Thank you dear subscribers, we are overwhelmed with your response.

Your Turn is a unique section from ThePrint featuring points of view from its subscribers. If you are a subscriber, have a point of view, please send it to us. If not, do subscribe here: https://theprint.in/subscribe/

For over three decades, the conveyor belt of global trade operated efficiently between the manufacturing hubs of China and the consumers of the United States and Europe. Goods flowed east to west; dollars and euros flowed west to east. This simple yet powerful arrangement fuelled globalization, lifted millions out of poverty, and reshaped the economic landscape of Asia- with ripple effects extending even to India.

While Donald Trump’s tariffs are often cited as the disruption point, it would be a mistake to treat them as the cause. Trump’s trade war and the broader geopolitical decoupling that followed was merely the trigger. The structural fractures in the US-China economic relationship had been forming for years, hidden in plain sight.

The long goodbye

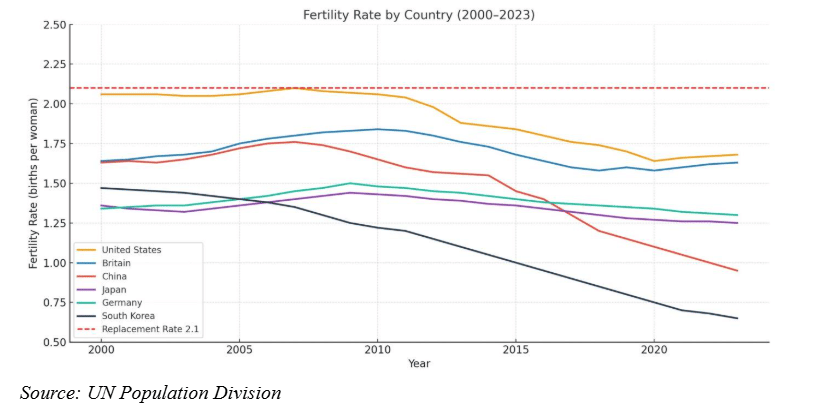

A surprising but powerful signal of global change is China’s collapsing birth rate. Since COVID, it has plunged from 1.7 to about 1 child per couple- a dramatic, unprecedented drop in peacetime. For decades, China was the world’s labour engine; that era is ending.

The demographic crisis is stark. As the chart above from the UN Population Division illustrates, China’s fertility rate has not just declined—it has plunged, now trailing behind the United States, Britain, and Germany, and approaching Japan’s historically low levels. This is not a trend that can be reversed quickly. The very structure of China’s labour-driven economy is now in question.

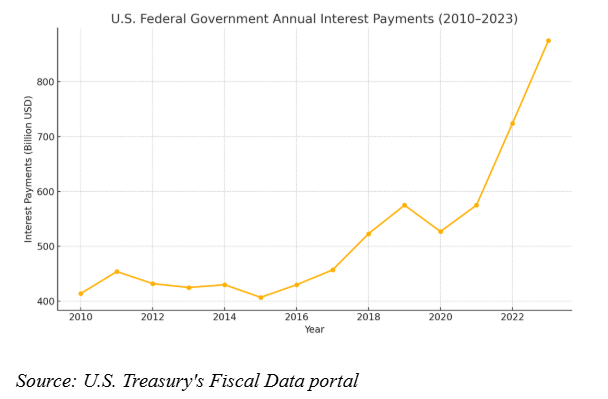

Across the oceans, the United States and EU played a complementary role- printing dollars and Euros and buying cheap Chinese goods, becoming the world’s consumption engine. But now, with soaring national debt and high interest rates, even America’s financial role is under stress.

In short: China is no longer the world’s labour capital, and the US and Europe no longer the world’s financial faucets. The trade model that once underpinned globalization is no longer viable.

Even if tariffs are lifted or diplomatic ties restored, the foundational dynamics have shifted. As the old rhyme goes: “All the Kings horses and all the king’s men couldn’t put Humpty Dumpty together again.”

A new paradigm emerges

What comes next is not a collapse, but the evolution of a new trade order after a process of reconfiguration. This may sound radical, but evolutionary history offers precedent. The extinction of dinosaurs cleared the way for mammals and, eventually, human civilization. Systemic collapse often births more adaptive, intelligent alternatives. This time, AI may be the engine of that new order.

The global trade system that is now emerging will be more fragmented, more intelligent, and more resilient. It will span more geographies and integrate a wider diversity of supply chains. Artificial Intelligence will increasingly manage production and logistics, dynamically reallocating resources across borders in real-time.

On the other end of possibly a decade-long transformation will be a new monetary order. National currencies like the yuan and rupee will remain largely domestic or regional. The US dollar and Euro, while still dominant, are unlikely to retain their unrivalled status forever. What may rise instead is a cyberspace-based global monetary system- decentralized, AI-enabled, and global by design.

India’s moment

For India and other emerging economies this moment presents a strategic opportunity. Rather than positioning themselves as a low-cost alternative to China, they can aim higher: to lead in shaping the next-generation global trade architecture.

That architecture will be built on AI, decentralized production, and digital infrastructure. Investments in these areas are no longer optional- they are the entry ticket to the new global order. India, with its pioneering digital public stacks like Aadhaar, UPI, and ONDC, enters this new era with a significant head start

Evolution teaches us that no new idea survives unless it enhances the efficiency and resilience of the overall system. AI, cyber-currencies, and the global industrial infrastructure build-out are ideas that have withstood the test of time- they are the likely drivers of the coming global systemic transformation.

Emergence of a new trade order

The US-China decoupling is not a random rupture triggered by an impulsive president. It could herald the beginning of a broader reordering of the global economy. What lies ahead would be a more complex, more distributed global trade system. The question is not whether we are ready to adapt, but whether we are bold enough imagine and lead this transformation.

Dr. Nikhil Joshi is the founder of LIFEL, a non-profit systems research organization that leverages nature’s time-tested principles to design sustainable socio-economic models. LIFEL operates at the intersection of science and organizational research to shape organizations of the future.

These pieces are being published as they have been received – they have not been edited/fact-checked by ThePrint.