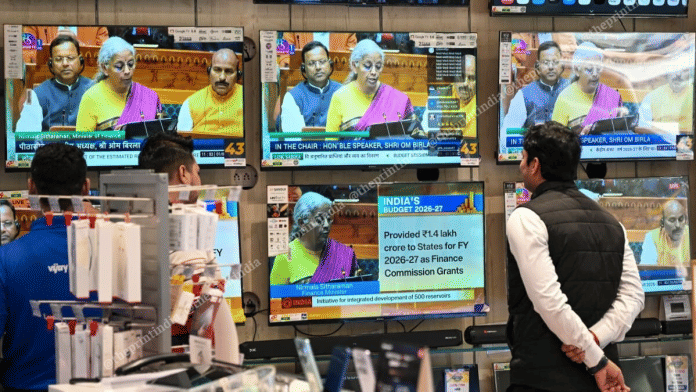

Finance Minister Nirmala Sitharaman is now presenting the Union Budget for the financial year 2026-27 in Parliament Sunday. This is her ninth consecutive Budget speech since taking on the role in 2019.

The presentation began around 11 am in Lok Sabha.

This is the second full-year budget of Modi 3.0. The presentation, like every year, comes after several pre-consultations held by the finance ministry with multiple stakeholders from various sectors of the economy, and will set the economic and fiscal roadmap for the next fiscal year.

For the preparation of the budget, Sitharaman is supported by a team of senior secretaries and officers, including Economic Affairs Secretary Anuradha Thakur, Revenue Secretary Arvind Shrivastava, Expenditure Secretary Vumlunmang Vualnam, Financial Services Secretary M. Nagaraju, DIPAM Secretary Arunish Chawla, Public Enterprises Secretary K. Moses Chalai, and Chief Economic Adviser V. Anantha Nageswaran.

As highlighted in the Economic Survey 2025-26, tabled on 29 January, India remains the fastest-growing major economy. India’s economy is estimated to grow 7.4 percent in FY26, with Gross Value Added growth at 7.3 percent.

For FY27, the GDP growth is projected to be in the range of 6.8-7.2 percent, even as the global economy remains fragile.

After her speech, the Finance Minister will interact with around 30 college students from across the country.

Follow live updates here:

12.50 pm: Tax holiday for foreign firms using data centre services in India

To encourage global business and strengthen vital infrastructure, the government has suggested a tax break till 2047 for foreign corporations that provide cloud services globally and use data centre services in India. To qualify, these corporations must also provide services to Indian customers through an Indian reseller entity, promoting both domestic and global investment.

12.35 pm: Excise duty exemptions

Sitharaman proposes to exclude the entire value of biogas, while calculating excise duty payable on blended CNG. Extended duty exemption on capital goods used for manufacturing lithium-ion cells for battery storage.

In addition, exemption announced on basic customs duty on components and

parts required for the manufacture of civilian, training and other

aircrafts. It is also proposed to exempt basic customs duty on raw materials imported for manufacture of parts of aircraft to be used in maintenance, repair, or overhaul requirements by Units in Defence sector.

12.32 pm: Tax measures

Finance Minister Nirmala Sitharaman proposed to reduce Tax Collected at Source (TCS) rate on sale of overseas tour programme packages from the current 5% and 20% to 2%, without any stipulation of amount. She also proposed reducing the TCS rate or pursuing education and medical purposes under the liberalised remittance scheme from 5% to 2%.

12.25 pm: FM Sitharaman ends speech

Nirmala Sitharaman concludes record 9th budget speech, speaks for around 1 hour 23 minutes.

12.23 pm: Markets watch

Sensex and Nifty continue in the red, with budget speech still underway. Among sectors, only healthcare trading in the green on Sensex.

12.20 pm: What FM said on non-production of books of accounts where payments are made in kind

“Non-production of books of accounts and documents. and requirement of TDS payment where payment is made in kind, is being decriminalised,” says FM, adding that further minor offences will attract fine only.

“Remaining prosecutions will be graded commensurate with the quantum of offences. They will entail only simple imprisonment of maximum two years.”

