The Nifty 50 futures traded at the Gujarat International Finance Tec-City surged as much as 3.2% to a record, indicating a strong opening. The rupee extended gains in the offshore market, and is expected to rise around 1% when local trading starts, according to analysts.

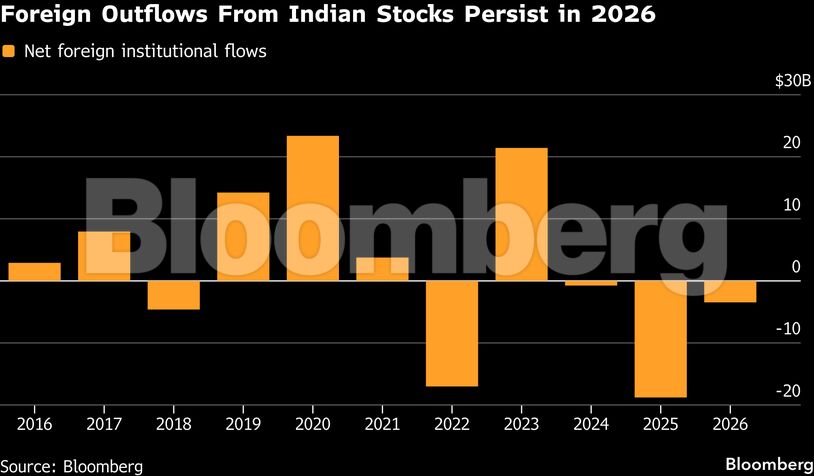

The rupee had been hitting record lows in recent days as persistent outflows from local stocks and lack of a trade deal with the US weighed on sentiment. Global funds continued to pull out money from Indian stocks in 2026 after two prior years of outflows.

“This deal should partially help Indian equities to catch up with the performance of other Asian peers that have benefited more over the past year as emerging market flows have recovered,” said Vivek Dhawan, portfolio manager at Candriam. “Over time, India could eventually work towards reclaiming its position as geopolitical safe haven.”

Here’s what strategists and fund managers had to say:

Citigroup Inc. (Surendra Goyal, head of India research)

- While we await further details, this announcement should remove a significant overhang on the Indian equity markets and aid foreign flows

- Should be positive for India manufacturing with interest likely returning in the China+1 theme, which had been impacted by a lack of a US trade deal

- This should also reduce the risk of any protectionist measures for India’s large services exports – GCCs as well as IT services providers

Sanford C. Bernstein (Venugopal Garre, strategist)

- We are calling for a short-term rebound, but our Nifty target remains unchanged at 28,100

- We are now at that moment, and with India’s sharp correction year-to-date the case for a rebound holds

DBS Bank Ltd. (Radhika Rao, senior economist)

- At the onset, this breakthrough is unmistakably positive for the real economy/ exports, sentiments as well as financial markets, while further details are awaited. Textiles, gems and jewelery, engineering goods, leather and chemicals are likely among the key gainers

- Domestic markets are expected to witness a relief rally at open, after high tariffs had been one of the key drags on sentiments in the past quarter

Kotak Mahindra Asset Management Co. (Deepak Agrawal, chief investment officer – debt)

- This development is likely to improve the country’s balance of payments gap, strengthen the rupee, and increase foreign exchange reserves and attract foreign institutional investors who had been waiting on the sidelines

- This positive macroeconomic outlook is also expected to keep interest rates stable

Wright Research PMS (Sonam Srivastava, founder)

- The deal is a meaningful positive for Indian equities, both from a sentiment and earnings visibility standpoint

- Export-oriented segments such as IT services, pharmaceuticals, specialty chemicals, auto ancillaries, and select engineering goods stand to benefit the most

- While the near-term market reaction is understandably sharp, sustainability will depend on execution, sector-specific uptake, and whether earnings upgrades follow. Still, as a signal, this is a clear risk-on trigger

Edelweiss Asset Management (Trideep Bhattacharya, chief investment officer – equities)

- The reduction in tariffs has come in materially better than consensus expectations

- When combined with the recently concluded India–EU trade agreement, this potentially represents one of the strongest external growth stimuli for the Indian economy in 2026

Pepperstone (Michael Brown, senior research strategist)

- It’s pretty huge news as the trade/tariff issue has been rumbling away for a while now, and has obviously been a significant tail risk

- The “deal” that US officials are outlining seems a relatively favorable one. There will be questions as to whether the $500 billion in purchase commitments ever come to fruition, though that’s not unique to the India deal

- Trade risks now markedly reduced, giving investors confidence to not only re-enter the market from the long side, but also to price a rosier economic outlook moving forward