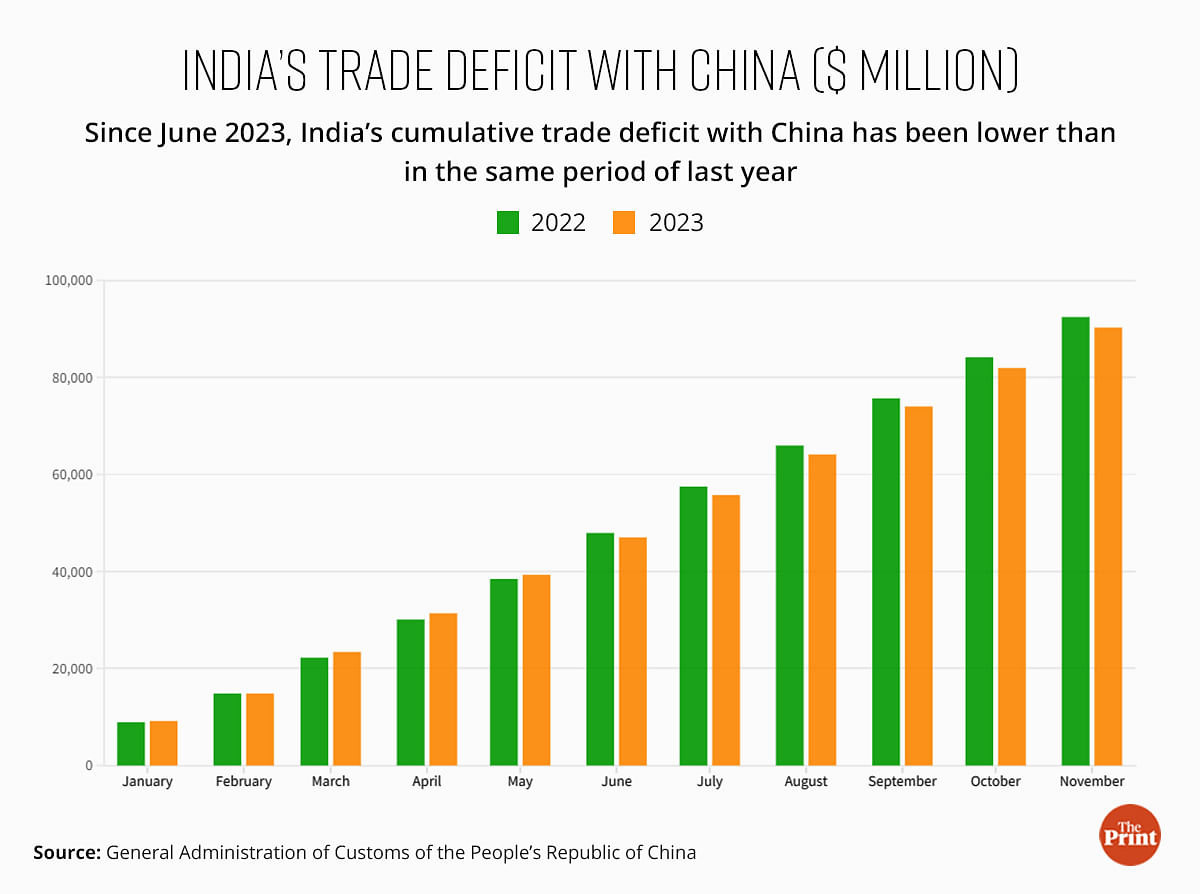

New Delhi: India’s trade deficit with China during the first 11 months of this calendar year has come in lower than the same period last year, with experts saying it will likely fall short of the $100 billion mark it had hit last year.

A trade deficit arises when a country imports more than it exports. Data from the General Administration of Customs of the People’s Republic of China (GACC) shows that in the January to November 2023 period, India’s trade deficit with China stood at $90.27 billion — $2.16 billion lower than what was recorded for the same period last year.

According to experts, the smaller deficit this year is more a factor of the slowing Chinese economy rather than a substantial growth in India’s exports to China.

