Bitcoin has experienced a sharp and sudden drop in value due to market turbulence. Within 24 hours on January 3, its price fell from $99,500 to a low of $91,231. The steep decline resulted from rising concerns about U.S. trade tariffs on Canada, Mexico, and China. This economic uncertainty triggered panic and forced many investors to sell rapidly. The swift drop highlights how global political instability can strongly influence cryptocurrency markets, causing unpredictable price fluctuations.

Bitcoin’s Oversold Condition Signals Potential Uptrend

The market saw massive liquidations, exceeding $2.3 billion and affecting more than 742,000 traders globally. This unprecedented liquidation surpasses the chaos of the COVID-19 market crash in March 2020 and the FTX collapse in November 2022. Many analysts argue that this significant drop pushed BTC

into an oversold zone. This will create potential rebound opportunities for traders watching market signals closely.

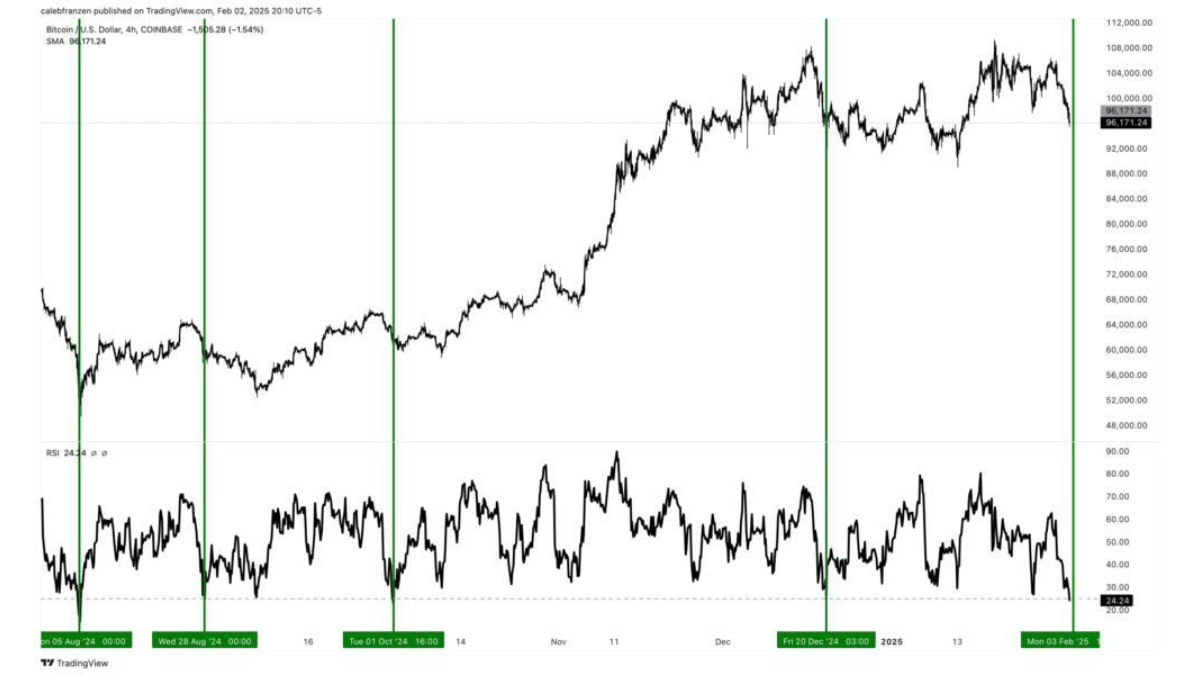

Graph 1, provided by Caleb Franzen, a well-known crypto analyst, shows how Bitcoin’s RSI is in oversold territory. He also stated that the 4-hour Relative Strength Index (RSI) had dropped significantly, reaching approximately 24. Bitcoin’s RSI has entered this range five times since August 2024, signaling potential accumulation. Historically, each instance of an oversold RSI has led to buying opportunities. Franzen’s insights suggest that Bitcoin could be nearing a rebound, presenting an attractive entry for investors looking to capitalize on market conditions.

Temporary Tariff Relief Spurs Cautious Optimism

The discussed decline shook the market, but trade tensions briefly eased when Donald Trump and Mexico’s president, Claudia Sheinbaum, delayed tariffs. This agreement stabilized prices for a moment. However, ongoing uncertainties with Canada still loom large. These concerns create instability in Bitcoin’s future price movement. As such, most Investors remain cautious, watching for any developments that might shift market sentiment.

Based on Graph 2, this move caused a slight recovery, with BTC trading at $98,644, up 0.4%. Despite this, opinions across the sector are still divided. Analyst Johnny believes that the worst of Bitcoin’s recent downturn might be over. He mentioned that this scenario would hold true if BTC stayed above its recent lows and the yearly opening price. On the other hand, Robert Kiyosaki, a well-known businessman and author, cautions that further declines could ensue. He stated that the US enforcing tariffs would boost the dollar and divert investment from risk assets like Bitcoin.

DexBoss Presale: Delivering DeFi Innovation Amidst Market Uncertainty

While investors remain cautious about the future of big coins, new innovative crypto projects like DexBoss show immense potential. DexBoss presale combines traditional finance with DeFi, creating an advanced trading experience. The platform uses its native token, DEBO, to power transactions. Users can also enjoy real-time order execution and advanced charting tools for seamless trading. This system allows direct trade management on charts with draggable bars for entry, exit, and stop-loss settings. DexBoss also provides liquidity farming and staking options, strengthening the ecosystem. These features help the platform grow while allowing users to earn a steady income through staking rewards.

Click here to know more about DexBoss

As of February 3, DEBO is available for $0011 in its presale phase, with an expected listing price of $00505. DexBoss presale has already raised $549,493.1, reaching 73% of its $750,000 target. To increase the DEBO token’s value further, DexBoss also employs a buyback and burn mechanism. It uses a portion of transaction fees to repurchase and burn tokens. This strategy reduces the total supply, potentially increasing the token’s value over time.

This platform is designed for both beginners and experienced traders and combines a deflationary model with advanced trading features. As DexBoss prepares for global expansion, it aims to introduce options and futures, strengthening its position in the DeFi space. However, all cryptocurrency investments require thorough research and diversification of the portfolio. The right decisions could lead to cashing in on the next floors of the crypto market.

ThePrint BrandStand content is a paid-for, sponsored article. Journalists of ThePrint are not involved in reporting or writing it.