New Delhi: Indian stocks are seeing a resurgence of volatility just weeks after being dubbed the world’s calmest equity market, with growing skepticism sparking an exodus of overseas investors.

The India NSE Volatility Index has risen 4.5 points from a record low in December, signaling increasing hedging demand. The gauge climbed to the highest level since June this week relative to the Cboe Volatility Index in the US, as the benchmark NSE Nifty 50 Index hovers around a three-month low ahead of the nation’s annual budget due Sunday.

“The recent spike in the India VIX suggests investors are trading with caution” ahead of the budget due Sunday, said Sahaj Agrawal, head of derivatives research at Kotak Securities. “India appears to be at the receiving end of several geopolitical issues, particularly with the US trade deal yet to materialize and limited participation in the AI trade.”

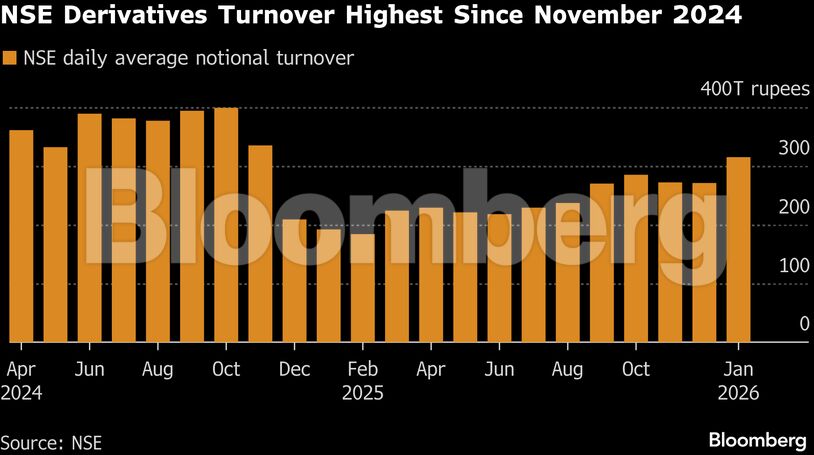

The rebound in volatility has come with a surge in options trading during the corporate earnings season, just as rising oil prices and a weakening of the rupee — now at a record low — add to the pressure. Daily derivatives turnover has averaged more than 300 trillion rupees ($3.3 trillion) this month on leading bourse National Stock Exchange of India Ltd., the highest since the regulator began curbing the market in November 2024.

“Volatility has been amplified by foreign selling,” said Gary Dugan, chief executive officer of investment advisory platform Global CIO Office. But unless “something breaks at home” — such as fiscal discipline slipping after the budget or inflation accelerating — the pullback looks more like a reset than the start of a deeper downturn, he said.

The recent rise in Japanese government bond yields could also have repercussions: The nation’s investors own as much as $28 billion in Indian equities, and at least part of that capital could shift back home as bond returns improve, HSBC Holdings Plc strategists including Alastair Pinder wrote in a Jan. 26 note.

The beginning of the year is typically bad for Indian stocks as companies report earnings and the annual budget is about to be released. The Nifty 50 has dropped every January since 2019 and just logged its worst start to a year in a decade. Still, that didn’t prevent the gauge from ending with gains in the past — it hasn’t had an annual loss since 2015.

Some are seeing Indian stocks as a way to diversify. They are a hedge against AI trades and foreigners’ low positioning means inflows may return should sentiment improve, according to Yiping Liao, a fund manager at Franklin Templeton Global Investments.

“India is perhaps a more contrarian view that we are taking at this point,” she said in a Bloomberg Television interview.

But the lack of AI-related stocks is a big drawback for many investors, and valuations remain expensive. Nifty 50 shares trade at 19.5 times estimated earnings in the next year, compared with about 13.5 times for companies in the MSCI Emerging Markets Index.

“Incremental capital is being pulled toward markets with AI earnings, which does not negate India’s structural story, but does raise the bar for the near term,” said Song Zhe, an investment specialist for emerging-market equities at BNP Paribas Asset Management, a firm that’s underweight Indian stocks.

Disclaimer: This report is auto generated from the Bloomberg news service. ThePrint holds no responsibility for its content.