Finance Minister Nirmala Sitharaman presented the Union Budget for the financial year 2026-27 in Parliament Sunday. This was her ninth consecutive Budget speech since taking on the role in 2019.

This is the second full-year budget of Modi 3.0. The presentation, like every year, came after several pre-consultations held by the finance ministry with multiple stakeholders from various sectors of the economy, and will set the economic and fiscal roadmap for the next fiscal year.

For the preparation of the budget, Sitharaman is supported by a team of senior secretaries and officers, including Economic Affairs Secretary Anuradha Thakur, Revenue Secretary Arvind Shrivastava, Expenditure Secretary Vumlunmang Vualnam, Financial Services Secretary M. Nagaraju, DIPAM Secretary Arunish Chawla, Public Enterprises Secretary K. Moses Chalai, and Chief Economic Adviser V. Anantha Nageswaran.

As highlighted in the Economic Survey 2025-26, tabled on 29 January, India remains the fastest-growing major economy. India’s economy is estimated to grow 7.4 percent in FY26, with Gross Value Added growth at 7.3 percent.

For FY27, the GDP growth is projected to be in the range of 6.8-7.2 percent, even as the global economy remains fragile.

After her speech, the Finance Minister will interact with around 30 college students from across the country.

HIGHLIGHTS:

7.05 pm: Cancer drugs & solar panels to get cheaper, seafood exporters to benefit

The Budget has reduced costs for priority sectors, such as clean energy, strategic minerals, electronics manufacturing, aviation, healthcare, and exports, while selectively raising costs for derivatives trading and non-priority imports at the same time. The pattern reflects targeted industrial and financial market signalling rather than broad-based consumer price changes.

ThePrint presents an item-wise snapshot of what has become cheaper or turned costlier, following the Budget. This is based solely on announced changes to customs duty, excise duty, and transaction taxes. Read here.

7.00 pm: Why RSS-backed BKS & BMS say Budget has let down farmers & labourers

It urged the Opposition as well as the government to amend the Budget to include farmer-friendly demands keeping the interests of the entire farming community in mind. “The Budget does not reflect the government’s promises.”

The organisation pointed out that the Kisan Samman Nidhi Yojana, which was started in 2018 under which Rs 6000 is provided to farmers, is a good initiative but added that it demanded that the amount should be increased, something which has not been done.

“This is a matter of concern and while the intentions of the government might be good but the Budget doesn’t reflect that,” BKS all-India general secretary Mohini Mohan Mishra told ThePrint.

Another Sangh affiliate, the Bharatiya Mazdoor Sangh (BMS), too, expressed dissatisfaction and strong resentment over the continued neglect of core labour and social security demands. “Without enhancing the ceiling limits for PF, ESI and bonus, the workers will not be covered under the social security net,” it said in a statement.

Read Neelam Pandey’s report.

6.50 pm: Budget pushes mountain trails for tourism, a challenge for state govts

Finance Minister Nirmala Sitharaman has specially mentioned developing mountain trails as a way to promote trekking and hiking in her Budget speech this year. The Union Budget 2026 proposes “ecologically sustainable” mountain trails across Himachal Pradesh, Uttarakhand, Jammu and Kashmir, and select regions in the Eastern and Western Ghats. The trails are meant to boost rural tourism and provide employment to local people.

This was not the launch of a brand-new tourism programme. It was a policy signal rather than a dedicated funding announcement.

India’s mountain tourism bounced back after Covid-19, with mountain sports in hilly areas such as bungee jumping, paragliding and river rafting. It has increased domestic adventure tourism and nature travel in areas such as Bir, Manali and Rishikesh, but many remote Himalayan areas are still untouched. The trails can help boost the tourism industry there.

The projects announced by Sitharaman are likely to be routed through existing Ministry of Tourism destination development schemes, including Swadesh Darshan 2.0.

“As of now, it isn’t clear how they will make these mountain trails, what the road network will be, and what kind of financing will be there. The government has to be clear on all these points. There should be decentralisation in the plan, and the government should understand that it will invite more tourists to the mountains, and we have to be careful about the carrying capacity,” said Guman Singh, an environmentalist from Himachal Pradesh.

Read Nootan Sharma’s report.

6.35 pm: ‘A budget for the real economy’

Kotak Mahindra Bank founder and director Uday Kotak writes on X: “Welcome increase in defence spend. Broad fiscal discipline continues. Works on balancing between financialisation of the economy, and focused development of diverse, deep India long term.”

Budget first take.

A budget for the real economy. Welcome increase in defence spend. Broad fiscal discipline continues. Works on balancing between financialisation of the economy, and focused development of diverse, deep India long term.

