VMPL

Mumbai (Maharashtra) [India], January 12: ALTPORT, a next-generation Alternative Investment Platform India, has officially announced the launch of its integrated advisory-led ecosystem focused on Alternative Investment Funds (AIF), SEBI-registered Portfolio Management Services (PMS), and GIFT City funds. Designed for discerning investors, ALTPORT enables access to structured, research-backed alternative investments through a disciplined and transparent process.

Built for long-term wealth creation, the AltPortFunds investment platform caters to high-net-worth individuals (HNIs), ultra-HNIs, family offices, and NRIs seeking diversification beyond traditional equity and mutual fund products. The platform is already trusted by investors across countries and continues to gain momentum as a credible destination for serious alternative investing.

Founder Story: Vikas Agrawal, Founder & CEO, ALTPORT

“Markets will always test patience, but a strong investment process keeps investors grounded,” says Vikas Agrawal. “ALTPORT was built to bring structure, clarity, and consistency to alternative investing.”

At the core of ALTPORT is Vikas Agrawal, Founder & CEO, a seasoned capital markets professional with over 20 years of experience in AIF and PMS distribution. With an MBA in Finance, Vikas has worked closely with leading fund managers, investment strategists, and institutional participants across market cycles.

The founder story of AltPortFunds is shaped by a clear philosophy: wealth creation is not accidental. It is the outcome of a repeatable process, disciplined fund selection, and the ability to stay invested through volatility. Vikas is known for advocating process-led investing and for educating investors on the critical difference between skill-based returns and luck-driven outcomes.

His exposure to global investment thinking, including interactions with some of the sharpest equity minds and attendance at Berkshire Hathaway AGMs, has deeply influenced ALTPORT’s long-term, fundamentals-first approach.

The AltPortFunds Investment Platform: Designed for Serious Investors

ALTPORT operates as a full-spectrum alternative investment platform, offering curated access to:

– AIF investment platform solutions across multiple strategies

– SEBI-registered PMS offerings for customized equity portfolios

– GIFT City funds for global and NRI-focused investments

Unlike product-driven distribution models, ALTPORT focuses on advisory excellence, portfolio monitoring and review, and long-term alignment with investor goals.

Platform highlights include:

– Independent, data-backed fund selection

– Institutional-grade research and due diligence

– Periodic portfolio reviews with minimal churn

– Direct engagement with fund managers

– Transparent performance tracking and reports publication.

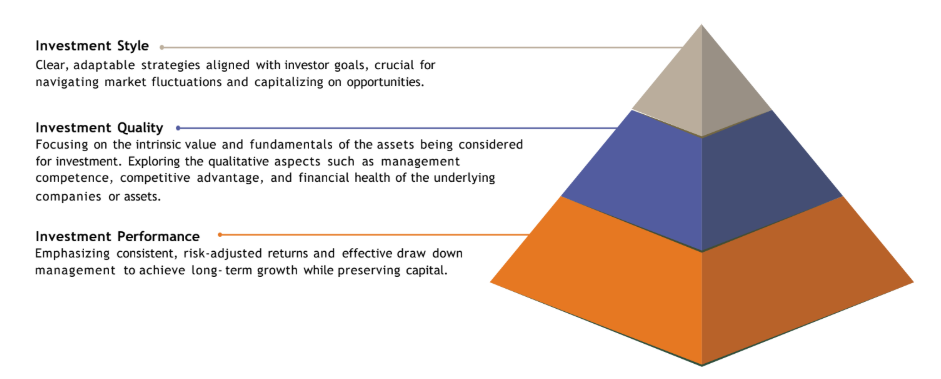

The 3Is of Investing: ALTPORT’s Core Philosophy

Every investment decision on the ALTPORT platform is guided by the proprietary AltPortFunds “3Is” / 3Is of investing framework:

– Investment Manager Style

Evaluates how fund managers generate returns, their discipline, repeatability, and performance across market cycles.

– Investment Portfolio Quality

Focuses on asset fundamentals, governance standards, balance sheet strength, and financial health.

– Investment Performance Consistency

Prioritizes steady, risk-adjusted returns over sporadic or luck-driven outperformance.

This philosophy ensures ALTPORT never compromises skill for short-term gains and remains focused on sustainable wealth creation.

How ALTPORT Constructs Portfolios and Selects Funds

Portfolio construction at ALTPORT follows a structured, multi-layered process overseen by an experienced investment committee. Each fund is evaluated using both qualitative and quantitative parameters before being approved for client portfolios.

Key elements of the fund selection and construction process include:

– Assessment of alpha consistency over long periods

– Analysis of adjusted gains and drawdown control

– Evaluation of fund manager pedigree and investment discipline

– Balanced & customized investment strategy

– Ongoing portfolio monitoring and review

Once funds are selected, portfolios are customized based on the investor’s capability, liquidity needs, time horizon, and financial objectives.

