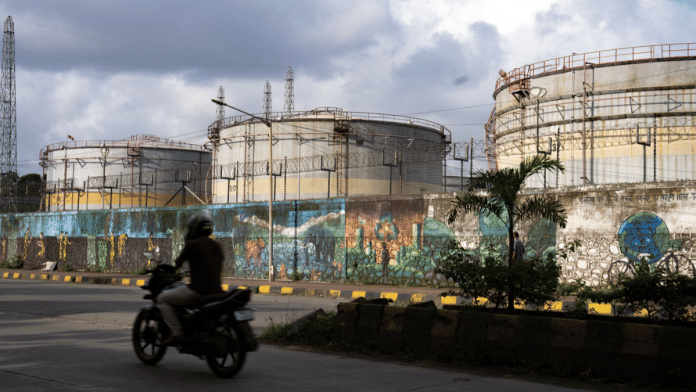

New Delhi: India’s goods imports from Russia declined 10.8 percent in the first seven months of this financial year, compared to the same timeframe in 2024—a likely reflection of mounting US pressure on New Delhi’s energy ties with Moscow.

Data released by the Union Ministry of Commerce and Industry Monday showed India imported $35.97 billion worth of goods from Russia between April and October 2025, down from $40.32 billion in the corresponding period last year.

In the 2024-25 financial year, India’s total imports from Russia stood at approximately $63 billion, largely driven by petroleum products.

The import decline comes as President Donald Trump, who returned to power for a second term in the US this year, spoke against India’s oil trade with Russia and announced American sanctions on two of Russia’s largest oil firms—Rosneft and Lukoil—last month.

The Trump administration had spent months pressing India to reduce its crude purchases from Moscow, arguing that New Delhi was aiding Moscow’s oil-dependent economy and prolonging Russia’s war in Ukraine. India, in response, maintained that it purchases energy from global markets keeping in mind its own needs.

The latest trade figures suggest some impact from US demands.

India was heavily reliant on discounted Russian crude over the last few years, but since the American sanctions, oil purchases from Moscow have dwindled. According to Bloomberg, some of the largest Indian refiners have not placed any orders for Russian oil for December. Typically, deals for the coming month are completed by the 10th of the current month.

“The decline in imports from Russia is noteworthy, likely reflecting both geopolitical pressures and the necessity for Indian refiners to diversify their sourcing as compliance risks escalate. However, unless export momentum extends beyond a few sectors, India’s external balance will remain vulnerable in the forthcoming quarters,” Bidisha Bhattacharya, Associate Fellow at the Chintan Research Foundation (CRF), told ThePrint.

Also Read: India and US inch towards first tranche of trade deal, focus on mutual tariffs and oil

US gains in tradeoff

Simultaneously, India’s imports from the US grew 9.75 percent between April and October 2025, compared with the same period last year.

Union Minister for Petroleum and Natural Gas Hardeep Singh Puri announced Monday that state-owned oil companies had struck a deal with the US to source 2.2 MTPA (million tonnes per annum) of liquified petroleum gas—roughly 10 percent of India’s total needs—in a first-of-its-kind agreement.

The US remains India’s largest export destination. Goods shipments to the US touched $52.12 billion in the first seven months of this year, up from $47.32 billion in the same period last year—a 10.1 percent increase despite Washington slapping a 50 percent tariff on Indian goods from August-end.

New Delhi has continued negotiating a bilateral trade agreement with the US since March 2025.

The first four months of the financial year saw strong export growth (April-July), followed by a dip in August and September. October witnessed an uptick, with India’s total exports to the US for the month standing at approximately $6.39 billion.

The ministry’s data shows that the UAE is a distant second as an export destination, with shipments valued at $22.14 billion for the first seven months of this financial year.

Modest overall export growth

India’s overall merchandise exports saw a marginal increase of 0.63 percent in April-October 225 compared with the same period last year.

India exported approximately $254.25 billion worth of goods, while in the same period in 2024, its total merchandise exports stood at $252.66 billion.

Imports of goods, though, grew 6.37 percent this FY. Overall merchandise imports stood at $451.08 billion at the end of October 2025, up from $424.06 billion in the corresponding period last year.

“The marginal increase in exports, coupled with a sustained rise in imports, indicates the external sector remains under pressure despite some stabilisation. The slight increase in exports likely reflects weak global demand and price effects rather than a significant expansion in volumes. At the same time, the more rapid increase in imports, particularly with a shift away from discounted Russian energy, suggests higher input costs for India and a potential widening of the trade deficit,” added Bhattacharya.

Services exports also witnessed a 9.75 percent growth in the first seven months of this FY, from $216.45 billion in 2024 to $237.55 billion in 2025.

Imports from China grew approximately 11 percent during the first seven months of 2025 compared with the same period last year. Between April and October 2024, India’s merchandise imports from China stood at $66.13 billion. This year, for the same period, India imported $73.99 billion worth of goods from Beijing.

However, exports to China grew as well. In the first seven months of 2024, India exported $8.04 billion worth of goods to China. In 2025, that figure stood at $10.03 billion.

Gold surge widens October deficit

A nearly 200 percent increase in gold imports last month, along with increases in silver imports, saw India’s overall trade deficit for October 2025 grow to $21.8 billion—more than double the overall deficit in the same month last year.

India’s overall exports marginally fell in October to $72.89 billion from $73.39 billion in the same month last year. However, India’s imports for the same period grew from $82.44 billion in 2024 to $94.7 billion this year for the month of October. This includes both merchandise exports and imports, as well as services.

For trade in merchandise (goods), India’s imports in October 2025 grew 16.5 percent compared with the same period last year. India’s merchandise exports fell from $38.98 billion in October 2024 to $34.38 billion in the same period this year.

Gold in particular saw a surge in demand in October due to festive demand and a possible tamp-down in the first six months of the FY.

The ministry’s data showed that total imports of the precious metal was valued at $14.7 billion in October—a 199.2 percent increase from the same month last year, when India imported $4.9 billion worth of gold.

Between April and September 2025, India’s overall gold imports were approximately $26 billion. This was less than the same period of the previous year, when it was $29 billion.

(Edited by Prerna Madan)

Also Read: The math is clear — buying Russian oil is now a losing deal for India