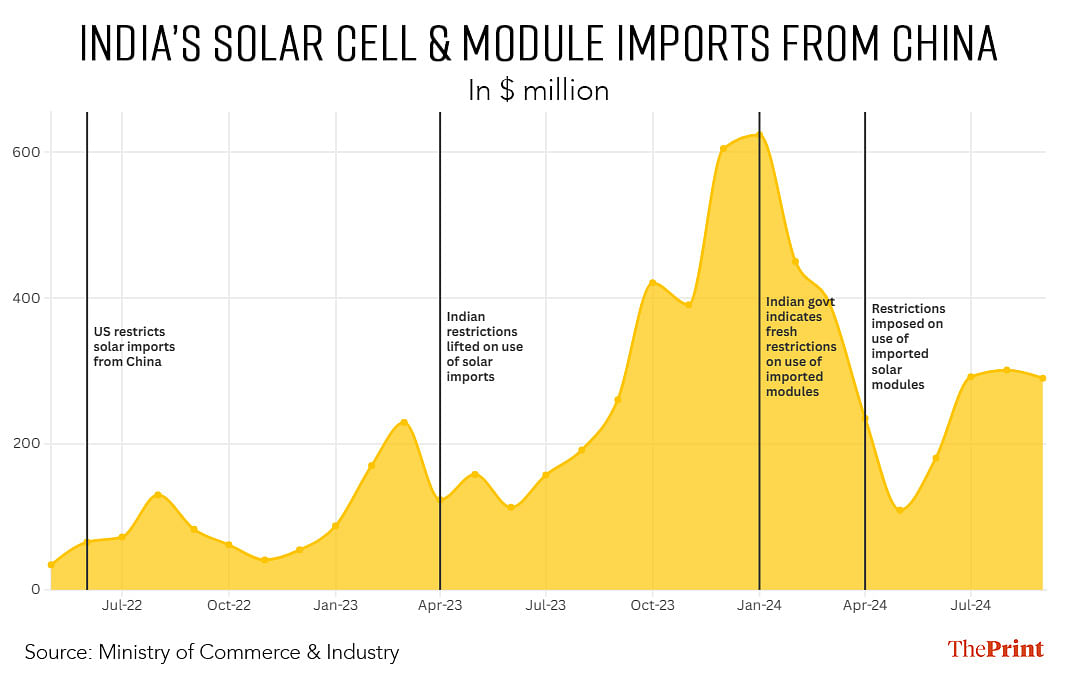

New Delhi: The Indian government has, through various notifications and instructions, tried to slam the brakes on the runaway growth in solar component imports from China. While the data shows this has worked to an extent, the problem is that the domestic industry still needs Chinese imports to cater to growing demand.

The issue of surging Chinese imports of unassembled solar cells and assembled solar modules arose after two contradictory policy decisions—one by the US government and one by India.

The US government, under its Uyghur Forced Labor Prevention Act, which came into effect in June 2022, restricted Chinese imports—including solar cells and modules—that came out of the Chinese province of Xinjiang.

On the other hand, the Indian government in March 2023 put in abeyance its requirement that only domestically produced solar modules could be used under government programmes and projects. In other words, it allowed the unrestricted import of solar modules and cells. China accounts for about 80-90 percent of India’s imports of solar cells and modules, so the move mainly benefited that country.

The combination of these two policies meant that India’s solar cell and module imports from China jumped more than 400 percent between April 2023 and January 2024 to $623.6 million.

Polysilicon is a highly pure form of silicon that is used in electronics and solar cells. Wafers are cut from polysilicon and then manufactured into cells. These cells are then assembled into modules.

The Chinese exporters were redirecting their excess capacity of both cells and modules from the US to India and Indian importers were buying them in bulk as they were cheaper than what could be manufactured locally.

Also Read: 1,000% rise in 4 yrs to 40% fall in just few months, why defence stocks are going from boom to bust

India pumps the brakes on solar imports

It is this runaway growth in Chinese imports that the Indian government has sought to slow down. ThePrint has learnt from officials in the Ministry of New and Renewable Energy (MNRE) that it began to warn domestic industry in January this year that it would reimpose the requirement to source inputs domestically.

This had an immediate effect, with India’s solar cell and module imports slowing sharply. By March, they fell by more than a third in two months to $393.6 million.

