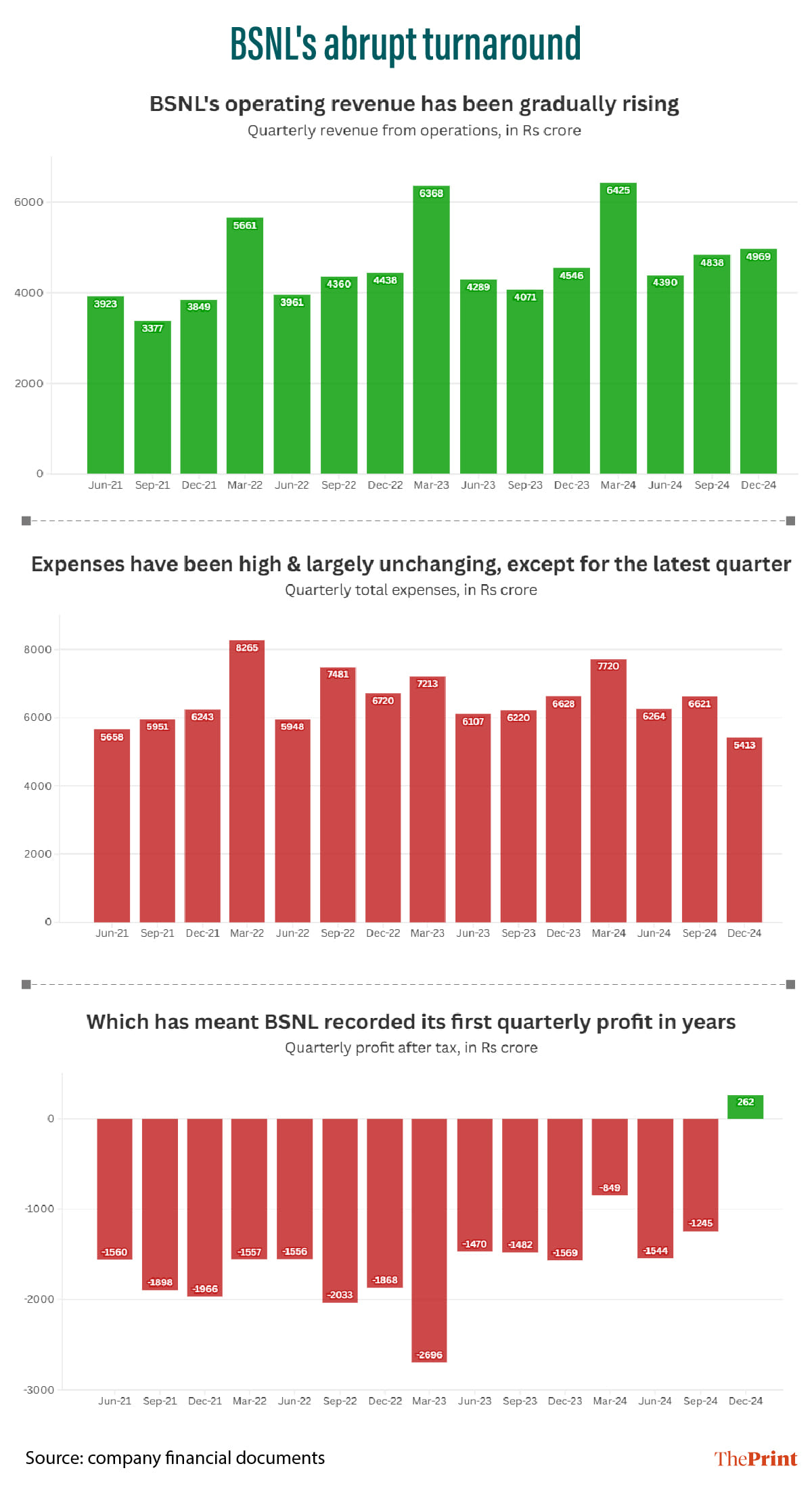

New Delhi: State-run telecom company Bharat Sanchar Nigam Limited (BSNL) reported a net profit of Rs 262 crore in the October-December 2024 quarter (Q3) of this financial year, marking its first profit in 17 years. But there’s a catch.

