New Delhi: Indian sugar mills are trying to lock in deals with buyers from China to Iran to begin exports from Oct. 1, when fresh government subsidies kick in.

The millers will start shipping from the country’s record stockpiles instead of waiting for the new sugar crop to become available to fully use the time it has until April, when supplies from rival Brazil start to flood the market, according to an industry association.

Indian producers are talking to importers in the Middle East, China, East Africa, Bangladesh, Iran and Sri Lanka with a view to starting shipments from next month, the beginning of the new season, Abinash Verma, director general of the Indian Sugar Mills Association, said in an interview.

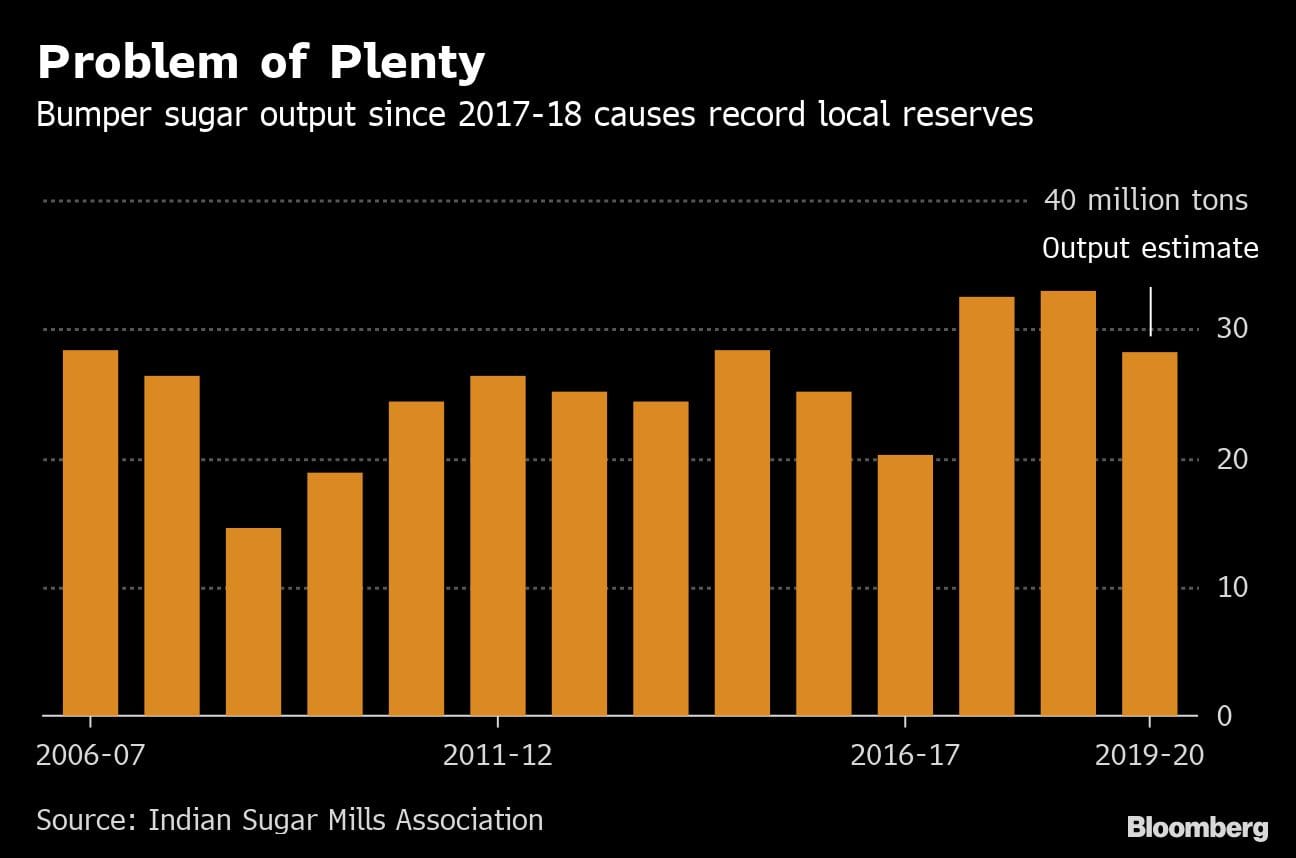

Higher exports from India may add pressure on global prices that are hovering near a one-year low, further irritating major growers. Australia, Brazil and Guatemala have jointly asked the WTO to set up a panel to challenge India’s subsidies. Indian millers say the country has been struggling with huge stockpiles due to bumper output in recent years and an increase in shipments could help ease their pain.

Incentives

India approved incentives worth 62.68 billion rupees ($875 million) last month to subsidize exports of as much as 6 million tons of sugar in 2019-20. The government will reimburse a portion of local and ocean freight charges and expenses related to handling, upgrading and processing sugar.

The move is aimed at cutting huge sugar reserves. India’s opening stockpiles at the start of the 2019-20 season is expected to be 14.2 million tons, before further swelling to 16.2 million tons at the end of the year, according to the government.

Inventories are expected to remain high despite predictions that sugar output may drop to a three-year low of 28.2 million tons in 2019-20 from a record of 32.95 million tons this year after dry weather parched fields in some major growing areas, according to the association.

India’s sugar exports may climb to 3.7 million-3.8 million tons this year, with the mills asking the government to help ship a record 7 million tons in 2019-20. – Bloomberg

Also read: In sugar rumble, it’s India versus the rest of world’s producers

Patanjali’s revenues are now badly hurt because of the franchise management issue. They are not using end to end franchise management software tool.

iSolve Technologies provides the complete franchise management software solutions designed especially for Patanjali.

For more info search: retail software isolve

Talk to experts: +91 8939838183

Write your challenges: business@isolve.co.in

How can a webportal on Congress payroll ever write anything good about Patanjali,since Ramdev is Modi supporter? What a biased view? For all the chamchas here, Patanjali is doing fine.Tell me why Maruti is facing recession?