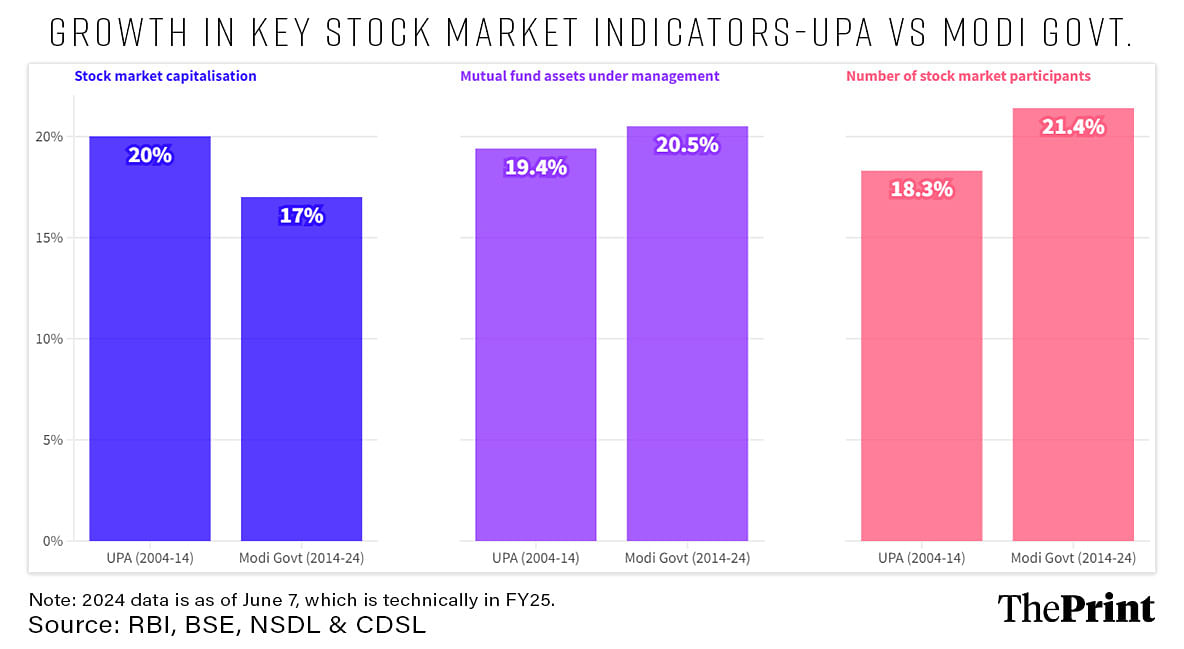

New Delhi: The market capitalisation of India’s stock market grew faster under the 2004-14 period of the United Progressive Alliance (UPA) than in the 10 years so far of the Modi government, an analysis by ThePrint shows.

That said, the growth in assets under management of mutual funds grew faster under the Modi government, as did the number of active participants in the stock market.

Further, while the share of foreign holdings in Indian stock markets has fallen, this wasn’t due to any actions India has taken, but rather in response to global factors, according to the National Stock Exchange (NSE).

In response to Congress leader Rahul Gandhi’s allegations of stock market manipulation by Bharatiya Janata Party (BJP) leaders — particularly Narendra Modi and Amit Shah — BJP leader Piyush Goyal held a press conference Friday in which he highlighted several achievements of the Modi government with regard to the stock market.

“From Rs 67 lakh crore during the UPA government, India’s market cap surged to Rs 415 lakh crore,” Goyal asserted, adding that India’s market cap now stands among the five biggest in the world.

Also Read: Indian economy has rung 3 alarm bells. The new govt must deal with it within 100 days

Market cap grew strongly, but slower than under UPA

Data on the stock market available with the stock exchanges shows that the total market capitalisation grew from Rs 74 lakh crore as of March 2014 to Rs 415 lakh crore as of 7 June, 2024. This means the market capitalisation is now about 5.6 times what it was in 2014, or that it grew about 17 percent every year between then and now.

However, data also shows that India’s market capitalisation in March 2004 stood at just Rs 12 lakh crore. This means that, over the UPA decade, India’s market capitalisation increased 6.2 times or by 20 percent every year — faster than what was achieved under the Modi government.

Goyal also spoke about the assets under management (AUM) by mutual funds saying that the industry’s size was Rs 10 lakh crore in 2014, which has grown to Rs 56 lakh crore now.

Data from the Association of Mutual Funds in India (AMFI) shows that the total AUM of the mutual funds industry grew from Rs 1.4 lakh crore as of March 2004 to Rs 8.25 lakh crore as of March 2014, and Rs 53.4 lakh crore as of March 2024.