While a surface-level look at BSNL’s finances suggests this profit is primarily due to a significant drop in its expenses, a deeper analysis reveals that this reduction was driven by accounting changes rather than improved efficiencies or cost-cutting.

For instance, the company reported a dramatic Rs 337 crore drop in its employee expenses, but this was not due to a reduction in salaries, pensions, or other actual payments. Instead, a substantial portion of these expenses was reported as assets.

Further, BSNL made methodological changes to the way it accounts for amortisation, which is the standard accounting practice of spreading the cost of an asset over its useful life. This change—highlighted by the company’s auditor—single-handedly reduced the company’s loss by Rs 782 crore.

The auditor also pointed out an increase in the company’s ‘other income’, which arises from sources other than its core operations.

ThePrint has reached BSNL over mail and phone with queries. This report will be updated if and when a response is received.

While the auditor highlighted certain aspects of BSNL’s accounting adjustments, the government and its ministers skirted around these issues while celebrating the telecom company’s return to profitability.

Also Read: Modi 3.0 gives giant relief to middle class—no tax on income up to Rs 12 lakh

Government celebration despite accounting adjustments

The Ministry of Communications issued a release on BSNL’s third-quarter financial results, claiming the company’s return to profitability after 17 years—since 2007—”reflects the company’s focus on innovation, aggressive network expansion, cost optimisation, and customer-centric service improvements.”

Communications Minister Jyotiraditya Scindia’s office posted on X, stating that the company’s net profit is a “testament to its ongoing performance”. Coal Minister G. Kishan Reddy also praised the leadership of Prime Minister Narendra Modi for this “historic milestone”.

Since 2019, the Modi government has approved three revival packages for BSNL and MTNL, amounting to more than Rs 3 lakh crore in total. However, MTNL continues to struggle, defaulting on loans, while BSNL’s net loss for the financial year so far—including the Q3 profit—stands at over Rs 4,500 crore.

Employee expenses slashed through accounting changes

An analysis of BSNL’s financial statements reveals that the company’s revenue from operations stood at Rs 4,969 crore in Q3 FY2024, up 9.3 per cent from the same quarter the previous year. This follows a 19 per cent increase in Q2.

However, the rise in operating revenue does not fully explain the company’s return to profitability. The most striking aspect of BSNL’s Q3 finances was the Rs 1,215 crore drop in total expenses compared to the same quarter the previous year.