— Uday Kotak (@udaykotak) February 1, 2026

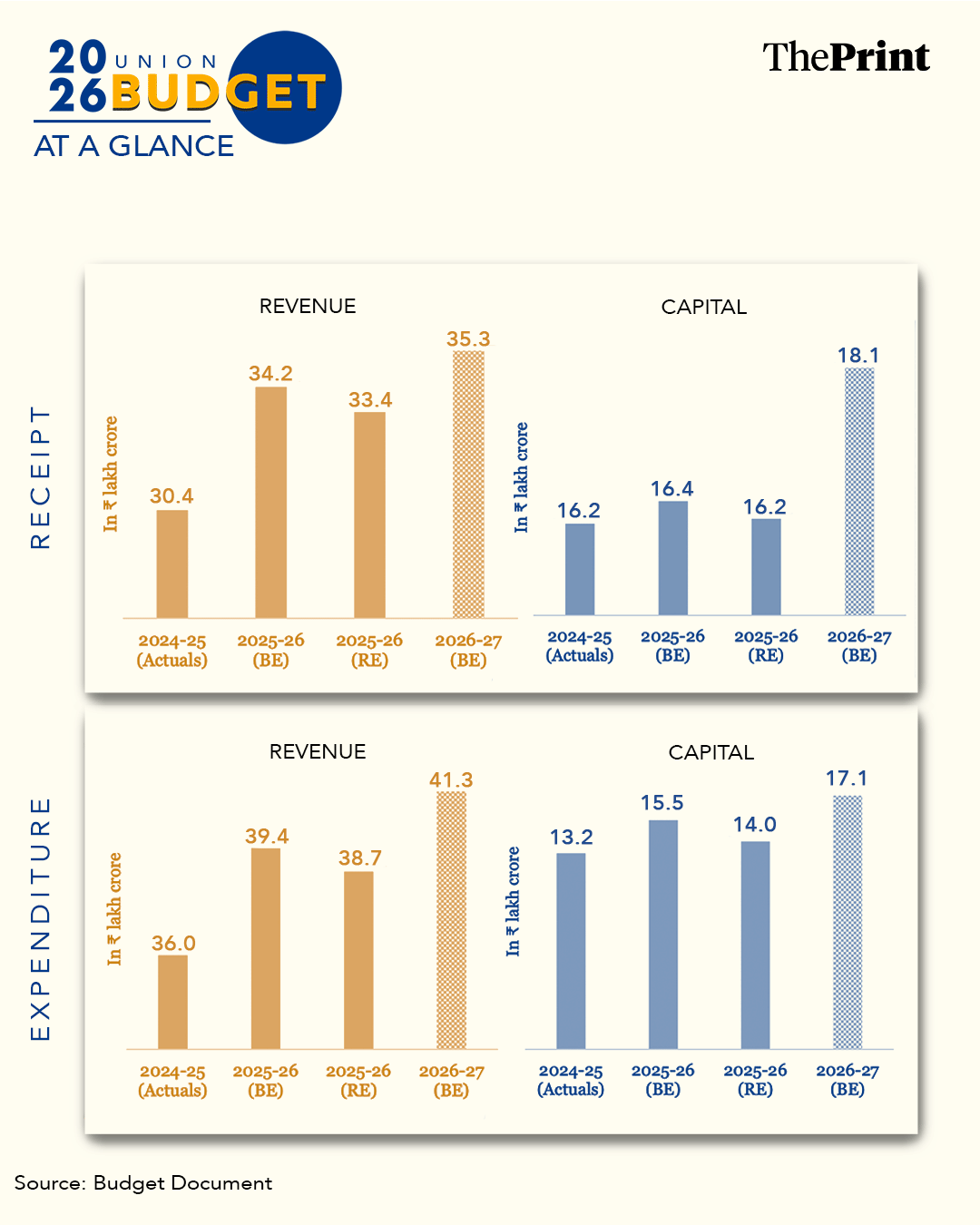

6.25 pm: A look at the estimated receipts and expenditure

6.20 pm: VB-G Ram G gets more than Rs 95,000 crore allocation, MGNREGA funds slashed

Set to replace the Mahatma Gandhi National Rural Employment Guarantee Act, 2005 (MGNREGA), the Viksit Bharat-Guarantee for Rozgar and Ajeevika Mission (Gramin) Act, 2025 has been allocated a whopping Rs 95,692 crore under the Union Budget. Overall, the budget for the Department of Rural Development increased from Rs 187754.53 crore in 2025-26, to Rs 194368.81 crore in 2026-27— a jump of 3.52%. However, the revised estimates had seen a drop to Rs 186995.61 crore in 2025-26. The VB-G RAM G budget now forms 49.18% of the total budget allocated to the Department of Rural Development.

At the same time, the budget allocation for MGNREGA has been reduced from Rs 86,000 crore in 2025-26 to Rs 30,000 crore in 2026-27— slashed to about one-third of last year’s amount. The revised budget estimate for the scheme had actually increased in 2025-26 to Rs 88,000 crore. Finance Minister Nirmala Sitharaman did not make any reference to the law in her speech.

Read Apoorva Mandhani’s report.

6.10 pm: Centre’s industry & investment promises for Northeast see muted push

The Centre’s promise to accelerate industry and investment in the Northeast through the launch of a new policy in 2024 found little reflection in the annual budget presented Sunday, with only Rs 50 crore allocated for the flagship UNNATI (Uttar Poorva Transformative Industrialisation Scheme) for 2026-27.

The Union Cabinet had approved UNNATI in March 2024, promising an outlay of Rs 10,037 crore over a period of 10 years for the development of industries and the generation of at least “83,000 direct employment opportunities”.

According to records maintained by the ministry, 792 applications have been received under the scheme so far, of which 327 have been approved and 242 are in progress. The Centre had previously announced that it envisages 2,180 applications under the scheme. The scheme replaced the North East Industrial Development Scheme (NEIDS), 2017, which was in force for five years.

Many industrial associations based in the region had termed NEIDS, the Modi government’s first industrial policy for the Northeast, a “flop show”. A parliamentary committee had also pointed out in its report that only Rs 1 crore was allotted to the scheme in 2019-20.

According to details in the expenditure budget presented in Lok Sabha by Finance Minister Nirmala Sitharaman on Sunday, Rs 8.05 crore was spent under the UNNATI scheme in 2024-25. In 2025-26, Rs 175 crore was earmarked for the scheme, but only Rs 33 crore was eventually spent. For 2026-27, Rs 50 crore has been allocated.

The budget saw no major announcement for the region, except for a proposal to develop Buddhist circuits.

Read Sourav Roy Barman’s report.

6.00 pm: ‘A Budget which creates opportunities’: Anil Agarwal

Calling 2026 Budget “growth-oriented”, Vedanta chairman Anil Agarwal says that it has a “clear focus on increasing public capital expenditure and boosting manufacturing”.

In a post on X, he wrote: “It is a Budget which creates opportunities, for youth to improve their livelihoods, women to become financially independent and for employment-intensive sectors like medical tourism to take off. I welcome the Government’s keen attention to critical minerals and rare earths. The Rare Earths Corridors for mining, processing, R&D and manufacturing in Odisha, Tamil Nadu, Andhra Pradesh and Kerala will boost growth, employment and mineral security. Import duty exemption on capital goods for critical minerals processing is very timely in the current global scenario.”

A growth-oriented Budget, with a clear focus on increasing public capital expenditure and boosting manufacturing.

It is a Budget which creates opportunities, for youth to improve their livelihoods, women to become financially independent and for employment-intensive sectors like… pic.twitter.com/C3SP6GnrV1

