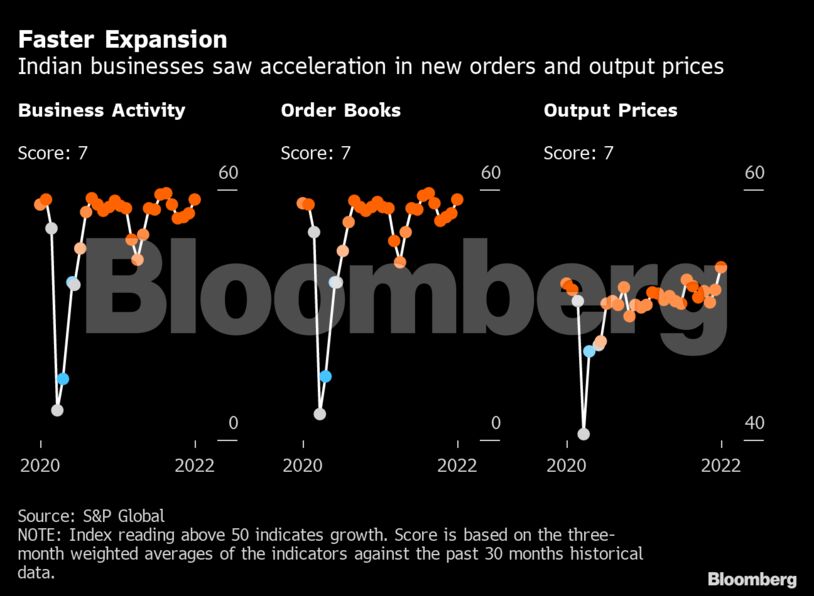

Business activity

Purchasing managers’ surveys showed services sector activity in April grew at this year’s strongest pace, while manufacturing also showed expansion. That helped the S&P Global India Composite PMI expand at the fastest pace in five months to 57.6 — far above the 50 threshold that separates growth from contraction.

The activity backed by stronger new orders was accompanied by a bump in output prices as producers started passing on high raw material costs to consumers. That’s a risk to headline inflation, which climbed to an eight-year high in April.

Exports

Exports grew at this year’s fastest pace, rising 30.7% in April from a year ago to $40.2 billion, although in value terms that was lower than the $42.2 billion seen a month prior. Imports also rose 31% to $60.3 billion as high commodities prices pushed up the bill for everything from crude to edible oils. That widened the trade deficit to $20.1 billion from $18.5 billion in March.

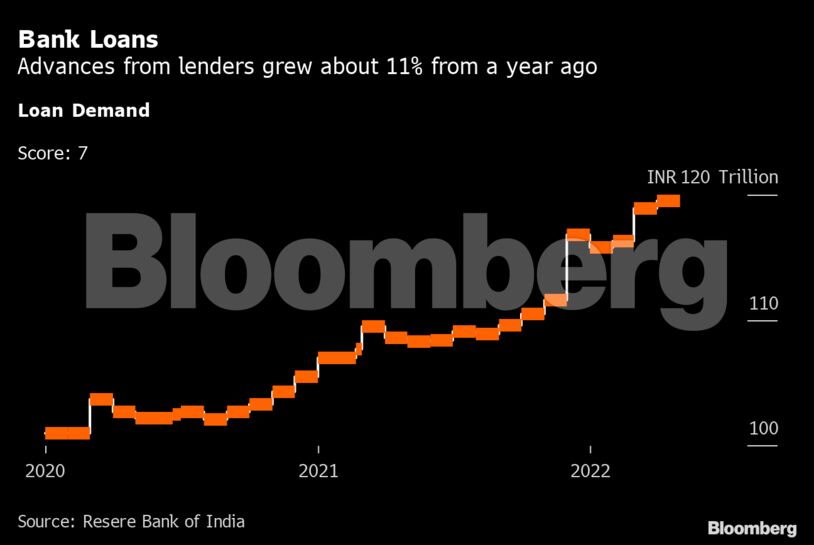

Consumer activity

The automobile sector continued to be weighed down by a global supply crunch, with passenger vehicle sales falling 10% in April from a month ago. The auto industry sees rate increases dampening consumer sentiment.

Other indicators of consumer activity were encouraging though, with bank credit growing 11.1% toward the end of last month from 9.6% in end-March. Liquidity conditions continued to remain in surplus.

Industrial activity

Factory output growth picked up, rising 1.9% in March from 1.5% in the previous month, aided by electricity and mining. The output growth of eight infrastructure industries slowed to 4.3% from 6% in February as coal and crude oil output fell from a year ago. Both the reports are published with a one-month lag. -Bloomberg

Also read : India’s power sector must brace for trouble as climate worsens. Govt can’t sit back