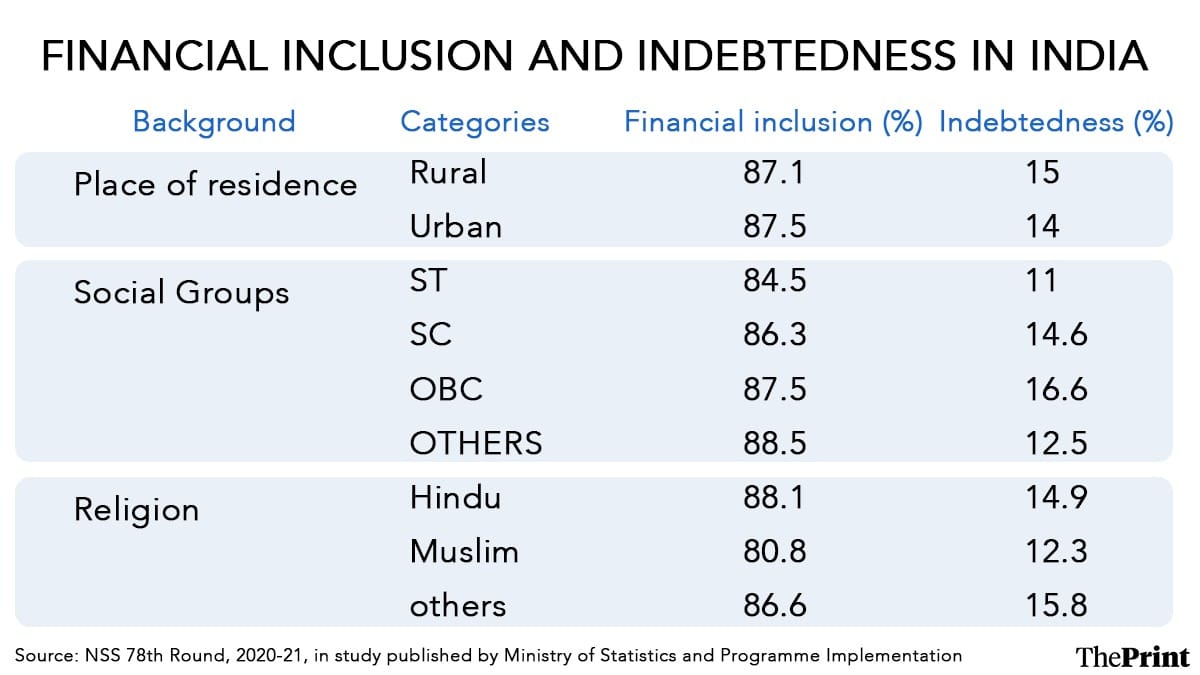

New Delhi: In India, financial inclusion is highest among Hindus at 88.1 percent and lowest among Muslims at 80.8 percent (compared to national average of 87.2 percent); while for other remaining religious groups it is 86.6 percent, according to a research paper published in the latest issue of Sarvekshana, a biannual journal published by the Ministry of Statistics and Programme Implementation (MoSPI).

The paper published earlier this week also notes that among the different religious groups, indebtedness level was the lowest among Muslims at 12.3 percent, while it was highest among Hindus at 14.9 percent.

