New Delhi: Would you open an app, pick a food item or restaurant, and place the order? Or instead choose first from a lineup of platforms, and then compare prices, delivery time and availability?

In April 2022, the Indian e-commerce sector woke up to an unusual market disruptor—the government. The stated idea behind the government-backed Open Network for Digital Commerce (ONDC) was to facilitate an ‘inclusive ecosystem’ that could dismantle private players’ hegemony in various sectors, including retail, mobility and logistics.

While it has achieved some degree of popularity and penetration in select pockets like Bengaluru, from where it was launched, ONDC is still playing catch-up in a highly competitive space.

This is due to a number of factors, from back-to-back leadership changes to limited market presence, and a fundamental question: would the customer prefer price over convenience.

Complexity navigating the ONDC network, given that little is known about it in large parts of the country, is another obstacle standing in its way.

On the idea behind a government-backed market disruptor, a former senior ONDC executive, who didn’t wish to be named, told ThePrint, “The US and Europe are trying to regulate the e-commerce market via a regulatory body, whereas in India we are doing it through technology and markets.”

An initiative of the Department of Promotion of Industry and Internal Trade (DPIIT) under the commerce ministry, ONDC is an open network, whereby different participants can engage in exchange of goods and services digitally. It is backed by 30 financial institutions both public and private including SBI, NABARD, Axis Bank, Bajaj Finserv, and HDFC Bank, among others. No one company has a major shareholding in the network.

For the buyer, the most important factor is price which is relatively lower on ONDC compared to most aggregators. But with lowered discounts and the possibility of a platform fee in the future, this advantage could fizzle out. As for the seller, the cost of doing business is lower since ONDC does not charge commissions for now. Other advantages for sellers include access to consumer patterns and equal prominence on the platform.

A Section-8 (non-profit) company led by industry veterans, ONDC was touted as the government’s next big digital infrastructure project after UPI—the mobile-based real-time payments system.

But industry experts ThePrint spoke to said three years down the line, ONDC has fallen short of making any sizable impact on the Indian e-commerce industry. It’s a good idea not marketed well, they said, though adding that it has potential in the long run and could do more to attract Gen-Z onto its network, for whom convenience is above all else.

How wide is the gap? Filings show privately-owned food delivery platform Zomato’s marketing and advertising spend in FY2025 was Rs 1,972 crore. In contrast, ONDC spent all of Rs 92 crore on incentives/marketing interventions during this period.

One major obstacle to smoother processes in this sector is that neither buyer nor seller apps on the ONDC network have any control over how food is delivered. The logistics partner is picked based on availability in that particular area, and an in-house fleet is used in the case of some network participants.

To top it off, with years of experience and deep pockets, Amazon, Zomato, Swiggy and other e-commerce giants have fine-tuned their user interface and user experience. In a May 2022 report, New York-headquartered capital markets firm Jefferies said customers satisfied with existing e-commerce players were unlikely to switch for incremental benefits to a new network like ONDC, unless there’s something compelling on offer.

Then there is the question of turbulence in ONDC’s top tier. Between December 2024 and April 2025, three prominent executives including founding member and CEO T. Koshy, chief business officer Shireesh Joshi and non-executive chairman R.S. Sharma stepped down.

Vibhor Jain was appointed the new CEO of ONDC in May 2025. Since he and the new team took over, a series of closed-door meetings have been taking place between ONDC executives and industry bodies to strategise next steps for growth, it is learnt.

ThePrint reached ONDC CEO Vibhor Jain and DPIIT secretary Amardeep Singh Bhatia via email for comment but had not received a response by the time of publication. This report will be updated if and when a response is received.

Retail on downward spiral

According to ONDC’s website, the e-commerce network is live across 600+ cities with 277 network participants including buyers, sellers, and technology service providers. It caters to 13 different domains including food, grocery, financial services, fashion, mobility, logistics and others.

