Thank you dear subscribers, we are overwhelmed with your response.

Your Turn is a unique section from ThePrint featuring points of view from its subscribers. If you are a subscriber, have a point of view, please send it to us. If not, do subscribe here: https://theprint.in/subscribe/

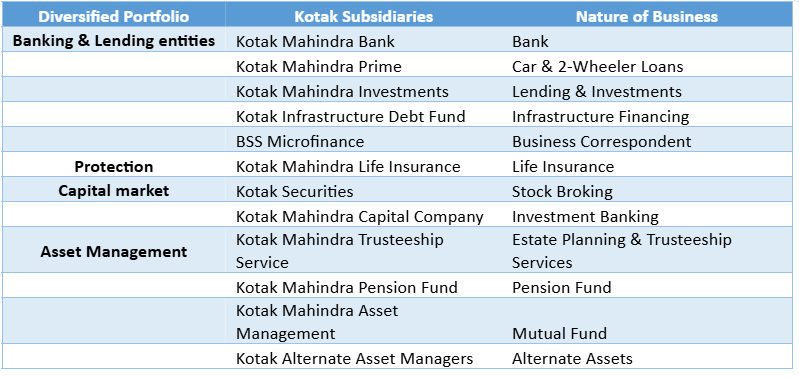

Kotak Mahindra Bank continues to play the long game focusing on quality over quantity. Kotak Bank is a diversified financial conglomerate with four engines of growth that enables it to meet customer needs across the financial spectrum such as banking & lending, capital markets, asset management and protection.

Kotak’s FY24 performance exhibits stability over short term growth despite a booming market. Its reluctance to expand its loan book aggressively underlines its identity as a ‘fortress bank’.

Strategic Moves that shape FY24-FY26:

- Accelerated Digital Transformation Post-RBI Restrictions – Kotak made a significant technology overhaul in FY25 after RBI lifted the 2024 restrictions on new digital onboarding. The bank modernized its core banking system (CBS), improving uptime and reducing UPI technical decline rates from 0.89% to 0.02%. It adopted a three-pronged digital strategy – resilient infrastructure, unified digital tools, and scalable apps focused on simplicity, speed and security. Kotak is positioning itself as a digitally mature, tech-first bank that blends reliability with innovation, turning regulatory challenges into opportunities.

- Focus on Premium and Segment-Specific Customer Strategy – The bank is transitioning from a “one-size-fits-all” model to a curated, segment-based approach shown up in the launch of Kotak Solitaire, designed for affluent clients integrating wealth, credit and lifestyle benefits. Kotak aims to deepen engagement and grow wallet share by focusing on high-value clients and personalized propositions, aligning with its “One Kotak” vision.

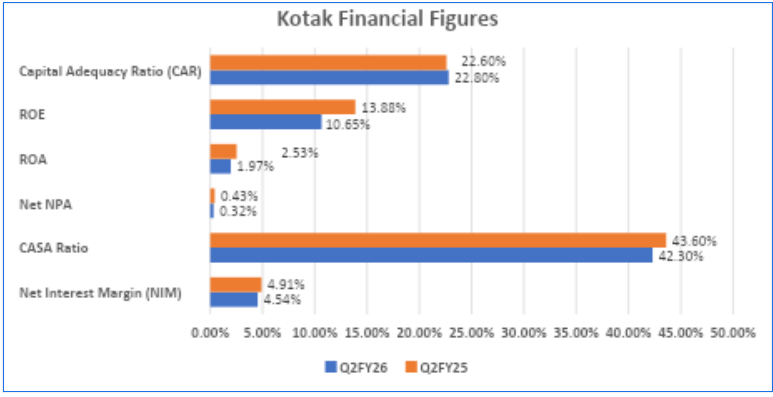

- Prudent and Profitable growth – Capital Adequacy at 22.8%, exhibiting strong balance sheet resilience. Book Value per share is ₹ 844 in FY26, an increase of 14% since FY25. Kotak continues its cautious growth model, giving priorities to asset quality, capital strength, and consistent profitability over aggressive lending.

- Expansion Through Diversified Financial Spectrum – The group’s Assets Under Management (AUM) surged to ₹ 7.6 lakh crore, surged by 12% since FY25, driven by growth in mutual funds, alternate assets, insurance, and pension businesses. Kotak is evolving beyond a bank into a comprehensive financial ecosystem, strengthening its non-banking subsidiaries to reduce reliance on lending income.

- Strengthening Financial Inclusion and Rural Reach – Kotak is extending microcredit and rural financing, particularly targeting women borrowers through acquisitions like Sonata Finance and BSS Microfinance. The bank is balancing urban digital growth with rural penetration aligning profitability with inclusivity.

- Strategic Portfolio Rebalancing and Global Partnerships – In 2024, Kotak divested 70% stake in its general insurance arm to Zurich Insurance, retaining 30%. This unlocked capital, strengthened foreign partnerships, and streamlined operations. Kotak is refocusing its capital on core strengths such as banking, wealth management, asset management, and striving to use global tie-ups to expand expertise.

Financial Snapshot

| Financial Parameters | Q2FY26 | Q2FY25 |

| Book Value per Share | ₹ 844 | ₹ 740 |

| Consolidated AUM | ₹ 7,60,598 Cr | ₹ 6,80,838 Cr |

| Profit After Tax | ₹ 4,468 Cr | ₹ 5044 Cr |

| Deposits | ₹ 5,28,776 Cr | ₹ 4,61,454 Cr |

| Customer Assets | ₹ 5,76,339 Cr | ₹ 5,10,598 Cr |

The Financial Pressures beneath Stability:

Despite its sound fundamentals, Kotak’s latest results reveal some stress points.

- RBI had restricted Kotak in FY24 from onboarding new digital customers due to IT deficiencies though restrictions were lifted in Feb 2025, the incident dented reputation. Regaining customer trust and demonstrating tech resilience amid competition from faster-moving digital-first banks and fintech’s’, remains a challenge.

- Consolidated PAT dropped to ₹4,468 crore from ₹5,044 crore YoY. Slower profit growth signals pressure on the bank’s core earnings driven by narrowing margins, higher costs, and weaker subsidiary performance especially life insurance and securities arms.

- ROA dropped to 1.97%, ROE to 10.65%, both slightly below peers. Indicates subdued profitability relative to balance sheet size, reinforcing the need to improve cost efficiency and diversify income streams.

- Subsidiaries such as Life Insurance PAT plunged from ₹360 crore to ₹49 crore YoY. Securities and Prime businesses also posted lower profits. Group profitability is being dragged by uneven performance across subsidiaries, exposing Kotak to volatility in non-banking segments.

Conclusion

Kotak’s Q2FY26 performance underscores resilience but also stress from shrinking margins, slowing profit growth, and subsidiary drag. While asset quality remains stellar, sustaining profitability in a high-cost, competitive environment is the bank’s biggest financial test. In India’s fast-moving banking race, Kotak Mahindra is pacing itself. The next few quarters shall reveal if the patience continues to pay off.

These pieces are being published as they have been received – they have not been edited/fact-checked by ThePrint.