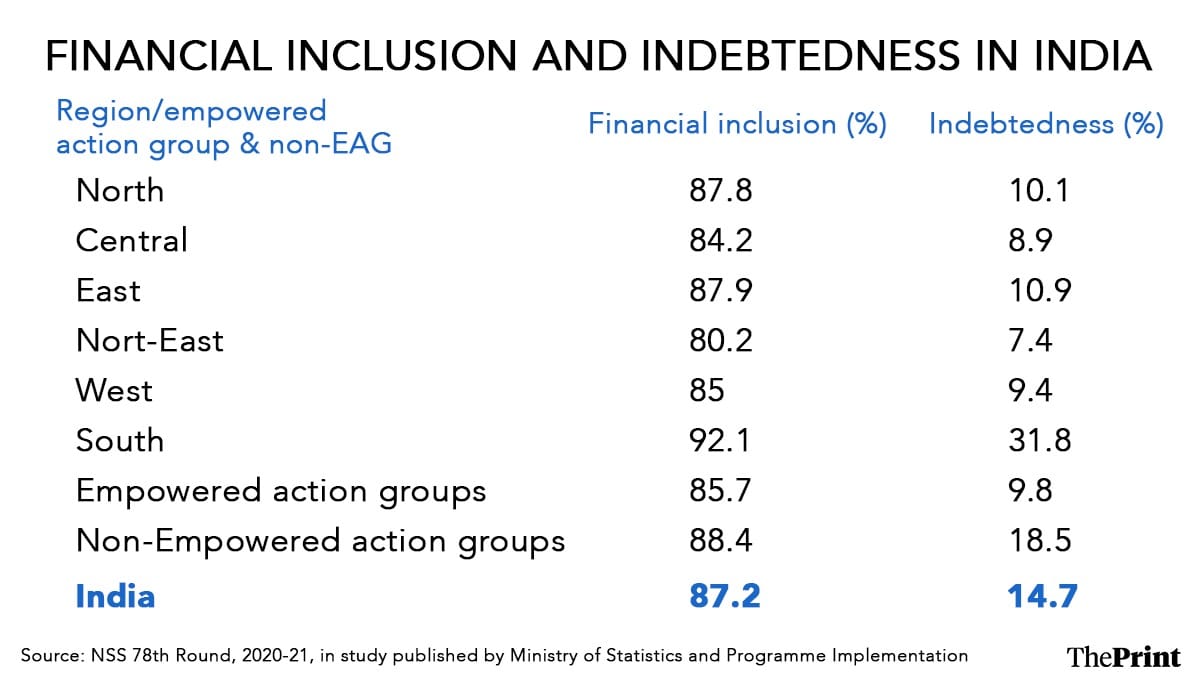

At the national level, the paper found financial inclusion at 87.2 percent while indebtedness level stood at 14.7 percent among population aged 15 and above.

M. Govind Rao, economist and member of the 14th Finance Commission told ThePrint that the comparatively lower level of financial inclusion among Muslims could be on account of the low levels of social inclusion with regards to education. “That could explain the reason for their low level of financial inclusion,” Rao said.

According to the research paper, a person is considered financially included if they have an account individually or jointly in any bank/other financial institution and mobile-money service provider, among others. A household member is considered indebted if he/she has taken a cash loan of at least Rs 500 and it remains unpaid on the date of survey. In the paper, financial inclusion and indebtedness have been estimated for persons aged 15 and above (adults).

Among different caste groups, the study found that while OBCs (Other Backward Classes) have high levels of financial inclusion at 87.5 percent, they also had the highest level of debt at 16.6 percent.

Closely following the OBCs in financial inclusion were the SCs (Scheduled Castes) at 86.3 percent and STs (Scheduled Tribes) at 84.5 percent. However, while the indebtedness level of SCs was high at 14.6 percent, it was the lowest among STs at 11 percent. For others (general category) financial inclusion was the highest at 88.5 percent.

The study authored by Dr Binod Bihari Jena, assistant professor of economics at DAV college, Odisha, and Rabinarayan Patra, visiting professor at Council of Analytical Tribal Studies, Odisha, is based on the unit-level data of the Multiple Indicator Survey in the 78th round of National Sample Survey (2020-21).

The survey collected information on household level data of access to bank/financial account related information, along with status of indebtedness based on a central sample covering 2,76,409 households (1,64,529 in rural areas and 1,11,880 in urban areas) across the entire country.

The paper attributes the high level of financial inclusion nationally to policy-determined outcomes with governments and regulators playing a central role in shaping the financial inclusion ecosystem.

It notes that eight government schemes have helped improve financial inclusion—Pradhan Mantri Jan Dhan Yojana, Pradhan Mantri Suraksha Bima Yojana, Pradhan Mantri Jeevan Jyoti Bima Yojana, Atal Pension Yojana, Pradhan Mantri Mudra Yojana, Stand Up India Scheme, PM Vishwakarma Scheme and Prime Minister Street Vendor’s Atma Nirbhar Nidhi.