This means the AUM of the industry grew at an average rate of 20.5 percent every year under the Modi government, marginally faster than the average annual rate of 19.4 percent under the UPA.

Another factor highlighted by Goyal in his press conference was the growing participation of the public — referred to as retail investors — in the stock market.

More Indian investors are entering the market

“It is a matter of pride for all of us that Indian investors, and within that, the retail investors, are getting the biggest benefit of this,” said Goyal.

He added, “Today, they are not mere bystanders watching the market rise. Now they are participating in the market, investing, and receiving the direct benefit of this.”

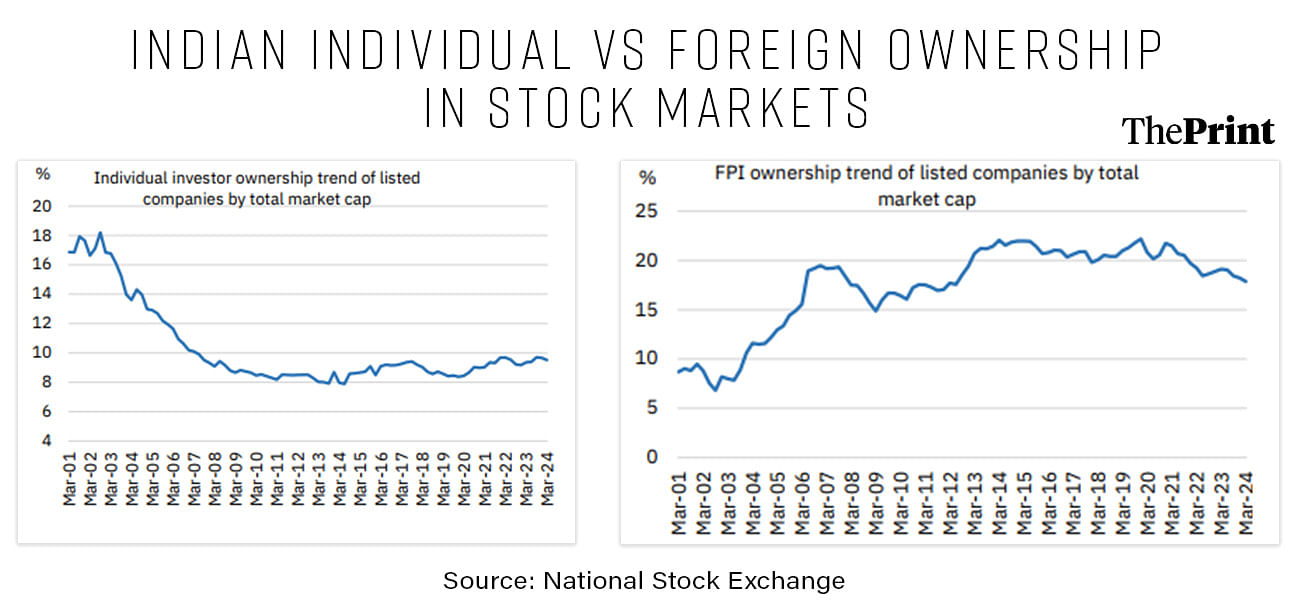

Data here shows a mixed picture. While the number of retail investors has indeed grown faster under the Modi government, their share in the overall market activity has remained largely the same for more than a decade.

The number of stock market participants — as recorded by the National Securities Depository and Central Depository Services — grew from 40.7 lakh to 218 lakh under the UPA, and further to 15.1 crore under the Modi government. This translates to an average annual growth of 18.3 percent under the UPA and 21.4 percent under the Modi government.

However, the share of individual ownership of stocks has remained between 8-10 percent since about March 2008, according to the NSE.

Foreign inventors make up smaller share

On the flip side, the share of foreign portfolio investors’ holdings in Indian stock markets has fallen below 18 percent for the first time in nearly 12 years — a trend highlighted by Goyal in his press conference as an achievement of the Modi government.

However, the NSE added that this was due to external factors rather than internal ones.

The NSE, in its India Ownership Tracker report for the January-March 2024 quarter said that the share of FPIs in India’s markets rose for two consecutive years until December 2019, but fell sharply during the first two quarters of 2020 following the onset of the COVID-19 pandemic.

“This, however, was temporary as huge liquidity injections globally improved risk appetite, leading to a jump in FPI share in the second half,” it added. “Since then, FPI share has been trending down, reflecting weakened investor sentiments in the wake of recurring COVID waves, China slowdown, Russia-Ukraine war, worsening growth-inflation dynamics, and rapid monetary tightening by global central banks, notably the US Fed.”

This is an updated version of the report

(Edited by Amrtansh Arora)

Also Read: Govt has reduced time taken to finalise GDP data by an entire year. Here’s inside story of how