— Anil Agarwal (@AnilAgarwal_Ved) February 1, 2026

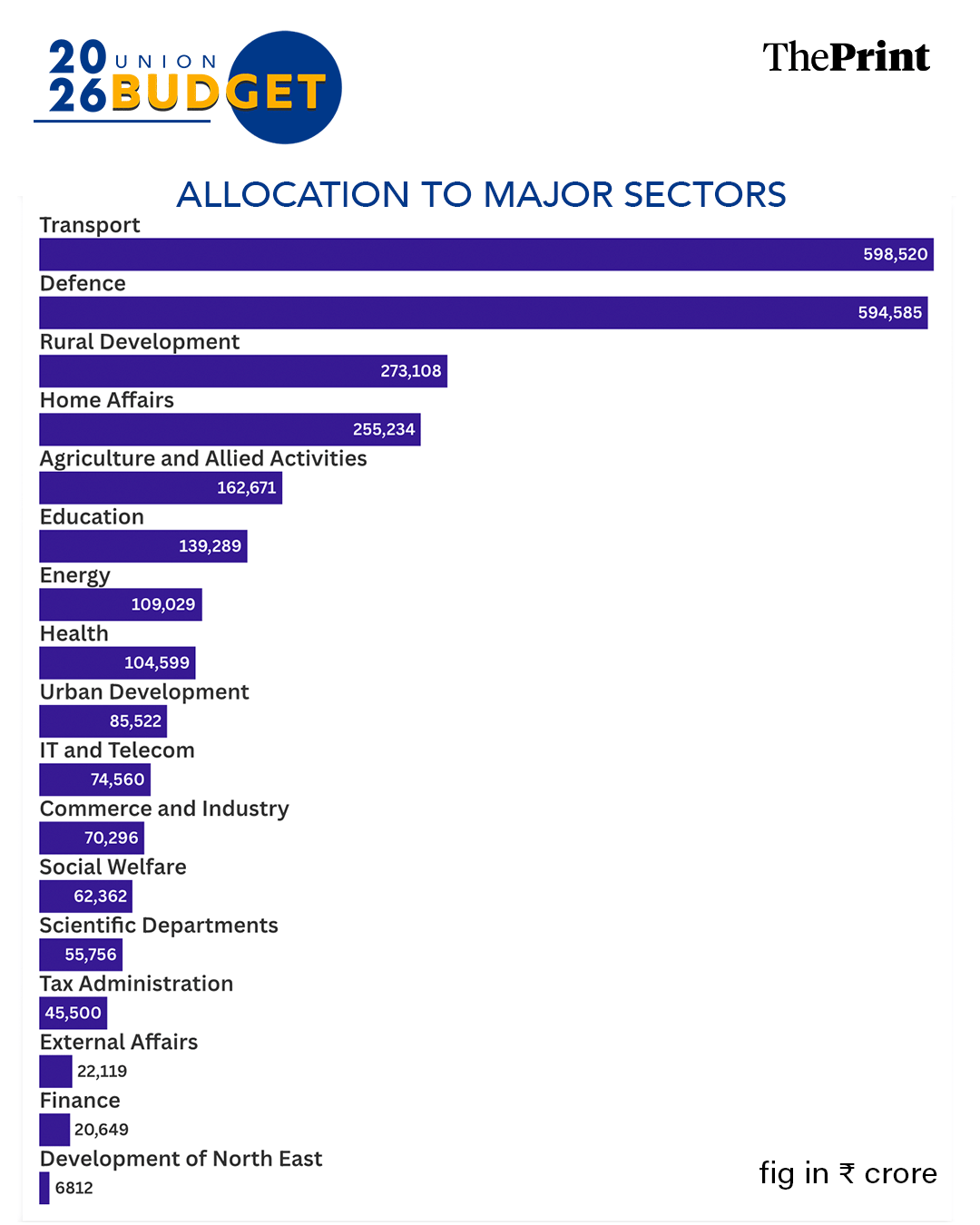

5.40 pm: Which sectors received the highest allocations?

5.20 pm: ‘A Centre indifferent to our pain, a state govt in denial of own fiscal profligacy’

Thiruvananthapuram MP and Congress leader Shashi Tharoor reacts to the Union Budget in a series of posts on X, calling out the “invisibility” of Kerala in the fiscal plan for the upcoming financial year.

“A disquieting sense of déjà vu pervades the FM’s speech today. For a state that contributes so robustly to the nation’s forex reserves, skilled workforce, and soft power, Kerala appears to be entirely invisible in the Centre’s fiscal vision. A “Budget of Invisible Kerala” in an election year is a message in itself,” he wrote.

“Even the promise of an All-India Institute of Ayurveda remains a mirage since Kerala is not mentioned. Thiruvananthapuram’s potential as a medical hub is being systematically stifled,” he posted.

The announcement of 7 new High-Speed Rail Corridors across India is welcome for the nation, but the glaring exclusion of Kerala is indefensible. We are a high-density state crying out for modern transit. The Centre ignores us, and the State proposes paper projects it cannot…

— Shashi Tharoor (@ShashiTharoor) February 1, 2026

In another post, he wrote, “Our coastlines are eroding—we are losing actual Indian territory to the sea annually. If this were a land border, it would be a defence emergency. On the coast, it is met with apathy. No ‘war-footing’ package for coastal protection suggests the Centre takes Kerala’s geography for granted. And the step-motherly treatment of the coastal community continues.”

“As the MP for Kerala’s capital, I see that our State Budget was built on a fantasy of central funds that today’s Union Budget has explicitly failed to deliver…”

As the MP for Kerala's capital, I see that our State Budget was built on a fantasy of central funds that today's Union Budget has explicitly failed to deliver. Sadly, the Malayali is caught between a Centre indifferent to our pain and a State Government in denial of its own…

— Shashi Tharoor (@ShashiTharoor) February 1, 2026

“The #UnionBudget2026 calls for a new hashtag: #InvisibleKerala!” he added.

5.15 pm: Big boost for Census with 6-fold allocation hike, 50% jump for CAPF infra funds

FM Sitharaman has allocated funds nearly six times the revised expenditure for last year’s Census and related exercises. The allocation has been increased to Rs 6,000 crore in the Union Budget for the financial year 2026-27, compared to revised estimates of last year’s Budget, which stood at Rs 1,040 crore.

The massive boost in funding for the Registrar General of India (RGI) comes at a time the Centre is scheduled to conduct a nationwide census. The first phase of the exercise, originally scheduled for 2021, is now set to start in April.

In the first phase, around 30 lakh enumerators and other field workers will carry out recording of data and details, such as mapping of buildings and houses, to gather information on households, such as quality of amenities like water and electricity supply, latrines, kitchen fuel, along with assets such as TV, phone, and vehicle.

The Finance Minister also increased the government’s planned expenditure on modernising the infrastructure of the internal security apparatus. The budgetary allocation for the infrastructure of the Central Armed Police Forces (CAPF), Central Police Organisations, and Delhi Police has been increased by nearly 50 per cent compared with the revised estimates of the previous year’s Budget. The CAPFs comprise the Central Reserve Police Force (CRPF), Border Security Force (BSF), National Security Guard (NSG), Central Industrial Security Force (CISF), Sashatra Seema Bal (SSB) and the Indo-Tibetan Border Police (ITBP).

A total of Rs 5,394 crore has been allocated to infrastructure projects under these categories, compared to Rs 3,684 crore in the revised Budget last year. A total of Rs 4,379 crore was originally allocated to the same verticals in last year’s Budget, released by Finance Minister Sitharaman.

Read Mayank Kumar’s report.

