Shimla: Himachal Pradesh is caught in a deepening debt trap, with the state’s repayment obligations for earlier borrowings higher than next year’s planned loans, just as a decades-old central lifeline also looks set to be withdrawn.

Data from the state’s finance department shows that Himachal has to repay Rs 13,000 crore in 2026-27, but plans to borrow only Rs 10,000 crore, resulting in a net outflow of Rs 3,000 crore. This imbalance has left a sword hanging over developmental works, social security pensions, pay and pension arrears, and even basic subsidies.

The financial stress comes as the state grapples with the 16th Finance Commission’s recommendation to completely discontinue Revenue Deficit Grants (RDGs) for all states in the 2026-31 award period.

RDGs are funds given by the central government under Article 275(1) of the Constitution to help states bridge the gap between revenue and expenditure.

State officials and independent fiscal experts estimate this RDG cut is set to create a cumulative revenue shortfall of more than Rs 35,000 crore for Himachal Pradesh over the next five years.

Chief Minister Sukhvinder Singh Sukhu has demanded the restoration of RDGs, or the establishment of a dedicated ‘Green Bonus’, including a proposed Rs 50,000-crore annual fund for Himalayan states.

He warned that 2025-26 “will be the most challenging year for our state’s economy in the past several decades”.

Leader of Opposition, the Bharatiya Janata Party’s (BJP) Jairam Thakur, described the RDG discontinuation as serious but urged better utilisation of past funds.

“The Centre has provided substantial funds to Himachal over the years. The challenge lies in mismanagement and the absence of meaningful efforts to expand the revenue base,” he said.

The phasing out of central support mechanisms that previously helped bridge revenue gaps adds to the deepening fiscal crunch for the hill state, already grappling with high committed liabilities, modest revenue growth and repeated natural calamities.

During the 15th Finance Commission period (2021-26), the state received a total of around Rs 37,199 crore in RDG, with annual allocations declining steadily: Rs 10,949 crore in 2021-22, Rs 9,377 crore in 2022-23, Rs 8,058 crore in 2023-24, Rs 6,258 crore in 2024-25 and Rs 3,257 crore in 2025-26—a roughly 70 percent drop over four years.

Earlier, under the 14th Finance Commission (2015-20), Himachal Pradesh received Rs 40,624 crore, averaging about Rs 8,000 crore annually. The 15th Finance Commission’s reductions brought the real-term value closer to Rs 30,000 crore after adjusting for inflation.

Himachal Pradesh, the only state run by the Congress in north India, expected a similar amount of Rs 30,000-35,000 crore for the next cycle, but the recommendation to scrap the RDG is a major financial blow.

The 16th Finance Commission has increased Himachal Pradesh’s share in the divisible pool of central taxes from 0.83 percent to 0.914 percent (potentially adding Rs 1,000–2,000 crore annually) and allocated around Rs 4,200 crore in tied grants for local bodies and disaster management.

But they are linked to specific schemes and lack the untied flexibility of RDGs.

Also Read: Key grant cut, cash-strapped Himachal slaps a hydropower land cess. Why Punjab is seeing red

Dependence on grants

According to 2025-26 finance department data, the state received Rs 7,440 crore as RDG, or 12.71 percent of the total budget of Rs 58,514 crore, highlighting its dependence on these grants. Chief Minister Sukhvinder Singh Sukhu claimed it as a right of states as under the Constitution.

The state’s finance department Sunday gave a detailed presentation to the state cabinet and legislators, saying that Himachal Pradesh has no funds on its own for development works, paying subsidies, salary pensions, or Dearness Allowance arrears.

The finance department suggested disbanding all subsidies, noting that it provides Rs 1,200 crore as power subsidies and Rs 1,661 crore as social security pensions.

It has also suggested adopting the Unified Pension Scheme or returning to the New Pension Scheme for future recruitment to secure additional borrowing of Rs 1,800 crore.

Principal Secretary (Finance) Devesh Kumar told the government and legislators that the state does not have funds to pay matching grants for central schemes, undertake fresh recruitment, or pay future DA and pension arrears.

He said the state is struggling to pay the Rs 500 crore DA arrears, along with Rs 8,500 crore in pay and pension arrears.

Kumar said that Himachal Pradesh is a chronically revenue-deficient state. “Development, capital expenditure from own tax revenue is very unlikely,” he added.