12.10 pm: IT sector & taxes

– Safe harbour: From Rs 300 crore to Rs 2,000 crore, and other relaxations– Till 2047, tax holiday for any foreign company providing cloud data services to Indian customers

12.05 pm: Direct taxes

– New Income Tax Act: To come into effect on 1 April, simplified rules and forms to be notified shortly– MCAT: Claims exempt of taxes– TCS rate to be reduced on overseas package– TCS rate cut for medical or education purposes from 5% to 2%– For small taxpayers: Rules-based automated application, instead of submission– Returns application deadline: 31 March, instead of 31 December– One-time 6-month foreign asset disclosure scheme for small taxpayers, such as students, Indians who relocated abroad, etc.– Penalty and prosecution: Integrate these proceedings by way of common order; no penalty on appeal period; for immunity for misreporting, but taxpayer will have to pay additional 100% of the amount owed

11.58 am: Macro-economic indicators

– 1.4 lakh crore to states as Finance Commission grants– Debt to GDP ratio of 50+-1%—estimated to be 55.6% in FY2026-27– Fiscal deficit: Fulfilled commitment made in FY22—estimated to be 4.4% in FY26, likely to be 4.3% in FY27

11.54 am: Focus on Third Kartavya

– Fisheries: Develop 500 reservoirs, amrit sarovars– Animal husbandry: Credit-linked subsidiary programme– Support high-value crops, such as coconut, cashew in coastal areas, and other crops in northeast and Hindi region– New Coconut Promotion Scheme– Dedicated programme for Indian cashew, cocoa– Sandalwood: To promote focused cultivation and promotion– Launch Bharat Vistaar—multilingual AI agri stack portal and ICAR package– SHE—Self Help Entrepreneur for women– For differently abled, industry and customised training; timely access to Divyang Sahaara Yojana; to encourage assisted living programmes– Set up NIMHANS 2 and upgrade other national mental health institutes– To upgrade and strengthen, will set up emergency and trauma care centres– Scheme for development of Buddhist circuits in Northeast for preservation of temples, monasteries

11.50 am: Environmentally sustainable cargo movement

FM announces new dedicated goods route from Dankuni in the East to Surat in the West to encourage environmentally sustainable cargo movement.

11.45 am: Renewed emphasis on service sector for youth

– High-powered committee to recommend measures for service sector growth; aim to have 10 percent global share by 2047; will study impact of AI on jobs and propose measures

– For new career pathways: Allied health institutes to be upgraded, new institutions to be set up in 10 sectors

– Rs 1.5 lakh caregivers to be trained in allied health sectors

– Medical tourism: Will set up 5 regional medical hubs in partnership with private sector—medical, education and research

– Exporting ayurveda products: Set up 3 new ayurveda institutes, upgrade ayush pharmacies, and drug accredition system; upgrade WHO ayurveda centre

– Animal husbandry: Scale up vet professionals by 20,000; scheme to set up vet and para vet colleges, breeding facilities, vet facilities

– Animation: 2 million professionals needed by 2030; Set up Indian Institute of Animation Technology

– Design: To establish new NID in India’s East

– Education: Help support states in creating education townships near industrial corridors; higher education, one girls’ hostel to be set up in every district; to promote astrophysics and astronomy, 4 telescope facilities to be upgraded or set up

– Tourism: Set up National Institute of Hospitality; pilot scheme for upskilling guides in 20 iconic tourism sites; National Destination Digital Knowledge Grid to be established; for trekking and hiking, to develop mountain trails in Himachal, Uttarakhand and J&K, Eastern ghats and western Ghats; turtle trails in Odisha and Kerala, bird watching trails in Andhra and TN border; develop 15 archaeological sites, including Rakhigarhi

– Sports: Launch Khelo India Mission to transform sector over next decade—training centres, coaches and support staff, sport science and tech, competition and leagues, infra development for training

11.42 am: New moves for capital improvement

In a move to strengthen capital, Sitharaman proposes building high-tech toolrooms to produce high-precision parts at scale and at reduced cost. In order to boost the production of high-value CIE, she announces the launch of a plan to improve infrastructure and building equipment. Additionally, the finance minister suggests a container manufacturing initiative that will allocate Rs 10,000 crore over five years.

11.40 am: Market indices in the green

Stock indices maintain momentum, trade in green as Sitharaman continues budget speech. Sensex rises by 306 points to hit 82,576, and Nifty by 65 points to reach 25,387, at 11.30 am.

