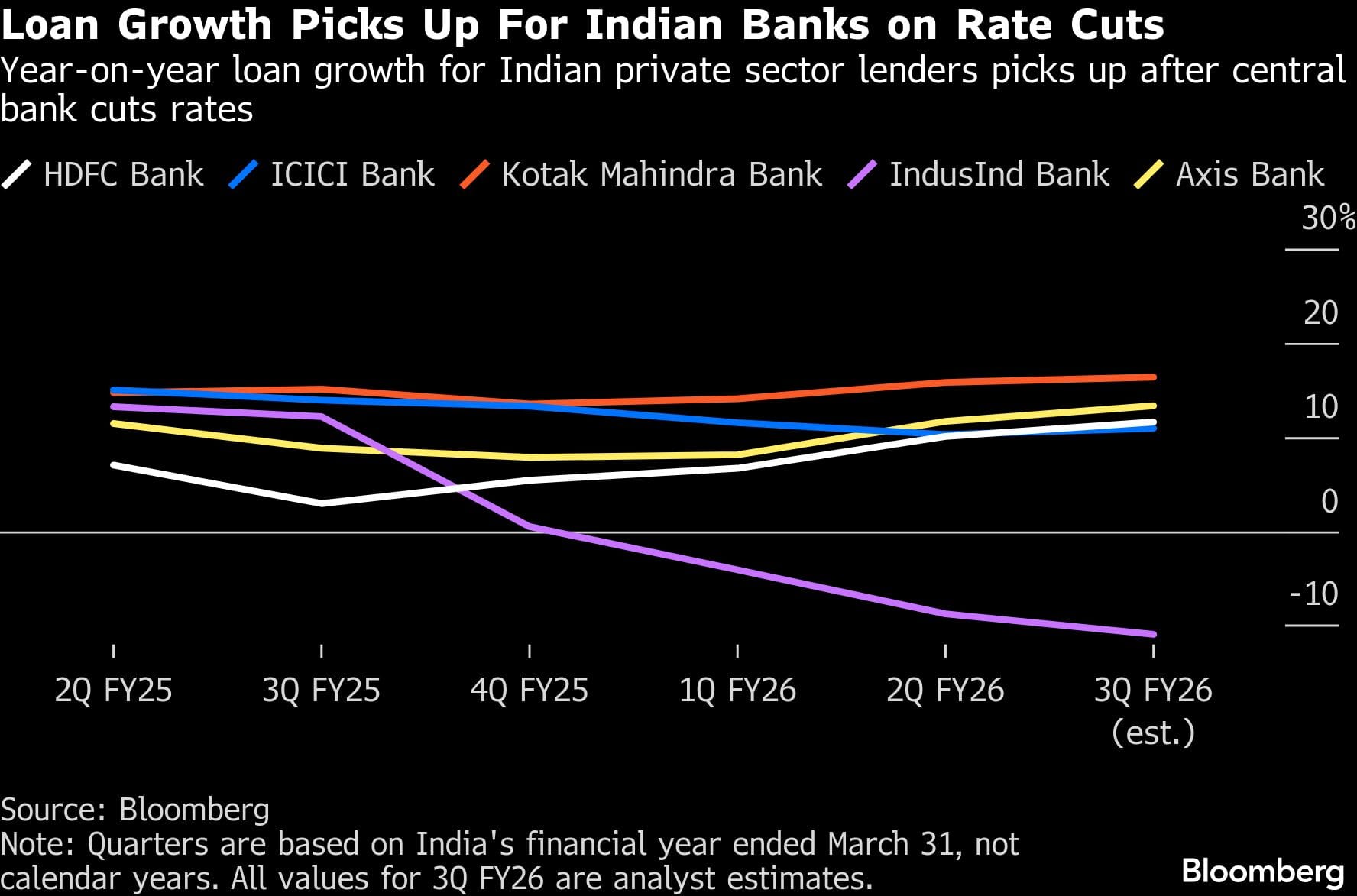

India’s top banks should post better loan growth numbers as the central bank’s rate cuts continue to take effect, with HDFC Bank Ltd. set to stand out as it emerges from a period of deliberate slowdown.

HDFC Bank and ICICI Bank Ltd. should see loan growth pick up in the October-December quarter after the RBI’s rate cuts last year and the 100 basis points cut to the cash reserve ratio in June. Lending margins should also stabilize, with Jefferies expecting a slight expansion sequentially as the cost of funds may be lower.

For IndusInd Bank Ltd., investors will focus on how the new management plans to turn around the bank after last year’s 19.6 billion rupees ($217 million) accounting discrepancy led its chief executive officer to resign. The bank said in a pre-earnings update that net advances at the end of the quarter slid 13% on-year, and deposits fell 3.8%.

Markets will also watch for commentary from India’s large pharmaceutical manufacturers. Semaglutide, Novo Nordisk A/S’s weight-loss drug, will lose patent protection this year in several large markets. An Indian court in December allowed Dr Reddy’s Laboratories Ltd. to manufacture and export the drug.

Highlights to look out for:

Saturday: HDFC Bank (HDFCB IN) is expected to post 9.7% quarterly profit growth, the highest among major lenders. It’s emerging from a slowdown when it actively scaled bank lending growth to build up its liquidity buffers. A recovery in lending margins after two straight quarters of contraction should also aid profit growth, Bloomberg Intelligence said.

- ICICI Bank’s (ICICIBC IN) profit should have grown 5.1% on strong lending growth. Commentary on management continuation will be the key variable going forward, Elara Capital said.

Monday: No notable earnings.

Tuesday: No notable earnings.

Wednesday: Dr Reddy’s Labs (DRRD IN) should post a 23% drop in profit because of pricing pressure for cancer drug lenalidomide, which represents a large portion of its US sales. Progress on semaglutide approval for the Canadian market will be key to watch, Motilal Oswal said.

- Disco’s (6146 JP) third-quarter parent sales grew 14%, according to a company filing, suggesting earnings may beat consensus. Growth for the Japanese chip gear maker should remain strong this year, driven by continued high demand for generative artificial intelligence applications and a memory market recovery, Jefferies said.

Thursday: No notable earnings.

Friday: IndusInd Bank (IIB IN) likely saw net income decline 77% in the third quarter as business growth and asset quality remained under pressure, Elara Capital said. Watch for commentary on its strategy outlook and leadership changes as it plans to expand its board.

- Cipla (CIPLA IN) is expected to post a 20% decline in third-quarter net income, squeezed by lower revenue from the US market and higher total operating expenses. On the upside, the pharmaceutical company should see a robust domestic performance like its peers, thanks to strong demand in cardiac, anti-diabetes and respiratory therapies, Jefferies said.

Disclaimer: This report is auto generated from the Bloomberg news service. ThePrint holds no responsibility for its content.