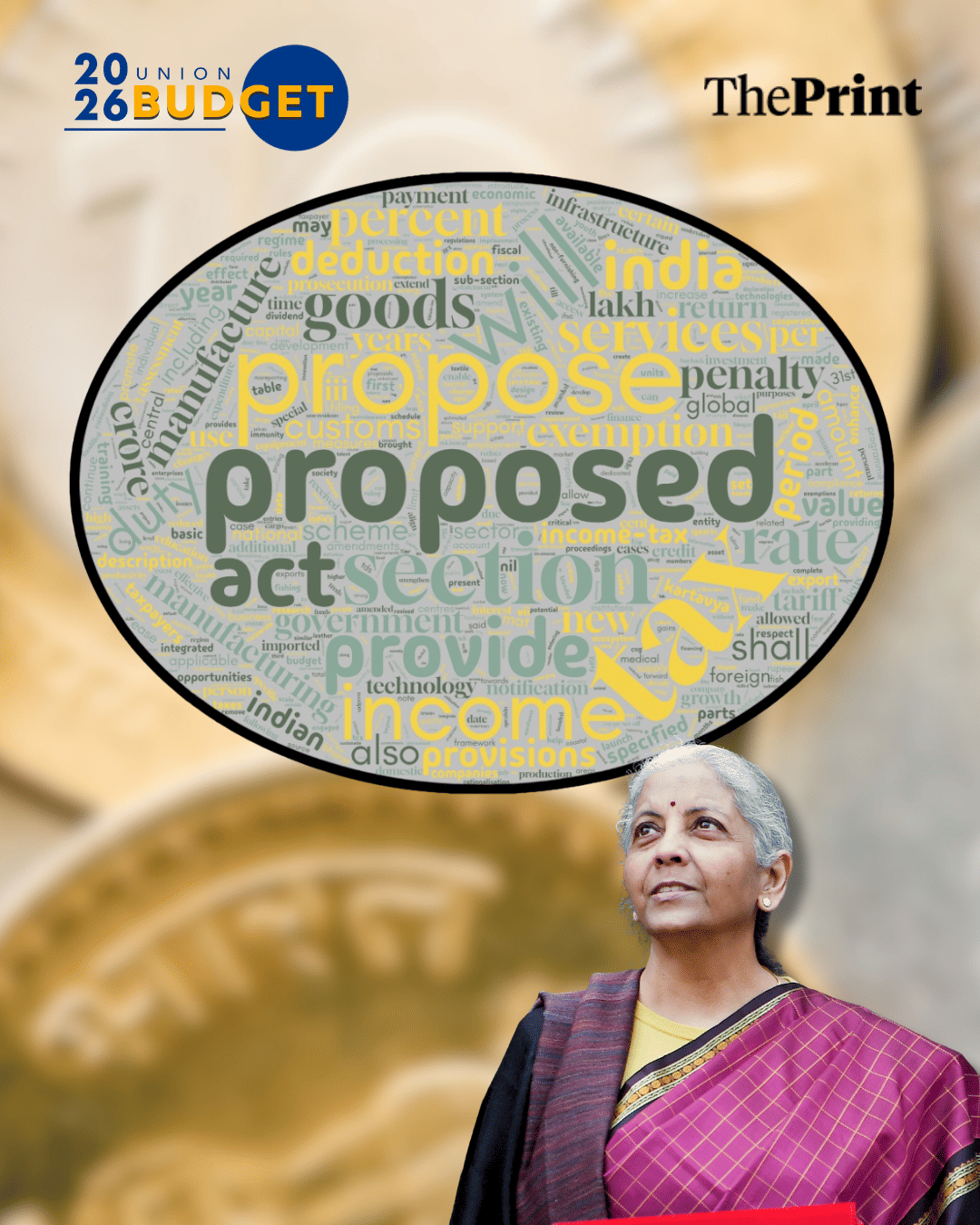

5.05 pm: Proposed, section, provide: The 2026 Budget word cloud

ThePrint generated a word cloud of the Union Budget speech delivered by FM Sitharaman Sunday. Redundant words have been removed to make the analysis more precise and make sense of the budgetary speech. The 10 major words used by Sitharaman this year were: ‘proposed’, ‘section’, ‘provide’, ‘exemption’, ‘income’, ‘tax’, ‘services’, ‘income’, ‘deduction,’ and ‘provide.’

4.50 pm: 10X Budget beef-up for Intelligence Bureau capex

In the wake of the twin terror attacks in 2025—Pahalgam and Delhi—the Centre has substantially beefed up the annual budgetary allocation for the Intelligence Bureau (IB), India’s internal intelligence agency.

In the 2026-27 Union Budget, FM Sitharaman hiked the allocation for the IB to Rs 6,782.43 crore, a more than 50 percent increase from Rs 4,159.11 crore as per the revised estimates for the ongoing financial year.

Out of the overall Rs 6,782 crore allocated, a huge sum of Rs 2,549 crore has been allocated as capital expenditure, a 10-fold hike from the Rs 257 crore in the revised allocation under capital expenditure vertical for the ongoing financial year. Capital expenditure covers investments in long-term assets, while revenue expenditure covers operational costs, such as salaries and other administrative expenses.

Mayank Kumar reports.

4.20 pm: Markets wobble as FM announces STT hikes of up to 150%

Union Budget 2026 has delivered a major blow to India’s derivatives market, proposing to raise the Securities Transaction Tax (STT) on Futures and Options (F&O) trading by up to 150 percent, in a move aimed at curbing excessive speculation.

The announcement triggered sharp market losses, with the BSE Sensex plunging over 2,200 points and the Nifty 50 falling 668 points after the announcement. Both indices recovered partially but continued trading in the red, marking the most negative Budget-day reaction in at least three years. Last year’s Budget had seen a muted market response.

Nifty 50 closed 2.33% down Sunday, while Sensex dropped by 2.23%.

Derivatives are contracts that derive their value from underlying assets like stocks or indices. Futures are agreements to buy or sell an asset at a predetermined price on a future date, while options give the holder the right—but not the obligation—to buy or sell at a specified price.

The Securities Transaction Tax is a direct tax levied by the government on purchase and sale of securities—such as stocks, mutual funds and derivatives—on recognised stock exchanges. It is automatically deducted during transactions, regardless of whether investors make a profit or loss.

Budget 2026 also suggested taxing all share buybacks as capital gains. Sitharaman imposed an extra buyback tax on promoters to deter them from utilising them to lower their tax liabilities. According to the new rationalisation of share buyback, corporate promoters will have an effective tax of 22 percent and non-business promoters will have a tax burden of 30 percent. This builds on the October 2024 guidelines, which transferred the tax liability from corporations to shareholders.

Sitharaman also proposed setting up a high-level committee on banking “for Viksit Bharat” to review the sector. This sparked speculations about greater regulation and possible mergers in the sector, leaving an impact on investor sentiment and triggering a selloff in PSU bank space.

Read Sampurna Panigrahi’s report.

4.15 pm: IT sector as India’s ‘growth engine’: Budget boosts tax certainty with safe harbour revisions

In her Budget speech, FM Sitharaman announced reforms for supporting the Information Technology sector as ‘India’s growth engine’. “India is a global leader in software development services, IT enabled services, knowledge process outsourcing services and contract R&D services relating to software development. These business segments are quite inter-connected with each other,” she said Sunday.

She then proposed to club all these services under a single category of Information Technology Services, with a common safe harbour margin of 15.5 percent applicable to all. She has also proposed to increase the threshold for availing safe harbour for IT services, from Rs 300 crore to Rs 2,000 crore.

A safe harbour is the range within which the tax authorities shall accept the transfer price declared by the taxpayer in transactions with its related parties. This is governed by the safe harbour rules framed by the Central Board of Direct Taxes.

The 15.5 percent margin is the new profit margin declared by the government. Essentially, the tax authorities would not question the transfer prices declared by a business, if it avails of the safe harbour treatment and has at least 15.5 percent profit margins.

4.00 pm: ‘Modi govt has run out of new ideas’

“This budget raises more questions than it answers regarding India’s significant economic, social, and political challenges. It offers nothing for the poor. They have not presented any solution, positive suggestion, or concrete steps to control inflation…The budget shows no intention of reviving consumer demand. The decline in domestic savings and the increasing burden of personal debt have also been ignored… there is no solution to the widespread unemployment crisis among educated youth,” Congress president and Rajya Sabha Leader of Opposition Mallikarjun Kharge reacts to Union Budget.

