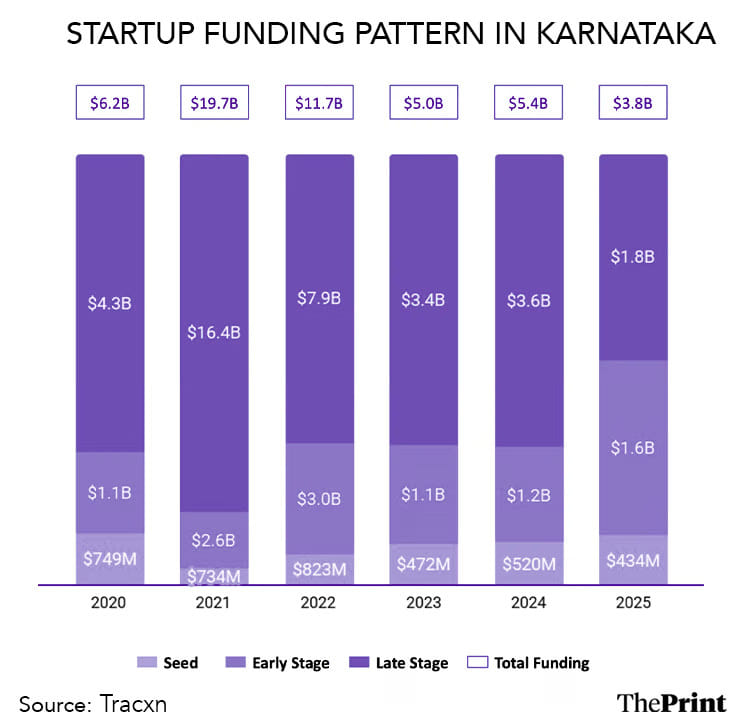

Bengaluru: Karnataka-based technology companies raised $3.8 billion in the calendar year 2025 as against $5.4 billion the year before, registering a 28 percent year-on-year decline, as capital deployment patterns varied significantly and late-stage investments contracted sharply, according to latest data shared by startup tracker, Tracxn.

The sharp contraction, Tracxn said, signals a shift towards high-conviction portfolio support rather than broad-based ecosystem expansion.

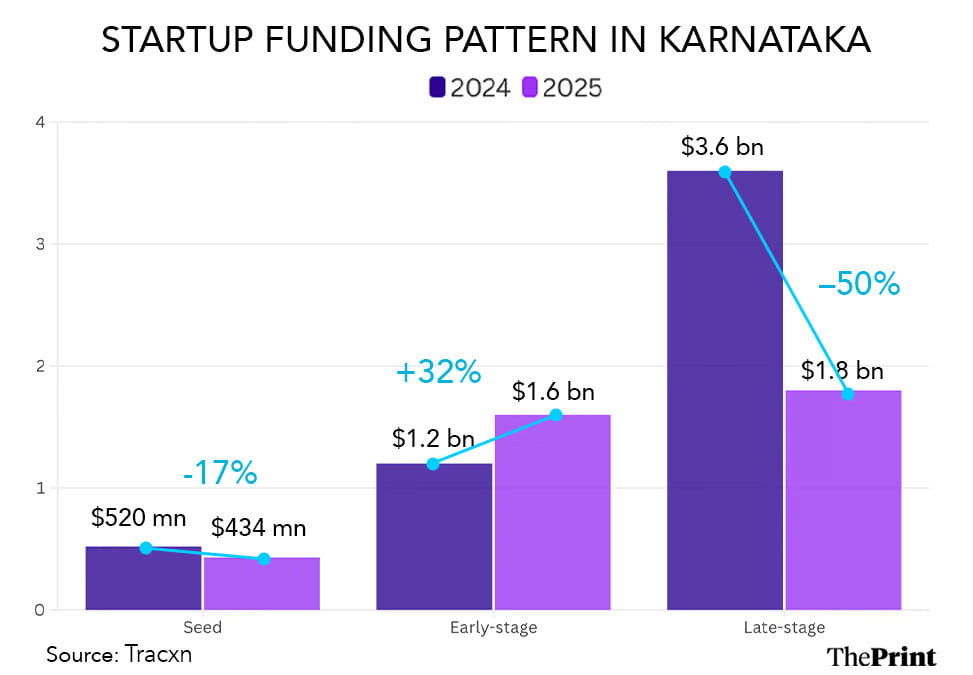

Funding into late-stage startups has registered a 50 percent decline, with companies raising $1.8 bn in 2025 as against $3.6 bn in 2024.

“Karnataka’s tech ecosystem in 2025 reflects a clear shift toward long-term value creation. While total funding moderated to $3.8 billion, a 28 percent year-on-year decline, the 32 percent increase in early-stage funding to $1.6 billion signals sustained investor confidence in the next generation of startups,” Tracxn co-founder Neha Singh said in a statement to ThePrint.

She added that this reallocation of capital toward emerging companies “”strengthens the innovation pipeline and supports the creation of more durable, growth-oriented businesses.”

According to the ‘Tracxn Geo Annual Report-Karnataka Tech 2025’ released Thursday, seed-stage companies in Karnataka raised a total of $434 mn in 2025, registering a 17 percent decline from $520 mn in 2024.

However, investments in early-stage startups surged 32 percent with $1.6 bn in 2025 as against $1.2 bn in the previous year.

The FinTech sector saw a total funding of $1B in 2025 which is an increase of 47percent, compared with $681 million raised in 2024, but still 13 percent lower compared to $1.2B raised in 2023.

Bengaluru-headquartered Zepto raised $300 mn in its Series H round. while investment platform Groww raised $202 mn in a Series F Round. Jumbotail, a B2B market place, raised $120 mn in its Series D round, ranking in the top three large rounds of investments in Karnataka.

Also Read: How startups are falling into lenders’ debt traps

Bengaluru & regional imbalance

The report also emphasised on the growing regional imbalance within Karnataka as Bengaluru, the state—as also the country’s—growth engine, bagged 100 percent of all investments that trickled in.

Tracxn said that the trend of Bengaluru soaking up all of the capital inflows, reinforces the city’s status as a “premier global hub where governance stability and deep talent pools” continue to attract investments.

“Bengaluru’s continued dominance in funding further reinforces its position as a globally competitive technology hub, supported by strong talent availability, active investor participation, and established exit pathways,” Singh added.

The ecosystem demonstrated sustained maturity with the creation of three new unicorns (Navi, Jumbotail, Justpay), proving that high-value company-building remains viable under more rigorous valuation frameworks and longer-term growth horizons, according to Tracxn.

The Enterprise Applications sector recorded total funding of $1.1bn in 2025, remaining in line with 2024 levels, but reflecting an 11 percent decrease compared to the $1.3bn raised in 2023.

Retail tech startups attracted $920 mn in funding in 2025, registering a decline of 36 percent than the $1.4 bn raised in 2024 and 51 percent below the $1.9 bn raised in 2023.

Karnataka, also dubbed the startup hub, recorded three $100 mn-plus funding rounds in 2025, compared to nine each in 2024 and 2023. Tech companies in Karnataka completed 46 acquisitions in 2025, which was lower than 49 in the previous year, registering a six percent decline.

The biggest acquisition of the year was Groww’s acquisition of Fisdom for $150 mn, making it the highest-valued deal in 2025. This was followed by ICRA’s acquisition of Fintellix at a transaction value of $26.0 mn.

(Edited by Ajeet Tiwari)

Also Read: Startups to govt policies—India wants to lead the lab-grown meat revolution