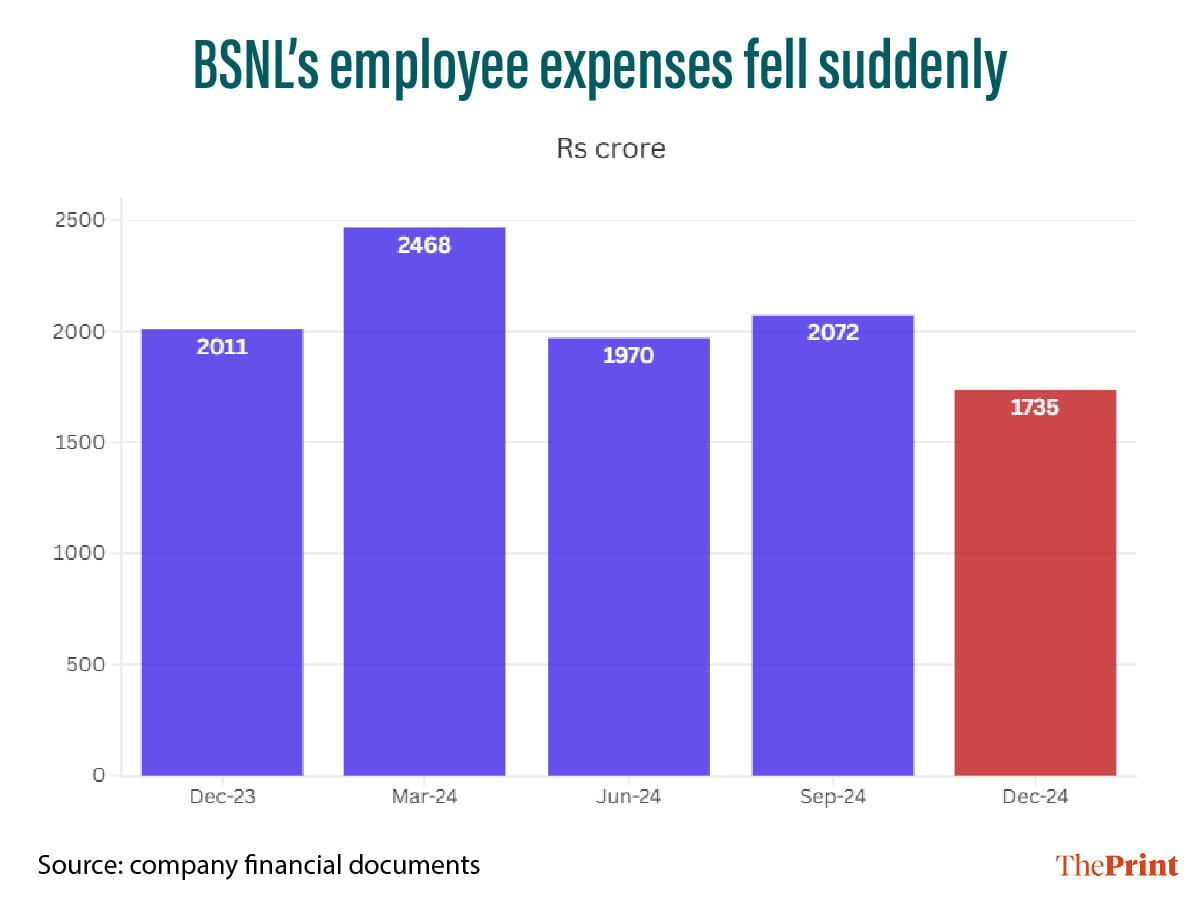

The company’s employee expenses illustrate several ways in which these reductions were made. Some of these were highlighted by the auditor, while others were uncovered through ThePrint’s analysis.

The auditor pointed out: “The obligation of the company for employee retirement benefits is short-funded by Rs 41,359.15 lakhs (Rs 413.6 crore) towards gratuity and by Rs 12,235.21 lakhs (Rs 122.3 crore) towards leave encashment.”

In other words, BSNL reported lower expenses than it actually would have to incur.

Further analysis of employee expenses indicates that the company capitalised some of these expenses—an accounting practice where a cost is recorded as an asset rather than an expense.

As a result, while total employee expenses before this adjustment stood at Rs 2,043 crore in Q3, almost identical to last year’s figure, they dropped to Rs 1,735 crore after capitalisation—making the final reported amount nearly 14 per cent lower than the previous year.

This capitalisation of employee expenses is not a new practice for BSNL. However, the amount capitalised in Q3—Rs 308 crore—is far higher than the Rs 21 crore in Q2 or the Rs 29.5 crore in Q3 of last year.

Amortisation—another major adjustment

Put simply, amortisation and depreciation are accounting methods used to record the costs of intangible and tangible assets, respectively, by spreading them over their useful lives rather than expensing them in one go.