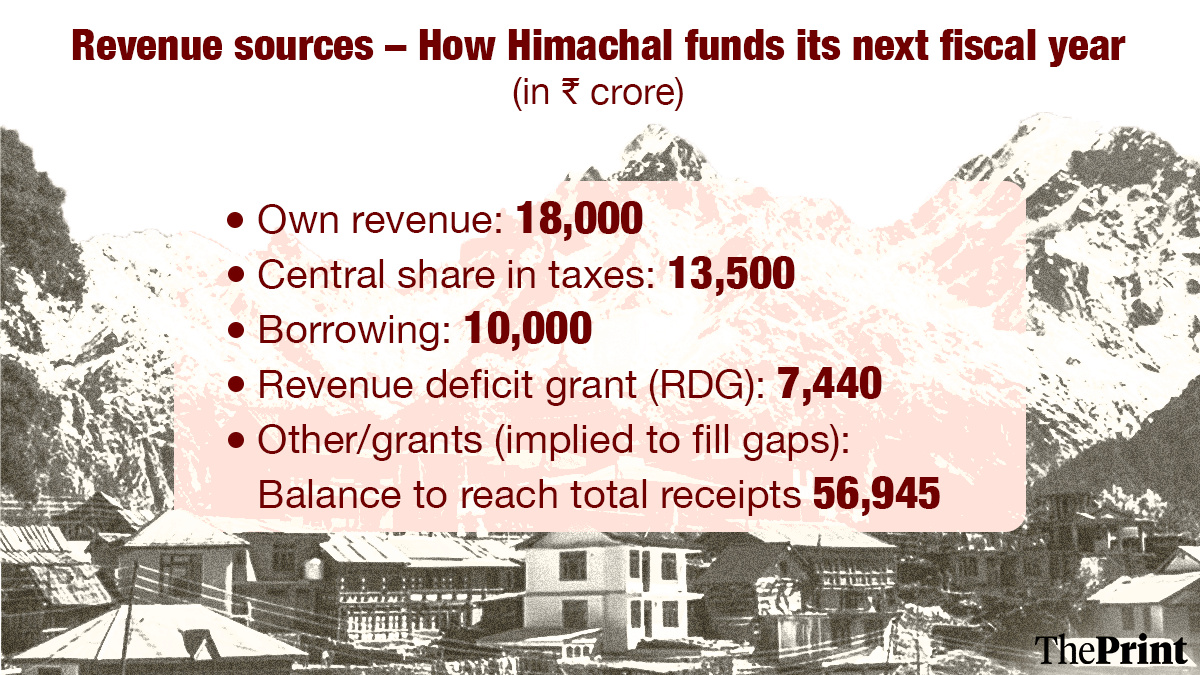

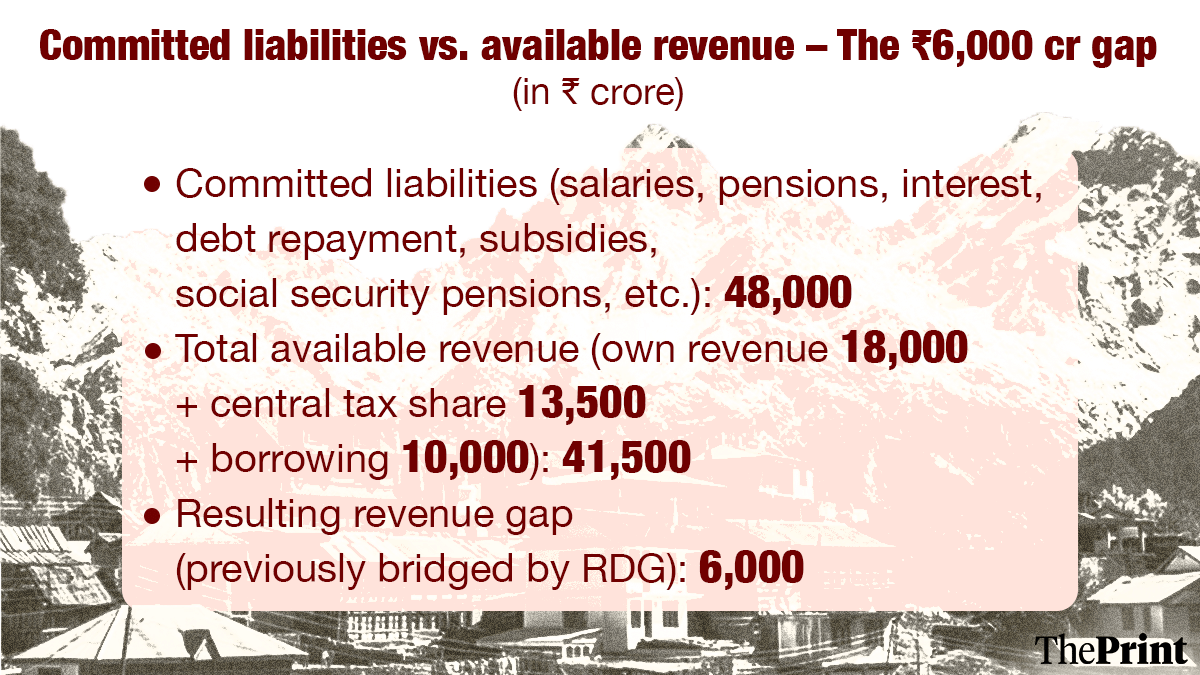

According to government data, the state’s own revenue in the next fiscal is pegged at Rs 18,000 crore, while Rs 13,500 crore is the central share in taxes and Rs 10,000 crore will come from borrowing.

