New Delhi: Meeting broad expectations in view of governments sticking to a course when an economy is broadly stable, the Union Budget 2026-27 is a continuity Budget, focused on investment, stability, and capacity, not dramatic giveaways.

Finance Minister Nirmala Sitharaman tabled the Union Budget in the Parliament Sunday.

In this report, ThePrint takes a closer look at the Budget announcements, the key takeaways, and what they actually mean beneath the headlines.

A textbook continuity Budget

There are no shocks in this Budget. Budgets change sharply when growth is weak, inflation is high, unemployment is rising, or there is visible economic distress.

With none of those warning lights flashing right now, the government has stayed its course, instead of changing the medicine.

In a volatile global environment, marked by wars, trade restrictions, and sudden capital movements, predictability itself becomes policy.

When the world is shaky, boring, and predictable, this is often the smartest economic choice.

Fiscal discipline protected, even before polls

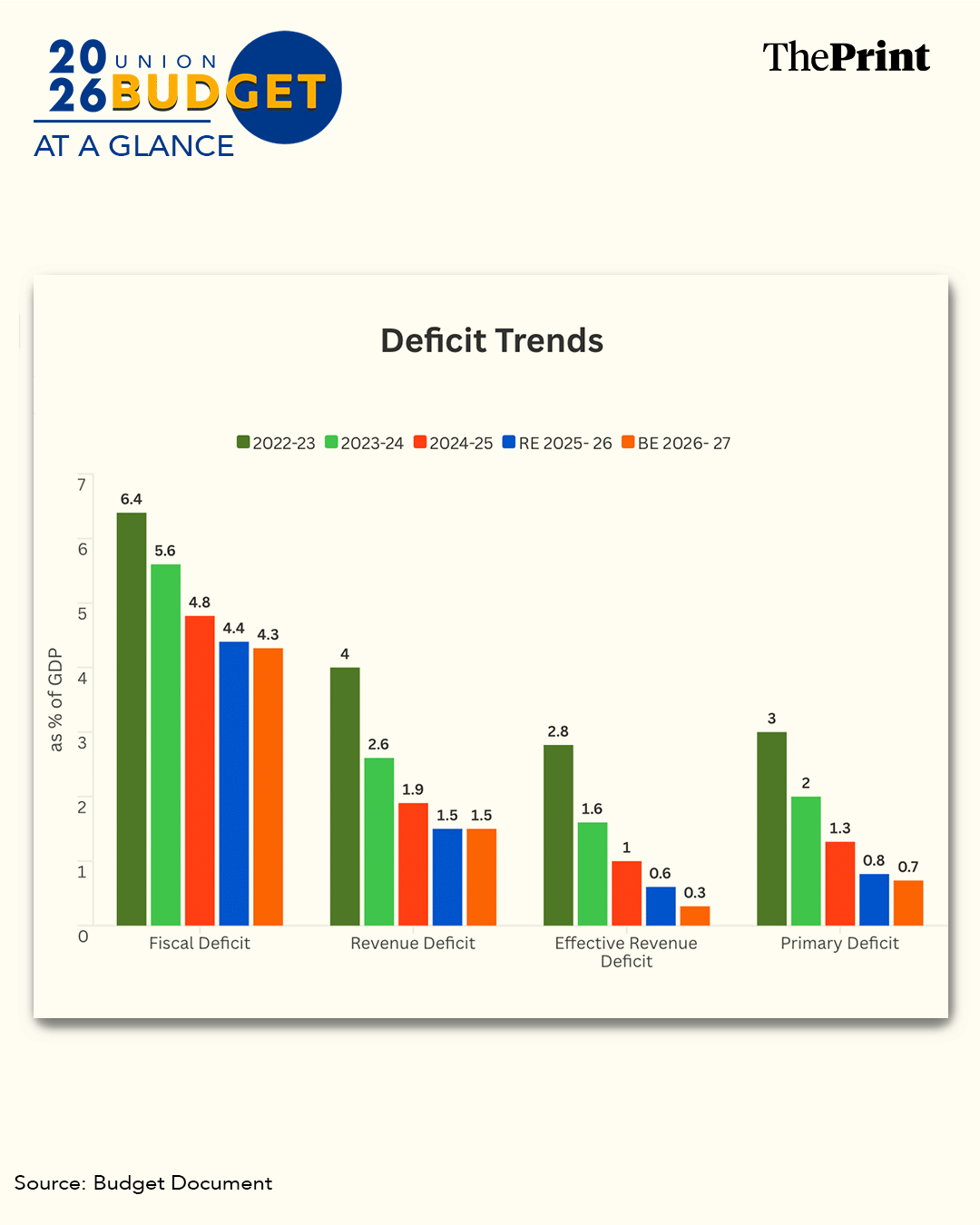

The fiscal deficit for FY27 has been pegged at 4.3 percent of the gross domestic product—a slight improvement from 2025.