#WATCH | Delhi: On #UnionBudget2026, Congress President and Rajya Sabha LoP Mallikarjun Kharge says, "The Modi government has run out of new ideas. This budget raises more questions than it answers regarding India's significant economic, social, and political challenges. It… pic.twitter.com/G5jSCVs9lJ

— ANI (@ANI) February 1, 2026

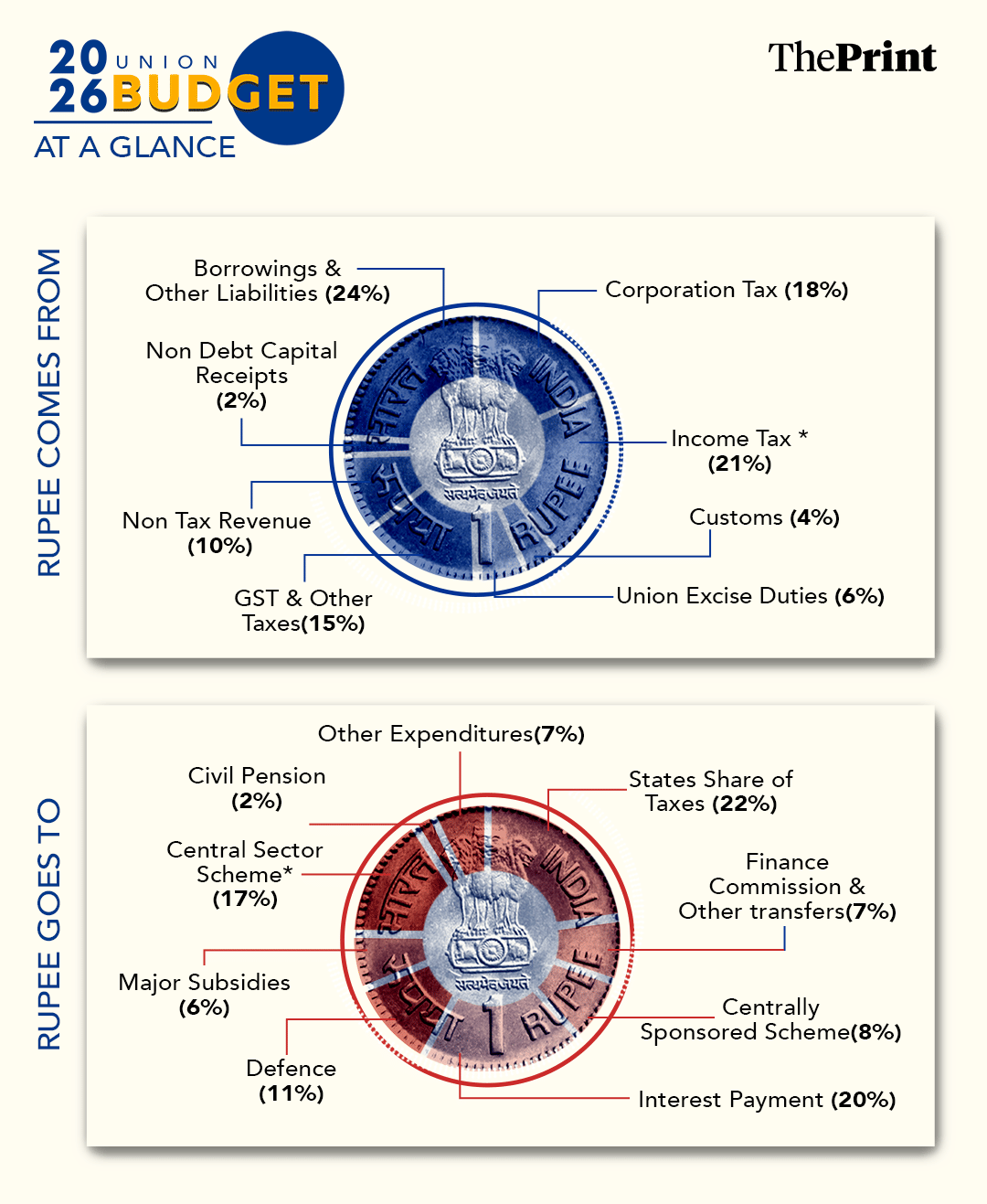

3.55 pm: Where the money comes from and goes

3.35 pm: What Budget really says about India’s economy

Meeting broad expectations in view of governments sticking to a course when an economy is broadly stable, the Union Budget 2026-27 is a continuity Budget, focused on investment, stability, and capacity, not dramatic giveaways. There are no shocks in this Budget. Budgets change sharply when growth is weak, inflation is high, unemployment is rising, or there is visible economic distress. With none of those warning lights flashing right now, the government has stayed its course, instead of changing the medicine.

Meanwhile, fiscal discipline is no longer a political choice—it is a structural constraint. India’s bonds are now part of global indices. Foreign investors track India daily. Borrowing costs are closely watched. If fiscal discipline slips, borrowing rises, interest rates rise, and costs increase across the economy. That hurts businesses, homebuyers, infrastructure projects—everyone. This Budget makes it clear that credibility with lenders is being prioritised over short-term populism, writes Bidisha Bhattacharya.

3.30 pm: Markets remain volatile

Nifty 50 slips by around 2.6%, as of 3.30 pm. Sensex loses over 2,000 points, dropping by more than 2.5%.

3.15 pm: ‘Drastic changes go down well’: FM on fiscal deficit target

“It should remain within a band… It is a responsible and realistic number. We should achieve it and not bring any kind of any turbulence anywhere,” says Finance Minister Sitharaman.

The fiscal deficit is estimated to be 4.4 percent in FY26, likely to be 4.3 percent in FY27.

3.10 pm: Semiconductors, rare earths—’important developments that will impact the Indian economy’

FM Sitharaman speaks on the key announcements with respect to semiconductor mission and the new rare earth corridors announced in the Budget.

#WATCH | #UnionBudget2026 | Union Finance Minister Nirmala Sitharaman says, "…Semiconductor mission had two major announcements that will improve the India stack and also the IP-related matters. The electronic components manufacturing scheme for Rs 40,000 crores is a major… pic.twitter.com/RwcSauOtkG

— ANI (@ANI) February 1, 2026

2.55 pm: ‘Capex outlay at decade high’

FM highlights the capital expenditure push in the Union Budget.

2.53 pm: ‘First budget of the second quarter of the century’

Finance Minister addresses media persons after the Budget presentation.

2.50 pm: Defence capital budget up 22%

Meeting expectations, Union Finance Minister Nirmala Sitharaman has hiked the defence capital budget by a whopping 21.8 percent, taking the figure to Rs 2.19 lakh crore with major increase in funds allocated for aircraft and aero engines.

The overall defence budget has seen a hike of 15 percent, taking it to Rs 7.84 lakh crore from Rs 6.81 lakh crore this fiscal. The pension bill in the defence budget stood at Rs 1.71 lakh crore, a rise from Rs 1.60 lakh crore for the current fiscal. Overall, the defence budget stands at 1.99 percent of the GDP.

The outlay on research and development has been hiked to Rs 17,250 crore in financial year 2026-2027, from Rs 14,923 crore this fiscal.

The increase in capital budget takes into account a slew of mega contracts set to be signed next fiscal, including the one for 114 Rafale fighter jets for the Indian Air Force (IAF), as reported by ThePrint. While the payments are staggered over a period of time, contract signing will involve outright payment of between 4-10 percent of the contract value depending on the terms agreed upon.

Read Snehesh Alex Philip’s report.