Committed liabilities—including salary, pension, interest, repayment, subsidies, and social security pensions—stand at Rs 48,000 crore. Still, there is a gap of around Rs 6,000 crore, which was supposed to be filled by RDG.

Auditors have warned HP time and again

The Comptroller and Auditor General (CAG) has repeatedly warned Himachal Pradesh about slipping into a debt trap.

Its 2016-17 report had predicted the state would enter such a trap by 2018-19 due to ballooning liabilities and heavy repayment pressures.

The CAG reiterated the warning in its more recent 2023-24 report (tabled in 2025), noting that the proportion of public debt used for loan repayments surged from 52.99 percent in 2019 to 74.11 percent in 2024, with borrowings increasingly servicing old debts amid rising liabilities and fiscal stress.

A modest increase in allocation

The state’s budget allocation for 2025-26 was Rs 58,514 crore, a modest increase of just Rs 70 crore from the previous fiscal year’s Rs 58,444 crore.

Total income was Rs 56,945.34 crore, against spending of Rs 58,514.31 crore. Revenue accounts show receipts of Rs 42,343 crore and expenditure of Rs 48,733 crore, resulting in a Rs 6,390 crore revenue deficit, or about 2.5 percent of GSDP.

Committed liabilities, comprising mainly salaries and pensions, dominate the spending pattern. Salaries and pensions together account for Rs 26,293 crore—Rs 14,716 crore for salaries and Rs 11,577 crore for pensions—accounting for roughly 62 percent of revenue receipts and 54 percent of revenue expenditure.

Interest payments add around Rs 6,738 crore, while debt repayment stands at Rs 5,840 crore (including public debt repayment of Rs 5,805.74 crore).

Of every Rs 100 spent, Rs 25 goes to salaries, Rs 20 to pensions, Rs 12 to interest payments, and Rs 10 to debt repayment, leaving just Rs 24 for everything else—including capital works, infrastructure, and development.

Capital expenditure remained limited, at Rs 3,941.13 crore in 2025-26 against revenue expenditure, reflecting a lopsided ratio that constrains growth-oriented investments.

Overall, about 67 percent of the budget was earmarked for salary, pension, interest payments, and debt repayment.

Debt has ballooned

According to budget documents, the state’s debt has surged to Rs 1,04,729 crore from Rs 86,589 crore in 2022-23, according to the Comptroller and Auditor General (CAG) report.

Of this, Rs 29,046 crore has been borrowed in the three years since Sukhu took office, though he maintains that 70 percent of these funds were used to repay loans and interest accumulated by the previous BJP government.

Own-tax revenue growth has been modest at 6-8 percent annually, limited by the state’s constrained industrial base and 67 percent forest cover.

The end of the GST compensation mechanism in June 2022 removed roughly Rs 3,000-3,500 crore annually, while borrowing limits have been curtailed following the 2023 revival of the Old Pension Scheme, reducing the effective ceiling and shrinking annual borrowing space by Rs 4,000–5,000 crore.

Natural disasters in 2023 and 2024 caused losses exceeding Rs 15,000 crore, with ongoing rehabilitation adding further strain.

Several of the Congress government’s pre-poll commitments from the December 2022 assembly election remain partially fulfilled or face funding challenges.

The Mahila Samman Nidhi scheme, providing Rs 1,500 monthly for women aged 18–60, has been rolled out in phases, but full coverage could require Rs 2,200–2,800 crore annually.

The promise of five lakh jobs has seen only 20,000–25,000 posts filled or notified in three years. The Rs 680-crore startup fund has faced slow disbursal due to administrative and budgetary constraints.

Sukhu has repeatedly linked the state’s fiscal difficulties to its ecological contributions.

“Himachal is preserving forests and rivers for the entire region. We are the water tower of northern India, yet we receive practically nothing in return except 12 percent royalty from private hydropower projects,” he said.

“If we were to exploit our forests the way some other states have done, we could generate Rs 1 lakh crore in two years. Instead, we deliver ecological services worth Rs 1.65-1.90 lakh crore annually to the nation through clean air, water security and climate regulation. The complete removal of RDG completely overlooks this contribution.”

Independent fiscal researcher Nikhil Mehta observed that the RDG abolition underscores the need for reforms.

“Himachal received close to Rs 70,000 crore in RDG over the last decade. Both the state and the Centre must answer what tangible steps were taken during that period to broaden the tax net and bring committed expenditure under control,” he said.

(Edited by Sugita Katyal)

Also Read: Himachal farmers are ditching apples for persimmons. ‘Earnings on par with JEE packages’

Himachal has high level of outward migration.

So, percentage of old people is increasing.

In a country like India, there should be some way of bringing back money of people going out. Like force people to send money home to ageing parents. This will avoid the need for state pensions.