11.38 am: Announcements for financial & banking sector

– Set up high-level panel for banking on ‘Viksit Bharat’ to review the sector

– NBFCs: Restructure power finance corporation, and rural energy corporation

– Foreign exchange management review

– Propose to introduce suitable access to corporate bonds

– To encourage municipal bonds, incentive of Rs 100 crore for single bond issuance of more than Rs 1000 crore; current incentive scheme to continue

11.35 am: City-based economic growth

– Focus on tier-2 and 3 towns, and temple towns– Rs 5000 crore per CER over five years proposed– 7 high speed rail corridors between cities, including Mumbai-Pune, Pune-Hyderabad, Hyderabad-Chennai, Hyderabad-Bengaluru, Chennai-Bengaluru, Delhi-Varanasi, Varanasi-Siliguri

11.30 am: Infra upgrade

- – Focus on infra development in Tier 2, Tier 3 cities

- Allocation of 12.2 lakh crore for coming fiscal

- To support private investment, infra risk credit guarantee fund

- Recycling of real estate assets

- Establish new dedicated freight corridors

- Operationalise 20 new waterways, starting with National Waterways 5

- Training institutes to be set up as regional centres of excellence

- Ship repair ecosystem to be set up at Varanasi and Patna

- Launch coastal cargo scheme for inland transport

- For tourism, incentivise indigenous manufacturing of sea planes

- Carbon capture utilisation tech, outlay of Rs 20,000 crore in 5 years

11.28 am: Creating champion MSMEs

– Equity support for select MSMEs with Rs 10,000 crore fund– Top up self-reliant India funds with Rs 2,000 crore– Liquidity support– Professional support: Facilitate institutions, such as ICMA, for design short-term courses, especially in tier-2 and tier-3 cities

11.25 am: New initiatives for textile sector

- National fibre scheme

- Textile expansion and employment scheme

- National handloom and handicraft programme

- Tax echo initiative

- Samarth 2.0

11.18 am: Scaling up manufacturing in 7 sectors

11.15 am: ‘Reform over rhetoric’

“Since we assumed office 12 years ago. India’s economic trajectory has been marked by stability. This government led by PM Modi has chosen action over ambivalance, reform over rhetoric. We have pursued far-reaching structural reforms, fiscal prudence and monetary stability, while maintaining a strong thrust on public investment”: FM Sitharaman

11.10 am: ‘First budget in Kartavya Bhavan, based on three kartavyas’

“Our government has decisively and consistently chosen action over ambivalence, reform over rhetoric and people over popularity,” says the finance minister. “India will continue to take confident steps towards Viksit Bharat… must also remain deeply integrated with global markets.”

Calling it a “Unique Yuva shakti driven budget”, she adds that the Budget is based on three kartavyas:1) Accelerate, sustain economic growth2) Fulfil aspirations of our people and make people partners in prosperity3) Ensure every family, community, region, sector has access to resources and opportunity for participation

11.05 am: ‘Decisive policy & action’

“India has achieved a growth rate of around 7 percent through decisive policy and action”: FM Sitharaman.

11.02 am: Budget speech now underway

Finance Minister Sitharaman presents Union Budget 2026-27. Watch live:

10.55 am: Opposition leaders call for a ‘Budget for the people’

Opposition MPs, including SP chief Akhilesh Yadav and TMC’s Kalyan Banerjee, stage protest inside Parliament premises ahead of Budget presentation.

VIDEO | Opposition leaders, including Samajwadi Party chief Akhilesh Yadav and TMC MP Kalyan Banerjee, stage protest inside Parliament premises ahead of Budget presentation.

(Full video available on PTI Videos – https://t.co/n147TvrpG7)#Budget2026WithPTI #UnionBudgetWithPTI pic.twitter.com/bObqaS2JxT

— Press Trust of India (@PTI_News) February 1, 2026

10.50 am: Budget gets Union Cabinet nod

PM Modi-led Cabinet approves Union Budget 2026-27.

10.15 am: Sluggish recovery after slow first hour

Stock indices Sensex and Nifty see slightly recovery after a slow first hour. BSE Sensex at 82,428, and Nifty at 25,335, as of 10a15 am.

Gold and silver prices plummeted up to 9 percent in the futures market, hitting the lower circuit ahead of the Union Budget. The precious metals prices crashed globally Friday, wiping out $5 trillion in market cap.

9.55 am: Finance minister arrives at Parliament

Nirmala Sitharaman with the Budget tablet outside Sansad Bhawan.

#WATCH | Delhi | Union Finance Minister Nirmala Sitharaman is set to present her ninth consecutive Union Budget today pic.twitter.com/GqjyTDhYp1

— ANI (@ANI) February 1, 2026

9.50 am: Sitharaman meets President Murmu

Finance Minister Nirmala Sitharaman and her team meet President Droupadi Murmu ahead of the budget speech.