In March, the government also came through on its warning, announcing that, from April 2024, companies that wanted to avail of benefits under government schemes or take part in government projects—such as the PM Surya Ghar Muft Bijli Yojana and PM Kisan Urja Suraksha evam Utthaan Mahabhiyaan (PM KUSUM)—would have to source their modules from an Approved List of Models and Manufacturers (ALMM).

Here, ‘government’ includes the central government, state governments, central public sector enterprises, state public sector enterprises, and central and state organisations and autonomous bodies, according to the MNRE.

As a result, India’s solar imports from China fell to $109 million by May—about just one-sixth of what they were in January.

“After April, you could not use imported modules if you want to avail of any of the government schemes, such as PM Surya Ghar Yojana, or net metering,” Jaideep Malaviya, a solar sector analyst, told ThePrint. “The latest ALMM list is much longer than earlier, which means domestic manufacturing has got a boost.”

Only 23 companies had been included in the original ALMM issued in 2021 and kept in abeyance through 2023-24. A total of 94 companies are part of the new list, issued in August this year.

“From January to March there was definitely a lot of import that happened from China and other South East Asian countries,” Chetan Shah, the chairman and managing director of Solex Energy, a solar module manufacturer, told ThePrint.

“What has happened is that because of the ALMM rules from 1 April, the imports fell sharply,” he added. “There was some confusion in the southern state discoms, who were not insisting on ALMM. But even that has stopped now.”

A long way to go to boost solar cell manufacturing

However, this is just a list of module manufacturers. The approved list of solar cell manufacturers has not been released yet since India’s capacity to manufacture cells remains very low.

“Setting up a polysilicon plant is a very capital intensive endeavour and so only some of the larger players will be able to do it,” Malaviya explained. “Reliance is coming up with a very big unit in Jamnagar, where they will make the polysilicon and then slice them into wafers. And then some companies will start processing these raw wafers into cells, which will get assembled into modules.”

The government, too, seems to expect that India’s solar cell manufacturing capacity will grow significantly over the next few years. Earlier this month, it announced that it was seeking industry comments on a proposal to also release an approved list of models and manufacturers of solar cells, and not just modules.

“With installed capacity of solar PV (photovoltaic) cells in the country expected to increase substantially in next two years, it is envisaged to issue List-II of solar PV cells under ALMM,” MNRE said in a notification dated 7 November, 2024.

Once this is done, the same restriction would exist on the use of imported solar cells as currently does for imported solar modules.

A continued reliance on Chinese imports

Until sufficient solar cell capacity comes up in India, Indian solar power producers and module makers are going to be reliant on Chinese imports—borne out by the fact that the value of the imports from China has begun rising again. They were at $301 million by August 2024.

“As far as Indian manufacturers of cells are concerned, our capacity is about 7 GW and output is hardly 2 GW,” Shah explained. “On the other hand, we have 70 GW of module capacity in India of which the output is about 35 GW. So there is a gap.”

The 2 GW worth of solar cells being produced domestically is not enough to fulfil the requirements under the government schemes and projects.

“It is now up to Indian companies to see how fast they can scale up their solar cell manufacturing capacities,” Shah added. “Right now we need to import wafers and cells from China. The Indian manufacturing story in the sector is only starting.”

Import curbs aren’t restricted to solar modules

India’s newfound drive to curb imports in the solar sector is not restricted to cells and modules either. The government has also imposed restrictions on the use of cheap and uncertified imported parts for solar water heaters.

“Ever since the subsidies for solar water heaters were stopped in 2017, there was no monitoring on how much domestic manufacturing of solar water heaters was happening,” Malaviya, who is also the founder and secretary general of the Solar Thermal Federation of India (STFI), said.

“While the subsidies were in place, the entire solar water heaters were being imported, but not in large amounts,” he explained. “After the subsidy was removed, to maintain the price levels, the cheaper imports of parts suddenly zoomed up.”

As a result, the quality of solar water heaters fell significantly in India, with complaints on the MNRE helpline predominantly coming in about faulty solar water heaters. The STFI had been tasked with handling the helpline for nearly a decade, Malaviya said.

In order to address this, MNRE in October 2024 issued a quality control order for solar thermal systems, devices and components. Under the order, all solar water heaters sold in the country would have to carry—both as a whole and on its parts—a certification by the Bureau of Indian Standards.

This effectively puts a stop to cheap imports, Malaviya said.

(Edited by Sanya Mathur)

Also Read: RBI sold $26 bn of reserves in a month to halt rupee depreciation, but Trump effect eventually won