2.40 pm: Rs 10,000 cr ‘Biopharma Shakti’ to power India’s biologics push

Sitharaman Sunday announced a Rs 10,000 crore ‘Biopharma Shakti’ programme that will run for over five years to support local production of biologics (medications from living organisms) and biosimilars (low-cost biologics) in the Union Budget 2026-27.

Announcing the plan in Parliament, Sitharaman said India’s disease burden is shifting towards non-communicable diseases, such as cancer, diabetes and autoimmune disorders, adding that biologic medicines play an important role in treatment but remain costly. “Biologic medicines are critical for improving longevity and quality of life, but their high cost limits access,” the finance minister said.

Read Sneha Ricchariya’s report.

2.35 pm: No Budget allocation for Chabahar Port as India withdraws from Iran amid US ‘maximum pressure’

The Budget makes no allocation for the port of Chabahar for the first time in almost a decade, a further sign of India’s move to wind up its operations in the Iranian port.

The US has been applying a “maximum pressure” campaign on countries to curtail its investments in Iran. The expenditure outlay for the Ministry of External Affairs (MEA) in this year’s budget makes no mention of specific figures allocated to the Chabahar Port, which had for years received allocations anywhere from Rs 100 crore to Rs 400 crore.

In the revised estimates (RE) for the 2025-2026 financial year, Rs. 400 crore was allocated to the Iranian port, which has strategic implications for India. However, earlier this year, the Indian government is reported to have exited the project, after transferring roughly $120 million to the Iranian government to complete its financial commitments to the project.

Chabahar gives India access to Central Asia and Afghanistan, bypassing the traditional land route via Pakistan. Seen as a strategic outlet for India, the port looks to build transport corridors linking its Western coasts to Europe and further.

Read Keshav Padmanabhan’s report.

2.30 pm: ‘Reform Express well on its way’—full text of FM’s Union Budget speech

As Finance Minister Nirmala Sitharaman began her speech Sunday, she said, “We have pursued far reaching structural reforms, fiscal prudence and monetary stability whilst maintaining a strong thrust on public investment. Keeping atmanirbharta as a lodestar, we have built domestic manufacturing capacity, energy security and reduced critical import dependencies. Simultaneously, we have ensured that citizens benefit from every action of the Government, undertaking reforms to support employment generation, agricultural productivity, household purchasing power and universal services to people.”

Read the full text of her 83-minute speech here.

2.15 pm: ‘They have not given a single paisa to Bengal’

West Bengal Chief Minister Mamata Banerjee reacts to the Budget: “What they said about three corridors is absolutely garbage of lies. Blatant lies. It is already in process and we have started working there. In the Jangalmahal Jangal Sundari project in Purulia, for this economic corridor, Rs 72,000 Crores are going to be invested…They have not given a single paisa to Bengal. Only one tax is there, GST. They are taking away our money and saying big things that they are giving us money…”

#WATCH | Kolkata: On #UnionBudget, West Bengal CM Mamata Banerjee says, "…What they said about three corridors is absolutely garbage of lies. Blatant lies. It is already in process and we have started working there. In the Jangalmahal Jangal Sundari project in Purulia, for this… pic.twitter.com/CaOfv4sHbn

— ANI (@ANI) February 1, 2026

2.05 pm: ‘Yuva-shakti budget’

The initiatives in the budget will create leaders, innovators and creators in every sector, says PM Modi in post-budget remarks.

The Union Budget reflects the aspirations of 140 crore Indians. It strengthens the reform journey and charts a clear roadmap for Viksit Bharat.#ViksitBharatBudget https://t.co/26hIdizan9

— Narendra Modi (@narendramodi) February 1, 2026

2.00 pm: ‘Solid push to sunrise sectors’: Modi

The budget is giving a solid push to sunrise sectors, says PM Modi, adds that the budget will propel MSMEs from local to global stage.

1.42 pm: ‘No jobs or employment given’

Samajwadi Party MP Akhilesh Yadav says, “This Budget is beyond the understanding of the poor and those who live in the villages. No jobs or employment have been given in this Budget. BJP’s budget is only for 5 percent people of the people in the country…”

#WATCH | On Union Budget, Samajwadi Party MP Akhilesh Yadav says," This Budget is beyond the understanding of the poor and those who live in the villages. No jobs or employment have been given in this Budget. BJP's budget is only for 5% people of the people in the country…" pic.twitter.com/WLRZKFfEEk

— ANI (@ANI) February 1, 2026

1.40 pm: ‘Will speak tomorrow’: Rahul Gandhi

Lok Sabha Leader of Opposition, Rahul Gandhi says, “I will speak tomorrow, using the platform provided by Parliament.”

1.30 pm: ‘Hollow toy that doesn’t even make a sound’

Congress MP Pramod Tiwari says, “Just look at the faces of the ruling party members themselves—they are saying that there could not have been a more disappointing, demoralising, and deceitful budget than this… I just want to say this: search anywhere in this budget, there is nothing for farmers, nothing for employment for the youth, nothing for the country’s economy.”

VIDEO | Union Budget 2026: Congress MP Pramod Tiwari (@pramodtiwari700) says, “Just look at the faces of the ruling party members themselves—they are saying that there could not have been a more disappointing, demoralising, and deceitful budget than this. They are calling it the… pic.twitter.com/O49jxnroXp

— Press Trust of India (@PTI_News) February 1, 2026

1.20 pm: ‘Our reaction is positive’: CII President

Confederation of Indian Industry President Rajiv Memani tells ANI the industry body views the Budget positively. He also notes the fiscal roadmap fulfils the demands of various industries, including MSMEs. “Our reaction to the Budget is positive as it fulfils the demands of the industries, including those of the MSMEs. There is also a focus on the services. The government has also heard concerns about tax simplification. Capex has also increased by 10-12% this time.”

1.10 pm: Stocks fall sharply

Nifty down by over 1.20%, while Sensex slips over 1%, following FM’s speech.

12.50 pm: Tax holiday for foreign firms using data centre services in India

To encourage global business and strengthen vital infrastructure, the government has suggested a tax break till 2047 for foreign corporations that provide cloud services globally and use data centre services in India. To qualify, these corporations must also provide services to Indian customers through an Indian reseller entity, promoting both domestic and global investment.

12.35 pm: Excise duty exemptions

Sitharaman proposes to exclude the entire value of biogas, while calculating excise duty payable on blended CNG. Extended duty exemption on capital goods used for manufacturing lithium-ion cells for battery storage.

In addition, exemption announced on basic customs duty on components and

parts required for the manufacture of civilian, training and other

aircrafts. It is also proposed to exempt basic customs duty on raw materials imported for manufacture of parts of aircraft to be used in maintenance, repair, or overhaul requirements by Units in Defence sector.

12.32 pm: Tax measures

Finance Minister Nirmala Sitharaman proposed to reduce Tax Collected at Source (TCS) rate on sale of overseas tour programme packages from the current 5% and 20% to 2%, without any stipulation of amount. She also proposed reducing the TCS rate or pursuing education and medical purposes under the liberalised remittance scheme from 5% to 2%.

12.25 pm: FM Sitharaman ends speech

Nirmala Sitharaman concludes record 9th budget speech, speaks for around 1 hour 23 minutes.

