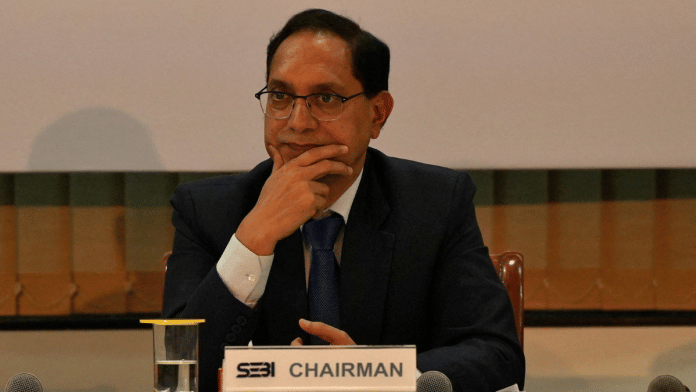

Mumbai: India’s markets regulator is planning to increase the tenure and maturity of equity derivatives contracts, its Chairman Tuhin Kanta Pandey said on Thursday, as it looks to curb trading in a segment where more than 90% of traders suffer losses.

A surge in derivatives trading over the last few years, driven in part by retail investors, has prompted the Securities and Exchange Board of India to limit the number of contract expiries and increase lot sizes to make such trades more expensive.

The plans to extend the tenure of such contracts is at a conceptual stage, Pandey said at the sidelines of an industry event.

Still, shares of stock exchange operator BSE and discount broker Angel One slid 5% each. Derivatives trading contributes more than 50% to BSE’s revenue, and three-fourths to that of Angel One.

Separately, SEBI also set up a dedicated unit to examine patterns of manipulation, the regulator’s whole-time member Kamlesh Varshney said at the event.

The move comes after SEBI had temporarily barred U.S.-based firm Jane Street for its trading strategies that “manipulated” a key stock market index. Jane Street has denied these allegations and said its trading strategies were simple arbitrage.

Pandey added that SEBI would work with India’s corporate affairs ministry and stock exchanges to build a regulated platform for the so called “grey-market”, where unlisted shares change hands.

(Reporting by Jayshree P Upadhyay in Mumbai, writing by Nandan Mandayam in Bengaluru; Editing by Rashmi Aich)

This report is auto-generated from Reuters news service. ThePrint holds no responsibility for its content.

Also read: Profit in NY, loss in UP—what Jane Street ‘market manipulation’ did to Tier 2 & 3 India