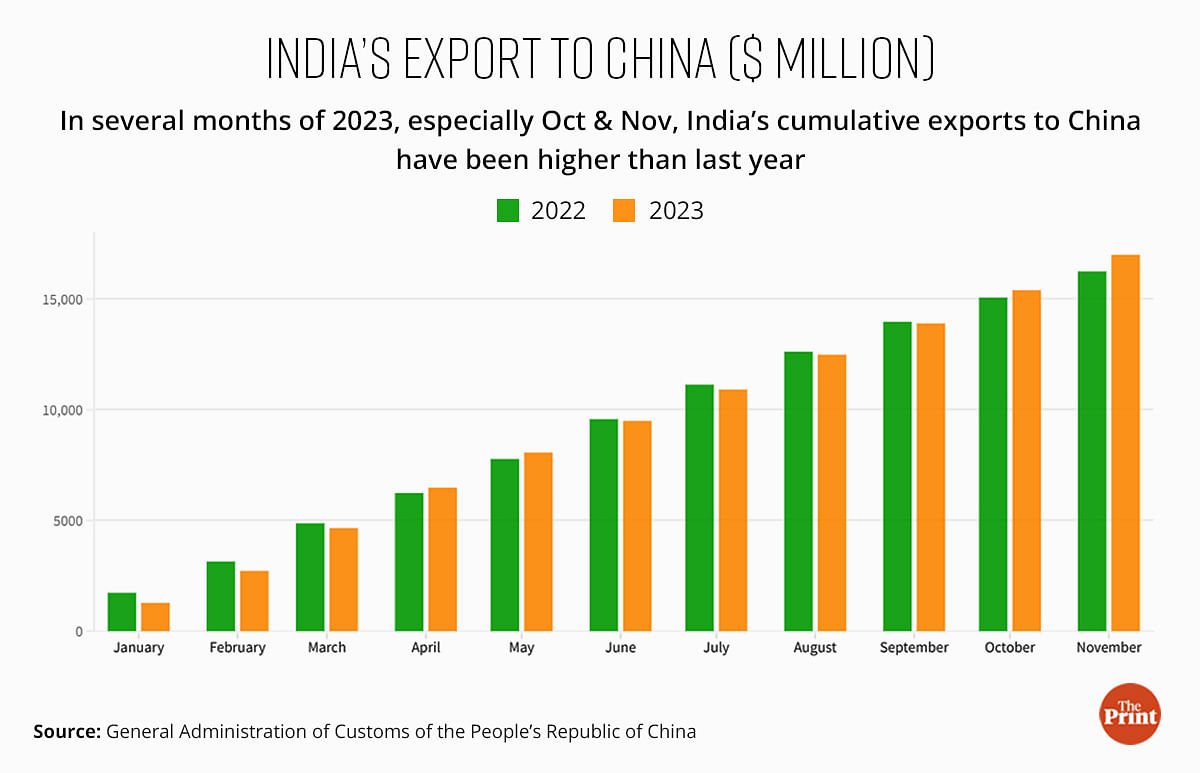

The GACC data shows that Indian exports to China rose to $16.99 billion in January-November 2023 from $16.25 billion in the same period in 2022 — a 4.6 percent increase.

Meanwhile, Chinese exports to India fell to $107.27 billion in January-November 2023 from $108.69 billion in the same period in 2022 — a 1.3 percent decrease.

“India’s exports to China may have shown 4.6 percent growth but that’s not why the trade deficit is showing a slight decline,” Mohammed Saqib, founder of Bureau of Research on Industry & Economic Fundamentals (BRIEF) and India China Economic & Cultural Council (ICEC), told ThePrint. “Lot of Indian exports rely on Chinese raw materials, so this is not a sign of decoupling. Other factors are at play.”

“India’s overall merchandise trade has contracted this year and there has been a considerable economic slowdown in China,” he added. “Fluctuation in the dollar could have also affected foreign exchange used in goods trade. A combination of these factors could explain the data we’re seeing.”

In terms of sheer volume, Indian exports to China remain roughly one tenth of Chinese exports to India.

Biswajit Nag, Professor at the Indian Institute of Foreign Trade argued that the increase of Indian exports to China in 2023 so far has been “minimal”. “We cannot consider it as a trend,” he told ThePrint.

It is also not a guarantee that the fact that the Chinese calendar year data is on track to show a trade deficit shy of $100 billion, the same will be reflected at the end of the Indian financial year.

“In many cases, payments against past trade are realised towards the end of the [Indian financial] year. The dynamics of yearly export-import gap may change due to that and hence, we better wait for a few more months,” he said.

Also Read: India foreign trade crosses $1tn in 2022. Record $100bn imports from China widen deficit

‘Modest’ decline in trade deficit year-on-year

ThePrint analysed Chinese customs data from January-November this year, which showed that starting June, there has been a slight declining trend in India’s trade deficit figures with China year-on-year.

According to Ajay Sahai, Director General & CEO of the Federation of Indian Export Organisations (FIEO), a body which functions under the ministry of commerce and industry, this decline is “quite modest” and the growth seen in Indian exports to China in the first 11 months of the calendar year is because of increased trade of electrical & electronics, cotton, iron & steel and iron ore.

“The declining trend in trade deficit is modest and we may just fall shy of the $100 billion mark,” Sahai said. “Indian exports to China seeing significant growth are electrical and electronics products and raw materials such as cotton, iron and steel and iron ore. Of course, we would like to see more growth in value-addition products and the processed sector.”

The Production Linked Incentive (PLI) Scheme, which aims to boost domestic manufacturing by providing financial incentives to homegrown companies, is “yet to bear fruit”, as investments have some gestation time, he added.

(Edited by Zinnia Ray Chaudhuri)

Also Read: ‘Don’t bet against India’ — CEA Nageswaran vs ex-CEA Subramanian in economy debate