12.23 pm: Markets watch

Sensex and Nifty continue in the red, with budget speech still underway. Among sectors, only healthcare trading in the green on Sensex.

12.20 pm: What FM said on non-production of books of accounts where payments are made in kind

“Non-production of books of accounts and documents. and requirement of TDS payment where payment is made in kind, is being decriminalised,” says FM, adding that further minor offences will attract fine only.

“Remaining prosecutions will be graded commensurate with the quantum of offences. They will entail only simple imprisonment of maximum two years.”

12.10 pm: IT sector & taxes

– Safe harbour: From Rs 300 crore to Rs 2,000 crore, and other relaxations– Till 2047, tax holiday for any foreign company providing cloud data services to Indian customers

12.05 pm: Direct taxes

– New Income Tax Act: To come into effect on 1 April, simplified rules and forms to be notified shortly– MCAT: Claims exempt of taxes– TCS rate to be reduced on overseas package– TCS rate cut for medical or education purposes from 5% to 2%– For small taxpayers: Rules-based automated application, instead of submission– Returns application deadline: 31 March, instead of 31 December– One-time 6-month foreign asset disclosure scheme for small taxpayers, such as students, Indians who relocated abroad, etc.– Penalty and prosecution: Integrate these proceedings by way of common order; no penalty on appeal period; for immunity for misreporting, but taxpayer will have to pay additional 100% of the amount owed

11.58 am: Macro-economic indicators

– 1.4 lakh crore to states as Finance Commission grants– Debt to GDP ratio of 50+-1%—estimated to be 55.6% in FY2026-27– Fiscal deficit: Fulfilled commitment made in FY22—estimated to be 4.4% in FY26, likely to be 4.3% in FY27

11.54 am: Focus on Third Kartavya

– Fisheries: Develop 500 reservoirs, amrit sarovars– Animal husbandry: Credit-linked subsidiary programme– Support high-value crops, such as coconut, cashew in coastal areas, and other crops in northeast and Hindi region– New Coconut Promotion Scheme– Dedicated programme for Indian cashew, cocoa– Sandalwood: To promote focused cultivation and promotion– Launch Bharat Vistaar—multilingual AI agri stack portal and ICAR package– SHE—Self Help Entrepreneur for women– For differently abled, industry and customised training; timely access to Divyang Sahaara Yojana; to encourage assisted living programmes– Set up NIMHANS 2 and upgrade other national mental health institutes– To upgrade and strengthen, will set up emergency and trauma care centres– Scheme for development of Buddhist circuits in Northeast for preservation of temples, monasteries

11.50 am: Environmentally sustainable cargo movement

FM announces new dedicated goods route from Dankuni in the East to Surat in the West to encourage environmentally sustainable cargo movement.

11.45 am: Renewed emphasis on service sector for youth

– High-powered committee to recommend measures for service sector growth; aim to have 10 percent global share by 2047; will study impact of AI on jobs and propose measures

– For new career pathways: Allied health institutes to be upgraded, new institutions to be set up in 10 sectors

– Rs 1.5 lakh caregivers to be trained in allied health sectors

– Medical tourism: Will set up 5 regional medical hubs in partnership with private sector—medical, education and research

– Exporting ayurveda products: Set up 3 new ayurveda institutes, upgrade ayush pharmacies, and drug accredition system; upgrade WHO ayurveda centre

– Animal husbandry: Scale up vet professionals by 20,000; scheme to set up vet and para vet colleges, breeding facilities, vet facilities

– Animation: 2 million professionals needed by 2030; Set up Indian Institute of Animation Technology

– Design: To establish new NID in India’s East

– Education: Help support states in creating education townships near industrial corridors; higher education, one girls’ hostel to be set up in every district; to promote astrophysics and astronomy, 4 telescope facilities to be upgraded or set up

– Tourism: Set up National Institute of Hospitality; pilot scheme for upskilling guides in 20 iconic tourism sites; National Destination Digital Knowledge Grid to be established; for trekking and hiking, to develop mountain trails in Himachal, Uttarakhand and J&K, Eastern ghats and western Ghats; turtle trails in Odisha and Kerala, bird watching trails in Andhra and TN border; develop 15 archaeological sites, including Rakhigarhi

– Sports: Launch Khelo India Mission to transform sector over next decade—training centres, coaches and support staff, sport science and tech, competition and leagues, infra development for training

11.42 am: New moves for capital improvement

In a move to strengthen capital, Sitharaman proposes building high-tech toolrooms to produce high-precision parts at scale and at reduced cost. In order to boost the production of high-value CIE, she announces the launch of a plan to improve infrastructure and building equipment. Additionally, the finance minister suggests a container manufacturing initiative that will allocate Rs 10,000 crore over five years.

11.40 am: Market indices in the green

Stock indices maintain momentum, trade in green as Sitharaman continues budget speech. Sensex rises by 306 points to hit 82,576, and Nifty by 65 points to reach 25,387, at 11.30 am.

11.38 am: Announcements for financial & banking sector

– Set up high-level panel for banking on ‘Viksit Bharat’ to review the sector

– NBFCs: Restructure power finance corporation, and rural energy corporation

– Foreign exchange management review

– Propose to introduce suitable access to corporate bonds

– To encourage municipal bonds, incentive of Rs 100 crore for single bond issuance of more than Rs 1000 crore; current incentive scheme to continue

11.35 am: City-based economic growth

– Focus on tier-2 and 3 towns, and temple towns– Rs 5000 crore per CER over five years proposed– 7 high speed rail corridors between cities, including Mumbai-Pune, Pune-Hyderabad, Hyderabad-Chennai, Hyderabad-Bengaluru, Chennai-Bengaluru, Delhi-Varanasi, Varanasi-Siliguri

11.30 am: Infra upgrade

- – Focus on infra development in Tier 2, Tier 3 cities

- Allocation of 12.2 lakh crore for coming fiscal

- To support private investment, infra risk credit guarantee fund

- Recycling of real estate assets

- Establish new dedicated freight corridors

- Operationalise 20 new waterways, starting with National Waterways 5

- Training institutes to be set up as regional centres of excellence

- Ship repair ecosystem to be set up at Varanasi and Patna

- Launch coastal cargo scheme for inland transport

- For tourism, incentivise indigenous manufacturing of sea planes

- Carbon capture utilisation tech, outlay of Rs 20,000 crore in 5 years

11.28 am: Creating champion MSMEs

– Equity support for select MSMEs with Rs 10,000 crore fund– Top up self-reliant India funds with Rs 2,000 crore– Liquidity support– Professional support: Facilitate institutions, such as ICMA, for design short-term courses, especially in tier-2 and tier-3 cities

11.25 am: New initiatives for textile sector

- National fibre scheme

- Textile expansion and employment scheme

- National handloom and handicraft programme

- Tax echo initiative

- Samarth 2.0

11.18 am: Scaling up manufacturing in 7 sectors

11.15 am: ‘Reform over rhetoric’

“Since we assumed office 12 years ago. India’s economic trajectory has been marked by stability. This government led by PM Modi has chosen action over ambivalance, reform over rhetoric. We have pursued far-reaching structural reforms, fiscal prudence and monetary stability, while maintaining a strong thrust on public investment”: FM Sitharaman

11.10 am: ‘First budget in Kartavya Bhavan, based on three kartavyas’

“Our government has decisively and consistently chosen action over ambivalence, reform over rhetoric and people over popularity,” says the finance minister. “India will continue to take confident steps towards Viksit Bharat… must also remain deeply integrated with global markets.”