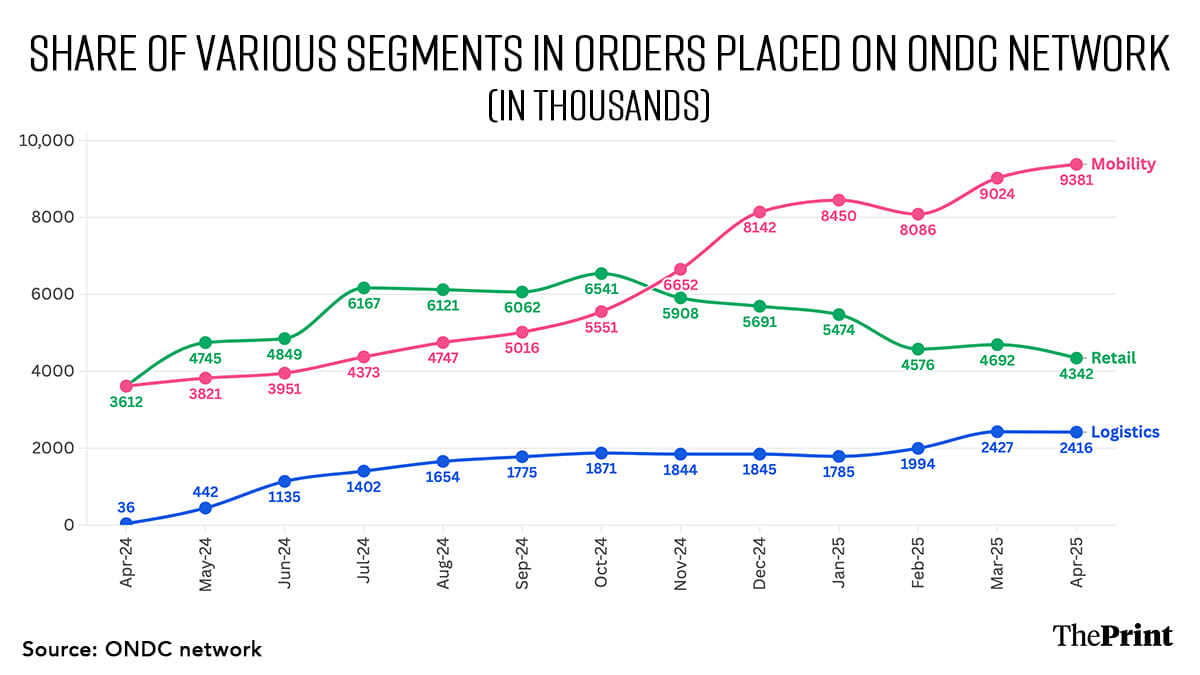

Though overall orders on ONDC grew month-on-month to reach 16.1 million in April 2025, cracks are emerging.

Its retail segment (fashion, food and grocery) shows a downward trend from 6.5 million orders in October 2024, when it accounted for 47 percent of orders placed on the network, to 4.3 million in April 2025.

The former senior ONDC executive quoted earlier said there were no specific reasons for the decline in retail orders. “Different segments grow according to their own path … it depends on how strong certain players are in a particular market and what push is being received from sellers.”

Refuting media reports about lowered incentives leading to decline in retail orders, the former executive said, “Incentives were initially offered to network participants only to stimulate demand through discounts, it was never meant to be offered till perpetuity and was eventually planned to come down.” The incentives, the former executive clarified, were based on transactions and were never offered as a lump sum.

But as retail orders slowed down, mobility (taxi, metro, auto) and logistics (parcel, courier, delivery) started gaining momentum. Compared to retail, orders on ONDC’s mobility segment grew nearly threefold from 3.6 million in April 2024 to 9.4 million in April 2025.

Overall share of the mobility segment also grew to 58 percent of total orders placed on the ONDC network during this period, largely on the back of direct-to-driver apps like Namma Yatri and Yatri Sathi (West Bengal). These apps work without commission or middlemen.

User experience is king

One of the biggest challenges staring down ONDC at this time is to create awareness about the network and its intended benefits for stakeholders. The former senior executive said ONDC does not have money to burn on promotion and marketing, and the onus lies with industry partners, and the government. “The new management must target to drive orders from 16 million per month to 160 million in the next few years.”

The CEO of a Delhi-based online restaurant booking platform, who did not wish to be named, said while ONDC is a great initiative, it is too early to compare it with big names of the e-commerce industry. “However, with network participants like Tata Neu and Ola, it can challenge the market share of large e-commerce players. But it will take time.”

In the food segment, for instance, National Restaurant Association of India (NRAI) was reportedly involved in a disagreement with ONDC over strategic alignment, but both have since re-affirmed their partnership.

“NRAI and ONDC are strategically aligned and are in the process of making some key decisions that would potentially bring some significant positive change to the sector over next two-three quarters,” said NRAI trustee Anurag Katriar.

According to him, the primary job for ONDC is to make customer experience on the network a lot more seamless, given that one of the key issues vexing customers coming to the ONDC network is the complexity to navigate. With multiple applications bundled on the network, there is a lack of “know how” among users and consistency in interface.