That tells us something important. Fiscal discipline is no longer a political choice—it is a structural constraint.

India’s bonds are now part of global indices. Foreign investors track India daily. Borrowing costs are closely watched. If fiscal discipline slips, borrowing rises, interest rates rise, and costs increase across the economy. That hurts businesses, homebuyers, infrastructure projects—everyone.

This Budget makes it clear that credibility with lenders is being prioritised over short-term populism.

No big tax cuts, as was always likely

There were no sweeping income tax cuts for the middle class.

Instead of tax reduction, what we saw was tax simplification, including extended timelines for revising returns, lower TCS (tax collected at source) on travel, education and medical spending, rationalisation of TDS (tax deducted at source) rules, and relief in specific hardship cases.

The logic here is simple. Large tax cuts reduce government income. If spending doesn’t fall, borrowing rises. When borrowing rises, interest rates rise. So paradoxically, aggressive tax cuts today can slow growth tomorrow.

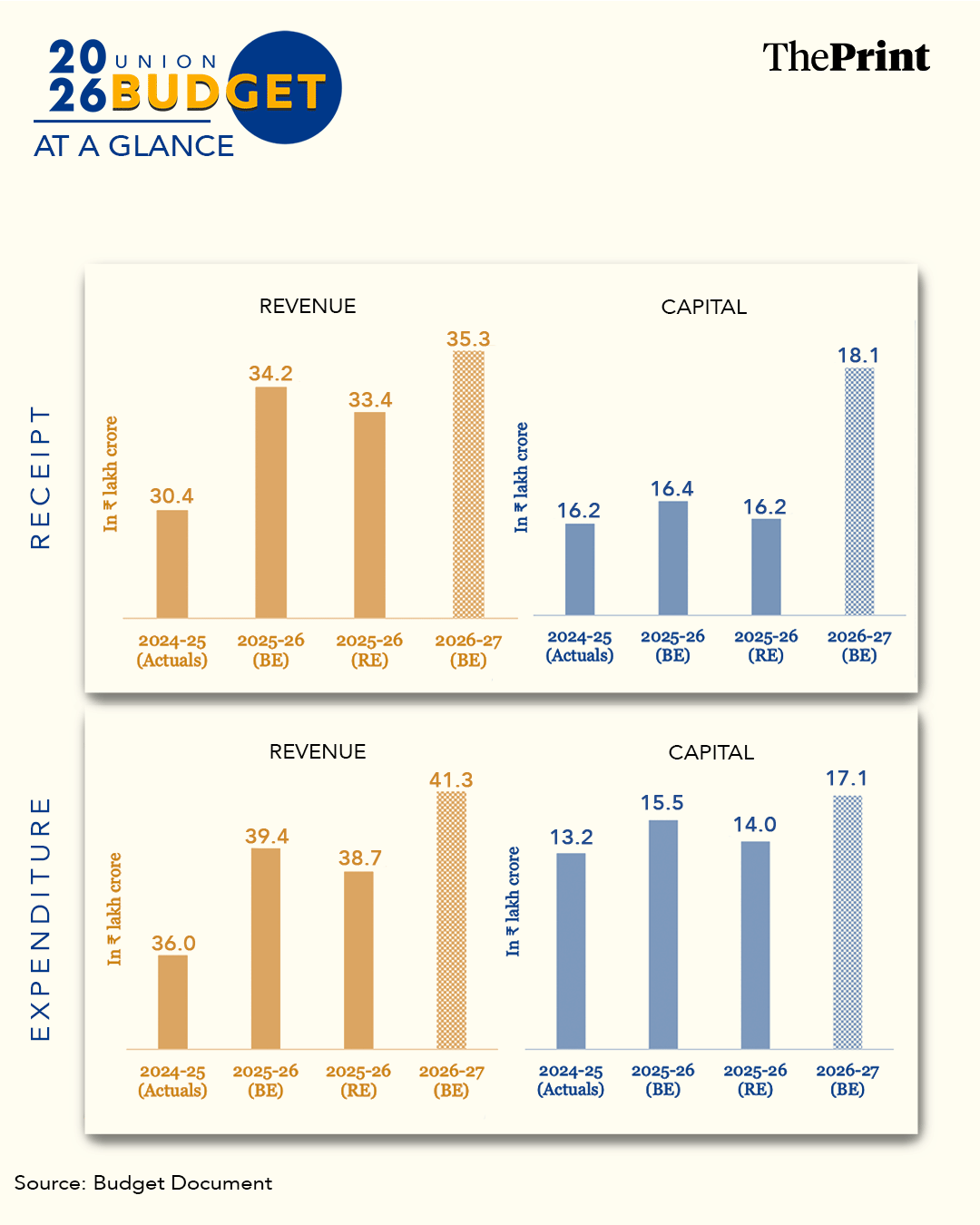

This Budget chooses lower friction over lower revenue. Capital expenditure’s main growth engine, still Public capital expenditure has been increased to Rs 12.2 lakh crore. This confirms that infrastructure-led growth is no longer a temporary strategy—it is now the core economic model.

Capex does three things simultaneously: builds productive assets, lowers costs across the economy, and crowds in private investment.

This is why the government, year after year, reconnects with infrastructure. It is slow, unglamorous, but structurally powerful.

Infrastructure about connectivity, not just construction

The announcement of seven high-speed rail corridors described as “growth connectors” remains important. This is not just about trains.

It’s about linking labour markets, reducing travel time between industrial hubs, and increasing economic density. Infrastructure policy has clearly shifted from building assets to integrating regions. That is a more mature phase of infrastructure thinking.

Manufacturing’s strategic, not cyclical

Across announcements on semiconductors, electronics components, biopharma, textiles, and capital goods, the message is consistent.

Manufacturing is no longer seen as just another sector. It is being treated as a strategic capability. Why? Manufacturing creates mass employment, generates exports, and supports currency stability.

Services stabilise the economy. Manufacturing transforms it. This Budget clearly reflects that distinction.

Rare earths & critical minerals, analysis to policy

One of the most consequential—and least flashy—announcements is the creation of dedicated rare earth and critical mineral corridors.

This matters enormously. The factories of the future do not run on tariffs or slogans. They run on copper, lithium, nickel, rare earths and reliable energy.

India’s manufacturing ambitions were increasingly constrained by a shallow and import-dependent resource base, as well as attempts to build factories without securing raw materials and midstream processing that those factories depend on.