Wealth Solutions for HNI and UHNI Investors

ALTPORT offers comprehensive wealth solutions for HNI and UHNI investors through a carefully curated range of alternative investment options:

– Alternative Investment Funds (AIFs):

Minimum investment of ₹1 crore, offering exposure to private equity, structured strategies, and thematic opportunities.

– SEBI-Registered PMS:

Starting at ₹50 lakhs, providing customized equity portfolios managed by experienced fund managers.

– Advisory-Led Portfolios:

Designed to balance growth, risk management, and long-term capital preservation.

In addition, ALTPORT supports investors with allied services such as estate planning, family office advisory, taxation consultancy, and trust structuring.

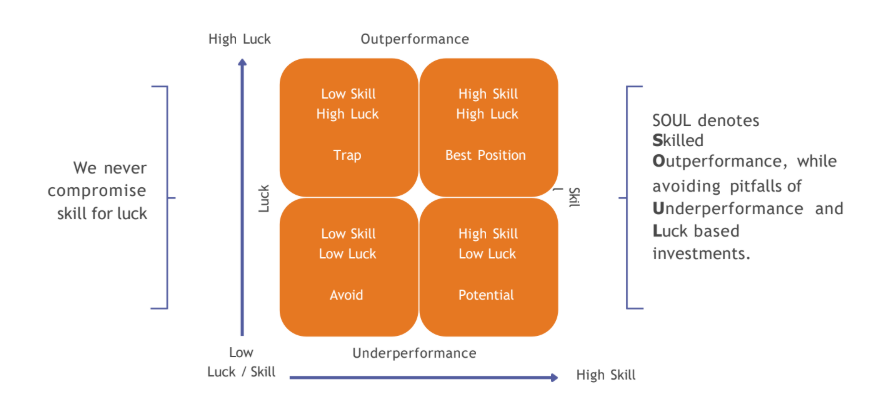

The SOUL Framework: How AltPort Thinks About Fund Selection

At the heart of AltPort’s fund selection philosophy lies SOUL — Skilled Outperformance, Unaffected by Luck. The framework is designed to separate repeatable skill from short-term market noise, ensuring portfolios are built for long-term durability rather than temporary wins.

What the SOUL framework prioritises:

– Skill over luck: Performance driven by process, not chance

– Consistency: Ability to deliver outcomes across market cycles

– Balanced: Skill based fund selection

How AltPort views different outcomes:

– Low skill + high luck: A performance trap that often reverses

– Low skill + low luck: Clear avoid zone

– High skill + low luck: Strong potential for future outperformance

– High skill + high luck: Best-positioned funds with proven capability

By refusing to compromise skill for luck, AltPort helps mitigate downside risk and focuses on managers with robust investment discipline. The SOUL approach ensures portfolios are aligned with sustainable, skill-led outperformance rather than unpredictable, luck-based returns.

GIFT City Funds and NRI Investment Opportunities

A major focus area for ALTPORT is GIFT City funds, which play a vital role in enabling NRI investment in India alternatives. GIFT City offers a globally competitive framework with regulatory efficiency, tax advantages, and simplified access to international markets.

For investors exploring how NRIs can invest in AIF in India, ALTPORT provides end-to-end guidance, including structure selection, compliance support, and portfolio alignment. These offerings allow NRIs to participate in India’s growth story while maintaining global diversification and operational ease.

Growing Trust Across Borders

ALTPORT currently serves over 350 active investors, including NRIs and family offices, with assets exceeding ₹500 crores deployed or advised through its platform. Investors are spread across 10+ countries, underscoring ALTPORT’s credibility as a trusted partner for cross-border alternative investing.

Conclusion: A Platform Built for Enduring Wealth

ALTPORT stands as a modern, process-driven AIF investment platform designed for investors who value discipline over noise and consistency over speculation. Under the leadership of Vikas Agrawal, Founder & CEO, the platform continues to expand its footprint across AIFs, SEBI-registered PMS, and GIFT City funds.

As alternative investments gain prominence in India’s wealth landscape, ALTPORT remains committed to one mission: helping investors build resilient, skill-driven portfolios that compound wealth over the long term.

Contact Information

ALTPORT (AltPortFunds)

Website: www.altportfunds.com

Email: contact@altportfunds.com

Phone: +91 95616 10108

For media queries, investor onboarding, or consultations, connect with the ALTPORT team to explore a disciplined approach to alternative investing.

(ADVERTORIAL DISCLAIMER: The above press release has been provided by VMPL. ANI will not be responsible in any way for the content of the same.)

This story is auto-generated from a syndicated feed. ThePrint holds no responsibility for its content.