Thank you dear subscribers, we are overwhelmed with your response.

Your Turn is a unique section from ThePrint featuring points of view from its subscribers. If you are a subscriber, have a point of view, please send it to us. If not, do subscribe here: https://theprint.in/subscribe/

The Textile industry engages in the design, production, and distribution of yarn, cloth, and clothing. The underlying strength of the textile industry in India is its strong production base of diverse range of fibre/yarns from natural fibres like cotton, jute, wool and silk, to man-made fibres (MMF) like polyester, viscose. India is the 3rd largest exporter of Textiles & Apparel in the world. It has a share of 4.6% of the global trade in textiles and apparel largely catering to United States, European Union, and United Kingdom. The Indian textile industry is the second largest producer of MMF after China.

Cotton is the essential crop needed in textiles. The proportion of cotton is 60% of raw material consumption basket of Indian textile industry. In India, the consumption of cotton is approximately 316 lakh bales per year and holds the highest cotton acreage of 36%, of the global world area of 326 lakh hectares. The major cotton production in India comes from ten major states. The ratio of use of cotton to non – cotton fibres in India is around 60:40 whereas it is 30:70 in the rest of the world. Indian textile industry employs 45 million people across the value chain and plays a pivotal role in sustaining their livelihood.

How does Indian Government promote Textile industry?

Policies like Advanced Technology Upgradation Fund scheme (ATUF), setting up of Mega Integrated Textile Region and Apparel (MITRA) Park scheme, capacity building scheme (SAMARTH) are some of the “Make in India” initiatives. “Skill India” efforts are also taken to address skilled manpower requirement in the industry to generate 7.5 lakh new employment. The purpose is to promote the ease of doing business with global players and attract fresh investments of Rs. 19,000 crore to create long term growth opportunities. Besides, 100% FDI in textiles, PLI scheme allocation worth US$1.44bn for MMF’s, and uniform GST rate at 12% on MMF, yarns and apparels are also a part of growth plan.

Current Outlook

Declining supplies, lower profit margins for spinning mills, falling yarn orders from fabric and apparel companies, and higher inflation levels have all pressured global consumption. Global cotton consumption will kick in as the world economy slightly improves in FY23-24, after a sequential decline over a few quarters. The consumer demand for finished fabrics will retreat as the global interest rates scenario gets softer.

Industry Tailwinds

Moderation in cotton prices, and freight prices upon new crop arrivals can reduce the price of final product and improve consumer demand. This supports revenues and margins for textile companies, subsides the inventory pressure, and optimises working capital when there is an increasing order flow from global and domestic clients, creating a strong brand proposition and giving better competitive positioning to textile companies in export markets.

China +1 factor, and India entering new trade tie-ups with key countries would also bring demand for domestic business and India can become an alternate supply base in future. This would mean more capital expenditure for companies to build on their capacity utilisation with value-added products to cater to strong demand and would naturally augment their revenue growth on Q o Q and YoY basis.

Industry Headwinds

Any sustained slowdown in the global export market due to inflationary pressure or any significant increase in input prices (cotton) poses key risk to companies’ earnings estimates. Geopolitical disturbances like Russia-Ukraine War reduces the demand visibility in global markets as the discretionary spend of consumers gets delayed.

Key Focus Areas for Textile companies

- Agro-based industry – exposure to vagaries of nature across the globe fluctuates the cotton crop prices, crop yield and causes supply bottlenecks.

- Cost Rationalisation – companies need continued focus on optimising operating expenses, marketing, and rentals.

- Margin improvement initiatives – Move to higher retail price products, focus on higher thread count sheets and higher grams per sq. meter (GSM) in Towels. Develop new and innovative products and leveraging consumer sentiments and behaviour to earn premium.

- Digital Imperatives – Increase capacity utilization of plants through digitization of processes and adopting lean practices, keeping exclusive merchandise for online, inclusive planning with e-commerce players.

- ESG Compliance – implementing ISO 140001 at manufacturing sites, use of treated sewage instead of freshwater in production, replacing coal with biomass to avoid emissions.

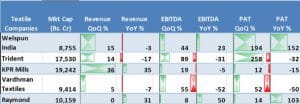

Financial Outlook of Textile Companies for FY23 YoY and QoQ

With global economy still reeling under the pressure of slowdown and customer sentiments relatively subdued, margins and revenues of the companies’ exhibit muted performance in FY2023. Textile Sector outlook remain cautiously optimistic but is expected to improve in FY2024 as we gradually retreat headwinds.

These pieces are being published as they have been received – they have not been edited/fact-checked by ThePrint.

COMMENTS