Calling it a “Unique Yuva shakti driven budget”, she adds that the Budget is based on three kartavyas:1) Accelerate, sustain economic growth2) Fulfil aspirations of our people and make people partners in prosperity3) Ensure every family, community, region, sector has access to resources and opportunity for participation

11.05 am: ‘Decisive policy & action’

“India has achieved a growth rate of around 7 percent through decisive policy and action”: FM Sitharaman.

11.02 am: Budget speech now underway

Finance Minister Sitharaman presents Union Budget 2026-27. Watch live:

10.55 am: Opposition leaders call for a ‘Budget for the people’

Opposition MPs, including SP chief Akhilesh Yadav and TMC’s Kalyan Banerjee, stage protest inside Parliament premises ahead of Budget presentation.

VIDEO | Opposition leaders, including Samajwadi Party chief Akhilesh Yadav and TMC MP Kalyan Banerjee, stage protest inside Parliament premises ahead of Budget presentation.

(Full video available on PTI Videos – https://t.co/n147TvrpG7)#Budget2026WithPTI #UnionBudgetWithPTI pic.twitter.com/bObqaS2JxT

— Press Trust of India (@PTI_News) February 1, 2026

10.50 am: Budget gets Union Cabinet nod

PM Modi-led Cabinet approves Union Budget 2026-27.

10.15 am: Sluggish recovery after slow first hour

Stock indices Sensex and Nifty see slightly recovery after a slow first hour. BSE Sensex at 82,428, and Nifty at 25,335, as of 10a15 am.

Gold and silver prices plummeted up to 9 percent in the futures market, hitting the lower circuit ahead of the Union Budget. The precious metals prices crashed globally Friday, wiping out $5 trillion in market cap.

9.55 am: Finance minister arrives at Parliament

Nirmala Sitharaman with the Budget tablet outside Sansad Bhawan.

#WATCH | Delhi | Union Finance Minister Nirmala Sitharaman is set to present her ninth consecutive Union Budget today pic.twitter.com/GqjyTDhYp1

— ANI (@ANI) February 1, 2026

9.50 am: Sitharaman meets President Murmu

Finance Minister Nirmala Sitharaman and her team meet President Droupadi Murmu ahead of the budget speech.

#WATCH | Delhi | Union Finance Minister Nirmala Sitharaman, along with her team, calls on President Droupadi Murmu before presenting her ninth consecutive Union Budget pic.twitter.com/96H5JV5obv

— ANI (@ANI) February 1, 2026

9.40 am: Key expectations from the budget

What are the expectations from Union Budget 2026? Join our broadcast LIVE with Bidisha Bhattacharya & Sabika Syed. Ask your questions.

9.30 am: Flat opening for markets

The stock markets open rather flat, with the benchmark indices slipping into the red zone. Sensex fell by 295 points to 82,271, and Nifty dropped by 126.8 points to 25,292, as of 9:25 am.

9.15 am: India has an import dependency problem. What Budget 2026 can change

The International Monetary Fund has consistently identified the country as the fastest growing major economy and a significant contributor to global economic growth, particularly at a time when most of the other regions are experiencing a slowdown. This assessment is indicative of robust domestic demand, public investment, and macroeconomic stability. However, maintaining this momentum necessitates an examination beyond mere headline growth figures. It requires critical analysis of India’s production, import patterns, and underlying reasons.

Within this analysis lies a subtle contradiction: India remains reliant on imports in sectors where it should not be.

This is most evident in the food and agriculture sectors. Despite being one of the largest global producers of crops, India imports approximately 60 per cent of its edible oil consumption, regularly imports 2-3 million tonnes of pulses, and is increasingly reliant on imports for animal feed. At the same time, rice production consistently surpasses domestic requirements, necessitating either exports or costly storage solutions. This simultaneous occurrence of surplus and shortage is not quite imposed by nature, but rather shaped by policy.

Read Bidisha Bhattacharya’s column.

9.05 am: The Budget tablet

Finance Minister Sitharaman and team pose with the Union Budget tablet outside the Minister of Finance.

View this post on Instagram

8.40 am: Sitharaman arrives at finance ministry

Finance Minister Nirmala Sitharaman arrives at the Ministry of Finance in Kartavya Bhavan 1 ahead of the Union Budget 2026.

Photos: Suraj Singh Bisht @Surajbisht25 #ThePrintPictures pic.twitter.com/2ga80aCEty

— ThePrintIndia (@ThePrintIndia) February 1, 2026

8.30 am: India ‘tamed’ inflation in FY26, but Economic Survey projects it to remain higher in FY27

While 2025 was a year which saw a continued decline in inflation figures, the Economic Survey says the inflation rate, headline and core—excluding precious metals—are projected to remain higher in FY27 than in FY26. It, however, adds that this wasn’t a reason for concern. “The trajectory of core inflation will need to be closely monitored in the context of monetary policy easing and potential upward pressures from global base metal prices,” the pre-Budget survey said.

Chief Economic Adviser V. Anantha Nageswaran said the document predicted headline inflation to be around 1.7 percent for at least the initial nine months of the year, primarily due to deflation in the food price index. The core inflation figure (including gold and silver) is pegged at 2.9 percent for FY 2026-27, he added.

At 1.8 percentage points in FY 2025-26, India recorded one of the sharpest declines in headline inflation among Emerging Market and Developing Economies (EMDEs).

Read Sampurna Panigrahi’s report.

8.00 am: Top takeaways from Economic Survey 2025-26

The Economic Survey 2025–26 was tabled in Parliament Thursday. It is the government’s most comprehensive report card on the Indian economy and it also sets the intellectual framework for the Union Budget.

The survey revises India’s potential medium-term growth rate upward to about 7 percent, from around 6.5 percent three years ago. This revision is significant because it reflects changes in the economy’s capacity, not just a good year. Growth is no longer being described as policy-driven or temporary. The survey is effectively saying India’s growth ceiling has moved up, but only if reforms continue.

The survey also repeatedly cautions that the world economy is entering a period of permanent uncertainty—from geopolitics to trade and capital flows. Yet, India is described as “relatively better off” due to its domestic market size, macro stability, and strategic autonomy. This is not optimism, it’s calibrated realism. The survey is saying India can grow steadily, but not by ignoring global risks, only by managing them better than others.

Meanwhile, India’s average headline CPI inflation between April and December 2025 was just 1.7 percent, the lowest since the CPI series began. The decline was driven mainly by food and fuel prices, which together account for 52.7 percent of the CPI basket. Crucially, inflation has fallen without a collapse in demand. This implies that inflation has been controlled through supply improvements, not economic pain. That’s the difference between stability that lasts and stability that cracks later.

Read Bidisha Bhattacharya’s top 10 takeaways from the Economic Survey.

Also Read: India ‘tamed’ inflation in FY26, but Economic Survey projects it to remain higher in FY27