New Delhi: To boost India’s space sector, Union Finance Minister Nirmala Sitharaman announced a venture capital fund of Rs 1,000 crore to enhance space sector development by five times in the next ten years.

“With our continued emphasis on expanding the space economy by five times in the next ten years, a venture capital fund of Rs 1,000 crore will be set up,” she said while presenting the Union Budget in Parliament.

This announcement is expected to assist over 180 government-recognised space technology startups in the country.

Pawan Goenka, chairperson of IN-SPACe (Indian National Space Promotion and Authorisation Centre), a single-window autonomous government agency to promote, permit, and oversee private sector space-based activities, welcomed the announcement. He told ThePrint that the fund is likely to be a multi-year outlay and will be managed by a professional.

“We will communicate how this will happen when details are ready,” he said.

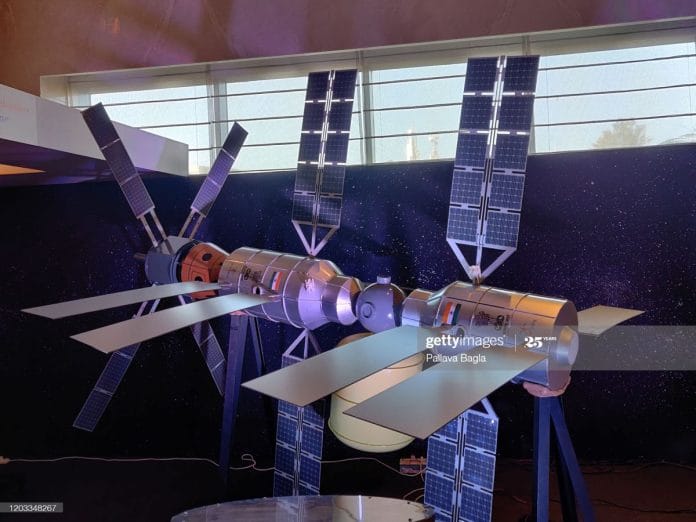

The Economic Survey 2023-2024, tabled Monday, also highlighted the developments in the space sector over the last few years and the government’s focus in the area. The survey pointed out that India currently has 55 active space assets, including 18 communication satellites, nine navigation satellites, five scientific satellites, three meteorological satellites, and 20 Earth observatory satellites.

Big boost to space sector

Experts said that this investment shows the government’s commitment towards the space sector.

“We previously advocated for increased financial incentives to support the burgeoning space startups in the country. The announcement of a Rs 1000 crore venture capital fund is a step forward, addressing the funding challenges these nascent ventures face in this capital-intensive domain,” AK Bhatt, director general, Indian Space Association (ISpA), told ThePrint.

Anil Prakash, director general at the SatCom Industry Association (SIA-India), told ThePrint that every rupee invested promises substantial returns, as the space sector holds immense potential for contributing to Gross Domestic Product (GDP) growth and enhancing national infrastructure.

He added the expansion of India’s space economy is set to impact sectors ranging from satellite-based services in agriculture and disaster management to advanced communication systems and space exploration missions.

“This growth is poised to drive innovation across multiple industries and unlock the full potential of our space ecosystem,” he said.

Prakash, however, added that to truly realise the space sector’s potential, the government must provide comprehensive support for startups. This would include providing tax incentives, regulatory clarity and the government acting as an anchor-customer.

Pavuluri Subba Rao, founder, CEO, and chairperson of Ananth Technologies, a Hyderabad-based aerospace technology development company, told ThePrint that the announcement for setting up a venture capitalist fund by the government was also a step towards “Atma Nirbharta’ (self-reliance).

“All along, private investment was part of venture capital funds. Most of them were supported by foreign companies. When the Indian government supports it, that reflects the spirit of Aatma Nirbharta,” he said.

(Edited by Radifah Kabir)