There is also a lack of clarity as to which application best delivers what product or service. For instance, a customer who wants to order a hot chocolate fudge from Nirula’s through ONDC first needs to explore multiple applications to get the best price, services and delivery time.

“No customer wants to go through multiple applications within a network for placing their order, especially when the current aggregators provide them with an easy, very user-friendly customer interface,” said Katriar, who is also the owner of Indigo Hospitality.

NRAI joint secretary Thomas Fenn said since ONDC is a network where multiple participants are operating buyer and seller applications, user interface for each would be different. “But there should be some level of consistency in servicing customer expectations and needs,” added Fenn, who is also co-founder of NCR-based restaurant chain Mahabelly.

According to him, restaurant owners should also make it a point to market ONDC on their social media handles, and drive consumer attention through perhaps a “lowest price guarantee on ONDC” line of communication.

Also Read: People in Tier-II cities spend twice as much of income on online shopping as Tier-I, finds survey

Bengaluru model & ‘cold start’ problem

While ONDC is yet to pick up pace in other major cities like Delhi and Mumbai, Bengaluru has been a success, primarily because the network was launched from the city in 2022. The pilot phase of integration between ONDC and NRAI too started from Karnataka’s capital.

Together, they have managed to capture 18-20 percent market share in food delivery in Bengaluru. “The NRAI team is actively working with restaurant partners in Bengaluru city to integrate on the ONDC network as a test case,” said Fenn. “Early results have been positive as nearly 18-20 percent shift in the consumer base has taken place, vis-a-vis aggregators.”

Data on the ONDC portal shows Karnataka accounts for 44 percent of total logistics volume and 17 percent of all retail orders placed on the network between April 2024 and March 2025. In the mobility segment too, Bengaluru-based Namma Yatri has been at the forefront of ONDC’s gains. For it, Bengaluru accounts for 85 percent share in total ride volume.

Since its launch in 2022, the app has processed over 9.98 crores rides on the ONDC network with 1.23 crores registered users.

Apart from NRAI and Namma Yatri, another application that has done well on the ONDC network in Bengaluru and other cities is the hyperlocal retail platform magicpin.

But for ONDC, traction in one city or state is not enough to declare victory. Bengaluru is a template that can be used as a model to scale across other cities, said Fenn, adding that entering a market early and unprepared may result in a setback and distort experience.

“ONDC may face a cold start problem in cities where there are insufficient buyers, sellers and delivery partners, thereby creating a cycle where low participation from one side may discourage engagement from the others,” he explained. “Once that is solved through test cases (pilot phase) flywheel effects (business concept whereby small wins can accumulate and create momentum) will automatically kick in.”

‘All necessary tools to become a success story’

While acknowledging the challenges, stakeholders ThePrint spoke to are hopeful that there is space for ONDC in the current e-commerce landscape. “Zomato and Swiggy charge commissions as high as 18-32 percent, a new restaurant or cloud kitchen cannot survive it,” said the CEO of a Delhi-based online restaurant booking platform quoted earlier.

In a marketplace, where large e-commerce players are squeezing retailers, sellers and customers with their dominant position, the role of ONDC as an emerging player that protects the interest of stakeholders becomes important, he added.

Fenn too said that he remains optimistic about ONDC’s prospects and points out that consumers’ habits take time to change. “It took years for Zomato, Swiggy, Amazon and other large e-commerce players to acquire customers. There is solid intent from ONDC to make this work, and the measured bet is that with time, the shift will take place.”

According to magicpin CEO and founder Anshoo Sharma, the time is now for ONDC to scale up. “It has all the necessary tools to become a success story. We are fundamentally aligned with ONDCs vision to empower and provide visibility, business opportunities and prosperity to retail and restaurant partners on the ground rather than competing against them.”

Katriar said ONDC must peddle a narrative beyond discounts and deals. “The talk should be about the benefits of ONDC. From greater transparency, reduced charges on delivery and packaging, best price guarantee for consumers to data sharing, reduced costs and greater control for restaurant partners.”

From the investor’s perspective, a spokesperson for NABARD said in response to an email questionnaire by ThePrint, “We are extending the Mystore engagement for another year, onboarding new sellers each quarter, refreshing catalogues and running fresh buyer-side promotions.”

Adding, “ONDC’s expanding category coverage and logistics integrations, underpin strong growth prospects over the coming years including compounding impact as the network density rises.”

Udit Bubna is an intern who graduated from ThePrint School of Journalism.

(Edited by Amrtansh Arora)

Also Read: Tech in US created a narrow elite of billionaires. India’s story is different