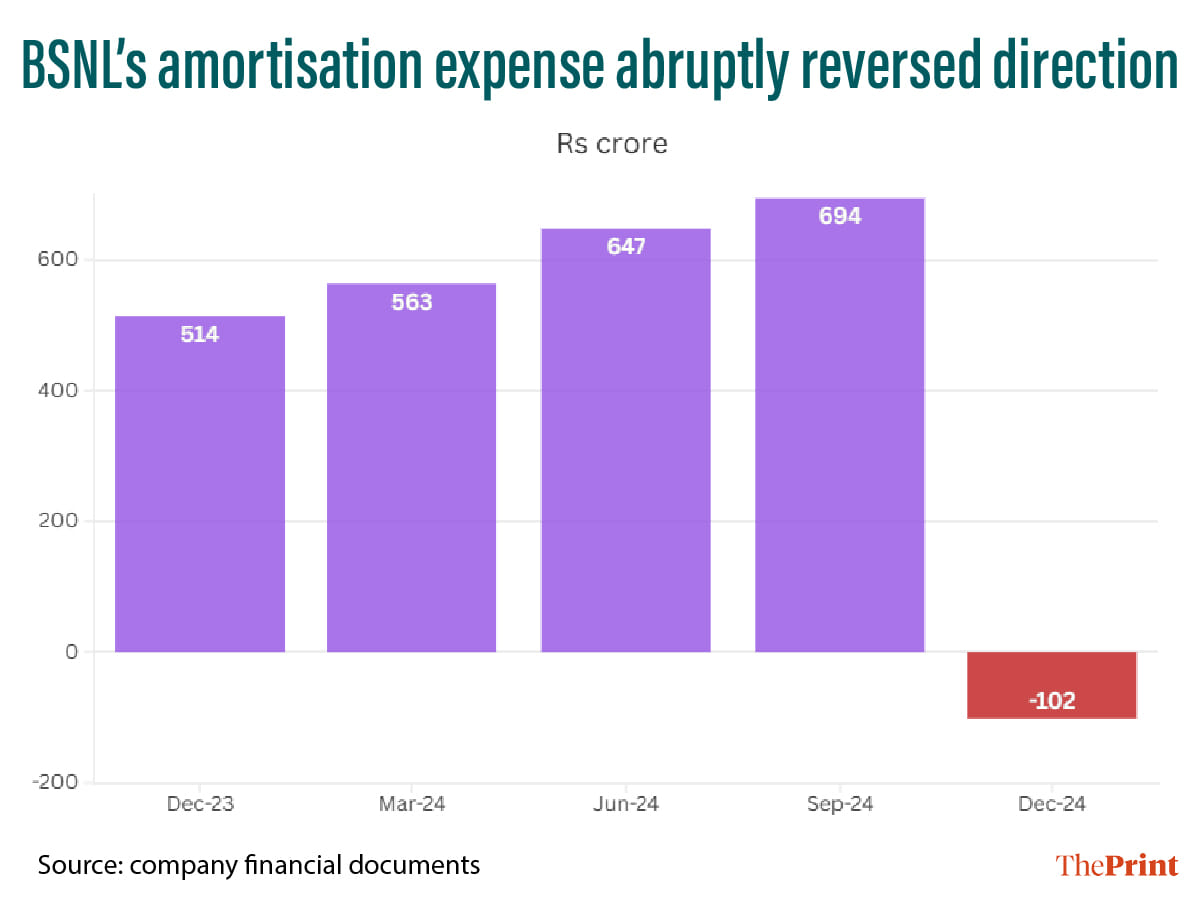

Documents indicate that BSNL’s amortisation expenses had been rising over time, reaching Rs 694 crore in the July-September 2024 quarter (Q2), up from Rs 563 crore at the start of the financial year. However, this rising trend was reversed in Q3, with amortisation expenses recorded at Rs -102 crore.

In other words, this expense actually reduced the company’s total costs in Q3 instead of adding to them. The auditor flagged this significant change.

The auditor noted: “We draw attention to Note No. 4 (iv) regarding change in method of amortisation of spectrum fee during the current quarter, which reduced the company’s loss for the nine months ending 31 December 2024 by Rs 78,198 lakhs (Rs 781.98 crore).”

Note 4 (iv) provides BSNL’s explanation for this dramatic shift:

“During the current quarter, the company changed the method of amortisation of spectrum fees (intangible asset) from the Straight Line Method (SLM) to the Unit-Based Amortisation Method (UBAM), effective from the beginning of FY 2024-25.”

While different methods exist for amortisation, SLM is the most widely used. However, BSNL claims that UBAM provides a more accurate reflection of cost allocation, matching with spectrum utilisation.

One-time increase in ‘other revenue’

The auditor also highlighted that BSNL recorded an increase in ‘other income’ due to another accounting adjustment.

“Other income includes Rs 28,520 lakhs (Rs 285.2 crore) being excess provision written back during the nine months ending 31 December 2024,” the auditor stated.

Write-backs are an accounting practice where funds originally set aside for potential costs are added back to income when those costs do not arise.

As a result of this write-back, BSNL’s other income rose to Rs 706 crore in Q3, up 91 per cent from Q2 and 37 per cent from Q3 of last year.

Also Read: Kerala budget brings hikes in taxes & levies amid fiscal deficit crisis

Sleight of hand accountancy is the secret sauce of BJP. It is the magic mantra which has made public sector banks suddenly profitable and now BSNL seems to have joined the party.

We elected Modi for “minimum government, maximum governance”. What we are getting is the exact opposite “minimum governance, maximum government”.

The public sector banks and companies like BSNL must be privatized at the earliest.