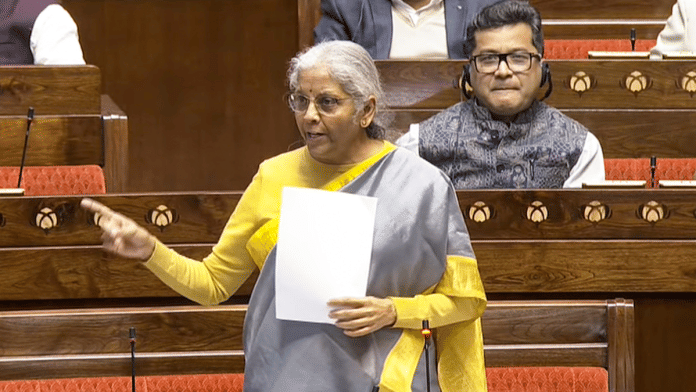

New Delhi: Finance Minister Nirmala Sitharaman Thursday tabled in Parliament a new draft Income Tax Bill which is a significantly shorter version of the Income Tax Act of 1961, with much simpler language. However, the new Bill mandates that assessees would have to share their computer “ access codes” with tax officials during search and seizure operations.

According to the Ministry of Finance’s press release, the core principles followed while drafting the Bill were: textual and structural simplification for improved clarity and coherence, no major tax policy changes to ensure continuity and certainty, and no modifications of tax rates, preserving predictability for taxpayers.

Following the introduction of the Bill, Sitharaman moved a motion for it to be reviewed by a select committee appointed by the Lok Sabha Speaker, which the House approved. The report of the committee will be submitted on the first day of the next Parliament session.

Before introducing the Bill, Sitharaman sought to address concerns of some members—N.K. Premachandran of the Revolutionary Socialist Party and Manish Tewari of the Congress—who argued that the new Bill was longer and had more sections than the 1961 one.

Sitharaman agreed with this, but highlighted the effect of subsequent numerous amendments made to the Act. “From that 819, we are bringing it down to 536,” she told Opposition legislators. The minister added that these were not “mechanical changes” but “substantial” ones.

“The number of words has come down by half,” she further explained, adding. “Where there were 5.5 lakh words, it has come down by half… sections and chapters have come down, and it’s in plain simple English and Hindi.”

While the current Income Tax Act, in its latest form is 823 pages long, the proposed draft Bill is 622 pages.

The press release added the new Bill achieved this simplicity by eliminating intricate language, removing redundant and repetitive provisions, and reorganising sections logically to facilitate ease of reference.

“The Income Tax Bill of 2025 marks a significant step towards a simpler tax system,” Sameer Gupta, National Tax Leader, EY India said in a comment following the tabling of the Bill. “By cutting down on sections and words, it aims to make the tax code more straightforward and user-friendly.”

Also read: Can income tax relief help BJP clinch Delhi? Anatomy of the middle-class voter demographic

Search and seizure rules

One of the biggest criticisms of the existing Income Tax Act was the expansive powers it gave to tax officials to enter premises, conduct searches, and seize assets and information without providing a reason. The new Bill does not dilute them.

In some cases, it adds aspects of cooperation with tax officials that were not in the existing Act.

According to the new Bill, an income tax official can enter any place of business or charity and require any proprietor, trustee, employee or “any other person”—who may at that time be attending to the business—to provide official access to various sensitive items or services.

The existing Act says officers can see books of account or other documents, can check or verify the cash, stock “or other valuable article or thing which may be found therein”, and demand “any information as he may require as to any matter which may be useful for, or relevant to, any proceeding under this Act”.

The new Bill adds to this by saying the person at the premises being inspected must also provide income tax officials the necessary technical assistance “including access codes” to enable the inspection of books of account or other documents, or computer system, or any other relevant material stored online.

Introduction of ‘tax year’

The draft Bill also does away with the concepts of “assessment year” and “previous year”, and introduces a new concept called the “tax year”.

In a separate explainer document, the Ministry of Finance explained that, from 1 April 1989, the dates for “previous year” were aligned to the financial year in all cases (starting on 1 April and ending on 31 March). However, the concept of an “assessment year” continued to be used for various proceedings under the Act.

“Thus, a taxpayer was required to track two different periods, i.e., the ‘previous year’ as well as the ‘assessment year’,” the document said. “This presented difficulties in complying to the provisions of the Act especially for a new taxpayer who had to keep track of ‘previous year’, ‘assessment year’ as well as ‘financial year’.”

Of the new “tax year” concept, the explainer said: “The timelines and computation in the Bill are now with reference to the financial year for which the income is liable to be taxed… It is expected that the use of ‘tax year’ will make the new Bill easier to comprehend.”

“Further, many of the comparable tax jurisdictions in the world are using one single term, for the purpose of denoting the unit period of taxation,” it said, adding: “‘Tax year’ is commonly used in many countries.”

According to the draft Bill, the tax year would be the twelve-month period of the financial year commencing on 1 April.

(Edited by Tikli Basu)

Also read: Modi 3.0 gives giant relief to middle class—no tax on income up to Rs 12 lakh

Hi TCA, this requirement was also under the Previous Provisions of Income Tax Act 1961,

“(iib) require any person who is found to be in possession or control of any books of account or other documents maintained in the form of electronic record as defined in clause (t) of sub-section (1) of section 2 of the Information Technology Act, 2000 (21 of 2000), to afford the authorised officer the necessary facility to inspect such books of account or other documents;”