According to Arun Goyal, director, Academy of Business Studies, a research consultancy and publishing organisation based in Delhi, besides government schemes, micro-finance and non-banking financial companies have played a major role in enhancing access to financial services across India in the last few years.

“These companies are giving tough competition to traditional banks by engaging in aggressive marketing through agents and self-help groups,” Goyal told ThePrint.

How different social-economic groups fare

The research paper finds a wide gap in financial inclusion among ‘ever married’ and ‘never married’ category of people.

While financial inclusion was at 90.9 percent among married people, it remained low for never married people at 76.4 percent. The contrast is similar with regards to debt levels for ‘ever married’ people, which stood at 18.4 percent while ‘never married’ was at 3.4 percent.

The paper highlights a direct relationship between education and financial inclusion levels. There is a gap of 9.7 percentage points in financial inclusion levels of non-literates (84.5 percent) and people with higher secondary and above education levels (94.2 percent).

Among gender groups, the female population (84.5 percent) lags behind the male population (89.8 percent) in terms of financial inclusion, the study finds.

The paper states, “There exists a direct relationship between indebtedness and household economic status and inverse relationship between indebtedness and household size.”

For large family households (greater than or equal to 8 people) indebtedness level was lowest at 10 percent, whereas for small households (less than or equal to 4 people), level of indebtedness was highest at 17.8 percent. “The likelihood of indebtedness was significantly higher among ‘ever married’ population, upper quartile households and marginalised section of the population, and was significantly lower among females, urban population, larger family size households, and for Muslims and other minority community members,” the paper observes.

Although there is a perception that urban areas have higher levels of financial inclusion in comparison to rural, owing to better infrastructure and greater access to financial institutions, the paper finds no major difference in India’s context, with urban areas at 87.5 percent and rural at 87.1 percent. The debt levels too remain similar for both urban (14 percent) and rural (15 percent) areas.

Indebtedness and financial inclusion in states

Among the six regions of India, the level of financial inclusion and indebtedness was highest in the south region (financial inclusion at 92.1 percent and indebtedness at 31.8 percent), whereas it was lowest for the north-east region (financial inclusion at 80.2 percent and indebtedness at 7.4 percent).

For context, states with highest levels of debt are primarily in the south—Andhra Pradesh (43.7 percent), Telangana (37.2 percent), Kerala (29.9 percent), Tamil Nadu (29.4 percent) and Karnataka (23.2 percent).

Similarly southern states also have high levels of financial inclusion—Karnataka (95.9 percent), Andhra Pradesh (92.3 percent), Tamil Nadu (92 percent) and Kerala (91 percent). Telangana is the only major southern state with below 90 percent financial inclusion at 86.5 percent.

“High level of literacy among females in South India is a major factor for high levels of financial inclusion in the region,” said Goyal.

According to the paper, some smaller states and union territories are very close in achieving universal financial inclusion—Andaman and Nicobar (97.5 percent), followed by Dadra Nagar Haveli (96.3 percent), Goa (95.8 percent), Himachal Pradesh (95.6 percent) and Puducherry (95.4 percent).

The national capital territory of Delhi is among states/UTs with lowest levels of debt in the country at 3.4 percent, however it remains at par with the national average (87.2 percent) in financial inclusion at 87.3 percent, behind states like Andhra Pradesh (92.3 percent), Odisha (90.5 percent), and West Bengal (89.7 percent) that have vast rural areas.

According to Rao, high financial inclusion in southern states is due to the existence of banks before Independence. “Banking sector existed in southern states before Independence; many banks like Canara bank, Corporation bank, Vijaya bank started their operations from south India,” he said.

Rao added that post 1991, growth of the service sector across cities like Hyderabad and Bengaluru also helped in enhancing financial inclusion in the region.

(Edited by Viny Mishra)

Also read: ‘Mujhe EMI bharna hai’—how voice tech is bringing millions of Indians into banking system