This Budget quietly acknowledges that gap.

By treating mining, processing, and mineral logistics as national economic infrastructure, the government is signalling a major shift, from viewing mining as a marginal revenue activity to seeing it as a foundational industrial input.

This is not about digging more. It is about owning value chains, especially the mid-stream, where strategic leverage sits. In a world where supply chains are weaponised, mineral security is security in manufacturing.

MSME policy shifts from survival to scale

The three-pronged MSME approach—equity support, liquidity support and professional support—reflects a change in intent.

For years, MSME policy focused on keeping firms alive. Now, the focus is on scaling viable firms, improving governance, and integrating MSMEs into larger supply chains. This is about productivity, not protection.

Compliance reforms, not headline reforms

There were no shock reforms in this Budget. Instead, what we see are process reforms—simplified tax procedures, clearer compliance rules, reduced ambiguity.

These don’t grab headlines. But they matter enormously to businesses. A firm would rather have predictable rules for ten years than a flashy incentive for two. This Budget clearly prioritises systems over slogans.

Rebuilding services policy around pipelines

The proposed education–employment–enterprise standing committee reflects a recognition that the growth of services alone is not enough.

What matters is skill alignment, employment pathways, and long-term adaptability.

Rather than announcing new schemes, the government is trying to fix transitions, from education to work, from work to enterprise. That’s a subtle but important shift.

Social spending is targeted, not expansive

Announcements around girls’ hostels, women entrepreneurs, and health and education capacity are carefully calibrated.

They aim to improve access, build human capital, and avoid fiscal slippage.

This is redistribution within limits – consistent with a stability-first framework.

Climate policy framed as industrial readiness

The Rs 20,000 cr allocation for carbon capture, utilisation, and storage is revealing.

Climate policy here is not framed as moral signalling. It is framed as technology development, industrial preparedness, and long-term competitiveness.

That is a pragmatic approach for a developing economy. Every major decision in this Budget fits inside one simple triangle.

Stability to investment to credibility

Stability allows investment, Investment builds capacity, and capacity reinforces credibility.

In a fragmented global economy, credibility is not a soft concept. It directly affects borrowing costs, capital flows, and growth.

This Budget is not about drama. It is about discipline.

And in uncertain times, continuity is not complacency—it is strategy.

(Edited by Madhurita Goswami)

Also Read: Electronics manufacturing shares rise after Budget 2026 sets aside $4.3 billion to boost sector

Please avoid using AI to write. There are too many gen AI speak indicators across this article.