#WATCH | Delhi | Union Finance Minister Nirmala Sitharaman, along with her team, calls on President Droupadi Murmu before presenting her ninth consecutive Union Budget pic.twitter.com/96H5JV5obv

— ANI (@ANI) February 1, 2026

9.40 am: Key expectations from the budget

What are the expectations from Union Budget 2026? Join our broadcast LIVE with Bidisha Bhattacharya & Sabika Syed. Ask your questions.

9.30 am: Flat opening for markets

The stock markets open rather flat, with the benchmark indices slipping into the red zone. Sensex fell by 295 points to 82,271, and Nifty dropped by 126.8 points to 25,292, as of 9:25 am.

9.15 am: India has an import dependency problem. What Budget 2026 can change

The International Monetary Fund has consistently identified the country as the fastest growing major economy and a significant contributor to global economic growth, particularly at a time when most of the other regions are experiencing a slowdown. This assessment is indicative of robust domestic demand, public investment, and macroeconomic stability. However, maintaining this momentum necessitates an examination beyond mere headline growth figures. It requires critical analysis of India’s production, import patterns, and underlying reasons.

Within this analysis lies a subtle contradiction: India remains reliant on imports in sectors where it should not be.

This is most evident in the food and agriculture sectors. Despite being one of the largest global producers of crops, India imports approximately 60 per cent of its edible oil consumption, regularly imports 2-3 million tonnes of pulses, and is increasingly reliant on imports for animal feed. At the same time, rice production consistently surpasses domestic requirements, necessitating either exports or costly storage solutions. This simultaneous occurrence of surplus and shortage is not quite imposed by nature, but rather shaped by policy.

Read Bidisha Bhattacharya’s column.

9.05 am: The Budget tablet

Finance Minister Sitharaman and team pose with the Union Budget tablet outside the Minister of Finance.

View this post on Instagram

8.40 am: Sitharaman arrives at finance ministry

Finance Minister Nirmala Sitharaman arrives at the Ministry of Finance in Kartavya Bhavan 1 ahead of the Union Budget 2026.

Photos: Suraj Singh Bisht @Surajbisht25 #ThePrintPictures pic.twitter.com/2ga80aCEty

— ThePrintIndia (@ThePrintIndia) February 1, 2026

8.30 am: India ‘tamed’ inflation in FY26, but Economic Survey projects it to remain higher in FY27

While 2025 was a year which saw a continued decline in inflation figures, the Economic Survey says the inflation rate, headline and core—excluding precious metals—are projected to remain higher in FY27 than in FY26. It, however, adds that this wasn’t a reason for concern. “The trajectory of core inflation will need to be closely monitored in the context of monetary policy easing and potential upward pressures from global base metal prices,” the pre-Budget survey said.

Chief Economic Adviser V. Anantha Nageswaran said the document predicted headline inflation to be around 1.7 percent for at least the initial nine months of the year, primarily due to deflation in the food price index. The core inflation figure (including gold and silver) is pegged at 2.9 percent for FY 2026-27, he added.

At 1.8 percentage points in FY 2025-26, India recorded one of the sharpest declines in headline inflation among Emerging Market and Developing Economies (EMDEs).

Read Sampurna Panigrahi’s report.

8.00 am: Top takeaways from Economic Survey 2025-26

The Economic Survey 2025–26 was tabled in Parliament Thursday. It is the government’s most comprehensive report card on the Indian economy and it also sets the intellectual framework for the Union Budget.

The survey revises India’s potential medium-term growth rate upward to about 7 percent, from around 6.5 percent three years ago. This revision is significant because it reflects changes in the economy’s capacity, not just a good year. Growth is no longer being described as policy-driven or temporary. The survey is effectively saying India’s growth ceiling has moved up, but only if reforms continue.

The survey also repeatedly cautions that the world economy is entering a period of permanent uncertainty—from geopolitics to trade and capital flows. Yet, India is described as “relatively better off” due to its domestic market size, macro stability, and strategic autonomy. This is not optimism, it’s calibrated realism. The survey is saying India can grow steadily, but not by ignoring global risks, only by managing them better than others.

Meanwhile, India’s average headline CPI inflation between April and December 2025 was just 1.7 percent, the lowest since the CPI series began. The decline was driven mainly by food and fuel prices, which together account for 52.7 percent of the CPI basket. Crucially, inflation has fallen without a collapse in demand. This implies that inflation has been controlled through supply improvements, not economic pain. That’s the difference between stability that lasts and stability that cracks later.

Read Bidisha Bhattacharya’s top 10 takeaways from the Economic Survey.

Also Read: India ‘tamed’ inflation in FY26, but Economic Survey projects it to remain higher in FY27